I’ve noticed a developing theme in this blog: a serious analytical post, followed by a few “lighter” philosophical posts. This wasn’t by design, but seems to fit the way my mind works. I hope you enjoy the approach (your feedback is always welcomed!). Today’s article is a more serious analytical post, but it’s extremely important in helping you achieve a great retirement!

Last week, I started the “When Can I Retire” series to help you determine when YOU can retire. I believe that anyone within 10 years of retirement should understand this process, and strongly encourage you to work through it with your spouse to better understand your current situation and realistic prospects for retirement. Last week’s article focused on Step 1 – Determing Your Retirement Spending.

Today’s focus will be on Step 2 – The Retirement Income Plan, consistent with the outline presented last week:

- Spending Plan *

- Retirement Income Plan

- Contingency Plan

- Putting It All Together – The Retirement Cash Flow Model

* If you’ve not yet read or completed Step 1 (The Spending Plan), please click on this link to review the first step.

After you’ve made some assumptions on spending requirements in Step 1, it’s time to move to the income side of the equation. This process will focus on two seperate streams of income: Fixed Income and Investment Returns.

Fixed Income Estimate:

The first step is to come up with a list of all “fixed” income streams you expect to earn. This consists of things like Social Security (technically not “fixed” income since it’s adjusted for inflation, but including it in “fixed” for simplification), Company Pensions, any annuities you may have, etc. Take the time to contact the appropriate resources to get an accurate estimate for your estimated retirement date, then fill in the estimated income.

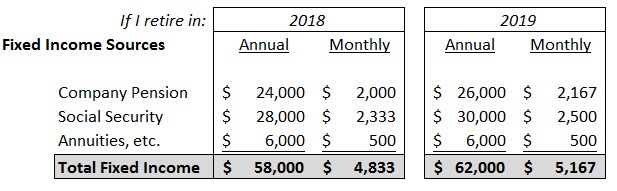

As you work through these “fixed income” estimates, you’ll quickly find that the amount of income you should assume is directly related to when you begin withdrawals. The later you wait, the higher the income. For Social Security in particular, there is a vast amount of information on how to “optimize” your claiming date (far beyond the scope of this blog, but suffice it to say you should defer claiming as long as possible given that the value increases ~8% per year, well beyond any other “safe” investment return you could achieve). I’d suggest you build a summary of these scenarios, using the following template as an example:

For most people, these “fixed income” sources will be insufficient to cover your entire spending requirements. Therefore, a second element to income planning needs to be developed to focus on your investment portfolio, which will be used to “fill the gap” between spending requirements and income provided from your fixed income sources.

Investment Returns & Drawdown

To determine how much money you can safely withdrawal from your investment accounts, I suggest the following methodology, each step of which is explained below in more detail:

- List all of your investment assets (use your Net Worth Statement as a starting point if you have one. If you don’t have one, read Post #20 on the importance of this “Gas Gauge”).

- Determine how those investments will grow between now and your retirement date.

- Estimate a “safe withdrawal rate” on those assets.

- Target your retirement date for when your “safe withdrawal rate” is sufficient to meet your spending needs.

Let’s start with step 1 and 2 (listing your assets and determining how they’ll grow between now and retirement). I’ll outline the methodology shortly, but wanted to give you a view of what this should look like when you’re done (see image below). Note the yellow highlighted “A”, “B”, “C”, etc. titles over each column – I address each one in detail below to help you create your own Investment Return estimate:

A & B: Investment Accounts: List all accounts you currently hold in column A. Include the latest year-ending balance in column B. It’s important that you have a complete listing of all assets you have which you will use to fund your retirement. If you’ve not yet done a net worth statement, take the time NOW to compile the detail on your investment holdings.

C: Estimated Return: This is a bit subjective, and can be done a variety of ways. You could use the historical rate of return for each asset class (easily found via Google), or use a conservative personal estimate. These can be modified going forward, so just use reasonable estimates now to get through your first draft at this process.

D. Current Year Contributions: To calculate how your investments will grow between now and retirement, you need to factor in both the incremental contributions you’ll make each year (Column D), as well as the projected investment returns (Column E).

E. Investment Returns: Multiply your projected rate of return from Column C times your base value and 50% of your contributions (assuming you’re contributing on a fairly level loaded basis throughout the year). This calculation assumes you earn approximately 6 months of return on your investments (12 months for Jan contributions, 1 month for Dec contributions).

F. Year End Balance: Starting with your initial value, this formula adds your contributions and investment returns to project your year-end balance for the current year.

Continue the exercise for each year between now and when you’re planning to retire. When you’re done, you should have a summary that looks something like this (the columns used to calculate return and contributions have been hidden in future years for simplicity):

In this example, you can see that your investment assets increase from $275k in 2015 to $364k by 2018 (assuming contributions and returns remain consistent with 2015 assumptions).

Safe Withdrawal Rates From Investments:

For the final step, it’s time to calculate how much income you can safely withdrawal from your investment assets to “bridge the gap” between spending and fixed income. There are volumes written on “safe withdrawal rates”; suffice it to say that the majority of pundits land between 3% and 4% of your investment assets as a safe withdrawal rate to insure your savings last a lifetime. To show the range, I’d suggest you simply multiply your year-end balances calculated above by both 3% and 4% to show you a range of projected income you can safely withdrawal from your investment assets. The final product should look something like this:

Looking at the blue highlighted area, you can see in the above example that you can assume annual investment income between $10k – $13k in this scenario if you retire at the end of 2017, increasing to $11 – $14.5k if you work one additional year, to 2018.

This has been a lengthy, but important, article. I challenge you to work through YOUR numbers. Find a system that works for you, but follows the logic outlined above. You cannot afford to retire without understanding this logic. If it’s beyond your capability, you should hire a professional financial advisor to work with you to determine a date that’s right for you.

Once you pull the plug, there’s no going back. Do your homework. Understand the implications.

Next week, we’ll start pulling the spending needs and the income together. If you’ve not started yet, go back to Step 1 and work through it first, then work on Step 2 in preparation for the important step of lining them up to see when you can realistically plan to retire.

Helping People Achieve A Great Retirement.

The Retirement Manifesto

I am really enjoying these step by step instructions. I have been reading for months and everything has been the vague 3% or 4% or a calculator that just doesn’t seem real to me. These steps are making me really study my situation. Unfortunately, I think I will end up with a later retirement date than I want but at least I will know and not be guessing. Thank you.

Clare, Thanks so much for your note. I really enjoy knowing that my words are having an impact on real people, facing real retirements. You’re an encouragement to me. Good luck with your retirement planning! If there are any topics you’re interested in that I haven’t written about, don’t hesitate to drop me a note with a request! Fritz

This is a really valuable exercise. I’m enjoying your thought process in your writing. In 2015 I started using mint to really track our spending and in that process I realized we were receiving a pretty substantial dividend income, all being reinvested. So I added a column between contributions and returns for the dividends. I’m also using a 4% rate of return on these stocks. Am I double dipping by doing this.? My thinking is, I want to withdraw the dividends upon retirement plus 3% draw down before our pension and social security kick in.

Fritz,

I think I finally got a good idea about how much my spending will be in retirement. I have been starting to work through the income portion of the balance sheet. I am planning on retiring at 59 1/2 and drawing my wife’s social security at 62 and mine at 65. The SS estimates go under the assumption that a person is going to work up to the day they start to receive benefits and therefore are overstated. We do plan to work some, but will only earn a fraction of current earnings. Can you tell me how to accurately estimate the ss benefits we will receive?