When I was working to determine “When Can I Retire”, I was focused on finding a retirement calculator that answered all of my questions. Based on the many emails I get from readers, it seems the topic is of interest to many of you on your journey to retirement. Today, I’ve decided to do a deep dive on a retirement calculator from NewRetirement (affiliate link) a calculator I used as part of my retirement planning.

Why Now?

I’m impressed with the team at NewRetirement. I met the founder, Stephen Chen, back in 2017 and agreed with his vision for what he is trying to do with his company. He’s sincere in wanting to fill the niche in the retirement planning community for folks who are essentially Do-It-Yourself but want some help along the way. His approach to Financial Planning is unique with, in addition to a first-class free calculator, the ability for users to ramp up their support to whatever level they desire. From…

- A free calculator that’s worth your time…to…

- A low-cost paid calculator that offers some impressive features, to…

- A free consultation with a CFP, to…

- A low-cost flat fee “retirement check-up”, to…

- Full-fledged CFP support for those who want to have an expert help them plan for their retirement.

It’s nice to have the option to stick with free or ramp up to whatever level of support you need, without having to put up with pesky sales calls trying to talk you into a higher-priced package. I like what they’re doing and want to support them. In full transparency, they’re also trialing a new affiliate program, and I’m a beta tester. Yes, that means I’ll get a small check to offset my costs of running this blog if you sign up for their paid model. In spite of that, my review is objective, though I always encourage you to evaluate things for yourself.

Three years after that initial meeting, NewRetirement is well on the way to fulfilling their vision. Their team is expanding, and they’re continually adding strong enhancements to their retirement calculator. I’ve continued to keep in touch with Stephen, and I continue to be impressed with what they’re doing.

I think their service could be a benefit to many readers of The Retirement Manifesto.

It warrants a deeper dive.

If you're looking for a retirement calculator that's worth your time, this review of NewRetirement will be of interest. Click To Tweet

NewRetirement: A Retirement Calculator Review

While today’s post is focused on a “deep-dive” review of the free retirement calculator, it’s important to note that NewRetirement offers a complete suite of retirement planning options. At the close of my calculator review, I’ll summarize some of the other services they offer, such as the paid version of their retirement calculator and their retirement advisor service, which includes a low-fee “check-up” option many readers are searching for. First, let’s check out the free retirement calculator.

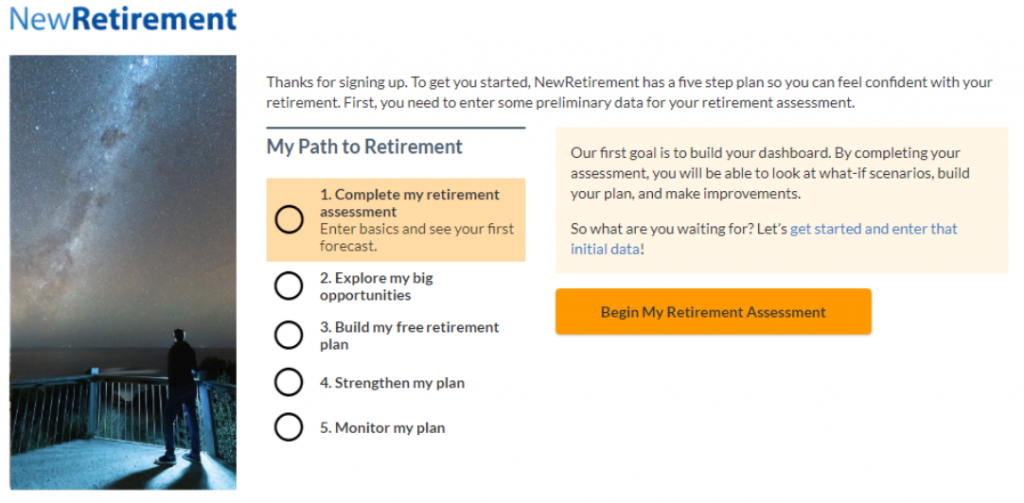

When you first click the link to NewRetirement, you’ll create an account and walk through their simple to follow set-up screens:

For today’s review, I created a fictitious profile for “Tom & Mary”, a couple with the following characteristics. All of these fields are from the input data required when you first enter your profile into the NewRetirement calculator:

- Age: Tom 55, Mary 54

- Children: Jack 22, Diane 20

- Targeted Retirement Age: 63 for both

- Income: Tom $84k, Mary $36k. Combined: $120k

- Social Security: Both start at Age 67 (Tom $1500/month, Mary $1000/month)

- Pension: $0

- Current Retirement Savings: $500k

- Annual Retirement Savings: $18k (15% of income)

- Other Savings: $25k

- Home Value: $250k ($100k mortgage @ 4% interest)

- Monthly Expenses:

- Mortgage: $1,500

- Medical $500

- Other: $4,500

- Retirement Goals: Living comfortably, traveling

As you’re working through the input screens, there are helpful tips accompanying most fields. I found the tips to be relevant, concise, and of value.

Excellent Visual Graphics

I started a new account for “Tom and Mary” using a different email than the one I use for my “real” account. Starting from scratch, I entered the above information (it took me about 10 minutes), and was presented with the following dashboard visuals:

I really like the “Dashboard” view in NewRetirement, which is the best I’ve seen in the retirement calculator space. The “Plan Strength Score” is immediately visible in the upper left, and the number you’ll likely be most interested in. Further, when you hover your mouse over various parts of the graph, the details pop up automatically. For example, see those little colored dots under the bars? Those are milestone events. Hover, and you’ll see that your mortgage will be paid off in 2026, you’ll apply for Medicare in 2030, and your RMD’s will start in 2037. All automatically. Cool, right?

If you hover over the bars, you’ll see the breakdown of your expenses for each year, and how you’ll fund them. (BTW, if you’d like to read more about determining retirement expenses, check out this post)

For example, hover over 2039 and you’ll see this:

To make adjustments to your base scenario, you’ll want to spend time on the “My Plan” tab. Scrolling through the pages on the “My Plan” tab, I was able to quickly find a place to add “one time expenses”, such as a $24k expense at Age 56 for Diane’s final year of college. I could also revise future expenses, starting at any age and lasting for whatever duration I choose. So, for example, you could ramp up retirement spending for 5 years of heavy travel. Here’s what those inputs look like:

Once these changes are entered, you can click back over to your Dashboard and see the updated charts, as well as a reduction in your Plan Strength Score from 97 to 88 (with increased spending). By going back to “My Plan”, you can simply click on the “X” (shown in the above picture, on right) to remove the revisions you were playing with. It’s an easy way to play around with some simple “what-if” exercises.

At each step of the way, there are handy suggestions and links for the topic you’re reviewing. For example, if you’re playing around with expenses, click on “additional resources about retirement expenses”, and a box will pop up with options to read about various aspects of retirement expenses. Click on the ones you’re interested in and you’ll receive the related information via email.

There are also some slick “What If I…” scenario buttons at the bottom of your dashboard which will automatically reflect some basic scenarios, such as “Stop working 3 years earlier than planned”, or “Achieve 1% higher average rate of return”. Simply click the button and watch your charts automatically update. Pretty cool.

By scrolling through your “My Plan” tab, you can easily find adjustments for things such as:

- Passive income (e.g., doing some consulting for 3 years after retirement)

- Social Security (including a link to a handy SS calculator to determine your optimum claiming age)

- Buying An Annuity (the impact if you add an annuity, including a handy annuity calculator)

- Adding a Lump Sum vs. Monthly pension

- Detailing your savings breakdown between Pre-Tax, Roth and after-tax.

- Adding a lump sum savings at a certain future point (e.g., inheritance).

- Medical Expenses – a place to reflect the cost of private insurance if you retire before Medicare.

- Long Term Care expenses

- Non-Mortgage debt

- Legacy issues, including a checklist of items you should have in place and a link for DIY’ers.

Make sure you spend time looking at all of your assumptions in the “My Plan” tab – it’s here that you’ll want to modify your spending to reflect your post-retirement spending adjustments.

Insights

After you’ve built the scenario you’re comfortable with, it’s time to scroll through the “Insights” tab, which provides more graphics on various aspects of your plan, including:

- Your Savings Timeline (shown in the screenshot above).

- Your Needs (your savings at various ages, under optimistic/pessimistic scenarios)

- Cash Flow Forecast (income, expenses, and savings throughout retirement)

- Net Worth & Estate through retirement

- Comparison Chart (how you compare to others in your zip code)

- Big Risks (a “traffic light” summary of your risks)

Pros And Cons

I like the fact that the base calculator is free and offers some flexibility to do scenario planning. Also, it’s nice to have a service that doesn’t require you to link all of your accounts, which worries some folks when using other services like Personal Capital. You won’t get any sales calls to sign up for their advisory service, though you will get some emails (their e-mail content is first class and non-obtrusive).

On the downside, you can’t review your asset allocation with this site, though I understand they’re considering adding that feature (and others). Also, you’ll likely get a bit frustrated when you see the options and flexibility available under PlannerPlus on the screen, but they remain “out of reach” unless you pay for PlannerPlus (more on that in a moment). There are “black box” elements to any retirement calculator, and I’d prefer to see more detail on how they calculate the assumed taxes (full tax detail is available in the paid version). Finally, you’ll need to make sure you work through the “My Plan” tabs to adjust your spending to reflect your post-retirement spending, especially if you’re not yet retired and your initial “spending” figures are based on your pre-retirement spending.

Conclusion On The Free Retirement Calculator

While the ability to customize your scenarios is limited, the free retirement calculator option is a great resource for anyone 3+ years from retirement. Sure, there are limitations in the free version (e.g., inflation and return assumptions are fixed, tax calculations are a bit of a black box, and your “withdrawal scenarios” are limited), but if you’re interested in doing a high-level check to confirm that you’re “on track”, it will meet your needs with enough flexibility to do some “what if” planning.

I used 3 free retirement calculators when I was determining When Can I Retire, and the NewRetirement was one of the three. It’s even better now than it was back then, and I would recommend everyone who is analyzing their retirement readiness take advantage of this excellent retirement calculator.

PlannerPlus (Paid Version)

As you’re playing around with the calculator, you’ll come across fields which can only be updated in the paid version (which is advertised at $6/month). As a special offer for The Retirement Manifesto readers, NewRetirement has established a Special Offer to let you evaluate the PlannerPlus version with a 14-day free trial. Simply use this link and you can try it without being charged, and you can opt-out any time in the 14-day period without having to worry about a credit card refund. Nothing to lose, right?

Following is a screenshot summarizing some of the key benefits of the PlannerPlus version:

In addition to the summary shown above (which, I admit, is impressive – especially the Roth Conversion tax-saving module, which likely justifies the low cost on its own merit), you’ll find other options in the “My Plan” tab which are only available in the PlannerPlus version, such as modeling a relocation/downsizing for retirement and adjusting the assumptions for things like stock market returns and inflation. I also like their various withdrawal models, which expand with the paid model and is an area where they’ve focused some of their most impressive enhancements. If you own a vacation home, you’ll also need the paid version to include that in your modeling. If you’re like me, you’ll wish you could click those options in the free version, but I can understand that there’s only so much functionality they’re willing to give away for free. To view the “Coach Suggestions” which are generated from your baseline plan, you’ll also have to subscribe.

If I were 2 years away from retirement or less, I would consider paying for a subscription. The added functionality is impressive, and the cost of $6/month is reasonable to increase your confidence in your decision on retirement timing. If you’re already retired, the Roth Conversion strategy module makes it attractive for folks who are pursuing that strategy to reduce their eventual Required Minimum Distributions.

A One Time Retirement Readiness Review

One of the options I applaud NewRetirement for offering is a one-time, flat fee retirement readiness review. For many DIY’ers, you simply want “an expert” to review your plan to ensure that you’re not missing anything. NewRetirement makes that available with two CFP planning sessions and a year of the PlannerPlus calculator for a flat fee of $500. I appreciate their low-cost “flat fee” structure, something that is difficult to find in the typical advisor model which charges a % fee based on “Assets Under Management”. I’m a big fan of flat fees, and that’s the model NewRetirement has chosen. Kudos, Steve.

If you’re interested in having NewRetirement conduct a Retirement Readiness Review with you, click here to set up a free account, then use their messaging feature to request a readiness review.

Free Financial Consultation

As you scroll through the “My Plan” tab, you’ll see the option of requesting a free financial consultation with a fiduciary financial advisor. If you have any questions about your plan, I’d seriously consider checking this box and seeing what they have to say. Chances are they won’t offer too many answers without you doing the Retirement Checkup, but I’m sure they’d answer a few simple questions, which may be all you need. And hey, it’s free.

Conclusion

The team at NewRetirement is doing a lot of things right. If you’re interested in doing a quick checkup to see if you’re on track, their free calculator is worth a look. If you want a more advanced calculator that will help you evaluate Roth Rollovers and other intricacies throughout your retirement journey, it’s a reasonable $6/month. If you’re looking for a low-cost retirement readiness check-up, they offer the best option that I’m aware of. If you want full-fledged CFP support, they’re certainly one of the options you should consider.

Bottom Line: NewRetirement is a retirement calculator that’s worth your time. If you prefer to have an expert walk your retirement planning journey with you, they offer the flexibility to only pay for what you need. NewRetirement offers the entire gamut, and it’s a package that can help you Achieve A Great Retirement (my byline).

I’m not a beta tester but concur with this review. New Retirement was very useful in developing my escape plan. I got to use some of the features of Planner Plus before they started the subscription – then got locked out. They’ve since added more to Planner Plus and I recently signed up as part of my plan update. Very helpful.

While they don’t do asset allocation like Personal Capital, they do allow you to input your own allocation and apply different optimistic and pessimistic rates of return for each allocation class. So bond returns might be 2-4% and stock returns 3-8%. Makes a difference.

I also like the graphics and summary of optimistic vs pessimistic assumptions they produce. Over 30 or so years, the range is astounding. Which reminds you it is only a plan.

KevG, I had to laugh at your “escape plan” comment. It definitely feels like that some days. =)

Kev, thanks for reinforcing my perception of NewRetirement. I thought long and hard before agreeing to be a Beta tester, but ultimately agreed since I am a sincere fan of the calculator!

Hi Fritz

I really enjoy your blog, I have been a long time user of the New Retirement site, also prior to the subscription version. I always found it helpful.

I am growing a bit disappointed in one area two of my favorite blogs yours and Can I Retire Yet have both started to compensation for promoting specific calculators, which makes it more difficult for independence and objectivity.

I am all for capitalism, so understand why you all are making your decisions but people have to acknowledge when the reporters get paid for their product, buyer be ware is critical.

Again appreciate all you do .

I feel the same way but understand the need to do some monetization of these blogs as they take a ton of time and are primarily a labor of love. Seems like lots of blogs are moving in this direction (e.g. promoting certain sponsors).

It is, indeed a labor of love. Assuming 15 hours/week, for the past 5 years…I’m approaching 4,000 hours of work on this blog, so I’ve probably earned ~$3/hour from this Passion Project. Making money is certainly not my purpose, I’ve never focused on monetization, and I suspect I never will. I write because I have a passion for the topic and sincerely want to help people achieve a great retirement. I plan on that that always being my goal.

Mike, sorry to disappoint you. In 5 years of blogging, this is the first review I’ve done a review of an affiliate calculator, and it may well be the only one you’ll see on my blog. You can rest assured that you won’t see them often (perhaps another 5 years?), but I really do like what NewRetirement is doing and have been a user for years. I’ll never recommend something I don’t use and think highly of, and I was pleased to see you’re also a long time user of New Retirement. Buyer beware is always a good policy, but I trust folks will find my review objective and not influenced by the affiliate relationship. I don’t do this often, and I’m very, very careful when I do. Thanks for understanding.

The energy and wisdom you put forward is certainly appreciated, as I started reading your blog. That needs to be the headline, you bring real situations to life and offer insight that others can build on.

Fritz, thanks for the article and another calculator to confirm my plan of retirement.

Fritz,

I have enjoyed your blog for the past couple of years! This article is timely for me, as I’ve been thinking about how to approach some Roth conversions. I heard the founders interviewed recently on two separate podcasts & was impressed with their understanding of the long term care landscape. (I’m a former elder law attorney). Thanks so much!

Glad to hear this post is timely, Mr. T. In case you missed it, you may be interested in this one I wrote about Roth conversions, too. Thanks for confirming the solid credentials of the NewRetirement team. Impressive group of folks.

i have been using this calculator since the beginning and although i still like it, most of the items that you have to pay for were all free at one time. If i were to use it now, there are way too many assumptions that make this not an accurate calculator in my opinion. Aside from the “cons” that you mention Fritz, in addition, there are several glaring ones with the free version (not sure if available in the paid version). For example – if you enter a mortgage or auto loan, it has no where to enter the “end date” or when you may have it paid off. Does the calculator just calculate the auto loan or mortgage in my debts until the year I die ? Also, just playing around with it to check it’s accuracy, I entered my expenses at 100,000 per year and that same year added a one time inheritance of $500,000. The calculator still showed i had an $85,000 shortfall in expenses even though i had the large inheritance (income stayed the same as previous years so not a factor in calculation). Also, since you can’t enter your returns from stocks, etc. in the free version anymore, what are the “assumed” returns they use ? There are several others but don’t want to make this post too long. I guess i will try the free trial to see if any of these flaws are “solved” by paying for it. Obviously none of these are perfect and this one is still helpful but as long as they keep taking features away from the free version, it becomes just like many of the others you can find out there. But heck, we all have to make a buck, so i understand.

Fritz, thanks for the review. I’ve been using OnTrajectory for a while now, after comparing it to NewRetirement. Ultimately, it seemed to me OnTrajectory is the more powerful and accurate tool of the two, albeit less visually appealing. OnTrajectory feels industrial and mechanical, whereas NewRetirement is a bit sexier. I realize you’re using NewRetirement and have a financial stake, although I’d refer you to the other for comparison. (Note: I have no financial stake in either company).

Hey Fritz,

Thanks for this review…I had heard their interview on a podcast recently and meant to check it out – this gave me the extra nudge to spend the time with it! I have struggled for years trying to find a good calculator that has the flexibility to handle my real estate assumptions in a clean and useful way. The initial run with their model was helpful and a good start – I’m contemplating “investing” in the upgraded analysis to handle some of the real estate and healthcare assumptions I want to optimize. The only criticism I have relates to the basic version’s healthcare assumptions and how to account for HSAs (I ultimately just had to treat it as another “savings” vehicle and mark my expenses separately). I appreciate the insight and glad to see you put your support behind a product that you recommend!

I tried to use it but did not care for it at all. Filling out the initial questionnaire, it put the default values back in every time I went to the next page. I tried the online help, but it said they don’t work on weekends. Then, after poking around, I found the area where I can update my information, but the explanations of what goes in each box is not always sufficient to understand what they are asking for (time frame, units, etc.) Maybe I’ll try again sometime in the future.