I read a lot of retirement books, and when I come across one that’s worthy of your time, I write a review to make you aware of new content you should consider to help you Achieve A Great Retirement (my byline). I just completed an excellent book, and dedicate today’s post to a review of the latest work from Dr. Wade Pfau, Retirement Planning Guidebook. Not by coincidence, it goes on sale today.

I highly encourage you to read it, and below I’ll tell you why in a simple list of “What Makes This Book Worth Reading”.

Wade Pfau is one of the most respected and knowledgeable professionals in the field of retirement planning. I was honored when he offered me access to an early “working version” of his latest book, Retirement Planning Guidebook: Navigating the Important Decisions for Retirement Success (Amazon link, I’ll get a small commission at no charge to you if you order via that link). It’s a meaty piece of work, and I devoured every word.

This is the fourth book Dr. Pfau has written and, in my opinion, his best. In summary, the strength of this book lies in the comprehensive coverage of almost every topic a person should consider for retirement. While it includes some of the hardcore number crunchings in which Wade excels, it also touches on some of the non-financial aspects which a person should consider as they contemplate retirement. Combined, it is the most comprehensive work he’s written, and it’s well worth your time. Read on for a summary…

If you're planning on reading only one book from Wade Pfau, I'd recommend you read The Retirement Planning Guidebook. It's his best book to date. Here's why... Click To Tweet

The Retirement Planning Guidebook

After writing for 6 years on the topic of retirement, I thought I was pretty knowledgeable on the topic. However, as I read the Retirement Planning Guidebook, I was reminded again and again how much I’ve yet to learn. Fortunately, there’s someone out there who seems to “know it all” (a compliment, not a criticism). Even more fortunately, that someone has documented all of it in one comprehensive retirement planning guidebook that is a “must-read” for anyone who is within +/- 5 years of retirement.

This book made me pause, time and time again.

I learned more in reading this one book than any other single piece of work I've read in the past 10 years of retirement planning. Click To TweetYes, it’s that good.

Table Of Contents

The content is both deep and wide, as demonstrated by the topics summarized in the table of contents below:

- Chapter 1: Retirement Income Styles and Decisions

- Chapter 2: Retirement Risks

- Chapter 3: Quantifying Goals and Assessing Preparedness

- Chapter 4: Sustainable Spending from Investments

- Chapter 5: Annuities and Risk Pooling

- Chapter 6: Social Security

- Chapter 7: Medicare and Health Insurance

- Chapter 8: Long-Term Care Planning

- Chapter 9: Housing Decisions in Retirement

- Chapter 10: Tax Planning for Efficient Retirement Distributions

- Chapter 11: Legacy and Incapacity Planning

- Chapter 12: The Non-Financial Aspects of Retirement Success

- Chapter 13: Putting it All Together

Take a moment to consider each of the topics above. If you have an interest in any one of them, this book is worth your time. Each chapter provides an expert’s well-thought-out overview on the topic, and the depth of the research supporting his commentary is beyond compare. In almost every chapter, I learned new things. Dr. Pfau’s depth of knowledge shone through and taught me new lessons on topics in which I considered myself well versed. I cannot reiterate how often I was impressed by Dr. Pfau’s knowledge on such a wide range of retirement topics.

I also like the format Wade used to summarize the key action items required from each chapter with a helpful “Action Plan” at the close of each chapter. A retirement planning guidebook, indeed.

Note: Since I read a working version, it’s possible slight changes have been made in the final version of the book.

What Makes This Book Worth Reading

Rather than doing a “play by play” summary of the comprehensive content, I’ve decided to summarize things that make this book different, as well as content that caused me to pause and think. In some areas, Dr. Pfau challenged my thinking on various retirement tools (e.g., annuities), and I’ve included those in the summary below:

1. What’s Your Retirement Income Style?

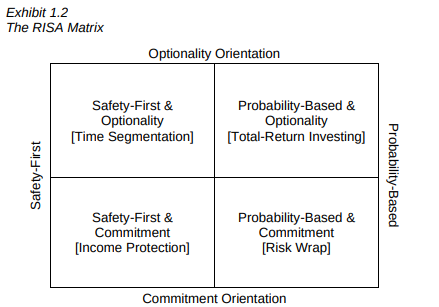

In the opening chapters, Wade explores a new approach to retirement income planning which was developed in-house at Retirement Researcher. Through an entirely new survey methodology, Wade and his team have established the following “Retirement Income Style Awareness” (RISA) Matrix, which can be thought of as a new way to establish your risk tolerance/capacity.

I’ve taken the RISA Profile which is discussed in the book, and am very impressed with how accurately my results matched my investment personality. I have a draft post on the RISA Profile which I plan on sharing in the coming months. Importantly, the book includes a link and secret code which you can use to take your own RISA Profile assessment without cost or obligation. That alone is worth the price of this book.

In summary, knowing your RISA Profile helps establish which approach to retirement income planning best “fits” your natural personality. In the opening chapter, Wade explains the details behind each quadrant in the chart above and the implications for your retirement planning in areas such as asset allocation, the role of annuities vs. bonds in your portfolio, and your natural tendencies toward risk vs. reward.

It’s groundbreaking work, and this is the first book that presents the new approach.

2. Retirement Risks & Implications

We’ve all heard about the main retirement risks:

- Longevity Risk

- Market Risk

- Spending Shocks

What makes this book unique is the way Wade presents the potential ranges of those retirement risks and, more importantly, the implications to your retirement plan. An example of the approach is best captured in this quote from the book:

“For a planned retirement budget, the overall cost of retirement will be less with some combination of a shorter life, stronger market returns, and fewer spending shocks. But retirement could become quite expensive when a long life is combined with poor market returns and significant spending shocks. The danger is that a combination of risks contributes to an overall retirement cost that exceeds available assets. Developing strategies to manage retirement risks is an important theme in the book”

3. When Can I Retire?

The early chapters of the book are dedicated to that age-old question of when can I retire. I include it here as one of the reasons to buy this book due to its comprehensive approach to that question. Wade lays out the complete process for how to compare your potential retirement income with your projected expenses to determine when your “funded ratio” is sufficient to consider retirement. A lot of people have written on this topic (including me), but if you’ve not yet done the math, this book is a great resource for learning how to do it.

4. The Value of Risk Pooling via Annuities

Prior to reading this book, I’ve been hesitant to purchase an annuity. As I wrote in “What Role Should Annuities Play In Retirement”, I’m currently in the “wait and see” mode as I consider buying a deferred annuity as a longevity hedge. I’ve been focused on the reality that in today’s low-interest rate environment, the payback is less than I’d prefer. In addition, I’ve always viewed my pension as a viable alternative to an annuity, given that it covers our essential spending without risk.

What I’ve been missing, however, is the value of the risk pooling and mortality credits provided via annuities.

I found the chapter on annuities the one chapter that most challenged my current thinking. Wade does an outstanding job of explaining the value of the various types of annuities and their role in your retirement income strategy, and how they can actually increase your lifetime spending versus various alternatives. A fascinating read with real application as you determine your retirement income strategy.

5. Social Security Spousal Benefits

Second only to the annuity chapter, Wade’s presentation of Social Security claiming strategies also challenged my current thinking. As I wrote in “Should You Take Social Security at Age 62 or 70”, I’ve been of the somewhat simplified opinion that I’ll defer until Age 70 to take advantage of the risk-free ~8% annual increase in the payout rate. What I missed in my article, however, was the impact (and complexity) of spousal benefits, especially where one spouse earned significantly less than the other.

Fortunately, I read this book before I had to make my decision (I’m 58 years old as I write these words), and Wade presented some excellent resources (SS Calculator links) to do a more complex analysis prior to finalizing your decision. When Wade says this is a decision you can not make without using a detailed SS Calculator to analyze your decision, I listen. I’ve saved those links, and plan on doing a more detailed analysis in the coming years.

As Wade so eloquently explains, the impact of a sub-optimal social security claiming decision can run into the hundreds of thousands of dollars range. If you gain nothing else from this book, the chapter on social security will likely pay you back manyfold on the purchase price of the book.

6. The Importance of Your Medicare Decision

I’ll be the first to admit that I haven’t studied Medicare in any detail at this stage in my journey. At 58 years of age, I have a few years before I need to cross that bridge. However, my eyes were opened as I read Wade’s words on the complexity of Medicare. He is a clear expert on the topic, and I learned more in his chapter on Medicare than in any other section of his book.

I can assure you that I’ll be pulling the book off my shelf and reading this chapter again in a few years, and there are very few books I can say that about. If you’re getting close to Age 65 (or you’re older than that, and not re-evaluating your Medicare elections on an annual basis), this chapter alone is reason enough to buy this book.

Game, Set, Match

I could easily add another 10 items to this list, but the 6 issues above had the greatest impact on me as I read this book. As I close in on 2,000 words with this post, I’m calling it complete.

In summary, I guarantee you’ll learn some new things when you read this book. Your list may be different than mine, but you WILL have a list. And that list is why you should read this book.

Who Shouldn’t Buy This Book?

One word of warning: This book is meaty.

If you’re looking for a quick and simple read on how to prepare for retirement, this book isn’t for you (read mine instead, wink). This book is not for a rookie who’s looking to learn some retirement basics, but rather for a more advanced investor who is willing to chew on a more comprehensive academic approach to the topic. Consider it a mix between a textbook and a retirement planning guidebook. If you don’t want to be challenged, stick to reading blogs. Smiles.

If, however, you’re at the stage where the most comprehensive book on retirement planning appeals to you, I can recommend no finer book. This author learned a lot by reading every word in the book, and I can assure that you’ll learn some new things, as well.

Conclusion

The Retirement Planning Guidebook is the most comprehensive book I’ve ever read on retirement planning. If you’re serious about doing a “deep dive” into the topic, you will love this book. I seldom go out on this branch, but I am confident saying that I guarantee you’ll learn some new things about retirement planning if you read this book, and your retirement will be better as a result. I give it a solid 5.0-star rating and recommend it fully.

Previous Book Reviews by The Retirement Manifesto:

Fritz, thank you so much for the wonderful review. I really appreciate it, and I’ll take advantage of retweeting those handy tweets you’ve designed.

Already retired, 73 is it worth it to read this book?

Barbara, it can still be worthwhile, depending on your situation. For instance, if you are not reviewing your Medicare options each year during the Open Enrollment Period starting in October, you might get enough value from the book just for that discussion alone. There may also be steps you can take with regarding to making sure you receive all eligible Social Security benefits, that you have all your estate planning documents and beneficiary designations in order, having a long-term care plan, and preparing your home for a stronger ability to age in place, and so on.

I am not sure why I should review my Medicare decision at all.

I have Kaiser Medicare Advantage.

I have “tested” it twice. Once with colon cancer surgery and chemo. Once with a perianal abscess (3 surgeries). I was very satisfied with treatment each time.

The main Kaiser facility is 4.2 miles from our house. The urgent care facility is 6.3 miles.

Thank you for this summary and I look forward to look into it . In my case it will read for general knowledge given part of it will not apply to my reality given in am Canadian . Would you be aware of a good Canadian book that could be a nice

complement . Thank you and congratulations on the new book .

Diane

Hi Fritz,

A great review! I have read other works by Dr. Pfau and found them to be a bit dry, but 100% useful and felt his treatment of any subject was balanced. I never get the feeling he is trying to sell me something. His ability to educate is outstanding. ( My own wife is a professor of economics.)

Thank you for doing this review. I just used the link to order the Kindle edition.

Fritz, I wish you all the best in your retirement journey and thank you for sharing your thoughts and experiences along the way!

Regards,

Bob

Fritz,

Thanks so much for doing a review on this book. I was considering buying it, and you just sold me on it. I’ll make sure to order through your link!

I just retired (for good) at age 63. This book sounds like it would be helpful to either confirm some of my preconceived notions on filing SS and doing Roth conversions, or could convince me to change course a bit.

Ordering the book thru the Amazon link provided, thanks Fritz for your detailed book report.

That Fritz said he learned some new things from this book impresses me and sells me on this book.

Thanks for the review. This looks like a great resource. I’m especially interested in the chapters on SS and Medicare. We’re the reverse of most couples. I’m 4 years younger than my husband and earned considerably more money during my working years. I’m not at FRA yet (only turning 63) while he is now 67, though I retired 3 years ago and he retired earlier with a small city pension. I’ve used some online tools to help us decide when we should file for SS but haven’t decided yet. This book should help us decide. One question – is there any disadvantage to ordering this for my Kindle rather than the paper copy? I’ve bought some Kindle versions of other reference books in the past and think the paper version would have been better because of the worksheets in those book. Also is the link and code for the RISA profile in the Kindle version?

This sounds like an amazing retirement planning guidebook!

I’m always open to new ideas and fresh perspectives on “achieving a great retirement”. The chapter on Retirement Risks and Implications sounds like it addresses the age old fear of outliving your savings. In addition everything else you mention, it definitely sounds it’s worth checking out.

Many thanks for this book! Do you recommend Hardcopy over Kindle? I use Kindle to ease eye fatigue (mild to moderate issue), but perhaps the book is well suited for adding notes and calculations by hand. I am almost 59.5 and have read about 25 books on retirement. This book seems like the perfect next step! On second thought, maybe I will get both Hardcopy and Kindle!

Thank you Fritz.

I too am a fan of Dr. Pfau’s work. I will take a closer look at his new book based on your recommendation. For me, the comprehensive retirement book I’ve gotten the most value from is Jane Bryant Quinn’s Retirement Guide, now outdated by publishing date but most of the content still applies.

I’ve listened to Wade on numerous podcasts and he’s always straightforward, super-smart, and balanced in his analysis. Great review Fritz!

Another great review. I’ve been anticipating the release of this book for the last couple weeks. Your review only emphasized that this will be another great source of wisdom for making informed decisions regarding retirement planning. Thank you. Can’t wait for the book to arrive.

I’m 49 and retiring from the military next year. I have no intention of retiring but rather excited to start the next chapter. As you can imagine, the military dominates your life. You’re a soldier 24/7 and the military directs via career managers and regulations etc. Given this, what can I gain from reading this book? My plan right now is to continue to build my real estate portfolio so I can have significant passive income. I don’t intend to withdraw anything from my TSP or any other investments until at least 60 which is 10 years from now. Thank you!

Fritz- Doc :

Sounds like just what the doctor ordered. I’m sold. Thanks for the post, tip and book recommendations!

I would also advise you to find some statistics about each state, because the percentages are higher or lower depending on the state and you can somehow influence this with the help of your registration!

Hi Fritz.

Just downloaded Dr Pfau’s new work following your review above. Im 67 & officially retired. I’m based in the UK so some of the content will not be so relevant but the bulk of the material will be invaluable.

I have been reading your blog posts Fritz since around the Winter of 2019 & find your writing style simple to understand and straightforward. You have been a great source of support in my own journey & I continue to look forward to future content.

Regards Rob.

Thanks for review. Luckily my local library has this book on order, so I’m first in line once it arrives :-). After I read it, I’ll decide whether I should buy a copy for myself. My hesitancy to spend money on it right now is that he might be ‘too heavy’ for my taste. I read some of his papers on Kitces website in the past, and I happened to lose interest. If the content is very dry and Ph.D-like level, then all I read is an executive summary and it’s already more than enough for me. However, the table of contents makes me interested in checking out the library book.

Like someone mentioned above, Jane Bryant Quinn did write a great guide but it’s a little bit old. I’ll have to revisit that book too as I have it at home.