I’ve been negligent.

Let me explain…

My negligence has not been in ensuring my wife and I were covered, but rather in keeping you abreast of our final decision for how to get health insurance in retirement. A lot of you have asked me about it after reading Health Insurance in Retirement: Unsolved, the post I wrote shortly after my July 2018 retirement announcing our decision to use the COBRA extension for 18 months.

In December 2019, our COBRA would expire and our retirement puzzle remained unsolved.

We retired anyway.

Today, I pick up the story of what happened after our COBRA expired, including an update on the alternatives we considered and the ultimate route we chose. In short, we’ve been buying private insurance for 19 months now. For the record, I retired at age 55 and will be buying private insurance until my wife and I turn 65 in 2028. It’ll cost us an astounding ~$250k to pay those monthly premiums, depending on how much they increase each year.

Ouch.

If you’re struggling with how to get health insurance in retirement, today’s post is for you. In addition to explaining our solution to the problem, I’ve included a “Resource” section to help you solve this puzzle for yourself.

Our COBRA health insurance coverage expired in Dec 2019. Here's what we did to get health insurance in retirement. Click To TweetHow To Get Health Insurance in Retirement

Health insurance is one of the biggest concerns for early retirees, especially those who retire before they become eligible for Medicare at age 65. It was a major focus of ours, and I’m sure it’s top of mind for you if you’re thinking about retirement.

It’s essential to include a detailed estimate of your health care costs when you’re projecting your retirement expenses. Fortunately, we planned conservatively and used an estimate of $2,500/month in our initial retirement cash flow model (escalating at 5% per year). Making sure you have a realistic estimate of health insurance is a key step you must take as you prepare for retirement.

Here’s how our actual journey has unfolded:

COBRA – The First 18 Months

As mentioned earlier, we decided to take the “easy” route of going with COBRA. My employer was partially subsidizing COBRA at the time, so our actual cost was ~$1k per month. It was surprisingly easy to make the switch, I simply advised my employer and insurance provider that I’d like to transition to COBRA, and it was done.

Once I retired, the only change we experienced was the higher monthly premiums. No application process, no health screening, no change in any of our pre-retirement processes. We did receive new insurance cards in the mail, and we were set. Given all of the other issues I was dealing with during the transition to retirement, I felt this was a reasonable short-term solution. Knowing I had 18 months to sort things out bought us time to focus on the other changes retirement brought into our lives, and it worked well.

Due Diligence as COBRA Expiration Approaches

Knowing our COBRA deadline was approaching in December 2019, I starting looking into what plans were available in my area based on Healthcare.gov. In November 2018 I had my first look at the site, and shared my findings with the world on my Facebook Page:

The Good News: There were 8 providers offering the Silver Plan in my area.

The Bad News: My pension meant we weren’t eligible for any ACA subsidies, and the average premium was $2,193/month. Knowing we had budgeted $2500/month for insurance premiums, we knew we could swallow this pill if we had to, but continued our search for lower-cost alternatives.

Christian Health Care Sharing Ministries

While not health insurance policies in the traditional sense, these ministries approach the problem by pooling money together from a group of like-minded people through monthly contributions, which are then used to pay the medical expenses of participants. They are very careful to clarify that they are not the same as insurance, but they are ACA compliant. This Wikipedia article provides a more comprehensive overview.

Several examples of Christian Health Sharing Ministries:

While their low cost is appealing, I have some personal reservations with this option. To keep it brief, I’ll include this summary of some of the risks as cited in “The Pros and Cons of Healthcare Sharing Ministries”:

- Many states do not consider healthcare sharing insurance, so consumers have little or no legal protection if a claim is not paid, coverage is denied, or the ministry goes bankrupt.

- There are certain restrictions and payment caps relating to pre-existing conditions.

- Certain pre-existing conditions, such as diabetes, may require a member to pay an additional monthly amount along with standard membership fees.

- Because healthcare sharing ministries are faith-based organizations, they can have specific rules associated with membership. For example, members might be required to attend church regularly, abstain from tobacco and illegal drugs, and attest to a specific statement of faith.

- Healthcare sharing ministries cannot be used with Health Savings Accounts (HSAs) or reimbursement plans, such as the qualified small employer HRA (QSEHRA).

I had a friend who went the HCSM route but changed his mind after discovering that one of his wife’s regular (and expensive) prescriptions wasn’t covered by the policy. So, I may have gone into it with some bias, but my biggest concern was the fact that they aren’t insurance companies, can legally deny claims, and provide no legal recourse in the event a major expense isn’t covered. In short, as cited in this Doughroller article:

“HCSMs provide no legally binding guarantees of coverage.”

As a conservative person, I felt the purpose of insurance is to have peace of mind in the event of a major health expense. In short, I was willing to pay a higher premium in return for guaranteed coverage. In my view, the HCSM provided a lower premium in return for some risk of not having catastrophic coverage. It wasn’t a good “fit” with my philosophy on how I viewed insurance.

In short, I just didn’t have peace of mind without a legal guarantee of coverage. That said, I know a lot of early retirees that use, and are comfortable with, the healthsharing approach. It just wasn’t for me. Finally, my understanding is the use of an HSA is not allowed with HCSM’s, and we’ve built up a decent balance in our HSA that I wanted to be able to tap for our medical costs.

Related: 10 Best Health Share Plans of 2021 – healthsharingreviews.com

Our Final Solution: An Off-Exchange Aetna Group Plan

A few months before our COBRA expired, we finally answered the question of “how to get health insurance in retirement”. After looking at all of our options, we determined that our best route was to sign up for a group plan with Aetna, effective January 2020. I’d read that “group” plans can offer lower premiums than individual plans since there’s an element of risk pooling, and I found that to be true as I did my research. Ours is an “off-exchange” plan, which means you won’t find it when you search the ACA options in our area.

How did we find a group plan?

We were lucky. My employer used to offer retiree medical insurance but discontinued the benefit several years ago. There was a “ramp-down” period where the company subsidy declined (from 100% to 75% to 50% to 0%). What I discovered was the group plan is still available, though at 100% retiree cost. Since it was designed for retirees from my company, there were no medical exams required, and any pre-existing conditions would have been covered (fortunately, we don’t have any, but still a nice feature).

Since it is a group plan, our monthly premiums are slightly below the best individual plans we were able to find with a comparable deductible and coverage. I don’t know if the “group” will remain intact until we’re Medicare-eligible in 7 years, but we’ll ride this horse as long it’s available.

Here’s a summary of our plan:

- Provider: Aetna

- Monthly Premium: $1,900

- “Silver” Level

- Medical and Dental coverage

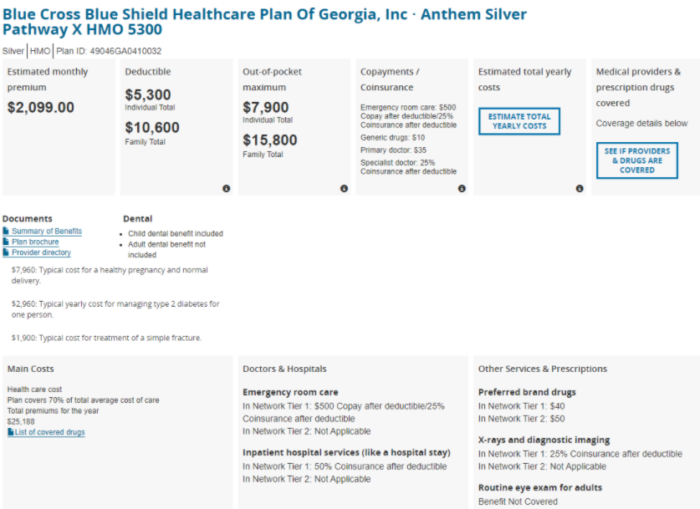

As a comparison, below is one of the comparable ACA plans which was available in our area. You’ll notice the premium and deductible are both higher for this individual plan than what we were able to secure through our group plan:

Since we went with a high deductible plan, we’re able to continue our HSA, though it can’t be used to cover the monthly premium. We max out our HSA contributions every year and use them to pay all of our medical bills as they occur. Since we’ve been paying less in medical expenses than the $8,200 allowable HSA contribution, our HSA balance has continued to grow in retirement.

We’re now in our 19th month with the “new” insurance and have been pleased with how well it’s worked. We’re healthy, so we haven’t maxed out our deductible in either 2020 or 2021. Having the dental insurance has also been convenient since many of the routine dental visits receive a lower negotiated rate. Most importantly, we found a solution that was below our $2,500/month budgeted level, and we have peace of mind that we’ll have “good” insurance should anything serious develop in the years ahead.

Related: For some ideas on group plans that you may be eligible for, check out this article from ChooseFI.

2021 – ACA Subsidy Modification

As an example of how fluid health insurance is, there was a major change in ACA subsidies brought about by the American Rescue Plan Act of 2021.

It’s time to be transparent: I totally missed it.

Having spent a lot of time finalizing our insurance decision for 2020, I was burned out on studying health insurance developments, and totally missed the change in the subsidy calculation. I won’t get into the details of the change, which are best explained in this 2021 Obamacare Subsidy Chart and Calculator. I found out about the change after 2021 had begun and I had re-enrolled in my Aetna group plan. Even had I found we’d be eligible for some subsidies, I’d likely have stayed with the Aetna plan for two reasons: 1) the revision in the subsidies is only in effect for two years, and 2) I like the stability of having our 8-year solution to our health insurance puzzle.

I do NOT want to get into the hassle of changing health insurance providers every year, even if we could save a bit of money by going through that exercise. If we’d have jumped to an ACA plan, would I be able to jump back into the retiree plan if/when the subsidies were revised again? I’ll never know because I was unaware of the development until after it was too late to act on it.

The lesson from this section: Keep abreast of health insurance developments, even when you think you’ve found your solution. Mark your calendar to do a bit of research every fall before the enrollment period closes. Lesson learned.

Resources – How To Get Health Insurance In Retirement

As I was working through our personal decision-making process, I came across some relevant resources that I felt would be of value in this post. Below is a bullet list:

- Your 101 Guide To Health Insurance – Policygenius.com, includes online insurance comparison/search.

- Healthcare.gov – the official government website for plans offered by the Affordable Care Act

- HeathSherpa – online insurance comparison tool

- Health Markets – an online insurance provider search tool

- Health Sharing Reviews – Compare health sharing plans.

- ChooseFI – An article with creative options for finding potential group plans

- Boomer Benefits – An independent expert for all things related to Medicare.

- How to Handle Health Insurance Under FIRE – A post on the topic from TheConfusedMillenial

Conclusion

Thanks to the many of you who have been asking “What did you do after your COBRA ran out?”. Apologies for my negligence in writing a timely response, but I’m happy to report that’s now been rectified.

In summary, what we learned is this:

Plan Conservatively. Use the highest reasonable estimate for your medical insurance costs as you’re determining when you’re able to retire. In our case, we estimated $2,500/month, and it’s nice to be paying “only” $1,900 (I winced when I wrote that sentence). Surprises to the good are always preferred in retirement. Medical insurance is EXPENSIVE, and must be a major element in your retirement cash flow planning.

Do Your Research. Check out the links in the resource section above, and look at all options available to you. I suspect you’ll be able to find medical insurance to cover you in your pre-Medicare years, but be prepared to pay up for it.

Stay Abreast of Developments: Don’t pull a “Fritz”, and miss an important update like the one triggered by the American Rescue Plan Act of 2021. I’ve learned my lesson, and now have an annual reminder on my calendar to review the health insurance market every Fall during the enrollment period.

Assess Your Risk Tolerance: Health Sharing Ministries may be an option for you. Ditto a “Bronze” plan, where your higher deductible will result in a lower monthly premium. We didn’t do much research on a pure “catastrophic coverage” strategy, I’d be interested to hear from you if you have.

If you’re wondering how to get health insurance in retirement, I hope this post has given you a place to start. Rest assured that this early retiree sorted it out, and I have confidence you’ll be able to do the same. If your numbers say you can’t afford at least $2,000/month, be realistic that this one issue may be big enough to force you to work for another year or two while enjoying your employer-provided coverage. Even if you think you’ll qualify for an ACA subsidy, recognize the risk that these subsidies are subject to change. If you’ve built it into your numbers and are confident you’ll be able to cover the expense, I encourage you to not let this one factor be the reason you continue to work.

There are options available.

Unfortunately, they come at a significant cost.

Your Turn: Did you retire before you were eligible for Medicare? What are you doing for health insurance? Also, has anyone investigated “catastrophic” strategies (e.g., you pay the first $50k, but the premium is very low? Is there a product that offers this type of option?). Finally, am I the only one who missed the update effective with the American Rescue Plan of 2021?

Fritz,

Thanks for posting this article. I think this is the biggest issue that early retirees face and is complicated to navigate the options. I too was not availed benefits from ACA since they count nontaxable income in their calculations for total income. I ended up going with a United Health Care Golden Rule option that is best for couples that are in relatively good health. It is less expensive and provides good coverage with two exceptions

1. In my state the policy has a 6 month term period and has to be renewed every 6 months

2. The policy does not cover pre-existing conditions

The UNH policy does not consider conditions like hypertension and high cholesterol preexisting but leans toward more expensive conditions like Diabetes and Cancer. Obviously there is inherent risk with this type of policy but the cost is about one third of the $1900 you quoted. In some states you can string together three terms (18 month) in a policy unfortunately Virginia is not one of those states.

My wife and I are 63 years old and rolling the dice on maintaining relatively good health for the next two year but this is clearly not and ideal option for everyone. I look forward to hearing what others are doing for coverage options. Thanks. Paul

Paul, the first comment, and already I’ve learned something. I think the comments on this post will be more valuable than the post itself! Thanks for sharing your “solution”, sounds like a good approach.

Fritz

I know this was a challenge to write, thank you for sharing. This was very important information. Timing is everything.

I am grateful every day that I fell in love and married a Canadian citizen 28 years ago. We left the US for Canada in 2013, when I was 61. I’ve paid for prescription drugs (fortunately I only take two generics), dental work, and glasses (my eye exams are paid for under our provincial health insurance plan).

I’ve only “purchased” health insurance when we’ve traveled outside Canada. We’ve met many US retirees in Mexico taking advantage of the low cost of private medical care there, many times from US-trained specialists.

Fortunately, we don’t need to pursue that option. I have all the care I need, when I need it, under a tax regime where I pay roughly the same rates as we did on Oregon. I hope that your coverage continues; what an awful situation to be in!

I retired when my youngest started college. For two years I was able to qualify for the ACA subsidy by keeping my income below the cutoff.

Once I had to start drawing from my retirement accounts, i lost the subsidy. At that time my child signed on for the insurance offered by the university (BCBS) for about $3000 a year, and we changed to a high deductible plan ($14000 deductible). Our premiums have actually gone down every year (from $1800, not to $1400). And we have opened a HSA.

With the removal of the subsidy cliff, our costs dropped to $1000 a month. But still with a high deductible plan.

Great timing on this piece, Fritz. COBRA is near completion for us, as well. As you advised me a year and a half ago, we too budgeted $2,500 (+5% yoy) for what would come next. I talked to Aetna back then, as well, and found the $2,500 to be a reasonable forecast. That knowledge helped manage my longer-term expectations. We are certainly lucky our former employer offers the coverage to us – even if they no longer subsidize.

Bob, great to hear from you, hard to believe your COBRA is close to expiring already. Time flies. Yes, we’re fortunate to have the Aetna group plan available to us, I hope it works as well for you as it has for us. Say hi to Mary from us, we’ll have to catch up sometime soon.

We both retired several years short of 65, did some research and attended a couple of insurance seminars. We did not qualify for an ACA subsidy for the same reason you didn’t. We ended up staying with the state’s retired educator insurance plan (no dental, vision or prescriptions) and when we were eligible for Medicare we switched into the silver supplemental plan from the same company. The decision was made easier when we learned that the supplemental covers the annual Medicare deductible. The years we were not on Medicare turned out to be only $120 more a month than what we are paying now for Medicare & Part D & supplemental. One of us has dental insurance and neither of us have vision. The biggest shock was the cost of prescriptions even with Part D as our pre-retirement insurance covered nearly everything. Same advice do your research! While his COPD inhalers just went up significantly but a couple of hospital stays have resulted in zero out of pocket costs.

MdH, I’ve only done surface research on Part D, but my understanding is they’re almost more complex than the ACA mess. I did read that it’s critical to study the various Part D options vs. the medications you’re taking, since coverage varies significantly between plans. It maybe worth investigating the alternative Plan D plans when you’re up for renewal in the Fall. Thanks for the comment.

I’m 62 and wanted to retire, so I stepped down from my stressful position and took a 20-hour part time position with NO stress. Some would say that’s not retiring, but to me it is. My employer offers insurance for 20-hour positions, so I’ll “work” in retirement for the next 3 years until I qualify for Medicare.

LIF, thanks for sharing the “Part-Time Work” solution to the insurance puzzle, certainly a viable option. You’re fortunate to “only” have to work 20-hours to qualify. If you did the math, I’m sure the “all in” hourly pay would be impressive (including the value of the health insurance). Real money.

Thanks for another great article. I know so many people that would like to retire early, but are concerned about health care costs. I plan on sharing this with them. We retired at 58 and as a lifelong federal employee I was able to continue my coverage. In the federal system, health care insurance for retirees is the same as active employees (as long as you are enrolled for the last 5 years of employment). So the government pays about 70% of the premium. This was certainly one of factors that enabled us to retire at a relatively young age.

Jake, definitely a huge benefit of working as a Federal employee, one of the few places left that offers both a pension and retiree medical insurance! You’re a lucky man.

Fritz love your content. Sorry – not sorry – that your pension pushed you above the ACA subsidy calculations. What a great asset for you that most won’t have going forward! I retired at 51 and still have 4 dependents. We have had a high deductible plan since almost the beginning so the value of our HSA is very large which is a great asset for us. We qualified for a $0 Bronze high deductible plan on the ACA. It covers all of our standard wellness at 100% and we are fortunate to be a healthy family with a large HSA protecting us so the no cost high deductible has been a great solution for us. I use the Kaiser Family Foundation Calculator to make sure our income stays within the ACA income guardrails and so far it has been spot on so that is a great easy to use tool for planning purposes. We have been very happy with our decision so far. Thanks again for your great articles!

Sorry, not sorry. Had to laugh at that. I’m blessed, and thankful that I can afford to cover the private health insurance, for sure. Congrats on crossing The Starting Line at age 51 – major accomplishment. Thanks for the tip on the Kaiser calculator to stay within those critical guardrails. For the record, I’m considering a “Bronze” plan for next year, seems a reasonable approach as long as we remain healthy.

Thanks Fritz,

As others have indicated health insurance is a real concern for those of us retiring. For me I retired the same year I was eligible for Medicare. My wife still had 5 years before she was eligible for Medicare but like you COBRA was the best coverage and least expensive option. A real cavate for us was that since I went directly on Medicare it was considered a qualifying event which allowed my wife to receive COBRA for 18 + 18 Months, 36 months total which gets us much closer to her Medicare coverage date. This qualifying event is well documented but not widely known by everyone in a similar situation. Hopefully those reading your Blog will not miss this opportunity.

Todd, thanks for sharing that excellent tip on the “qualifying event” when a spouse qualifies for Medicare. You taught this old dog a new trick, hopefully others who can benefit will find it buried here in the comments, too.

I retired in late 2019 (early 40s) and went on COBRA for $700 a month, while Dragon Gal went on an ACA plan for about $375 a month. I have been a cancer survivor (in full remission) for 10 years now. My oncologist is not covered by any of the ACA plans in our area, so COBRA made sense for me for the first year. I wasn’t sure what we were going to do when COBRA was over. I only had to see my oncologist a couple of times a year but I didn’t want to have to change beccause he is part of a top cancer center. We found out through a friend that in our state, a husband and wife can get small business insurance without have any additional non-family employees. So in 2021, we established an LLC and have been on a BCBS small business PPO plan. We each have individual coverage in our own HSA eligible plans. I am on a Gold plan and spouse is on a Bronze plan. Total annual premiums are a little over $1,100 per month. But since it is a PPO we can still see all of our doctors and specialists. I will hit my out of pocket through my lab work at the cancer center. So total budgeted expense this year is $17,000. It is a lot, but we had budgeted for the high costs. I am just glad I can still see my doctors. I would love to get on an ACA plan and get some subsidies, but I value seeing my specialists more.

Wow, retired in your early 40’s as a cancer survivor. You’re my hero, and you make my challenges with healthcare pale in comparison. Great solution to “discover” the small business approach, a very creative solution to your particularly challenging situation. Congrats on beating the cancer, btw. Puts things in perspective for all of us.

Like FarmerJake, I was able to retire a few years before 65 as a federal employee and kept my coverage active (BCBS Federal) as It had been active for 5 years continuous before my retirement. The interesting twist is that at 65 one can take Medicare Part A the traditional hospitalization coverage at no additional cost, and continue the federal coverage. The network is nationwide or even worldwide and we have never had a claims issue. Now they do change the fee schedule with network providers that makes the provider take the Medicare fee after 65. And if you ever switch to Medicare you can never go back. My first surprise was needing hearing aids at 66 and finding NO coverage via Medicare, but a 3000.00 every 3 year benefit with BCBS federal. This speaks into what a patchwork our health care coverage is at present, and if Fritz can’t keep up, the rest of us are beyond hope! Great post.

If Fritz can’t keep up, he may just be getting old and not paying as much attention – wink. I’m finding much more enjoyable things to do in retirement than study health insurance after I “solved” the puzzle. Expensive mistake, perhaps, but I have no complains.

Just to update you Quentin. Federal Employee Plan pays $2500. Once every 5 years as of 2021.

I was laid off in August of 2020 just after I turned 61. As part of my severance package my company paid the employer portion of the COBRA premiums for the first five months after I left the company. So my health care premiums were only $200 dollars a month thru the end of January 2021 then they increased to $1200/month. The American Recovery Plan Act has been a big help to us. As part of the ARPA the government is paying my COBRA premiums from April thru September. I am now deciding whether to stay on COBRA, which I can do thru February of 2022, or switch to an ACA-based plan. Again the ARPA is a big help here. I entered my data into the ACA web site and I qualify for a $1750 monthly tax credit. I’m currently leaning toward a plan with a premium just over $200/month, after the tax credit. It has no deductibles and a family out-of-pocket maximum of $3000. After next year I’ll be looking at premiums of about $2000/month if I don’t quality for a subsidy but we have enough after tax savings to probably go for a couple of years with income low enough to get a subsidy. After a couple of years we’ll then switch to Medicare. My wife is only a few months younger than me so we’ll both be able to switch to Medicare about the same time. Our current doctors and prescriptions are included in the ACA plan.

One of the considerations in this is the fact that I’d like to convert some of our tradition IRA savings to a Roth. About 75% – 80% of our savings are in traditional IRAs. My original plan was to do a Roth conversion of a few hundred thousand dollars this year while on COBRA, as the additional income would not impact the COBRA premiums. However with the changes to ACA from the ARPA I now can do a conversion both this year and next without impacting my ACA premiums, although a high income next year would impact my Medicare premiums in the first year that I switch to Medicare. My wife’s birthday is late enough in the year that she could wait until the following year to switch to Medicare and still be within the three-month window after her 65th birthday to avoid a penalty.

Reading this (as someone still working with health insurance via employer), I was able to follow (nearly all of it). However, your post also indicates just how complicated this all is. My goodness.

Thanks to you and everyone who is sharing their experiences.

Chris, yep, it’s complicated! Great point to bring up the Roth conversions, I’ve been doing those aggressively since I don’t qualify for ACA subsidies, but they can be a major trap for folks who aren’t aware they can easily disqualify you from that all-important subsidy. Glad to hear you’ve been able to figure all of that out after being laid-off, it’s hard for folks who have time to plan for it, it must have been stressful to figure it all out “under the gun”. Thanks for sharing your situation, sounds like you’re on top of things!

Chris, File for IRMA relief the year you go on Medicare based on the income you will have that currant year, not based on the year or two-years prior that included the Roth conversions. Investigate and file the IRMA relief requests. Our surprise was Medicare looks back 2 years. And even though we got relief the first year after filing, we had to file again the 2nd year too. Good luck! Joel……

I’m planning on retiring next year at 62. COBRA this year would be $ 615. I’ve run the numbers several ways. Turning my 403b into a variable annuity and taking social security would put me too close the premium subsidy cliff. I’m planning on turning 65% of my 403b into an annuity and taking social security. That gives me a good stable income.

I will be using ACA. I’ve run the numbers and I can still contribute to the HSA. The prescriptions will run about $150 per month and the Silver plan about $125, much cheaper than the $615 COBRA. Fingers, toes and eyes crossed that this work.

But how did you type with those fingers crossed? Wink.

The elimination of the ACA subsidy income caps is a VERY BIG DEAL!!!

I’ve been following you since your pre-retirement days and your advice is pretty good, but Fritz, you really whiffed big time on this post, my friend.

You spend more ink on very shaky Christian health pools and fail to mention the ACA until the very end?

The temporary elimination of the income cap/cliff and the 8.5% insurance to income limit deserves a separate post from thought leaders like you.

Temporary? Yes. A big deal, absolutely! Our switch to an on-exchange plan in May will save us $1100 dollars a month!

Spread the word.

I whiffed, indeed. Proof that even folks who study retirement planning can still miss a big one from time to time. Guilty as charged. Still love me?

Absolutely!

Ahh the healthcare mess in America. I’ll have a government pension but won’t get it until I’m 62. And as my business continues to grow the income from that alone might make me ineligible for an ACA subsidy, I haven’t checked yet. But thanks for reminding me to spend some miserable time looking into all the numbers. It shouldn’t be so hard…

Misery, indeed. The bad news for you will be if the graphics biz knocks out your subsidy, but you’re generating less than what the value of the subsidy was. Like walking backward on a treadmill. Hoping you can keep your income below that limit, my friend.

Fritz, excellent article on a very complicated subject. I know this firsthand since I retired in 2018 as a healthcare administrator who had many years in negotiating managed care contracts, and moreover responsibility for billing departments. For those with high deductible plans, indemnity coverage, self funding, or faith based sharing policies, I highly recommend negotiating for a reduced rate on services. If you can get a current procedural terminology CPT five digit code of services to be provided, just Google Medicare for average payments for those services as a baseline to negotiate a reduced rate since Medicare payment is often significantly lower than private payers. Once you show up in hand with those numbers, then you can offer to pay on the spot. Most billing departments will work with you since they will gladly take money up front to avoid an additional accounts receivable.

I was fortunate to retire at 58 and go on my wife’s policy since she is younger and will retire in about 7 years in time for my MC to kick in. Though the premiums are high at $800 month, it was better than any ACA out there especially since I don’t qualify for any subsidies.

We have an expert in the house!!

Thanks for the great tips, Eduardo. Very helpful for all of us struggling with this “very complicated subject”. Much appreciated!

This is a very important point that shouldn’t be overlooked – the American healthcare system runs on CPT codes. If you have the codes that are being used for any procedure, you have power – you can find out, as Eduardo mentioned, the Medicare reimbursement for these CPT codes and then negotiate accordingly. You can also use the CPT codes to check the reimbursement of your insurance company and know exactly what you part will be before agreeing to any medical procedure. Doesn’t solve the high cost of our system but it does provide some level of negotiating power / options to the consumer!

Hey Fritz – one clarification: You said, “Healthcare sharing ministries cannot be used with Health Savings Accounts (HSAs) or reimbursement plans…” which is partially incorrect. An HSA cannot be funded while using an HCSM but any funds already in an HSA can be used for qualified medical expenses (payments to medical providers, etc) while using an HCSM.

Good to know, Pete! Thanks for clarifying that the funds already deposited can still be used, I wasn’t aware of that. Man, I’m learning a ton reading these comments today!

I’m confused when y’all say that you cannot fund an HSA while using an HCSM, since that is exactly what we do. Our HCSM is HSA-qualified and runs us about $450/mo for the two of us. We use the same HSA (tied to my SSN) that we started many years ago while on a regular high-deductible insurance plan thru a previous employer. When we began the HCSM, they gave us the option to use any HSA provider, so we moved the old HSA from HSA Bank (required by the old insurance) to Fidelity. Fidelity walked us through the process, and we funded it fully for both 2020 and 2021 since we started with the HCSM.

I will say that there is one thing about the HCSM that caught us off guard. This is a different topic, but when my youngest started at a state university last year, they required health insurance to enroll him and would not accept the HCSM. We ended up having to buy separate, regular insurance for him through the school. It was about $1400/semester and then another $60/mo plan over the break this summer. We didn’t see that one coming, so heads up to the college parents out there, if you are considering a healthshare plan.

WOW if what you say is true, this is news to us. We use Medi-Share and even a high deductible agreement, and we were informed that the federal government did “not” consider “any” HCSM organizations to be eligible for HSA participation. As far as I am aware of, Medi-Share has been lobbying Washington for HSA eligibility forever. Can you tell us what HCSM you use? Many thanks!

Sure. It’s called MPowering Benefits. I had to go back and look over the particulars, but in re-reading the fine print, I see that it is correct to say that the health sharing plan alone still does not qualify for an HSA. What MPowering has done is to combine a health sharing plan (ours is Sedera) with a preventive-care-only health insurance policy that does meet the qualifications for an HSA. The ability to do this might be state specific, so ymmv.

Fritz – another excellent and timely article that I’m sure I will refer back to many times over the next couple of years. I just retired June 30 at age 59. My wife is 61 and already retired. We’re going with COBRA for 18 months – $1,600/mo. I was already paying about $500 a month with me employer so the increase is about $1,100/mo. I made the decision to pay off the remainder of my mortgage several months before before I retired, so I essentially swapped the new health insurance premiums for the prior mortgage payment.

I’ve been researching ACA policies in my area for when COBRA ends. Fortunately I live in a state where there are currently 10 companies offering plans. I expect to move to an ACA plan when COBRA ends and I’ve budgeted $2,000/mo based on Silver plans available in the market. We will have 2 1/2 years for my wife and 4 years for me left when COBRA ends until Medicare.

One of the tricky timing issues will be deciding whether we want stay where we are currently living or move to another state which we’ve been considering. We have 18 months to figure that out before we choose an ACA plan.

Congrats on crossing The Starting Line, it sounds like our paths are very similar, best of luck figuring out your longer term solution (including where you’ll live!) before that COBRA expires.

We retired at age 48 as a generally healthy couple, and have been on ACA each year since. We fund life by withdrawing Roth contributions and careful taxable stock sales and also manage to make IRA to Roth conversions but keep our MAGI near 30K to keep ACA premiums as low as possible. We chose a BCBS bronze option which has our regular doctor in network, for a little bit over our ACA premium credit. Last year we received a huge medical loss ratio refund. Our plan deductible is obscene, pretty much equal to our out-of-pocket max > 15K but we have some HSA as a backstop, and so far our healthcare expenses have averaged < 2K/year. We shopped around using provider cost estimator tool for a cheap imaging provider, which has saved us hundreds…their cash pay cost can be lower than our cost using insurance. We know more expenses will come eventually, so we consider every cheap year as a bonus.

Congrats on getting out early, and managing your health insurance puzzle effectively. Great tip on the “provider cost estimator tool”!

I will retire on Sep 10 at age 62. We did large Roth conversions the last two years so we have enough money in Roth accounts and traditional IRA accounts to manage our ACA income each year to get a Bronze plan with no cost to us with subsidies. We care about catastrophic coverage, not cheap office visits.

With the elimination of the subsidy cliff in 2021 and 2022 we will probably do more Roth conversions to reduce our RMDs in the future.

Bobby

The Starting Line approaches! Exciting time for you, Bobby. Nice job thinking ahead and doing those Roth conversions before they’d hit your ACA subsidies. Best of luck in your retirement!!

Fritz – When I shared our story after reading your book and in a subsequent guest blog article several months ago, you told me “be cognizant of health insurance.” After reading your post and the readers’ reactions, I’m having a moment of gratitude. I work for an employer that funds “pay-go” for retiree health insurance for current retirees as well as saves for OPEB (Other Post Employment Benefits) for future retirees. Health insurance is covered for me AND the family until age 65 at 100% (except deductibles). I’ll retire at 46. It’s something I never would’ve known as a younger person but am eternally grateful for now that I stayed with my employer. Rare, but for the younger readers, those employers are still out there.

You are truly a lucky man, Joe. Enjoy that free health insurance for 19 years! Wow, just wow!

Thanks for this. I took the same approach, and I have found that shopping around each fall is a good use of time. After my COBRA ran out, I purchased an individual policy here in Pennsylvania directly from the insurer (UPMC). That was 2020 and my silver plan (just me, no dependents) cost $1,073 per month in premiums with a $2,300 deductible. Seeing that there would be a large increase for 2021, I shopped around and found a comparable silver plan through Capital Blue Cross for $837 per month with a $3,950 deductible. Luckily I am in excellent health and have no prescriptions, so I never spend the deductible. I plan to continue on this course until I am 65 (4 more years).

After much research, we opted to go with a health sharing ministry for our first year after COBRA. Although I shared the same concerns you expressed with a HSM, we have had seen how one of these ministries has come through for a couple of families we know personally who experienced multi-year major health care situations (leukemia, ALS). Our COBRA premium was over $2k per month for 2020. Our HSM coupled with a direct primary care physician totals less than $750 per month. We strongly considered an ACA plan but we hope to do Roth conversions over the next 10 yrs which would put us well over the income limit to receive any ACA premium tax credits. The cost of an ACA plan (even with some premium tax credit) plus the tax implications of not doing Roth conversions led us to go with HSM for 2021. So far so good. We are generally pretty healthy but I needed a relatively minor surgery this year which was almost completely covered by the HSM. I wish I could say I was comfortable with my decision for the next 8 years like you Fritz, but I think I’ll have to revisit my decision every year.

I retired at the end of 2016. Briefly looked at the HCSM and decided they were too risky for me since they are not “real” insurance. Stayed on COBRA the full 18 months but in retrospect I would have done better with ACA given my relatively low post-retirement work income.

First 2 years on ACA took Bronze plan with obscenely high deductible/OOP, as I didn’t know what my contract job would be paying. Fortunately I had no medical issues to speak of and my income was lower than expected, resulting in refund of overpaid premiums, so this gamble paid off. Have had almost no reportable income for 2021 since I put 100% of part time paycheck into pretax 401K so I can pull from taxable accounts just enough to make the minimum income. Now am on ACA silver plan paying peanuts monthly and great coverage, no deductible and low OOP. Have had a couple of medical problems this year so it’s really paid off to have good coverage.

Retired from work altogether now as of early July. For the next 2 years I will be pulling minimum income from pretax retirement accounts to just barely qualify for ACA and live off cash savings to make up the deficit. Once on Medicare for the tax years when I am 66 to before taking SS at 70, I will take Roth conversions to fill up lower tax brackets.

Thank you Fritz, this is very timely. Just retired in April at 62. Healthcare costs were a prime factor in determining how and when to retire. In fact it was the single most common question I was asked before I left. I will be using COBRA this year and probably next year as my former employer has very nice deductibles and OOP max for their high ded plan, premiums $550/mo. Will bridge to pension @65 using $$ from taxable accounts.

Looking at Silver ACA plans in my state without subsidies it would be ~ $1200/mo. for myself. When I planned out when to retire I had budgeted worst case for paying $1500/mo for myself not knowing if ACA was still going to be around. I was planning on taking Roth conversions to get enough income to qualify for ACA in 2023 but not so much as to lose the subsidy and have future IRMAA problems. The comments so far have given me quite a bit to think about, particularly about the subsidy cliff elimination next year. I had looked at it once but had thought staying on COBRA would be better. Need to look at that again.

Thanks, Fritz, for this very informative post (and to everyone who’s talked so openly about their strategies for obtaining insurance). It’s been incredibly valuable to read not just theory but actual stories of what has worked and what the costs/risks are of different approaches.

My wife and I, having retired last year in our early 50’s, started our Blue Shield ACA Silver PPO plan just last month. We live in CA and, without subsidies, this plan costs us $1700/month (which I was surprised is far less than the HMO plan you were quoted in GA). Although it’s expensive, we had budgeted potentially $2500/month in health costs based on info from a number of sources (including this blog!), so we’re pretty happy with the headroom to pay for prescriptions, co-pays, …

On a related topic, and truly without trying to start a political holy war here, I’m curious if/how people’s attitudes toward the ACA have changed over the years. Fritz, you wrote your post in Sept 2016 about how Obamacare is falling apart, correctly pointing out a number of threats to the sustainability of the program. Now, 5 years later, my own experience and the comments I read here seem to show the ACA is actually working for many of us in providing guaranteed health care from a choice of providers, often at little to no cost.

Yes, that is the elephant in the room: the Affordable Care Act actually works for many of us.

Blasphemy! Isn’t it? 😉

Amazing what happens when an administration works to improve it rather than trying to get it “repealed and replaced” every year.

I’m not going to take that bait, Ken. Wink.

Thank you so much for all of your valuable articles! They are all helpful, but this one was particularly relevant to me. I have a clarifying question- the first post from Paul mentioned that the policy he got excludes pre existing conditions. I thought that one of the provisions of the ACA was that pre existing conditions have to be covered. Am I mistaken? I’m 54 and hoping to retire very soon but the health insurance has me very afraid- especially if an insurer can exclude pre existing conditions. Can anyone clarify for me? Thank you!

I wondered that too, but I believe those are plans that are purchased outside of the ACA exchange?

I can’t speak to the details of Paul’s plan, LC, but given it’s 6-month term I believe it is a unique plan and not a “typical” ACA plan. My understanding is the same as yours, that “typical” ACA plans allow pre-existing conditions.

Just to clarify the short term plan I purchased from United Healthcare was purchased outside the ACA and is used as a gap plan until I get 65 year old. I can only assume that the exclusion of pre existing conditions is what keep the premium cost much lower. The policy has a $2500 family deductible and has a relatively low copay for prescriptions. Still not optimal given I did not qualify for ACA subsidies.

Just to clarify the short term plan I purchased from United Healthcare was purchased outside the ACA and is used as a gap plan After COBRA. I can only assume that the exclusion of pre existing conditions is what keep the premium cost much lower. The policy has a $2500 family deductible and has a relatively low copay for prescriptions. Still not optimal given I did not qualify for ACA subsidies.

I assumed he is referring to short term policies that don’t qualify as major medical. They often have a life time cap as well.

I believe he said he could only get one for six months, and in his state renew it twice.

Great information. Thanks for sharing this ever important topic.

For anyone even considering a health care ministry, please watch this:

Don’t forget to check if you have any Roth IRA money available – those withdrawals (at age 59.5 or later) are not taxed and not counted as income for ACA subsidy purposes, I believe. We are trying to live on our Roth IRA until 65 when we qualify for Medicare and then talk into the non-Roth IRA. Crossing my fingers for Medicare expansion!

You know what’s more expensive than health care insurance? Health care.

Sorry the video link didn’t show up in my original comment: https://youtu.be/oFetFqrVBNc

Although I have no doubt that the rapid expansion of HSMs since the ACA has resulted in some shady organizations, the HSM we use has been around for decades, has a great reputation for meeting obligations, and over 90% of all contributions go directly to health care needs (i know this to be true because the HSM we use requires us to send checks directly to individuals). As with all areas of life, let the buyer beware – do your research, assess the risks, and make an informed choice. That informed choice should consider whether you can truly agree with the HSMs statement of faith, and if you can’t, you should look elsewhere.

Fritz,

Any thoughts on “creative” solutions? I was once on a shuttle ride with a ex-pat (DC -> Portugal) and she had nothing but great things to say about Portugal. The insurance costs, cost of living really were what did it for her, but just the access to the continent as a whole great too! I’d have to research more but maybe you could do a post about things of that nature?

I will say this – there are a lot of expat options floated out there. Mexico, Belize, Costa Rica, Portugal, Thailand, etc. In the past three years I’ve spent 2+ months in Europe and recently Mexico. I can tell you that I could handle Portugal and most of Europe for a few years to bridge an early retirement to Medicare. Mexico and some of the Central America (and likely Asia) options – no so much.

Any comments from anybody appreciated!

We have been looking into Portugal as well to bridge to Medicare. The healthcare is excellent and the cost for a resident ex-pat couple is around $1500/yr. That is what a monthly payment would be in America with a much higher deductible. I think the problem is how often and how long you would plan to visit America. It’s very expensive to get short-term medical coverage in America or Canada. The rest of the world is reasonable. We pay more in medical premiums than Europeans pay in taxes for their Health Care. About 2x more in fact. The other option is to dial in our income to stay below the ACA future limits using our Roth account. We would love to live in Portugal. Imagine, living on that beautiful coast with $50 flights to Paris or Rome 🙂

Jack, going the “Expat” route is certainly a viable option being pursued by many early retirees, including my friend Jim @ RouteToRetire. Personally, I love the USA, and have built in the cash flow to cover the expense associated with staying here. For those that don’t have the means, exploring an international retirement is certainly an option. I’d love to write a post on that topic, though I don’t have any personal experience. Perhaps I’ll offer a guest post to someone who’s living that life, thanks for the suggestion.

Fritz, thanks for following up with the Medical Insurance thread. I was fortunate enough to retire 8 months ago at 55 with no pension or insurance. We struggled with the correct medical path, which is different for everyone. It appears that no two problems or solutions are the same in this arena.

We opted for the marketplace (BCBSNC) plan, high deductible with dental, and a fully-funded HSA. We are still relatively “young” and healthy so it has been surprisingly easy and low cost while the HSA provides an additional tax-free savings vehicle. I was aware of the potential reduction in rates and investigated how it would affect ours. Relatively minimal change on a low rate plan ( a third of what you are paying). Also, the marketplace will implement the change (if any) to your rates by September if you have not done so already.

We will re-examine at the end of the year, but for our family, this is working well.

Great job and resource links, Fritz! Appreciate you 🙂

Thanks for providing this info. I thought my healthcare options were limited and expensive until I saw what yours cost. I am 56 and getting ready to retire from a major university in California. Since I will be escaping California and moving out of state, my medical options are limited to 2 types of Anthem policies. One has a lower deductible but my share of the premium would be $800 month. The high deductible option is free to me. The yearly out of pocket deductible is $3,000 before the plan pays. Maximum yearly out of pocket is $6,500. I am healthy and not needing medical care at this time in my life and intend to keep it that way. I am choosing the free high deductible plan until I am eligible for Medicare. Thanks for giving me a reality check.

Hi Fritz,

Another timely article as I hope to be facing this decision within 18 months or so.

Another connected subject to this matter (hint would love to see future article) would be choosing your retirement state destination and how future state taxes might be taken into consideration as another one of the “long term expenses”. This subject goes hand in glove with the ACA offers that each state has. Many people who have not yet familiarized themselves with the ACA may not be aware of all of the differences states have in ACA coverage.

Thanks so much for what you do and for sharing with the rest of us.

MAI, I agree there’s a lot of content behind choosing which State to retire in. If I were to write it, I’d encourage folks to look beyond state income taxes, as my philosophy has always been that it takes a certain amount of $ to run a state, and if the state has no income taxes they likely get the revenue through other means (e.g., car registration fees, property taxes, higher sales taxes, etc). In addition, the complexity of studying ACA options by State seems a bit overwhelming to me. Something to ponder, thanks for the suggestion.

Also, wanted to highly recommend GoodRX for prescriptions. My scripts through a GoodRX membership are less than when.I was working and had full coverage. I mention this because my ACA high deductible plan does not cover meds and I assume others are in the same boat. If you are paying a premium to get prescriptions covered in your medical insurance, run the.numbers and.you might be surprised.

My approach, not geared for FIRE Folks.

Civil Servants (federal employees) who work at least 5 years and carry health insurance at least their last 5 years of service can retire at age 62 with a pension, albeit a small one, and have in retirement:

1) the option to participate in the government’s health insurance program for life, and

2) continue theeir govt. subsidy into retirement!

A nice 3 legged stool with one minor blemish; the employees contribution is no longer tax exempt, oh darn.

At 65 you are eligible for Medicare. Part A at no cost and you can purchase any other Medicare plan like any 65+ US citizen. We’re up to 5 legs if you’re counting. .

Warning, the govt. doesn’t pay as well as many private firms and its slow to move up in. But we do get 10 or 11 paid holidays, sick leave, and 3 weeks of Vacation for the first 3 yrs., then 4 weeks between yrs. 3 & 15 (5 weeks thereafter). BUT WAIT THERE’s MORE! How is an alternate work schedule that could provide an additional 26 or 13 days off annually? All this time off helps at my age.

I went into Civil Service at age 55 after my employer was forced to close in the 2008 economic down turn. At age 61 I was fed up, determined to leave when I mlearned all this 9 months before I would meet full eligibility on my 62nd birthday. DID I EVER DODGE A MISTAKE!

I turn 66 next month and when I retire my pension will now more than cover my non-subsidized Heath Insurance (~33%) for perhaps the rest of either mine or my wife’s life.

Recap: join Civil Service, put in 5 yrs. purchasing health insurance for at least the last 5 years, be at least 62 yrs. young and Uncle Sam will pay ~67% (current subsidy) of your health care premium for life. In my case my pension may cover an additional Medicare plan as well and we’ll be free to live off our life-long savings and SS.

It’s really worth consideration! AND US tax payers can use all the dedicated talent they can find. If you consider this option check with someone like Resume.com (I used them but am not affiliated) that focuses on helping gear your resume to the govt’s. style.

Hey Fritz,

Count me as one of those readers who has been waiting for this post since 2018. I remember reading the post in 2018 and being eager to see the follow-up. As I’m getting closer to a life without a full-time job, healthcare is always on the back of my mind (and my wife’s). COBRA will be a good 18-month option for us as we have a great plan now with my employer. But the cost of the right plan/provider after that worries me in our high cost of living area. Though I had a conversation with a friend recently who challenged me saying, “it’s only a few hundred dollars more! Is that holding you back?”

-RBD

Good afternoon, Fritz! Appreciate your detailed walkthrough of your thought process and decision. As was mentioned by many in the comments this is very complicated and personal as one size does not fit all. In fact, as you likely recall, I was one that reached out to you individually via email as I re-read your post earlier this summer, “Health Insurance in Retirement, Unsolved.” Appreciate your timely response! For your readers and to make a long story short, I will be 58 in 2 short months and my wife of 35 years is 6 months younger but still looks 27 (in case she reads this 🙂 … I would like to retire at year end and like Fritz have heavily loaded Healthcare, Dental and Vision in our plans as though we will be paying full freight in perpetuity. We are fortunate that we can defer a small pension, 401K and Pre-Tax IRA’s, Social Security and small annuity payments post medicare eligibility as we have built a buffer of Taxable brokerage investment savings that we can use to bridge the gap while giving us flexibility to manage our MAGI for ACA Cost Sharing options. We too are looking at a Bronze, HSA, policy with a very low premium that includes our respective doctors and hospital network which also allows us to continue to add to our current HSA bucket. We are healthy and hopefully will remain so for many, many years. Yes, through my research, ACA is a good option for us, especially in 2022 with no cliff and lower premiums due to Pandemic relief…but obviously this will not last forever, and who knows what will happen with all of the debate around lowering Medicare age and including dental and vision as well as the current Delta variant. All of which is out of our control and very difficult to plan around. Hence our predicament. I work in the Federal Reserve Banking system, after attaining age 55 and 10 years of employment, retiree, subsidized health insurance is an option for my wife and I including Medicare Advantage subsidies, no dental or vision but the option to continue in the group plans with no subsidies. I am 3 years away from attaining this benefit however, the movement of my cheese, the bureaucracy and politics wear me thin and I hate the thought of going through the motions just to attain a very nice benefit when my time is more important than money…however, where we are with Healthcare options in the country, this seems to put me more in control … could I suck it up and cross the finish line…sure…do I have to no … I know how Fritz responded in his response back to me…interested as to what others would do if they were or have wrestled with a similar predicament?