We all know about Vanguard’s low-cost mutual funds, right?

However, have you ever spent time looking around Vanguard’s site to see what’s available for free? After all, since they keep their costs so low, they probably don’t provide much in the way of free information, right?

Wrong.

Vanguard offers a wealth of free tools in their Retirement Planning section. Today, I give you an overview. Click To TweetI spent a few hours on Vanguard this week, and I’ll admit it’s the first time I’ve really had a hard look at what’s available. I’ve been an investor with Vanguard for ~25 years, ever since our company moved our 401(k) over to Vanguard (thank you, employer!).

25 years, and I’ve never really had a look at what they offer. What? Sure, I’ve spent hours on their site managing my investments, but I’ve never really looked at their educational offerings.

How About You? Have you ever looked at the educational material they offer for free? If not, today’s post is for you, as I’ll give you a guided tour of what’s available.

Vanguard’s Retirement Academy

If you click over to Vanguard’s Retirement Page, you’ll discover a treasure trove of well organized and professionally written educational material on retirement planning. I went down a rabbit hole there this week, and it led me to write this post. As readers of this blog, I suspect most of you are self-educating yourselves on personal finance (yay, you!), and I wanted to make you aware of this valuable resource.

BTW, I’ve named this section of the Vanguard site their “Retirement Academy” (it’s not the “real name”, but it seems to fit).

(Full Disclosure: I’m not getting any compensation from Vanguard for this post. In fact, they don’t even know I’m writing it! Also, I’m not sure if the information is available to everyone, or only to Vanguard investors. Apologies if you’re not a VG investor and unable to access the link above).

Here’s a glimpse, organized by Age Group:

Let’s have a quick look at what’s offered by Age Group:

Ages 20 – 49 “Saving”

Click on the first link under your age column (Learn The Basics Of Saving For Retirement), and you’ll see the following listing of interesting topics, which Vanguard claims are “the most common things people ask us about retirement savings:

For the sake of brevity, I won’t go through each of the topics. Suffice it to say that if you click on any of the topics, it’ll take you down a trail of relevant content on the topic selected. It’s well organized, clear, and a great place for folks to go who are interested in learning more about a particular subject.

Ages 50 – 64 “Getting Ready”

Since the majority of my readers are in this demographic, I’ll spend a bit more time on this section of the Vanguard Retirement Academy. Below is the overview tab for this age group:

This section is summarized as “You’re in the homestretch! The 5 to 10 years before you retire is a critical time for planning to meet your goal.” I couldn’t agree more and spent a significant amount of time putting together my Ultimate Pre-Retirement Checklist to help readers through this critical time period. If you click on Vanguard’s “Learn the basics of planning for retirement”, you’ll be given the following choices (again, for the sake of brevity I’m only touching on the content, visit yourself to dig deeper):

- See when you can realistically retire (a link to Vanguard’s retirement calculator).

- Learn how medical expenses could affect your expenses.

- Learn how Social Security timing will affect your income.

- Make a plan to pay off your debt.

- Keep your plan on track.

Will I Have Enough To Retire?

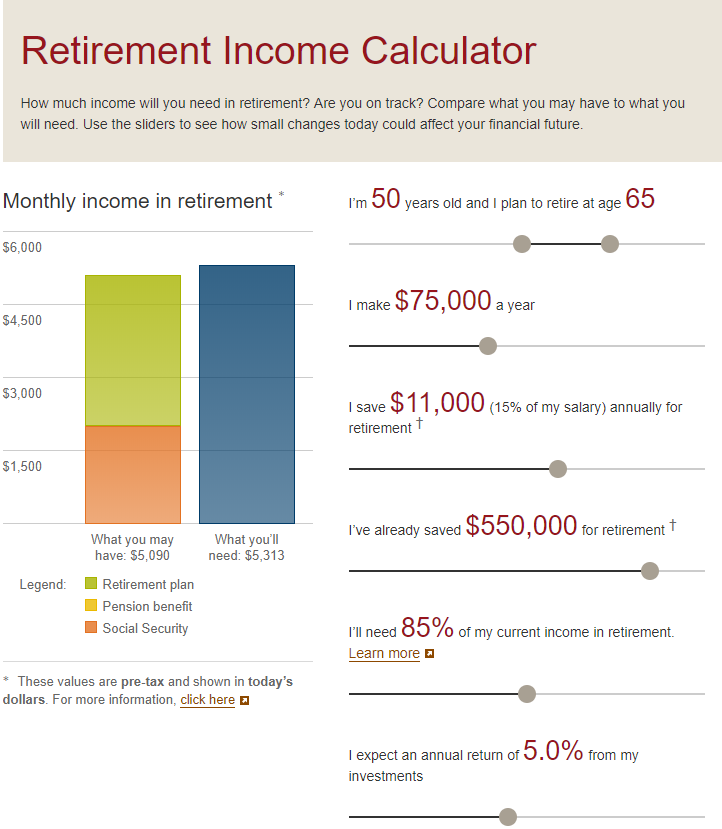

This section of the Vanguard site also has a link to their Retirement Income Planner, a screenshot of which I’ve attached below:

Get Your Retirement Plan From Vanguard

For those who are intimidated by “Do It Yourself” retirement planning, Vanguard offers a retirement planning service from their Vanguard Personal Advisor Service. I’ve instructed my wife in our “Love Letter” (In Case Of Emergency) to turn our investments over to this service in the event of my untimely demise. Their 0.30% charge is a reasonable cost for those who aren’t comfortable managing their personal finances, and I have no issue recommending them to folks as a viable option vs. Do It Yourself planning.

Age 65+ “Living It”

The final section of the Vanguard Retirement Academy is for those already in retirement:

The first link will bring you to an interesting section titled “Living In Retirement: How Much Do You Know”? This section is worth spending some time in, as it includes a comprehensive section on myth vs. reality of retirement planning, with links to dig as deep as you’d like into relevant topics.

The “Get Your Finances In Order” section is also worth your time, as it includes links to calculators to help you determine:

- Your retirement expenses (worksheet here)

- Your retirement income (worksheet here)

- Guidelines to calculate your safe withdrawal rate (here)

Conclusion

This blog’s purpose is to Help People Achieve A Great Retirement. As I come across resources which can help folks achieve this goal, I feel it’s appropriate to share them here. Vanguard’s Retirement Academy is one such resource. Again, I don’t know if this is available to folks who aren’t’ invested with Vanguard, and I apologize if the links don’t work for non-investors (there’s no way for me to check this since I’m a Vanguard investor). I’m sharing this purely as a Public Service Announcement, and am receiving nothing from Vanguard for this post. I hope the resources prove helpful to those of you seeking information to help you plan for your retirement.

By The Way, if you’re looking for additional resources, feel free to check out The Retirement Manifesto Resources Page, it’s packed full with useful tools to help plan your retirement.

I Need Your Help: If you have other links to great resources you’ve found for retirement planning, please share them in the comments below. If you are a Vanguard investor, were you aware of the great resources they have available? What other resources do they have which I may have missed? I look forward to continuing the discussion in the comments…

Together, let’s help folks Achieve A Great Retirement!

Thanks for sharing! This looks like a really great resource. Vanguard continues to win the hearts and minds of all of us in the FI community.

F40P, thanks for stopping in with the first comment! Yes, Vanguard is a “fan favorite”, and for good reason. I suspect most come for the low fees, but the educational offering is also first class!

I’m so glad you shared this! I’ve spent some time on the platform, but I can’t wait to dive more into these tools. I also can’t believe how much service they provide via phone. Even from the first moment that I opened my account (and was nowhere close to Admiral Shares or anything!).

Penny, I’m so glad that you’re so glad! A bit of a departure from my typical post, glad to hear it was helpful for you and others.

Fritz, your blog arrived at the proper time for me as I have been looking at some things that Vanguard offers. My sister, now deceased, had all her retirement savings and investments with Vanguard and was really thrilled with them. Keep up the good work, Fritz.

Don

The Veteran!! Great to see you here, Don, and glad to hear my post was helpful for you. I’m a fan of Vanguard, let me know if you have any questions as you evaluate their services. Thanks so much for stopping by, hope all is well with you in FL!

I was surprised their retirement calculator maxed out at $2 million in investments. Quite a few people have more than that saved up. Nice site and helpful post!

Wow, I didn’t realize that, Steve. I agree that’s low, will go have a look myself at the calculator (just to check, are you talking about their retirement calculator, or their cash flow projector?). I’ve used their retirement calculator in the past, and don’t recall that limitation. I’ve not used their cash flow projector until researching for this post, and only entered some general numbers for the benefit of this post, didn’t exceed $2M.

I just tried the retirement calculater too and it topped out at only 2,000,000 in savings and also topped out at 400k in annual income and topped out at only $60k in annual savings.

Good idea with the recommendation to your wife. I will do the same.

Most of our investment is at Vanguard already, but there are still some stragglers. I know she won’t want to deal with dividend stocks, rentals, and various P2P stuff. It’ll be easier to let Vanguard manage it when I’m not around.

Thanks for this.

Joe, let’s hope it never comes to that, but it was the best option I came up with for my wife. A full service CFP could certainly offer similar and/or more personal “hand holding” if she needs it, but I’d prefer to have her avoid that expense since I believe their Personal Advisory Services should be sufficient for anything she’d need.

You missed a big one. Financial Engines. This is something that Vanguard offers which negates the need for use of the advice bot from Bettterment or Personal Capital.

With a few clicks, you agree to share your account details and then Vanguard crunches your portfolio through Financial Engines. What emerges is a set of recommended adjustments. I use it to rebalance asset allocation two or three times per year. Plus, I love the price. Free. (Well at least it is free to my account class at VG). It may not be free-for-all.

GREAT addition to the discussion, Tony. I have used their Financial Engines service through my employer, wasn’t sure if that was included for direct investors or not (sounds like it is, though perhaps only once a certain level of assets are with Vanguard?). I agree it’s a great tool, thanks for adding the suggestion.

Yes, Vanguard has some of the best educational materials around! As far as other resources I find helpful is a website http://www.dinkytown.net which has a multitude of financial calculators. Their Retirement Saving and Planning section is particularly robust.

Thanks for the addition, David. I’ve not heard of Dinkytown, heading over to check it out now. Much appreciated!

Thanks for sharing this information. I have only really looked at their Monte Carlo Simulator. I am going to have to take a deeper dive at look at more of these tools.

Thanks for pointing out these tools. We’ve been with Vanguard for several years and I had no idea these tools existed. Granted, Mr. G does most of the investigative work but he may be unaware too.

Great share!

Mrs. G! Glad the article was of interest, I wasn’t sure how this would “play” since it was a change from my normal approach for a blog post. Felt it worthy to share, hope you and Mr. G benefit from it!

I think your link will work whether or not people are with Vanguard. I’m with them but in Australia.

I clicked on the link and it sent me straight to the page.

🙂

I didn’t know about this either, thanks for posting!

The ideal mix of stocks, bonds and cash in your investment portfolio changes over time. It’s logical that in our younger, working years, we want to be more aggressive with our investments. This typically involves favoring higher-risk assets like stocks over more stable but less lucrative bond investments.

Fritz, thank you for all the interesting articles. I have read several and have much more to learn.

I’m new to this whole seen. Getting a late start, have one year to go to retirement. I’m 67, and have very little

knowledge in the investment world. But i’m down to crunch time and need to become better educated.

I have an annuity which I can start drawing down at 70.5. We sold our house and down sized. Have 200k in money market fund. Have a 401k which should be worth over 100k by the end of the year. I got a late start on saving for retirement, so it is what it is at this time. So any ideas for what I should do? I have read little bit on the bucket strategy, still trying to figure it out. I’m little gun shy with investments, have lost a lot in each of the down turns. What should one roll there 401K over to when I leave my employment? Any direction would be helpful. I enjoy your website and blog very much. Thank you so much for all your time and effort!

Bruce

Bruce, thanks for becoming a reader of The Retirement Manifesto, and congrats on your initiative to self-educate yourself on retirement planning! It sounds as though you are, indeed, at “crunch time”. I don’t provide individual advice, but a few thoughts on your situation. With your ~$300k in MMF and 401(k), you can plan on ~$12k/year, or $1k/month of income/drawdown from your investments (using the 4% rule). To this, you can add your annuity and your social security to determine your total retirement income. Since you have $200k in your MMF, I think you’re safe to leave the $100k in equity investments to allow for some future growth. As for rolling it over from your 401(k), that’s an option but not required. We kept our money in my 401(k) when I retired since we’re happy with the 401(k) plan from my employer. I hope that helps, sorry I can’t be more specific, trust you understand.

Fritz,

Thank you for your response, I really appreciate it. Some of this is overwhelming, esp. for a rookie.

I will continue to read your blog with interest. We are also looking to travel, camp and do volunteer ministry work.

Hope you have a great 2018. Happy New Year

Bruce