How long do you want to be alive?

Do you want to be alive to 100? For me, it depends on what you mean by “alive”. If I knew I could be healthy, independent, happy and that my wife would be there alongside me, of course I’d want to live a long time. Ok, I’m game.

I’ll shoot to live to 100.

I’ll become 100 years old in 2063 (I’ll try to remember to write a post about it, I hope you’re all still around to read it!). At that point, I’ll be one of almost 1 Million Centenarians in the USA according to this article from Genealogy In Time. Wow. That’s a lot of old folks stumbling around.

It’s most likely going to happen. I hope they’re building up their investments now, they’re going to need them! The question today is:

What Will You Do If You're One of The 1 Million People Who Live to 100? Click To TweetIf there are 1 Million people in the USA over 100 years of age by the latter half of this century, there’s a good chance that someone reading this today may well be among them. What if it’s you?

What If You Live To 100?

We’ve got a lot to worry about as we face retirement:

- Longevity Risk: No one knows when they’re going to die.

- Inflation Risk: High inflation can devastate a retirement plan.

- Unplanned Spending: Spending “shocks” can derail the best laid plans.

- Sequence Risk: What if there’s a major stock market correction early in your retirement?

- Cognitive Decline: How are you going to handle things if your mind decays?

- Poor Investment Return: What if your investment returns are below your plan?

If you worry a lot about the various risks you face in retirement, I encourage you to read Managing Post-Retirement Risks – A Guide to Retirement Planning. I found it while doing research for this article, and it’s a good summary of all of the risks we face in retirement planning, as well as some suggestions for dealing with each type of risk.

Running Out Of Money

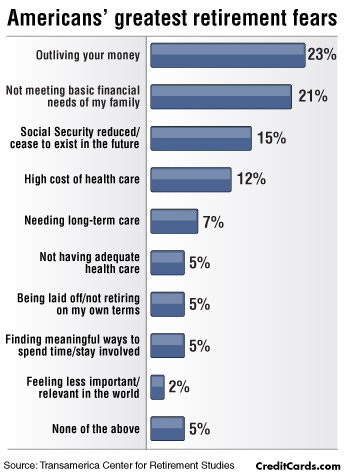

Of all of the worries we face, #1 on the minds of most retirees is running out of money before you die.

The longevity worry is only heightened by the reality that none of us know when we’re going to die. If you beat the odds and end up living to 100, your risk of running out of money becomes a very legitimate concern.

How do you avoid running out of money if you live to Age 100? Click To TweetWill You Live To 100?

Before you get too worried about living for a century, let’s have a bit of fun. To see if there’s a chance you’ll live to the Century Mark, I found three interesting sites for you.

- How many of these 29 Signs That You’ll Live To 100 do you exhibit?

- If you want a bit more scientific approach, run this life expectancy calculator from “LivingTo100” (I just ran it, looks like I’ll be living to Age 93. Guess I don’t have to worry about running out of money!).

- Run this University of Pennsylvania life expectancy calculator if you want another opinion. (I should have stopped at #2, as #3 said I’d only make it to 88. I think I’ll stop now, while I’m ahead.)

If it looks like you’ll be around a while, you’d better pay attention to this article.

Determining The Impact Of Living To 100

Retirement Calculators: To start, no one should be retiring without running a few retirement calculators. Here’s my list of my favorite calculators. Since you’ll be running a few anyway, use that exercise to visualize the impact of living to 100.

The baseline “Death Date” for any retirement retirement calculator should be 95 years old, according to this article. You want to insure you have enough saved for a reasonably long life, but you don’t want to make it unrealistically long. If, for example, you enter “110 Years Old” into a calculator, it will generate a savings number that will require you to work far longer than you realistically have to.

If you “passed the longevity test” above, and it looks like you have a good chance of living a long life, I’d suggest you “tweak” your expected death date from 95 to 100 years old in a few of the calculators, and compare the results. This will help you incorporate longevity risk into your decision on when you’ll plan to retire.

If you’re already retired, I would also suggest you run several calculators every year (you should be doing that, anyway!). Increasing your expected death date will show you how much you’d need to reduce your monthly spending now to cover the additional living years later.

Steps To Make Your Money Last

Ok, so now we know how long you’re going to live, and how much money it’s going to take to get there.

What if we’re wrong? (we will be, you know)

Every good retirement plan should have some contingencies built in, including the risk of outliving your money. I’ve included some Risk Mitigation strategies below, as well as my comments on how my wife and are are including each one in our personal retirement plan:

Save Like Your Hair’s On Fire

Ok, in fairness, if your hair were on fire, the last thing you’d be thinking about is your savings rate. The point is this: if you’re still working, add a sense of urgency to your savings effort. Go in today (I’ll wait….) and increase your automated savings by 2% vs. whatever your current rate is. Sure, it’ll stretch you a little bit, but see if you can make it. Get the hay in while the sun’s shining.

Soon, the rain will come (loss of employment income), and the only hay will be what you’ve put in your barn. You’re going to be eating that hay all winter, and you want to make sure there’s enough hay to cover every meal. Fill that sucker, and fill it full. Open another tab in your browser window, and do it now.

Be conservative on your withdrawal rate

Historically, folks have said a 4% withdrawal rate (e.g., if you have $1,000,000 you can pull $40,000 / year to live on) is safe enough to insure your money lasts a lifetime. There’s a lot of debate on the topic at the moment (best article I’ve seen lately is Early Retirement Now’s “Ultimate Guide To Withdrawal Rates”, which I encourage you to read).

Personally, I think 4% is too aggressive, given the bearish outlook for equity returns over the coming decades. (See this article from FinancialLibre on why future returns will likely be muted). Like Early Retirement Now, we’ll be targeting a 3.5% or lower withdrawal rate. Get this number as low as you can, and your chance of funding your retirement to the Century Mark increases dramatically.

Delay Social Security

There’s a lot of information on Optimizing Social Security, and it’s beyond the scope of this article to dwell into the details. Suffice it to say, the longer you live, the greater your payback from delaying your claiming date for Social Security. With an 8% annual increase for each year you delay, there are no other safe investments that give you the lifetime income growth associated with delaying social security.

For our plans, we’ll likely have my wife draw spousal benefits in her mid-60’s, but we’ll definitely defer my start date to Age 70 at a minimum. Not only do you increase the initial benefit payout by deferring, but future inflation adjustments are also compounded off a higher base.

Be Flexible

Regardless of what withdrawal rate you settle on, your chances of long term success are significantly improved if you’re willing and able to adjust your spending rates based on market performance. In years when the market declines, freeze your withdrawal at the previous year’s level, or decrease it to your bare essentials. If the market performs well, increase your spending in line with inflation.

For our retirement plan, we’ll likely implement a floor and ceiling approach, which again is beyond the scope of this article. Essentially, you create a floor which covers all of your essentials, and you force your spending to drift down following a bear market. In a good year for the markets, you create a “ceiling”, which allows you to increase your spending (perhaps time to replace that old car?), but only to a pre-defined limit.

Use The Bucket Approach

I wrote extensively about the Bucket Strategy in “How To Build A Retirement Paycheck” (which, by the way, was my #1 most read article in 2016!). Using the bucket strategy allows you to have sufficient cash reserves to survive through a bear market (avoiding selling stocks at a low point). In return, you can invest significant portions of your portfolio in the equity markets, which historically have generated the highest returns. There’s no doubt about it, if you want your money to last to Age 100, you’ll need to have an ongoing exposure to stocks.

The strategy which my wife and I will be using is detailed in the referenced article. Have a look, and take the time to fill up “Bucket 1” with 2-5 years of spending requirements before you retire. We’re busy filling Bucket 1 now, and it will be a continued focus from now until we die.

Live Abroad

Sound crazy? Maybe so, but it’s a trend that’s really gaining momentum. Chances are, if you go to a low cost country as a retirement strategy, you’ll find yourself surrounded by many other “Retiree Expats” doing the same thing. A bit radical for my tastes, but a definate option if you’re facing a Retirement Crisis and are running out of options. For the adventurous among us, it could be a thrill. One thing’s for sure, you can live on a lot less money in some of the countries currently favored by retiree expats. Check out these 8 Countries where you can live for 30 years on $200k. Do that for a decade or two, and you’ll be well on your way to preserving your portfolio for your 100th Birthday!

Tapping Home Equity

Having a home that’s paid for should be a priority for your retirement. We paid off our home in April, and it feels really, really good to be entirely debt free. Not only does it reduce your living expenses once you’re on a fixed income, but it provides flexibility. I’ve not researched this topic in detail, and I don’t plan on using it in our retirement. However, it is an option, and one to seriously consider as you approach your later years.

There’s a lot of information available (I just did a google search for Reverse Mortgage, and came up with over 10 Million hits). At a minimum, this should be something to remember as a contingency plan if you get into serious trouble later in life.

Longevity Annuity

The “Deferred Income Annuity” is a controversial subject. Critics will claim they’re a means for insurance companies to extract exorbitant fees from unknowing retirees. Advocates claim they’re the savior of retirement. The reality, per usual, is somewhere in between. In essence, with a longevity annuity, the retiree deposits a certain amount of money with an insurance company today in return for an income stream in the future. There are risks with such products (e.g., your money is inaccessibly tied up, and you may lose it if you die), but they certainly play a role. Use a hammer to drive a nail, as they say.

In our retirement Cash Flow Model (click here for a copy of the spreadsheet template, available to all of my readers), I’ve created several scenarios. In one scenario, we’ll deposit $100k – $200k into a longevity annuity at Age 65, and begin receiving an income stream at Age 85. For now, I’m content to continue to study this product, and will make our final decision in another decade or so. I have talked with Vanguard about the concept, and have actually received quotes from them for the purpose of my Retirement Cash Flow Model. If you’re seriously considering it, work with a Certified Financial Planner (just make sure they’re not a commission based agent, who gets revenue from selling annuities!). Also, if it were me, I’d wait for interest rates to increase a bit before I deposited the money, as the future income stream is driven by the interest rates in affect at the time of the contract.

Conclusion

I’m looking forward to my 100th birthday blog post in 2063. Until then, recognize that longevity risk is something you should seriously consider in your retirement planning. Make a “base case” scenario using “average” life expectancy, but have some contingency plans at the ready. A few minor tweaks along your retirement journey will go a long way in insuring that you last longer than your money.

If all else fails, you better be really nice to your children.

You may end up living with them.

Fritz – this is exactly the reason I plan to work well after FI And also the reason I have multiple FI tiers as guidelines. I have a high probability (minus my job) that I will live into my 90s. All of our family has lived well into their 80s and now some in their 90s. With medicine being what it is these days I can only assume it will get better… Then again, we may suffer an apocalypse and all of this will be a moot point. Anywho, preparing for the future will be a part of my life regardless if I am 38 or 68. 😉

“Save like your hair’s on fire” – amen.

On his radio show, Ric Edelman often discusses exponential technology and scientific advances that increase longevity. He talks about 100-year-olds being in better shape than 50-year-olds and people no longer dying mainly from disease, but from accidents. It’s certainly scary to wonder if you’ll outlive your money or if you’ll outlive your health. We’re doing as much as we can to keep both the finances and our bodies in shape.

My biggest fear is cognitive decline. For the moment, I’m fairly sharp (on good day, that is), but I’m sure that won’t last forever. I already notice a drop in my driving skills. Part of my strategy for dealing with cognitive decline is being very nice to my nieces and nephews. They’re good kids, so I’m fairly confident one of them will step up when Mrs. G and need the help. Another thing I’m intrigued with is a longevity annuity. If some financial firm out there can come up with a product with reasonable fees, I would jump all over it. Better to have more mailbox money than money in a brokerage or bank account that can be swindled! I guess I should start doing my homework now. Thanks for a very informative post, Fritz. You gave me a lot to consider.

GREAT post, Fritz! I took two of the life expectancy quizzes – 95 and 97. Apparently I need to plan on living to 100. The two things that concern me the most on your “worries” list are unplanned spending and cognitive decline (which could, potentially, go hand in hand).

I like to prepare for the worst and hope for the best. “Save like your hair’s on fire” is great advice. Sure, increasing that savings rate will be challenging in the beginning, but after a while you’ll get used to it and won’t miss it.

Thanks Miss Mazuma, The Groovies and Amanda for your thoughts! I’m currently slamming away at a work thing, but wanted to give you all a huge shoutout of thanks for commenting on this post!

It’s important to think of various scenarios (dementia, living to 100, etc), and build some contingencies into your retirement plans!!

I took the first survey (turns out I already had an account…!) and excited to say it projects me to live to 97! Just like you, I’ll stop while I’m ahead :). And on second thought that’ll mean much more cushion for my investments. I currently plan on withdrawing a conservative 3-3.5% and still living a modest lifestyle. In years where the market doesn’t perform as well, I’ll try to cut back to help funds last longer. Living to 97 would mean right at 60 years of retirement for me (according to my plan today)! That’s a lot of years of expense!

Wahoo – 95!

I am surprised that health care wasn’t a higher concern but I suppose Medicare kicks in quickly for most retirees.

Running out would definitely be my fear – but that is what conservative planning and passive income is for. Good post Fritz!

I did the calculation.. 97 years old! I have 73 more years to go, crazy to think about that.

I’m 24, and I’m trying to accumulate as much money as I can early in life, and let compounding do it work later in life. I’m not worried about retirement per se, hoping more to have options in the future!

Plan for the best possible outcome and utilize all the tools you have! What an uplifting message.

I watched my father and grandfather lose a bit of zeal and acquity, so I would only add that I want to “stay in the game”. I will be doing so through online entrepreneurial opportunities that I control, unlike Mr. Market.

Thanks Fritz!

The University of Penn calculator says age 86. Apparently my life expectancy is 2.8 years shorter because I don’t drink. 😀

I’m certainly not planning to be an octogenarian, but I can’t imagine that if I were to retire at say 40 or 50 that I would just stop producing income. You have lots of good ideas and annuities will probably make a lot more sense when we see higher interest rates again. It’s also alawys nice to know that we have the “live abroad” in our back pocket. There’s a great website called the overseas retirement letter that those interested in that possibility might want to check out, they have a digital magazine you can subscribe to with more details on the 8 countries you listed as well as some others:

http://overseasretirementletter.com/

Thanks for the shout-out and endorsement!!!

Great post – and I enjoyed the fascinating links, too! My Life expectancy is 93. Also quite interesting: 2-7 alcoholic drinks per week gives you the max. I knew it!!! Interesting thought about the longevity annuity, too.

So, we’re planning not only for a long retirement horizon but also higher health expenses (and/or in-home care) when old. That entire travel budget will just shift into health care etc. I have no illusions about reducing (real) spending when we get older!

Cheers!

Big ERN! I agree on the need to insure planning for higher health expenses (I wrote about that in “Obamacare Is Falling Apart“). Of all “retirement concerns”, health care and longevity are the two which concern me the most. Like you, we have contingencies in place! Thanks for stopping by!

Bahaha! The last two lines 😉 I tell my parents that all the time – they had better live long enough to be a burden on me!

You bring up so many invaluable points. There are tons of unknowns facing each generation, especially when it comes to longevity. The worse I feel (it’s temporary!), the more I think about health and its relation to finances. Longevity calculators fascinate me, but they can be troubling, too! I think you’re right to quit while you’re ahead.

Ya’ll are awesome. Thanks for so many great comments on this one! Busy travel week, so took the approach of a “group thank you”! Just got on a plane…heading back East to the mountains of N Georgia!

Great work as usual, Fritz…and many thanks for the great shout! Apologies for joining the party late here!

It’s purely selfish, but I just hope I’m the first to go among my immediate family. I’ve lost loved ones long before their 95th or 100th birthday…couldn’t bear it if it were Lady Libre or Little Libre before me. If it’s quick, painless and happens before I’m a burden to anybody else, I’m sure I won’t be able to complain too loudly. 🙂

Your points here are super – and a valuable wakeup call to people inclined to use benchmarks like the 4% Rule without considering retirement length, allocation issues, etc. Luckily, there are some fairly easy ways to fix the Rule’s shortcomings, and there are great options for reducing cost of living – including going abroad, which I’ve found injects more life into your years, even if it doesn’t increase the number of those years.

Also, since it comes up in a few of the comments here and is an obvious concern for many, there’s some emerging and very compelling research on the benefits of nicotine supplementation (via patch or gum) with respect to warding off and even treating Parkinson’s, dementia and Alzheimer’s. The Michael J. Fox foundation is among groups actively researching this, and it’s certainly something to watch for anyone planning to live as long as Jiminy Cricket.

Great job, and thank you again!

FL, I was pleased to reference your work, you’re cranking out some solid stuff on your site! Thanks for your comments here in the land of mutual respect! Hasta Luego, mi amigo.

Tru dat, Fritz. Play on playa.

My great aunt lived until she was 101 and recently passed away in November. Her secret was she drank a glass of scotch everyday. We joked that she pickled her liver 🙂

She didn’t make a ton of money and her husband passed away when she was 43. So she was responsible for taking care of herself. She quickly found a job in the government and was able to get a small pension which took care of all her wants and needs.

But I know not everyone was is as fortunate as she is.

Wow, a truly amazing story. I can’t imagine living as a widow for 58 years. (Maybe that’s why she drank that Scotch!). Looks like you may have longevity in your blood, better make sure you’re prepared!

Well done Fritz!

Tracking retirement spending and “minding the gap” — the difference between investment gains and spending — is key to avoiding failure. As you emphasize, building in some cushion makes it possible to cut back if necessary to avoid outliving your money.

But note too that with a robust stock allocation, even rather high spending rates (4.5% +) work more than half of the time for many, many, years. So, although like you, we are planning a more conservative initial withdrawal rate (around 3%), a recent health scare also reminded me of how important it is to enjoy life while you can. I am thus trying to get comfortable with the idea of going above 3% in a particular year in exchange for some awesome experiences while recognizing that we may need to trim later depending on how everything unfolds. As in all other aspects of life, balance is key.

Thanks again for the excellent article, and keep up the good work.

Mr. FIDough

https://fidoughhub.com/

P.S. I added this article to FIDough’s Current Picks!

FIDough, thanks for your great comments. Withdrawal rates are an interesting phenomenon, in many, many 30 year windows, a w/r of 5% or more wouldn’t be a problem. The thing that makes it difficult is that you never know what your “30 year window” will look like, since you’re looking to the forward instead of the past. Therefore, we’ve no choice but to be conservative, and adjust spending based on actual market performance. Thanks for stopping by, I always appreciate your input.

You give some good pointers on how to deal with retirement financial risk.

TO me, being flexible and having a conservative withdrawal rate are key. In Belgium, we have no way at this moment to delay the pension payment.

Working with buckets could be a great way to create ease of mind.

My biggest worry: not being mentally fit to deal with all the sells and reshuffles I would have to do. Action plan: make it part of the values I pass to my kids so they can do it for me!

I do hope I can read your post in 2063

Amber, nice seeing you here! I agree mental decline is a huge concern. My wife and I are planning on turning our financial management over to Vanguard Personal Advisory Services when we’re 70. At a cost of only 0.3%, it’s worth the cost to avoid the concern. Training your kids is another creative approach to the problem! Thanks for stopping by!

I’m betting longevity annuities will become a more common way to generate late life income. A relatively inexpensive way to cover a low risk high impact event. Sort of like a tontine, which was very popular until outlawed in early 20th century. Even if longevity isn’t your primary concern, could allow a more definitive planning horizon.

I remember scoffing at an old Fidelity article saying a family earning the median $50000 income should save 20% over a 45 year career to accumulate well over 1 million to cover the remote possibility of living to 100. It seemed crazy to me to over save for such an improbable event, that would be much cheaper to insure against.

Stevie, ironic that you mentioned “tontines”, a friend and I were chatting about them a few months ago. Fascinating topic, and actually make a lot of sense!! I agree that longevity annuities will likely gain in popularity as the “baby boom” demographic wave enters middle retirement. Not a bad option to cover longevity risk, as long as you’re aware of the details and choose wisely. Thanks for stopping by!

Well, I would appear to be getting healthier. I took your first calculator a few years ago and it said 94, today it was 100, Your second one came up with 96. Fortunately I was planning on 99 anyway, because I come from a family of ninety year olds on my mother’s side, and I am definitely my mother’s daughter.

Like many people above, cognitive decline is my top worry. My Dad had dementia in his late 70’s, but my Mum was still sharp when she died at 94. So I am hoping I have Mum’s brain genes, as well as the longevity ones!

However, I believe that living healthily, taking exercise, keeping your brain active, and having a positive outlook are the best things you can do for yourself. While money helps, these are things that you can do regardless of how much money you have.