There are a few things you need to know before you retire.

If you’re not retired, it’s impossible to know what it’s REALLY like to be retired. Without knowing, it’s difficult to determine how to plan as you make your final preparations for retirement.

Your next best option, then, is to learn from those who have walked the trail ahead of you.

Today, you’re in luck.

Below, we’re sharing the things you need to know before you retire. Retirement will likely be some of the best years of your life. Making the transition, however, requires planning to be successful. So, consider these 5 areas as you make your plans. Addressing them before you retire will increase your odds of a successful transition and lead to many enjoyable years in retirement.

If you’re already retired, I’d love your input. After reading the 5 things outlined below, I’m asking you to jump into the comments with other tips you’d give someone who is on the brink of retirement. Let’s make this a community effort to help those who are following in our footsteps.

There are certain things you need to know before you retire. Today, we're sharing the things that really matter as you plan for your retirement. Click To Tweet

5 Things You Need To Know Before You Retire

When you’re planning to retire, it’s natural to focus on the numbers. None of us want our money to run out before we die. Money seems like the highest area of risk, so we focus on getting it right.

Focusing on money is necessary, but insufficient.

Once you’ve retired, you realize there’s much more to a successful retirement than money. There are a lot of other risks beyond the financial ones. Risks of becoming depressed, getting bored, being lonely, and feeling lost. Focusing on these risks is a critical, and often overlooked, step in the retirement planning process.

To increase your odds for a smooth transition, it’s critical to plan for the non-financial aspects of retirement in addition to focusing on the finances. Research has proven that the amount of time you spend planning for retirement is highly correlated to how smooth your transition will be. Based on my personal experience and years of research, below are 5 non-financial items you should think about in your final year before retirement.

1) Freedom Is Great, But It Comes With An Obligation

The biggest allure of retirement is Freedom.

Freedom…

- …from the alarm clock.

- …from the commute.

- …from the boss.

- …from those dreadful Zoom calls.

- …from those even more dreadful annual performance reviews.

And yes, the Freedom IS wonderful. But….

Think back to your childhood years, when you had that thrill of Freedom on your last day of school. Ah, a whole summer off! FREEDOM!! If you’re like me, however, by the middle of July you were getting bored. Your Mom would make suggestions on things for you to do, and you’d give her one of those infamous adolescent eye rolls.

News Flash: Retirement is a LOT longer than summer vacation. Longer, even, than those 20+ years you spent in school. And with it comes an entirely new (and often, unexpected) obligation. Being unprepared for that obligation can result in a difficult transition as you figure out what you’re going to do with your endless summer vacation.

The obligation? Figuring out what you’re going to do with your newly discovered time freedom.

- 24 hours a day

- 365 days a year

- For the next 20 years.

If you’ve thought about it at all, you’re likely a bit worried about getting bored. I know I was. And yet, I’ve never been bored a single day in my 6 years of retirement. Why?

Because I pursued my curiosity and found some things that gave me life.

The good news: you can easily manage the obligation you’re about to face. The key is to think about it beforehand, and start preparing for the journey ahead. The more time you put into it before you retire, the easier the task becomes.

2) Your Transition To Retirement Will Be Harder Than You Think

Barbara retired 6 months before me, and I’ll never forget a comment she made a few months later. “Wow,” she said, “the transition to retirement is SO much harder than I thought it would be. I wish someone had told me how hard it would be before I retired.”

Consider yourself told.

Based on research I published in the Retirement Blind Spot Study, 52% of pre-retirees expect their transition to retirement will be smooth. When folks who retired were asked the same question, however, only 32% of retirees said it actually was smooth. Do the math, and that means 68% of retirees had a rough transition.

The transition to retirement is hard.

Your entire world changes and most folks are unprepared for how dramatic that change will be. As we’ll discuss in Item #4 below, you’ll miss a lot more from your job than just the paycheck.

It’s time to put on your game face. Recognize your world is about to change in ways you never expected, and prepare yourself to make some major mental adjustments. In time, you’ll get through the transition and likely find retirement to be the best years of your life. But I urge you to be realistic about how long it will take to successfully implement the change.

The more time you spend thinking about those changes, the shorter your transition will be.

PS: There’s a fascinating post on Facebook where someone asks:

As I write these words, there are 370 responses to that question. If you want to get a sense of how big those surprises are, read the comments here. (Note, you’ll have to join The Retired Life group before you’ll be able to see the actual post, but I assure you it’s worth the effort).

The good news: Your transition doesn’t have to be difficult. My transition was smoother than I could have imagined, and I didn’t struggle in the least with the move into retirement. Why? Because I put a lot of effort into addressing both the financial and non-financial aspects of retirement in my final years of work. I mentally prepared for the change that was about to happen in my life, and I was realistic with my expectations. Nothing magic, and something anyone can do.

3) Money Won’t Matter As Much After You Retire

In my final few years of work, I talked to a lot of retirees. I was really focused on “the numbers” at the time, and I was surprised how often retirees told me they didn’t think much about money in retirement. “You have what you have, and you learn to live with it,” was a common refrain.

I’ll admit, I wasn’t a believer.

As I worked through the One Retirement Question Project, however, I started questioning my beliefs. The answers from the numerous 80+ year-old retirees I interviewed were surprisingly consistent. Almost none of them mentioned money as the key to a successful retirement. All of them stressed that the true key to a successful retirement was finding something that you enjoyed doing, something that motivated you, something that provided personal reward.

Three years into my retirement, I realized they were correct. I wrote about my conversion in The 90/10 Rule of Retirement, where I defined the rule as follows:

“In preparation for retirement, most people spend 90% of their planning time on the financial issues and 10% on the non-financial issues. After retirement, the ratio reverses, and most retirees spend the vast majority of their time focusing on the non-financial issues of life.”

The concept of finding your Purpose became the theme of my book, Keys To A Successful Retirement, and I’m now a firm believer in the importance of the non-financial aspects of retirement.

If you’re not yet retired, I understand your hesitancy to believe the phenomenon. Been there, done that. All I can say is “trust me,” and consider my advice to recognize that it’s critically important that you carve out some time to think about the non-financial aspects in your final few years before retirement.

Your retirement will be better as a result.

4) You’ll Miss Certain Attributes From Your Working Years

When people think about leaving their jobs, their thoughts naturally lead to the loss of their paycheck. That’s natural and understandable.

What most people don’t think about, however, are the numerous non-financial benefits they receive from their work. Things like:

- Structure to their day

- Mental challenges

- Relationships

- A sense of reward

- Purpose

- A sense of identity

When you retire, it isn’t just your paycheck that disappears. Everything on that list vanishes in a moment.

Your day is no longer structured. In a single day, your life goes from one that is tightly structured to a day with no structure at all. You no longer have to wake up at a certain time. You no longer have meetings filling your calendar. You no longer have deadlines you’re working toward. All of the structure is, in a moment…

Gone.

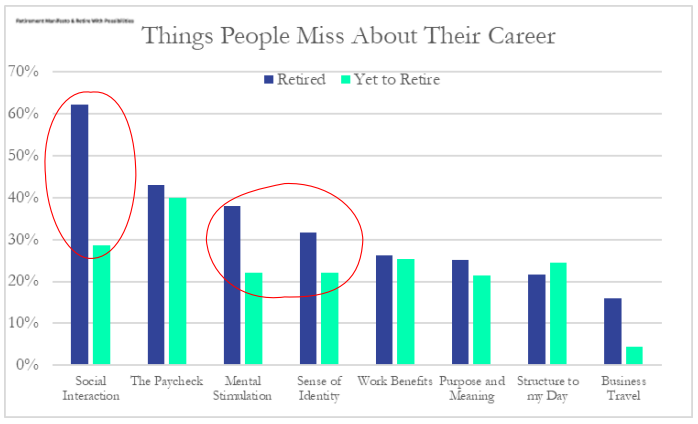

At the same time, you find your day has no specific purpose for you to work toward. When people ask you what you do, you hesitate as you realize you don’t really have a response to that question. You think you’ll stay in touch with the people you worked with, but in reality, those relationships fade quickly. The following chart from the previously mentioned Retirement Blind Spot study highlights this reality:

Ultimately, it’s the non-financial aspects from work that you miss more than the paycheck, and it’s one of the primary reasons 28% of retirees are depressed.

The Good News: It doesn’t have to be this way. As you’re making plans for how you’re going to Replace Your Paycheck in retirement, take time to think about how you’re also going to replace all of those non-financial attributes you currently get from work. I did exactly that, and it looked something like this:

- Do you want some structure in your day? Join a gym, and sign up for a few classes.

- Worried about losing your sense of identity? Start a blog, and become a writer.

- Find ways to build relationships outside work, before you retire.

- Worried about losing your purpose? Start (or join) a charity.

You get the idea. Now, the hard part. Do it.

5) You’ll Have An Important Job In Retirement

I hate to break it to you, but your “working years” don’t end when you retire. It turns out you’ll be working a lot in retirement, but it’s not what you think.

Your retirement “job” is unlike anything you’ve ever done in your life. There is no resume required, and no job interview will take place before you’re hired. You’ll be your own boss, and you’ll develop the requirements of the position. The job description cannot be written, because the job you discover will be unique to you. Your first task is to learn to exercise a portion of your brain that’s likely been dormant since you were a child. Learn to listen to your curiosity, and have the courage to follow wherever it leads.

Learn to play again, like you did as a child. The play will be different this time, but it will have similarities to your childhood. Yes, I still ride a bike in the woods, just like I did as a child. But I also spend a lot of my time helping others, something that my childhood self wasn’t too interested in. Just like a child, I don’t worry too much about money these days. My job isn’t focused on making money like it was in my working years.

Now, it’s about something bigger.

Your retirement job will focus on finding things to do with your time that bring personal reward, enrichment, and satisfaction. Cherishing time with the future generations, and being intentional as you pass down your legacy to the family members who follow behind. Being more aware of your spiritual life, and investing in things of eternal significance. Doing what you can do to change the world (or at least the small corner of it that you call home).

Or not.

It’s your job, and you have the freedom to decide what it entails.

As a child, I ran when we played tag. I swam at the local beach through those endless summer days. I rode my bike as I delivered newspapers around my hometown. Now, I run, swim, and bike because I’m focused on doing what I can to improve my healthy years of life. While the purpose may have changed, I continue to find those activities just as enjoyable as I did in my youth.

This, then, is your retirement job.

For the next 20 years, you’ll be continuing this work. Exploring things that interest you. Finding ways to use your time that bring a sense of satisfaction. Finding ways to help other people. Taking care of your body, mind, and soul.

In your final years of work, prepare your mind for your new job.

Like many things in life, your new job will be as rewarding as you make it.

I suspect you’ll find, like many others, that it’s the best job you’ve ever had.

A Final Thought

Last month, I appeared in my favorite podcast episode to date. You know how sometimes you just feel “alive” and your brain is firing on all cylinders? That’s how I felt when I was talking with Caleb and Riley in this episode of the Awe-Inspired & Retired podcast. If you have a few minutes, I’d encourage you to give it a listen, especially if you’re not yet retired.

What did I like about the interview? I was brutally honest in my response to their question, “What would have kept you at work?” I was unprepared for the question, and the response I gave came straight from the heart. If you don’t have time to listen to the entire episode, just scroll on this link to the 16:00-minute mark and have a listen. The quote below was part of my response, as well as the edited video clip below (to hear the complete response, you’ll have to listen to the podcast, but I trust you’ll find it worth your time):

“We’ve got a very limited timeframe here where we can live life like we’ve never been able to live it before. That’s worth more than money.”

Click on the image below to hear an edited clip of my response:

Perhaps my favorite part of the interview? My impromptu response to the final question of the interview, when Riley asked me “What do you want to do when you grow up?“. If you’d like to hear it, scroll to the 57:30-minute mark here. I won’t give you any insight into my response other than to say I’m considering writing an article to expand on the answer I gave. I also got a great email from a woman who heard the podcast and wrote to tell me she loved my answer to that question. I smiled as I read her words. I consider emails like hers my compensation in retirement, and they’re worth more than money.

Bottom line: Retirement is amazing. It’s our one chance in life to do what we want to do, whenever we want to do it. It’s our chance to change the world. I wouldn’t encourage anyone to work longer than you have to. Even if you love your work, is it really worth giving up the few remaining healthy years you have left in your life? Is it worth losing the rare opportunity to explore other things that could bring more joy to your life than you ever expected?

For me, the answer is obvious, and I don’t think I could have given a better answer than the one I gave to Caleb and Riley.

If you’re nervous about retirement, I hope my answer assures you that the joy of retirement is worth the effort.

Yes, the transition can be difficult.

However, by addressing these 5 Things You Need To Know Before You Retire, you’ll be well on your way to a smooth transition, and a retirement life that exceeds your expectation.

It’s time to start your new job.

Are you ready?

Your Turn: If you’ve not yet retired, have you spent much time thinking about the non-financial aspects of retirement? If you’ve already retired, what other advice would you give to those following in your footsteps?

Bold, to not encourage anyone to not work longer than they have to do so. I loved my job, or most of it, and I would have liked to have moved to a couple of days a week rather than full time. I have been retired two years now and I have a recurrent dream that I am on long term sick leave and need to hurry back to work! Still getting used to being retired, I suppose.

I agree wholeheartedly with what you write, Fritz. I began to build a portfolio of activities in my final work years so that I could slide across to them when I stopped work. This has worked very well and I am busier than ever doing a range of nice things from helping others to getting fitter.

Go bold or go home? Wink. I wouldn’t have said it if I didn’t mean it…

Funny that you mention recurring work dreams. I’m 6 years in, and still have them. (Then again, I had those “exam anxiety” dreams for 20 years after I graduated from college, so there’s that).

Yes, I have had that recurring nightmare that I should be at work! Been retired 2 years now. I developed some new skills and hobbies but most of my time has been taken up caring for two elderly family members, mom and mother in law, 95 and 94 respectively. I have never complained of boredom these past two retirement years

So nice to know I am not the only one, recurring dream about not going to class all semester and final today!

That’s the one! I hate that dream/nightmare!

Hobbies, purpose, service, engagement. Now that I’m retired, I feel like a teenager with resources. It’s great. I can say “yes” to all the people and activities I never had time for while I was working. I feel as if I’m living the life I always dreamed about. I recognize my privilege with gratitude, and make an effort to share and pay it forward.

Being a save my whole life, this transition to spending the sacrosanct retirement fund was an adjustment. An annual budget and long-term plan put me on a path I can relax into.

“I feel like a teenager with resources.”

Hold that thought…I just started my next post (hinted at in the end of today’s article), and I think you’re going to like it. Teaser launched.

Hi Sandy!

I love your reply. Recognize your privilege with gratitude and pay it forward to others. Outstanding attitude towards life and retirement young lady!

If everyone could wake up reminding themselves to act humbly and be kind to all with gratitude for their new day….well, what a world that would be to live in, huh?!

My input to Fritz’s outstanding post would be to join him in urging all to replace “work” with serving others in a charity. Serves you with purpose, social interaction and getting one out of your home. Build fences for dogs (:-)), homes for humans with Habitat for Humanity, walk dogs at a shelter (exercise), clean your church, put smiles on children’s faces at a hospital, or any other thing that inspires you. Countless ideas avail. on the Web.

God’s blessings to all you readers, Steve

“…Build fences for dogs (:-))…”

What a marvelous idea. Wink. Thanks for all you do for Habitat, my wife and I have talked often about how much Freedom For Fido resembles Habitat, it’s just that we do our builds for dogs!

As always, excellent and insightful!

Simplify your living space. It’s time to start getting rid of clutter and excess possessions. This should have been done, probably, long ago. Do you really want your heirs to see how much and what kind of junk you have?

HA HA….. Bring the trash bin!!

So true! My retirement coincided with both parents having life altering or ending health issues. The process of clearing out two houses was educational. Took me about 5 days to empty, move and clean Dad’s house by myself because he’d purged beforehand. It took all 3 sisters two months to sort through Mom’s house and then we had an estate sale. I’m doing my own downsizing now.

Yep. We went through the same, and my wife and I have been committed to keeping the clutter cleared. We sold or donated all of our “excess” stuff when we downsized for retirement, and continue to maintain the “bring one in, take one out” philosophy for keeping down the clutter.

If you can transition from work from 6 days a week down to two it makes it so much easier. This allows you to work longer if you enjoy your job which helps with time and money.

I can’t say enough about transitioning from full time to part time. I am 70 years old and semi-retired last June. I now work 5 days a month on average. I was in the home building industry and now am focusing on repairing/updating our home. Two things I’ve learned over the past 6 months.

1) don’t try to use the same approach you did while full time problem solving-SLOW down what didn’t get finished today will still be there tomorrow!

2) DON’T be afraid to take a nap, they are worth every second!

Jeff, your comment reminds me of the answer from the first “One Retirement Question” interviewee, he said “there’s always tomorrow, don’t stress about getting everything done today.”

And…nothing beats a good nap.

I retired 3 years ago and was fortunate to get a part-time teach job at our near by university. It gives me purpose to pass along my knowledge and work experience to the younger generation. It provides me some structure in my daily schedule. Allows me to stay current in my field of expertise.

We all have gained a wealth of knowledge during our working years and why not share that knowledge with some of our future leaders. It has been a wonderful experience for me.

RWW, no doubt that a slow-down transition is an effective strategy. It wasn’t an option for me, but pleased to hear you were able to work it out. In effect, my writing and charity work have become “part-time jobs”, so in a sense I did end up creating a serendipitous transition plan.

I was in the fortunate position (sales) to do what I then called “practice retirement” where I only worked a day or two per week for the last couple of years of employment. So when it was time to “flip the switch” the transition was extremely smooth.

Note: my initials are also RWW

I think the most important retirement preparation takes place when you’re first entering the workforce. The axiom I imparted to my students (I’m a retired dermatologist) is: Make sure medicine (insert your career choice here) is what you do and NOT who you are! Too many people identify themselves with their career. I frequently heard “It’s not what I do, it’s who I am.” Well, whatever your career, it will eventually be taken from you. And at that point, if it’s who you are, who are you? Put that mental prep work in, and the earlier the better! I dropped the mike, walked out, and haven’t missed the career I loved for a nanosecond. Hitting your retirement number (12X annual salary in savings), living within your means, a spiritual foundation, old adage one house/one spouse/one job (not shopping around and constantly looking for more/newer/better), and educating yourself about money and writing down a plan are timeless concepts that are still invaluable. Best of luck to all who read these feeble words!

Feeble words? Not in the least. Sound advice, I hope those young students of yours took it to heart.

“Hitting your retirement number (12X annual salary in savings),…”

Formulas like this are meaningless. Everyone has their own financial means and everyone spends differently. Also 12x what salary? If someone makes $200k per year they probably don’t need 12x that in retirement–again, depending on their lifestyle they wish to have.

Studies have shown most retirees spend LESS in retirement, not due to having less money, but simply that there are factors that change their spending habits regardless of available retirement funds.

Do not take this lightly. Money is one thing. Your brain is a different animal. I was able to retire at 55 and thought I was set. We traveled from CA to SC for ten months and thought we would be in an RV fulltime. Looks like my brain wanted more than just sitting around a pool all day. All those cool pictures of the two lounge chairs at the beach viewing the sunset……….. it’s all BS!!!!! Our minds and hearts want & need more. Take time to check and plan your LIFE……… You have enough money!!

Preach it, David. Our minds and hearts need more, indeed. Best to recognize that fact while you’re still making your retirement plans. It makes the transition a lot easier.

I have considered retirement to be equal to all those summer months as a kid when you had all that time to do whatever you wanted. I make sure to have a large list things I wanted to try in retirement that I didn’t have time for when worked such as painting classes, language classes, travel, pickleball, etc.

Now, 5 years in, I have settled on those things I enjoy the most and left the others behind. So, I encourage folks to make a list things you always wanted to try and then try them and see what gives you the most pleasure.

“I have settled on those things I enjoy the most and left the others behind.”

Exactly how I play the game, Donna. Your sentiment was what I meant when I talked about picking up cards during that podcast interview. Always trying to improve my hand, and I never hesitate to put a card back down on the table. My answer to “What do you want to be when you grow up?”, after I talked about exactly that sentiment, was “to be a professional card player.”

Man oh man, that loss of status and identity was brutal for this retired insurance exec. I also miss the expense account. And the paycheck every other week replaced by a smaller monthly pension check.

My work friends and I did a great job keeping up for a year, but it slowed to once a year lunches by the end of year two.

Yup.

This is fabulous, Fritz. I’m planing to retire (or as I prefer to call it leave-my-full-time-career-but-not-really-retire) later this year. I’ve spent the last two to three years figuring out how I’ll reinvent myself. I’m excited!

It’s a shame that more people don’t take the time to make a plan for how to fill those hours and find purpose. Having worked on the financial side of retirement for many years, I’m on a mission to change that.

“I’m on a mission to change that.”

You and me both, Michelle. 🙂

Excellent I would add my heartfelt “amen” to what you said. I have been retired a year and a half. I am know volunteering and having the time of my life. If I had read the point about money before I retired I would have scoffed. But it is so true. I pay little to no attention to the stock market. A financial planner helps us so that we get our monthly “paycheck”. It is indeed what it is and it is enough. Maybe this is the best part of retirement. We worked it hard before retirement, planned and prepared and are satisfied with our life. Our strong desire is to help and to make a difference

“If I had read the point about money before I retired I would have scoffed. But it is so true.”

You and I both felt the same, and I suspect 90%+ of the pre-retirees who read these words doubt their validity. In time…they will. Then, like you and me, they’ll get on with their “desire to help and to make a difference.” Funny how retirement transitions toward that goal for most people.

I was totally burned out when I retired. Biggest thing has been loss of structure and time pressure. Most days it feels like I get less accomplished than when I was working AND running my horse farm with twice as many horses than I care for now. After a decade of pretty severe stress from an abusive relationship, sick parents, loss of one parent and 3 horses in 3.5 years’ time, and job stresses I’ve deflated into a bit of a funk that I’m working to dig myself out of. Folks, manage your stress and boot bad people from your life. I suffered an autoimmune condition from mine.

“I’ve deflated into a bit of a funk that I’m working to dig myself out of.”

You’re far from alone with that struggle, Lynne. Sorry about your losses, hope you’re able to get yourself on track for a great retirement in 2024!

Thanks Fritz. Because of your book and this blog, I have been taking steps to prepare outside of the finances. I am currently in the “one more year” syndrome, but using the time to get fit (gym has been a previous priority) by losing 13#, researching and getting coaching through wellness benefits at work.

I am starting to look into charities. One in particular, Love Inc. is something I could get behind, but may also look into our local soup kitchen. We have also been introduced to the Tres Dias community and really enjoy the growth In our faith. I currently serve on our church council and have decided I don’t like more meetings in my life….two more years in my term and will have served out six years.

I am also looking into finding a sunny space in our yard for a small garden (old one is too shaded). I need to have some things around the house to get me outside.

In the final year and a half left of work, I plan to work full time through 2024 and transition to part time (80% for 5 months and 60% for remainder) for up to 6-8 months in 2025 as a way to ween off of the work routine while taking care of some home improvements/fixes.

On the financial front, 2024 sure was refreshing and if 2025 is just ok for returns we will be in great shape… thinking about an annuity to help bridge us to SS and Medicare and meeting with a CFP to solidify our plans in February.

A year ago, I was concerned about what I would “retire to”, but much less worried about that now.

Your insights, questions and articles have been instrumental in shaping my planning and mindset. Thank you for being an inspiration and for making us think out of the box.

Best,

Dave

“Your insights, questions and articles have been instrumental in shaping my planning and mindset.”

As a writer, I could has for no greater compliment. Your plan sounds solid, best of luck as you work toward The Starting Line. Ironic, we’re also planning on putting in a garden this year (though I question whether we’ll really have to time to keep it maintained…time will tell if we keep that card in our hand beyond 2024).

I just retired 6 months ago at the age of 56. We are still adjusting and thinking (concerned) about money even though we should be very comfortable in our savings. We are going to track all of our spending for the next year to see if our projected spending is realistic (ie too high). My husband, whose financial knowledge allowed me to retire early, is still tracking the stock market daily so I think that has fostered the continued concern about “do we have enough”. It will be interesting to see how we feel in a year from now.

“It will be interesting to see how we feel in a year from now.”

It will be, indeed. Since you’re only 6 months into retirement, it’s reasonable to still worry about the money. I strongly suspect that focus will diminish in time.

Fritz,

Great post. Probably one of your top posts imo. After, many years in the Corporate world, we become very adept to managing money. I’d wager the vast majority of your readers have the ability to create the simple financial plan for retirement in less than 30 minutes. It’s actually quite simple, and I was amazed (over) seven years ago, how easy the financial part was to my retirement. I’d spent 30 years mapping it out. I’d covered every financial aspect and “what if” scenario, that I could possibly imagine. I had tons of hobbies, a great family support structure, and a great circle of friends. I had built a list of activities to keep me busy for at least a year or more. What could go wrong?!

The line above that you stated so eloquently, “Learn to play again, like you did as a child.” Was the shocker that I never saw coming. I had built tons of activities to keep me busy (too busy) when I retired at 50 years old. I was six months into retirement before it struck me like a rock. I woke up as normal, went for my morning run. I’d already burnt through my post-retirement “to-do list”… I suddenly felt like a kid on the first day of summer beak, with nothing to do. It was terrifying and liberating all at the same time. It took me a while to come to grips with the feeling. Don’t get me wrong, I loved it. The freedom, the carelessly long days, the choice to do whatever tomorrow…but it comes with a nagging voice in the back of your head asking, “what do I really want to do tomorrow?” It can be a shocker for us type “A” personalities. I managed to figure out what truly inspires me, and I’m still loving retirement after nearly eight years after leaving MegaCorp, but it’s a much bigger blind spot than the financial stuff. We are each different, but you need to understand what inspires you to get up each day. I rarely think about the financial side anymore, but I’m always thinking about what will excite me about tomorrow! It is (by far) a much more important question you should be asking yourself. When you can answer that question, you won’t have enough time left to work anymore because you’ll only have time to retire and get to it.

“Learn to play again, like you did as a child.”

Oh man, you’re going to LOVE my next post….

Loved reading your story. That nagging question in the back of your mind “what do I really want to do” is a key part of the retirement transition. Most folks start with a bunch of activity focused (bucket list) type of items, but in time that inevitable question rears it’s ugly head, and it’s only in answering that question that we find our path to a truly great retirement. You and I are a lot alike, Thom.

Planning for retirement reminds me of planning for a child’s birth. So much focus is on the labor and delivery and so little on what to do with this child once born. I appreciate your bringing all these issues into focus. My husband and I are scaling back work while we start adding more of the things we like including travel, exercise and spiritual growth.

Interesting analogy, Lauren. I like it.

Fritz – as usual, your article is spot on when it comes to preparing for retirement and I’m not questioning your experiences in the 6 years since you retired. However, when you use terms like “I’ve never been bored a single day” and “I didn’t struggle in the least with the move into retirement”, it makes the rest of us wonder what we are doing wrong. I’ve been retired for almost 4 years and while I grade my experience an overwhelming success, for sure there have been a few down days and struggles along the way. In my opinion, the important point is to work through the process and continue to learn despite the inevitable bumps in the road. Thanks for all you do!!

“…it makes the rest of us wonder what we are doing wrong…”

Sorry for the unintended consequences, Al. Just telling my story, but I totally understand how it could cause others to question why they’re having a more difficult time with it. Mine was extremely unique, and my hope is others can learn from my experience. Thanks for your insightful comment.

Great post! I would say “amen” to “I wouldn’t encourage anyone to work longer than you have to..” Track expenses for a year or two before you retire and you’ll reduce the stress of not knowing what you actually spend and what you need. I did not hit my magic number before I retired at 63 but did within two years of leaving a stressful, unsatisfying job as I had more time to become an independent investor and active landlord. Find volunteer work that is meaningful to YOU – I work with VITA preparing free tax returns out of my local library – the environment is terrific, the genuine thanks we get from 90% of our clients fills my heart and it keeps me active in my community. Retirement is the best job I’ve ever had *and* I bought my first, my not last, business class ticket to Europe to replace that long ago expense account 🙂

I would say “amen” to “I wouldn’t encourage anyone to work longer than you have to..”

I hope Stephen reads your comment. At least I’m not solo in being bold. Enjoy that business class flight…

Great article and comments. I just turned 63 and plan – God willing – is to retire at 65 (but not tap into SS until 67). I have enjoyed working out my whole life and I see that continuing in retirement – without feeling rushed to get back to the office after my lunchtime workout!

I especially appreciated the comments about transitioning into retirement by working from home and/or part-time for one’s current employer. I am hopeful I can arrange for something like this for up to two years.

I also appreciate the confirmation that money is not the driving concern (unless, of course, one has not adequately saved). I get tired of those “experts” who say one needs at least $5 Million or so to retire. Fat chance in my case. Sorry to be long-winded. Thanks!

“Sorry to be long-winded.”

You’re preaching to the choir, Ken. Try as I might, I can’t seem to avoid these “long-form” posts of mine. Glad so many folks are willing to read my long-winded writing…wink. Good luck in your final 2 years to The Starting Line!

Great post Fritz!

Being a planner facilitated my transition to retirement. Having retired young (50), after spending 5 years downsizing and planning our adventures, a key process for us has been our annual “planning” process where we take stock and decide on our plan for the next 12 months. 13 years on since leaving corporate America, we could never have planned all the twists and turns our life has taken, regular planning cycles has allowed us to adapt and take action. Life is short, making the most of every day takes planning and action! 😀

Great article. Prepare to retire to something not from something. Start off retirement by exploring all or most of the things you’ve wanted to do. Also, your work relationships will fade quickly so if you don’t have a strong friend group start looking for a network of sorts. Local groups like Lions, Rotary, church, volunteering are good places to start. Also, work on your health. I was recently told by a financial planner that something like 50% of his retired clients are in assisted living within 5 years of retiring. Consider completing something like “What color is your parachute in Retirement” as it helps you think about the non-financial aspects of retirement. Retire the minute you can. It’s worth it. I retired two years ago.

“Retire the minute you can. It’s worth it.”

Preach it, Mike! Shocking stat from your planner (50% of his clients in assisted living with 5 years), seems exceedingly high, but a word of warning none the less. Our time is limited, use it wisely.

Very timely article! At the end of 2022, I semi-retired from being a co-managing partner from a health care clinic I co-created and now “only” perform health care services. It’s been great but also humbling as I have had a difficult time figuring what I’d really like to do “when I grow up”. I still enjoy the part-time work and the tax write-offs and wholesale products that come with it but I should probably get your book to flesh things out better. Thank you for all the resources you offer!!!!

A great example of pursuing your curiosity, a key element of the retirement “job” for all of us! And yes, you probably should get my book. Wink.

Take some time and focus on health. I was too busy (or thought I had to put in more hours) to focus on my health when I was working. You can have all the love; you can have all the money; you can want to travel/golf/fill in the blank; but none of that will matter if you don’t have your health. I’m not trying to live longer, I am trying to live better. I want more years of activity, less trips to healthcare providers (i.e. spend less money on this).

“I’m not trying to live longer, I am trying to live better.”

We’re kindred spirits, Doug. As Dr. Attia says in Outlive, it’s all about our “Healthspan,” not our “Lifespan.”

I have always had a financial number to hit before i would consider retiring. Then my mom suffered a stroke and I immediately resigned from my well paying Corp. job to take care of her. She passed shortly thereafter and my Dad needed help. I never went back to that Corp. job, I fueled a small side hustle to keep some income coming in and was present in those moments with my parents until their last breath. No regrets and a full heart. My side hustle has grown into my main job now, which is 3/4 time, as i see fit as the scheduler. I converted a cargo van into a glamping van and joined RV groups that gather throughout the year. I joined 12 local hiking, backpacking, FI groups when i am home and find that blending work/play is the way to coast into retirement. I have learned that starting retirement life while you are working is the smartest, most comfortable and secure way to go into retirement. Transitioning from full time work to no work is not for the faint of heart. All of my groups have rendered amazing trips, activities and now life long friends, many of whom are retired. I have time for both semi and retired folks and I feel like i have it all. Have i hit my financial number yet? No. But my small business is my own now and I only work part time. I took on an independent consulting job for 2 years and together, fulfills my annual income needed to work, but I don’t work for anyone as an employee on purpose so my time is my own to recreate, explore, adventure and retire into until I come out of that mode to work. I am so enchanted with my semi-retired life now and cannot believe how much fun I am having, I am finding each year increasingly difficult to generate energy and attention to work at all. I am going with the flow for now, but I am sure I have saved enough to make it since i am debt free, own my home, camping van and SUV outright and converted all of my $750K in retirement investments into my ROTH finally after 20 years of rollovers as it made sense to do so. I hope this helps others see the “life” side of retirement.

Great comment, teri. One of the key reasons folks leave work earlier than planned is to provide healthcare to a family member in need. I love your “no regrets” comment, and appreciate you showing us where there’s a will, there’s a way.

I still work, but moved to a big retirement community in Arizona. When I was a kid, I spent my summers playing tennis, softball, and basketball. My retirement community has lots of activities and many consider it to be an adult playground. We have softball, pickleball, tennis, golf courses, and gyms, and I’m never bored.

I have now been retired for approximately five days. I am constantly reading other people’s experiences because I am trying to figure it all out. A co-worker who retired six months before me keeps sending me texts asking me how I like it. Honest answer, I am not sure yet. Still trying to process the whole thing. And yes, I am worried about money. I have a pension coming and I will be able to keep my same medical plan (yes I have to pay for it), so that is comforting on some level.

I think the hardest part for me is the structure. My work day was structured because that is how my mind works. Having to learn to let go and be unstructured is currently what I am working on.

I have plans to travel the first four months of this year, and I started volunteering before I left work. So all in due time I anticipate it will fall together. Reading your book and this blog has been very insightful and helpful.

5 Days!

Congrats on crossing “The Starting Line,” your best years are ahead of you! I totally relate to your comment on “structure,” it’s bigger than most folks realize. You’re early in your journey, relax and enjoy the ride!

Deborah,

As to your concern about structure, a childhood friend of mine who retired a few years back gave some good advice, which is to make a list every morning or the night before of five things to accomplish that day. I plan to make use of this idea when my retirement comes.

Thanks for sharing the words people need to hear. I am 3 years retired and when people ask what my favorite part of retirement is, the answer is easy. Flexibility. One of the first words we learn as a child is “no”. It becomes easy to say as an adult. No, I don’t have time. No, I don’t have money. No, I have to work. In retirement, I have the flexibility to say “yes.” Drive 13 hours to celebrate my grand pups birthday…why not! My daughter still says it’s been the best surprise in her life. Organize and attend a volunteer event 1,600 miles from home… certainly! So many options and the ability to say “yes” whenever I want. That my friend, is a blessed retirement.

And…your ability to say “Yes” to joining a Fido build while you were in our neck of the woods. Special memories of that one, thanks for using your Flexibility to help us help the pups! A blessed retirement, indeed.

Three things:

1. You need to do the homework and figure out your financial situation and whether you have enough to last 30 years. Use online calculators to give you a big picture, and then find a financial advisor to go through the details. Planning is critical.

2. What they don’t teach you while you have been saving all of these years while working and saving in your 401k and IRA’s is taxes. You may have a substantial amount saved which is great. Then…the tax person will come when you start withdrawing. (Unless you have a Roth) Especially when you reach RMD age you may face a “tax torpedo.” Again, planning is critical.

3. You better be comfortable with watching your savings taking a drop each month, because without a paycheck you are now spending down. The good news is if you are well diversified (which is important) your other accounts will continue to compound over the years to help balance out what you are withdrawing to a point. The key is diversification.

Because I did these three things, I retired with an annuity to pay for my essential needs budget. I’m 63, so for the next seven years, I am using my 401k / IRA funds to pay for my discretionary budget. This will take the sting out of my RMD withdrawals when I’m 75. I will take social security at 70 to max out my income stream, so god willing, I have enough income until I die.

Good addition to the list, Vince. Getting the financials right is a critical element, for sure.

Fritz, well done, great post. Biggest surprise for me is my “play” became vigorous exercise classes, mostly spin, bodypump, total conditioning, pilates fusion, pilates strength and power yoga among them. Recommend Younger Next Year to everyone.

I’ve been retired 1 year now, and I read your book and tried to prepare myself. I was really worried about being bored and lonely. At your suggestion, I started listing ideas for things I could do in retirement, and when I look back at that list now, I see that I have really only done a few of them. I have not connected with people by joining a gym like I thought I would for example. But other things that I wouldn’t have imagined have come my way, like reconnecting with friends from college as we have all retired, and finding a rewarding volunteer position. In general, I would say that I haven’t needed to keep as busy and I thought I would! I’m happy with a balance of busy days and quiet days doing things that I like, and that’s been a nice surprise.

“I started listing ideas for things I could do in retirement, and when I look back at that list now, I see that I have really only done a few of them.”

The same happened to us, Michelle. We filled that bucket jar with ideas to last through the first two years (assuming we did one of the ideas per week). 6 years in, and we’ve only pulled a few of those pieces of paper, have enough in there to last the rest of our lives. Funny how busy life becomes when you pursue the things you love.

Fritz:

It just keeps getting better! Everything you wrote….agree.

One thing I’ve done to help me with direction and purpose is to create a personal mission statement for this season of financial freedom (I don’t like the word retire other than I retired from the need to generate income); My personal statement: I am embracing the freedom to pursue the life, work and relationships that matter most. This serves as a guide for making decisions on how to invest my time, talent and resources….

Thanks for being FRITZ!

I love your personal statement, Mark. I’ve not done that, but you’ve planted the seed…

As for being Fritz, do I really have any other option? Wink.

Tomorrow’s my BIG DAY…I will be retired at 4:00 pm Eastern January 5th, 2024. It will be the end of a working career that started in September or October, 1967…at McDonald’s and ended with my third career as an Academic, (having celebrated my 15th anniversary November 2, 2023) coming to an end. My contract actually ran until June 30, 2025, but I decided the time had come.

Am I ready? Probably not, but I will be regardless. I have a self constructed list of things to do around the house, garage, and yard, that will take me a few months, but it will start Monday Morning with me at the Gym. I started the process August 7th, 2023 by starting on the Carnivore Diet. I have lost 45 pounds to date, with minimal damage from the holidays, and my A1c is down to 5.7. Only 100 more pounds to go! Ha!

We will travel some this first year, and we actually started last Thanksgiving, when we spent the week in Fritz’s home town, Blue Ridge Ga. I learned I love the Mountains but I think I prefer looking at them to driving in them. We will hit the NC Beaches, The Villages in Florida, Western PA and Eastern TN this year, on a search to see if we want to relocate in retirement, or stay put. I am in favor of a fresh start in new place, but time will tell.

We enter Retirement will no mortgage, no debt, a new car, and almost 1 million Delta and American Airlines miles…along with @200,000 IHG (Holiday Inn) points. I had over 1M IHG points, , but we used a few thousand and I gave $220-$300K to our kids the last few years. Because I waited until 70 to claim Social Security, our SS checks are more than our total living expenses, so that allows us to let our portfolio and annuities continue to grow, until inflation or medical issues cause us to need them.

As always, Fritz has put together a thought provoking article and I am looking forward to listening to the podcast he values above the others he has done. I am sure it will be something else.

Happy Retirement to one and all and I wish you a Happy & Prosperous 2024.

Congratulations, Kevin! I smile as I write these words on January 6th, realizing today is your first day of retirement. Exciting times for you, I’m honored that my words have played a small role.

And…losing 45 pounds to date is amazing. Congratulations on focusing on the things that matter the most as you prepared for retirement. Enjoy your transition, you’ve got some great years ahead of you.

My wife passed away suddenly 10 months before I had planned to retire. I retired as planned, but all the post retirement plans went out the window. I have been able to pivot and have been blessed with a new wife and expanded family. So now I bounce between two states every other month and my new wife is retiring (finally) in March!!!

My suggestion for those contemplating retirement is to consider the loss of a partner or serious medical issue that may alter your plans. Talk with your partner about what you or they should do if one of you suddenly dies or becomes medically disabled. Having those conversations will help the surviving partner continue with their life. Eventually this will happen so talking or planning for it earlier makes the loss a little easier to bear.

“My suggestion for those contemplating retirement is to consider the loss of a partner or serious medical issue that may alter your plans.”

Wise advice from a man who has lived it. Sorry for the loss of your wife, but happy to hear you’ve found a new love and you’re finding your way. And yes, the reality of the risk of widowhood is real, I know too many people who have lost their loved ones and had a (forced) change of plans. Tough situation, thanks for making folks aware.

“Learn to play again, like you did as a child.”

Fritz, I love this article! I retired this week so this is very timely! All of the things that I loved doing as a child and had to stop so I could make a living, I can now enjoy!

“…I retired this week…”

Wow, seems we have a record number of new retirees stopping by today. Congrats on crossing The Starting Line. And, if you liked my “play as a child” comment, you’re going to love my next post. Stay tuned…

The best advice I got was to plan in advance for my retirement with THE RETIREMENT MANEFESTO!!! I mean that sincerely!! I decided to list the 6 MOST IMPORTANT things in my life to pursue: 1. Chase my passions, not my pension. 2. Seek God first!!! 3. Family matters. 4. Be of service to others. 5. Conscious of my wellness daily. 6. Be a life long learner. “If you don’t prioritize your life, someone else will”. Toby Keith, a well known country singer was playing golf with the famous actor Clint Eastwood in a celebrity golf outing and he asked Clint. How do you stay so active and vibrant at your age. His response was “I don’t let the Old Man in”. Keith quickly wrote a song “Don’t let the old man in”, my advice you YOU TUBE it TODAY!!!!

Marc, thanks for being a loyal reader, I’m honored that my blog has helped on your journey. I love our Hillsdale College connection and appreciate your engagement with my writing. I love your list, reminds me of the 10 Commandments of Retirement I wrote shortly before I retired, a list that’s been a helpful “North Star” on my journey. Off to view that Toby Keith YouTube video….

We planned so much before retiring early 55 and 60. Including reading your blogs. 2 years in and we love it.

What we miss is our friends retiring too. So many of our good friends have no plan. We miss them on our adventures and also feel a little resentment from them.

“…also feel a little resentment from them…”

Sorry to hear that, Shazzy. Fortunately not a reaction I’ve experienced, but the majority of my relationships are now retired folks, so there’s that…

We are 63 and 1-2 years from retiring. One factor we have to consider is family members who need help of various types.

Specifically, our 29-year-old daughter was injured in two different car accidents in 2022 and 2023 and couldn’t work for months. Though she got some disability after the second one and an insurance settlement after the first one, we’ve helped her out financially quite a bit, to the detriment of our own savings. We can afford it right now while we’re both still working, but these twin misfortunes (she was a passenger both times) have made us a bit nervous about pulling the plug on our own paychecks until she’s fully back on her feet.

On a different note, my in-laws are in their 80s, and she has advanced Alzheimer’s, and he has health issues that are becoming increasingly serious. They live in their own place in an over-55 community with about 25 hours per week of in-home caregivers right now. But it’s a matter of time before my husband, who’s their executor/trustee and has their powers-of-attorney, may have to devote a lot of time to overseeing his mother’s care and/or settling their estate. They live about 400 miles from us.

So we may need financial margin to help our daughter and schedule margin to help my husband’s folks. This influences both our thinking about when to retire and about time we’ll need to spend with caregiving, etc. Thoughts about a “purposeful” retirement may have to take something of a back seat to those considerations, at least for awhile. (I’m not saying that supporting family is not “purposeful’; of course, it is. But it’s not the same as starting a nonprofit or turning one’s hobby into a major passion…)

I’m sure we’re not alone in having our own immediate plans somewhat up in the air, if not derailed entirely, by the needs of family members on either end of the “sandwich.”

You’re far from alone, Dana. The “sandwich” thing is a reality, and something my wife and I have also had to manage. It’s a challenge, but far from insurmountable. Good luck figuring out your path.

My wife and I are retiring in June 2024 at 55 and 52. We already have been taking 4-5 day weekends to use up vacation time. We are taking about 100 hours off every month. We are not taking trips elsewhere during the time off all the time. We are feeling out the day to day living situation in our area. Go bike riding, walking, hikiing, play pickleball, take pottery, etc. This is helping us transition into retirement as we adjust to having more time on hands to do other things.

Your post is timely and we relate to it as we get closer to retirement. Keeping fingers crossed the transition continue to go well.

I love the approach, RE. A great way to build in some transition and give yourselves time to think about what you want your life to be in retirement. I’m confident the approach will serve you well when you cross the line next year.

These days many people face retirement earlier than they planned as they are pushed out of a role or face an illness. It happened to me. I think you’re lucky to have had time to plan out what you wanted to do in retirement

You’re absolutely correct, Lisa. Even in today’s comments there are others who were forced out early. I’ve written in the past that slightly over 50% of folks retiree earlier than they planned, it’s very much a reality. And yes, we were lucky to have had time to plan out our retirement. We were also blessed to retired at age 55, which reduced our odds of getting forced out earlier than we were planning.

Semi-retired last November at 55 and still have a few clients that I really love, keeping a few dollars rolling in for now until I unplug. Have really enjoyed Fritz’s writings and advice immensely. I’m still working on my “what do to with your time list”, but it grows frequently, so that’s encouraging! As a small business owner, the lack of schedule and connections was definitely a concern, but a move across country coming up hopefully will play into that solution. It’s a fun journey!

“Have really enjoyed Fritz’s writings and advice immensely.”

Thanks for the kind words, Jonathan. And congratulations on your recent semi-retirement!

Excellent Post and as always, you cover so much ground and I need to circle back on a few items. I’m now 8 months into this retirement gig and I’ve had the occasional thoughts of getting bored, being lonely, and feeling lost. They quickly pass as I transition between things in the day, You’re right about the post retirement money focus, but have to add that there’s more money than time left in my glide path. Learning how to spend my nest egg continues to be a learned skill just like was for the accumulation phase skill.

I’m writing this from New Zealand at the start of 5 week run in the Southern Hemisphere.

My advice for those on the threshold of retiring is set sites on your own trip of a lifetime as it will take an easy 6 months of planning and logistics.

The last piece that I can add is.

Never let your memories be bigger than your dreams.

I picked this up on a podcast during my 16 hour flight to New Zealand.

“…I’m writing this from New Zealand…”

You’re killing me, Francis. You know that, right? Enjoy your 5 week run, sounds amazing.

Hi Fritz. I ran into your “manifesto” several years ago and have enjoyed the information and comments all the way to full retirement from my engineering manager position 3 months ago. I was blessed with impeccable timing in my career. Right place, right time, right skills/experience when our company was purchased. At the end of my 40 year tenure, I was asked to come back half time as a trainer….and covid hit. What else to do but work from home and earn some extra cash sharing 40 years worth of info and writing procedures? And totally enjoying the new engineers and watching them develop!

I am fortunate to have grown up with a stepfather who was a contractor and taught me basic wiring, plumbing, homebuilding, etc. My father also taught construction trades to high school students. What to do in full retirement? Enjoy sharing my two dad’s legacy by helping rehab a couple of houses our church owns last summer prepping them to sell. Currently filling the janitor position at church after the sudden resignation of the janitor. I have found perverse pleasure this week in deep cleaning bathrooms recently, lol.

I have more projects than time left on this earth already and as one commentor above said, i can now say yes to requests for help. Hey, not all projects need to be done before I leave! Helping others is the best feeling ever!

I fell in with a group of guys at the local coffee shop and we meet at 7 every morning for an hour or so. I have relationships going to replace those at work and I keep my same up at 5 and out to run at 5:30 routine as i did when working full time.

My only loose end is the not worrying about the money. I will have to trust you on that one (its early, only 3 months into retirement so still adjusting to no paycheck) well, you and our financial advisor who says we are doing fine!

Keep writing, Fritz!

3 months into retirement and you’ve already found a coffee shop group. I’m envious, Bruce! My Dad met a group for breakfast 2x/week for 2-+ years, I always enjoyed joining them when I was back in town visiting my Dad. Those guys were some of my Dad’s best friends, I trust you’ll find the same. I’m glad you “ran into” my work, and honored to hear it’s helped on your journey.

Humans are made to be happiest when accomplishing things. Whether this is in-bedded in our build from the Almighty or passed down genetically from days gone by. Personally, I feel much better about a day of accomplishment vs a day of recreation ( both are regulars on my schedule ).

I’ve long passed accumulating the necessary funds to walk away from work. However, if I need to find ways to replace what I have at work, why not just keep working? I’ll use the additional money for the good of my family and the charities of my choice ( 529s for the Grandkids).

I do have a job which I enjoy and greet each work day with enthusiasm. Why walk away with the hopes I can replace what I have working elsewhere in retirement sans the paycheck? Why didn’t Warren Buffett, and countless others, just play golf after they made a few billion? Fritz, you call yourself ” retired ” but it appears to me that you’ve simply made a career change for corporate employee to an entrepreneur / blogger / media guest. Congrats to you but lets call it what it is… a new occupation.

“A ship in a harbour is safe but that is not what ships are built for” – John Shedd

I for one, will be sailing the seas for a while yet.

“…Humans are made to be happiest when accomplishing things…”

I agree 100% with that statement, Jeff. I’d also add “made to be happiest when they’re with the ones they love.” The great thing about retirement is it’s a personal choice, and if continuing to work when you no longer need the money works for you, I’m good with that. As you said, my life in retirement does include “work,” but my “job” is different now (as highlighted in point #5 in the post). We’re both happy doing what we’re doing, so you’re proof that there are various ways to sail our ships out of the harbor.

My experience in retirement is not one on your list. I have always been a very stylish woman who was always complimented on my appearance. My hair was always styled, I wore very expensive suits with all the finest accessories. Now, no one would believe I was once that woman because I look far different than I did when I was getting up everyday and going to work. Today, a hat, sneakers, comfortable leggings, a simple t-shirt and no makeup is my daily look. I like to think it’s my retirement look, but I think I’ve gotten lazy so prepare yourself, you will need a new style when you hit retirement.

“…Today, a hat, sneakers, comfortable leggings, a simple t-shirt and no makeup is my daily look…”

We have that in common, FL. Minus the leggings (I prefer sweatpants). Wink.

Try coaching kids, join a school board or anything where you are trying to help others improve or improve our society

Spot on post and I whole-heartedly agree! I shared this post with two friends who are still working so they can begin preparing now. I would also suggest to folks that are still working: listen to the thoughts you’re having now and write them down…meaning, when you think “if I didn’t have to work today I would…” “If I could take the rest of the day off I would…” etc. Capture those things now to review when you’re ready to retire. They may not still be important in the future but it will be a reminder of what you would’ve rather been doing when you were still working. I’m almost 2 years into retirement and I’m going to start thinking like my inner child/teenager, what would SHE want to do?? Thanks Fritz!

“I shared this post with two friends who are still working so they can begin preparing now.”

Best compliment I’ve received all day, thanks for that. I love your suggestion to capture those “I would” thoughts. And, as you “start thinking like my inner child,” prepare yourself for my next post. I think you’re going to enjoy it…

Don’t put it off, no matter how much they ask you to stay! I kept working after my wife retired so she could supervise building our retirement home; I transitioned to part-time intending to stop soon. She developed ALS and died in 13 months, the last several spent caring for her; our dreams evaporated; now I am faced with making a new life. I am enjoying not working but please keep in mind life throws you many pitches impossible to hit.

Horrific story, Stephen. We lost a friend to ALS, and I can empathize with the true horror you faced. It’s an awful disease, and my heart breaks for what you’ve gone through. Impossible pitches to hit, indeed. I’ll be praying for you as you figure out your difficult journey ahead. A poignant reminder for all of those who think it can’t happen to them.

I’m on the edge. Of “what” I’m not certain! I’m 58 and have been (seriously) considering retiring for about a year. I’ve made up my mind that, at the earliest, I’ll retire this April. At the latest, next April. As I said, I’m on the edge. As like many of your followers, the “what’s next” question is starting to plague me. But your advice: “Learn to play again, like you did as a child” is something I can wrap my head around and provides me comfort as I stand here looking into the abyss. Who didn’t like to play as a child!?! I’m going to start thinking more like a child and less like a nearly retired adult. Fritz, bit THANKS for following your curiosity and publishing this blog.

This post made a good discussion topic over on the MMM forum! I agree on three of these but not so much on the other two. Retirement transition was vastly easier than I dreamed. I had real concerns I would not enjoy it as much as I enjoyed my career. Not the case, not for one moment in the eight years I’ve been retired. Work was fun but retirement has been glorious!

I also don’t miss the things I enjoyed most about work. I still get to do those. My volunteer work gets me free travel and continuing education, we do multi-million dollar projects at the hospital and college not so different than we did at work. My network stays fresh and I’m often treated to dinners and lunches so people can pick my brain on various topics. I’m still asked to speak to groups. I’m still in the paper and on the news once in awhile. I still get invited to corporate events by my former employer and asked to consult (which I turn down). Its strange that all that stayed the same, but it has for the first eight years of retirement. I would be fine if it all went away, but its kind of nice it hasn’t.

Your write-up on retirement is great, Fritz.

I am 70 and started retirement planning 10 years ago. My health is good and I look more like 50 than 70. Being healthy is so very important in retirement if you plan to have an active lifestyle, which I do now and hope to continue. I pedal a bike, play basketball with other seniors, have some musical talent, and even started downhill skiing again after a 20-year hiatus. I am not worried about staying busy.

We live in a single-family home so there is a yard to keep up, household repairs, and hopefully a vegetable garden to tend soon. Our deck needs a rebuild and I have the carpentry skills to do it.

My 40+ career in Information Technology has paid well but I had many setbacks that led to monies taken from my 401k for unforeseen circumstances. I have made up the majority of those losses and am now confident in having a comfortable retirement, finance-wise. I started collecting my SSI when I hit full retirement age in 2019. The taxes are a killer but the net still allowed me to build up my savings.

My initial retirement date was 2021, but when the Covid debacle hit in 2020, most of us were allowed to work from home, which eliminated my 50-minute each way commute. That took off a lot of stress, and my well-salaried job is shift work, meaning there are no after work concerns such as being on-call 24×7 like many of my past positions. So I pushed back my retirement date to early 2025, as we still work from home although it’s only allowed 3 days a week vs. full time now. But my office location changed to being only 15 minutes away instead of 50.

Your table of things people miss from their career lists social interaction as the highest concern. That probably amplified due to Covid, but it doesn’t apply to me mostly due to the work from home situation and there are very few people I interact with even when I do go to the new office, which is 90% vacant! Number 2 on that table doesn’t concern me either due to carefully planned finances. None of the other categories bother me.

There were some financial reasons I kept working, however. I bought a new sports car (Corvette) but had to offset the guilt factor by helping my wife buy a new car and giving my son and his new bride a substantial amount for a down payment on their first house purchase. But I am very involved with the car enthusiast crowd which will be another hobby in retirement. So those things prolonged my working life.

My wife still works and is many years younger than myself and we recently learned that a grandchild is on the way (our first). The house they bought is only a few blocks away from our home so we anticipate spending a lot of time with them and their newborn.

We are blessed but I feel for the younger generation who will not be so fortunate due to today’s economic situation and the struggles they will face.

My motto is “Live your best life now!”

Gosh, don’t know what happened to my paragraph spacing.

Sorry about that!

Hey Fritz, awesome article, I just loved it. I also enjoyed reading through the comments. People’s feed back is usually pretty interesting stuff.

So, in July I finished my 10th year of retirement and it still feels like the first day of summer vacation when I was 10 years old. I guess that about says it all for me.

God bless you and your family, keep writing when you have the time. You are a wonderful source of retirement information on so many different aspects of the adventure!