I thought figuring out when to claim Social Security would be one of the more complicated decisions we’d have to make in retirement.

I was wrong.

In less than 15 minutes, we now have a strategy.

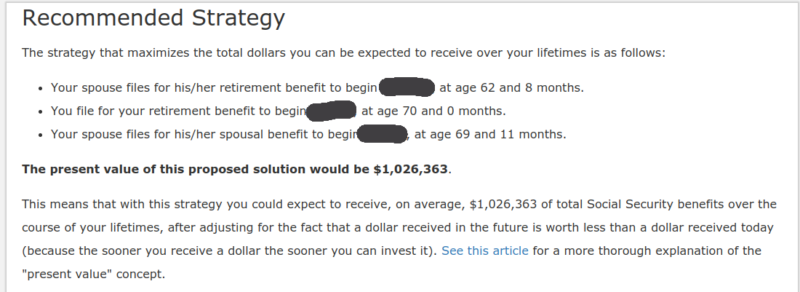

My wife will start her Social Security at 63 years of age, and I’ll start mine at age 70. My wife will claim her spousal benefits at age 69 years, 11 months.

And just like that, we have a plan.

Easy.

Today, I’ll share the tool I used to get our results.

If you’re struggling with determining when to claim social security, today’s post is for you.

I thought figuring out when to claim Social Security would be hard. I was wrong. I just figured it out in 15 minutes. Here's how... Click To Tweet

How To Determine When To Claim Social Security

When I first started thinking about Social Security, I over-simplified things.

For my article titled Should You Take Social Security At Age 62 or 70, I did the math and determined it was in my best interest to delay claiming Social Security at Age 70, with a break-even age of 84-85. If summary, if I lived longer than my mid-80s, I’d get more in SS by delaying. I encourage you to read that post for my analysis.

But…I made a mistake.

I did a lot more work than I had to, and I still missed a hugely important factor in my analysis.

In fairness, I wrote that post way back in 2017, years before I had to sharpen my pencil for my final decision on when to claim social security. But still, I should have recognized a critical factor, yet I completely omitted it from my analysis.

That factor? How to optimize spousal benefits…

The Importance of Spousal Benefits

It wasn’t until I read Wade Pfau’s excellent book, Retirement Planning Guidebook (affiliate link), and wrote this review that I realized the importance and complexity of spousal benefits. As I cited in that book review:

“I’ve been of the somewhat simplified opinion that I’ll defer until Age 70 to take advantage of the risk-free ~8% annual increase in the payout rate. What I missed in my article, however, was the impact (and complexity) of spousal benefits, especially where one spouse earned significantly less than the other.”

Fortunately, Dr. Pfau suggested some social security calculators in his book, which I mentioned in the book review and ultimately led to today’s post:

“When Wade says this is a decision you can not make without using a detailed SS Calculator to analyze your decision, I listen. I’ve saved those links, and plan on doing a more detailed analysis in the coming years.“

Now I’ve Done It.

I’ve taken Dr. Pfau’s advice and I’ve done the “more detailed analysis” using the Open Social Security calculator recommended in the book. I even went a step further and contacted the calculator’s developer, Mike Piper, CPA, explained I was writing this post and asked if he’d be willing to answer any questions I have as I work through his model.

Fortunately for all of us, Mike said yes.

Today, we're doing a deep dive into the Open Social Security calculator, with Q&A from the developer, Mike Piper, CPA. Click To TweetThe Open Social Security Calculator – A Review

The Bottom Line: If you’re trying to figure out when to claim social security, I highly recommend spending 15 minutes with The Open Social Security Calculator. It takes all of the complexity out of the topic and tells you, in very simple terms, when both you and your spouse should file for social security to maximize your lifetime returns.

By following 3 simple steps, you’ll have a strategy. I know, because I just did it (and will be sharing screenshots with my actual results below).

Here are the three steps:

- First, you must create (or log into) your mySocialSecurity account.

- Second, you enter your data from that site into the calculator.

- Finally, you hit “Submit” and get a clear recommendation on when to claim social security.

Interested in learning more?

Read on…below I share our actual results and screenshots from the calculator. I also share my exchange with Mike to offer you more insight into how his calculator works.

Before I go there, here’s a bit of background on Mike Piper, the developer of the model, in his own words:

Q: Mike, what’s your background, and how did you develop your expertise regarding Social Security claiming strategies? What lead to your creation of the calculator?

A: I’m a CPA who focuses on retirement planning. I first really began to develop an expertise in Social Security when researching and writing the first edition of my book, Social Security Made Simple (affiliate link) back in 2011-2012. (The 2022 edition is the 7th edition of the book.) And over the decade since, I’ve been fielding questions regularly from readers and clients about Social Security rules and planning.

Entering Your Data Into Open Social Security

I was impressed with the simplicity of the model. Once you click on the site, you’re asked to enter some basic information, as shown below. Note, you’ll need your “PIA” (Primary Insurance Amount) from the mySocialSecurity site, which is simply the benefit you’ll receive if you file at your Full Retirement Age.

Following is the data I entered, which took me ~1 minute to input (birthday’s omitted for the purpose of this post):

The Recommended Social Security Claiming Strategy:

Simply click on the “submit” button, and you’ll be given the following personalized strategy:

As you can see above, the model quickly made the recommendation which I summarized in the opening of this post, but I’m sharing it again below so you can see the summary:

My wife will start her Social Security at 62 years and 8 months of age, and I’ll start mine at age 70 years and 0 months. My wife will claim her spousal benefits at age 69 years, 11 months.

It doesn’t get much easier than that, and it took me less than 15 minutes for the entire process.

But wait…there’s more.

Social Security Payout By Year

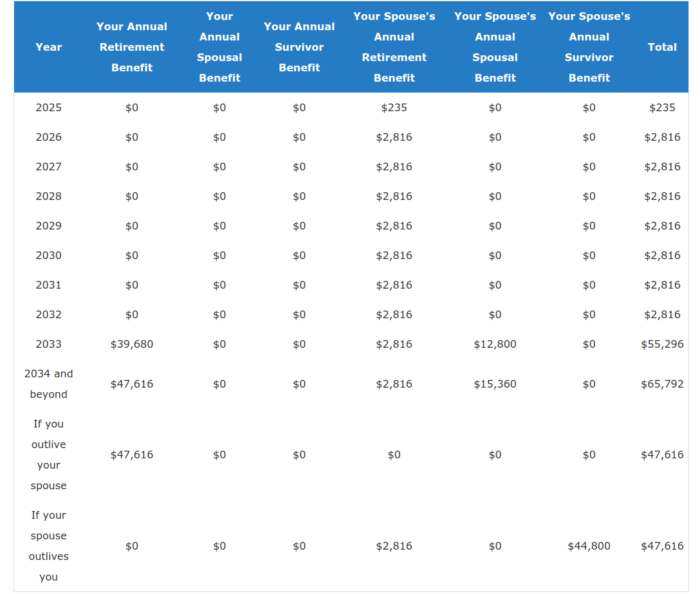

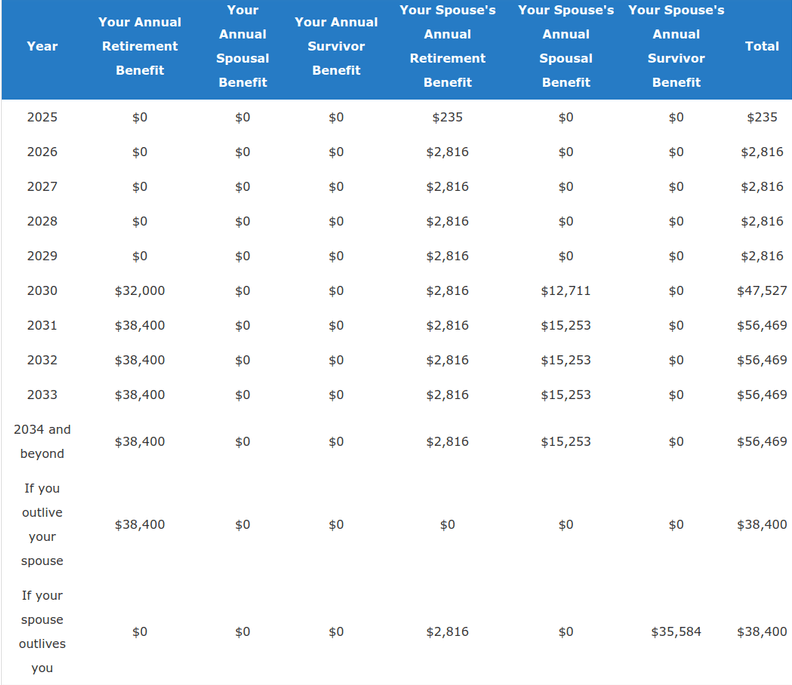

The model presents a clear summary of how much social security you can expect per year, including the breakdown of each spouse’s social security benefits. It also provides a nice summary at the bottom of the table of what happens if either spouse dies first:

Testing Alternative Claiming Strategies

The model presents a graphic that shows the reduction from optimal for any other scenario you may be interested in. Simply click anywhere on the graphic and the calculator will run the numbers for your payouts, including a Net Present Value calculation that you can compare to the recommended strategy.

Alternative Scenario: Claiming At Full Retirement Age (67)

In my case, I wanted to run a scenario where I started my payouts (and my wife started her spousal benefit) at my full retirement age of 67. Given the wide gap between my wife’s benefit and mine, I wanted to understand the impact if I started my SS at age 67, which would allow my wife to claim her spousal benefit 3 years earlier than the recommended strategy. A few clicks, and I was able to see the impact by year:

Comparing The Alteratives Graphically

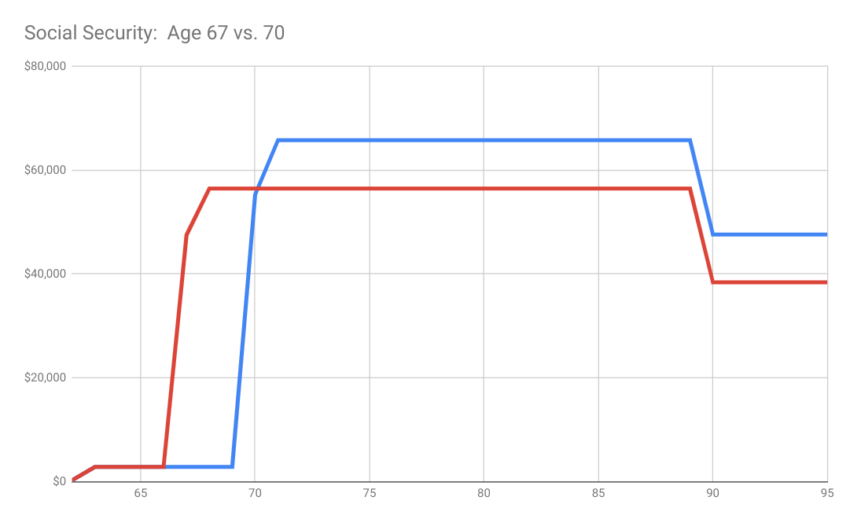

I’ve always liked graphs, so I plugged the two scenarios (Age 70 in blue vs. Age 67 in red) into a spreadsheet and built the following chart. The lines represent total annual social security for our household, and both scenarios assume one of us dies at age 90 (with the benefit dropping to the survivor benefit figure):

As you can see, our SS increases earlier if we claim at age 67 (red line), but never achieves the higher annual income we’d achieve if we wait until age 70. Also, the survivor benefit is lower in the scenario where we claim at age 67 instead of waiting until age 70. In both scenarios, we see some income starting when my wife claims her SS benefit at age 63.

Looking at the model’s “Net Present Value” (NPV) comparison between the two scenarios, you’ll find we lose a total of $35,724 in value if we claim at age 67 vs. age 70:

- Age 70 NPV: $1,026,363

- Age 67 NPV: $ 990,639 (3.5% below the optimal strategy of delaying until age 70)

Steps To Finalize Our Strategy

Based on the output of the model, I’m confident that I won’t be making any decisions for at least 8 more years (I’m currently 59 years old). I’ll explore more models and continue to educate myself on the topic, but at least I know where things are heading as I continue to learn about social security claiming strategies. There are also other factors I’ll continue to evaluate, including:

- the benefit of having more time to do our annual Roth conversions,

- monitoring the annual performance of our portfolio (to fund the delay period),

- evaluating annuities, and other options to provide a longevity hedge,

- monitoring inflation and the best options to provide a hedge.

Inflation and longevity are the two hedges I consider to be best served by social security, and I’ll be keeping a close eye on them in the coming years. It’s helpful to think about major decisions while we still have plenty of time, and this calculator was useful in this stage of our decision-making process. In many ways, this reminds me of when I started using retirement calculators 5+ years prior to my retirement date, and that’s a useful comparison at this stage for my preliminary work on determining when to claim social security.

Some Questions About The Calculator, And Mike’s Response

If you’ve been paying attention, I’m sure you have some questions about the model. Hopefully, they’re the same as mine, since I was able to send them to Mike to get his responses. Here’s our exchange:

The calculator does let the user adjust the discount rate though, by checking the box at the top of the page for additional options.

If you wouldn’t mind, could you review my summary conclusion and confirm that our recommended course is Option 1 (claim at age 70), as suggested by the model. Are there any other considerations we should factor in before finalizing that as our strategy?

Conclusion

Given the complexity of spousal benefits in optimizing your lifetime social security payout, I agree with Wade Pfau that it’s critical to run your scenario through various calculators before finalizing your decision on when to claim social security. The implications on your lifetime income are significant, and shouldn’t be taken lightly.

Based on my experience, the Open Social Security model is a good calculator for someone without knowledge of the intricacies behind spousal benefit strategies. The result is simple, quantified, and customized to your situation. I’ll plan on running a few more calculators in the coming years, keep an eye out for future posts.

Also, if you’d like another perspective on how a blogger I admire is approaching his decision on when to claim social security, I recommend reading ESI’s article A Social Security Seminar and Our Current Plans. If you’d like to dig deeper on the topic, below are two relevant articles from Kiplinger:

- 12 Things You Must Know to Maximize Your Social Security Benefits

- When You Claim Social Security Can Have Huge Implications For Your Spouse.

Finally, a HUGE shout-out to Mike Piper for all of his help as I work through this puzzle. He’s been responsive to every question, and this writer greatly appreciates his help. Following are contact points for Mike, I’d encourage any of you with questions to check out his excellent work:

Mike Piper, CPA

https://michaelrpiper.com/

https://opensocialsecurity.com/

https://obliviousinvestor.com/

Your Turn: Have you finalized your social security claiming decision? Did you use a calculator, or take a different approach? Let’s chat in the comments…

You state that you are 59. I assume that your wife is of a similar age. Therefore, these complex claiming strategies no longer apply to you because Congress (in its infinite wisdom) closed what they considered to be a loophole. See here for details: https://www.ssa.gov/benefits/retirement/planner/claiming.html

Indeed, the restricted application and file & suspend strategies are no longer applicable. That’s not what’s being discussed in this article though.

Mike! Great to have you “in the house” responding to comments. Thanks for all of your help as I worked through the article, appreciate you taking the time to check in on comments!

What about “deemed filing” as it relates to when your wife files for benefits?

The calculator accounts for deemed filing when applicable. In the case being described here, it just means that Fritz’s wife’s spousal benefit will automatically kick in when he files for his retirement benefit.

Earl, that isn’t what is happening here. Neither Fritz nor his wife are trying to claim part of the other’s benefit early. They are each taking their own at the time they desire. Only after Fritz claims his benefit at age 70 will his wife be collecting a spousal benefit.

Please be careful, in deciding, if you were born after Jan 2, 1954. Please read up on “Deemed Filing”.

Deemed filing means that when you file for either your retirement or your spouse’s benefit, you are required or “deemed” to file for the other benefit as well. The Bipartisan Budget Act extends deemed filing rules to apply at full retirement age and beyond.

What is the reason for this change? Historically, if spousal benefits were higher than their own retirement benefit, they received a combination of benefits equaling the higher benefit. This change in the law preserves the fairness of the incentives to delay, but it means that you cannot receive one type of benefit while at the same time earning a bonus for delaying the other benefit.

The calculator does account for deemed filing when applicable.

“Deemed filing means that when you file for either your retirement or your spouse’s benefit, you are required or “deemed” to file for the other benefit as well.”

Apologies if this feels like a nitpick, but deemed filing doesn’t always kick in just because you have filed for retirement or spousal benefits. It also requires that you are eligible for the other type of benefit.

So, for example, in the proposed filing strategy Fritz is discussing above, deemed filing for his wife does not kick in when she files for her retirement benefit. Rather, it kicks in later, when he files for his retirement benefit, because that’s when she becomes eligible for a spousal benefit. And by that point she has already reached her FRA, so that spousal benefit will not be reduced for early entitlement — though her retirement benefit would still be reduced (all of which is accounted for in the calculator’s math).

I concur with Zoe.

From the Social Security web site: “Deemed filing means that when you file for either your retirement or your spouse’s benefit, you are required or ‘deemed’ to file for the other benefit as well. The Bipartisan Budget Act extends deemed filing rules to apply at full retirement age and beyond.”

Also, the screen shots suggest that a spouse can collect both their own benefit plus a portion of their spouse’s benefit. Pretty sure it’s the higher of the two not the combination of the two.

Deemed filing cannot kick in until eligibility for both types of benefits exists. See POMS GN 00204.035:

https://secure.ssa.gov/poms.nsf/lnx/0200204035

You can also find the applicable wording from the Bipartisan Budget Act here, Subtitle C, Section 831.

https://www.congress.gov/bill/114th-congress/house-bill/1314/text

“

Also, the screen shots suggest that a spouse can collect both their own benefit plus a portion of their spouse’s benefit. Pretty sure it’s the higher of the two not the combination of the two.”

This is a pervasive misunderstanding. If a person is entitled to a retirement benefit and then also becomes entitled to a spousal benefit, they continue to receive their retirement benefit, plus the spousal benefit, after reducing the spousal benefit by the greater of their own PIA or their own monthly retirement benefit. In some cases this is a distinction without much meaning. But in some cases it’s super important. For example, if the person has a government pension and the GPO is applicable, it’s important to know that the GPO can only reduce the part of their total monthly benefit that is a spousal benefit. It cannot reduce their own retirement benefit. And they are still receiving their own retirement benefit.

For the applicable POMS reference, see here:

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615020

Note that in POMS lingo, “A” is a retirement benefit, “B” is a spousal benefit.

Earl, you always get your own benefit first. If you are entitled to a higher amount as a spouse or survivor, the difference is a top-off on your own benefit.

A friend of mine who is now 65 has been a proponent of take it now and invest it. His reasoning was two-fold. One, he feels he could get a better rate of return on the investment rather than wait and get a bigger check. Two, he was concerned about the government changing the rules where SS is provided based on your retirement income.

My concern is waiting and then not surviving to the break even point. A bird in the hand….

Great article and it gives me more to think about!

Possibly with a higher risk profile, but keep in mind that social security is indexed for inflation, so the investment needs to exceed the inflation rate.

My present wife and I both lost spouses who lived till age 62. Both were previously in good health with a family history of longevity. They both left a working lifetime of SS benefits on the table that could not be recovered. So at the present time I decided not to fool with math, or calculators, and take my benefits at full retirement age (66) and my wife will claim at age 62. No regrets and no math, just a paycheck that allows us to decide what to do.

Appreciate your article for its thorough approach. On this topic much is driven by bias and emotion, and regret.

Quentin, sorry to hear about your losses. No doubt, SS is a decision which includes many emotional components. While those can’t be addressed with a calculator, it is nice to have a tool that “does the math” so it can be incorporated into your decision making process. Like many things in retirement, sometimes it’s not about getting the absolute optimum result from a purely mathematical perspective.

We use the same tools and still haven’t decided. I guess not deciding to collect yet is some sort of decision. My husband is already past FRA and was the lower wage earner and I’m old enough to collect early. I like the prospect of waiting for maximum benefits but don’t want to lose out if we don’t make it to the break even age. We’re generally healthy but have had some concerning issues in the past few years. I was on the tool yesterday and playing with the options for collecting at different dates. Now we just have to decide how much money we’re comfortable leaving on the table if we don’t collect as recommended and enjoy better than average longevity. Great article as usual.

Ironic that you were on the tool yesterday. Amazing minds. And, thank you for your compliment on the article, much appreciated.

So this is odd. My husband and I are the same age (he’s 2.5 months older). Our PIA will be exactly the same, whether at age 67 (our FRA) or age 70, according to MySocialSecurity.

I did Mike’s calculator, and it came out almost identical to your results—I should take the benefit at age 62.8, he should wait until 70. I’ll be 62 in August, and I’ve never considered filing before age 67, and we thought we should both wait until age 70. I should add that we’re both still working now, and I expect to work until I’m 65. Wouldn’t taking benefits before my FRA and still working cause my benefits to be reduced?

So I’m not understanding two things. How are our results almost identical to yours, when our PIAs are so different? Second, it seems arbitrary that he should wait until age 70, not me, even though our PIAs are identical. It seems like the person with the best actuarial chance at making it to 70 is the one who should wait, and isn’t that typically/always the woman? Let’s say for the sake of this discussion that we’re both in good health at age 62 and our family histories suggest that we’ll make it well past 70.

Finally, what happens if I follow this advice and file at age 62 and then he doesn’t make it to 70? Let’s say he goes at age 68. I assume I’d get his age-68 benefit as a survivor benefit, which would be higher than my age-62 benefit. What if I do this and he dies at 64? In both scenarios, I’ve lost the opportunity to get the maximum benefit by waiting until age 70 myself.

We’re fortunate that we can get by for a few years without claiming SS benefits if we decide to go that way—it’s a long-term financial decision rather than a basic survival decision—but I’m still a bit confused by the advice I’ve received.

“Wouldn’t taking benefits before my FRA and still working cause my benefits to be reduced?”

Yes, potentially. Make sure that you have checked the box at the top of the page for additional options, and entered your anticipated earnings so that the earnings test can be applied.

How are our results almost identical to yours, when our PIAs are so different? Second, it seems arbitrary that he should wait until age 70, not me, even though our PIAs are identical. It seems like the person with the best actuarial chance at making it to 70 is the one who should wait, and isn’t that typically/always the woman?

It’s probably a nearly identical result if you flip who is filing early and who is waiting. See the color-coded chart in the output.

The fact that he’s slightly older has a slight effect of pushing it in favor of him being the one to wait (because the joint life expectancy when he is a given age is slightly longer than the joint life expectancy when you are that age). But again, it’s probably almost indistinguishable.

Finally, what happens if I follow this advice and file at age 62 and then he doesn’t make it to 70? Let’s say he goes at age 68. I assume I’d get his age-68 benefit as a survivor benefit, which would be higher than my age-62 benefit. What if I do this and he dies at 64? In both scenarios, I’ve lost the opportunity to get the maximum benefit by waiting until age 70 myself.

If he dies after FRA but before 70, your maximum total benefit would be the amount he would have received if he had filed on his date of death. If he dies before FRA, your maximum total benefit would be his PIA.

Thanks for the comprehensive reply, Mike. Great to have the “expert” answering some of the more technical questions. I know when I’m out of my league. Thanks again!

Thank you!

This is an excellent article and I definitely appreciate the tool a lot! My only concern is that there’s no “what if” regarding the fact that, at the moment, “benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted. At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits.” (reference https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p111.html#)

I know everyone says it’s “political suicide” to reduce SS benefits, but politics have become SO divisive that I personally believe there WILL be some type of reduction. It would be nice to see the calculations if, in fact, 2037 results in the projected 24% reduction, or some other % reduction.

The calculator does have such a “what if” option. Check the box at the top of the page for additional options, then check the box for potential future benefit cut.

Thank you! I totally missed that!

Are you able to share what lessons you learned from using this what if option?

I ask as IMO in some scenarios over-optimization of SS could be really quite risky!

Thanks so much for this, Fritz and Mike! Great tool!

As the article states, the NPV discount rate used is critical to the outcome of the calculation. Assuming 3 or 4% vs. 0.52% makes all the difference in the world. This article and tool have made me reconsider my SS strategy which will likely influence my (early) retirement date.

Keep in mind that:

– The tool uses TIPS to arrive at 0.52%. TIPS is Treasury Inflation-Protected Security

– Social Security is indexed to inflation

The “3% or 4%” would need to be after inflation to do an apples to apples comparison.

Love your writing, Fritz.

Just wanted to point out, as this article from AARP states, that “The top spousal benefit is 50 percent of your husband’s or wife’s primary insurance amount (the retirement benefit he or she is entitled to at full retirement age, which is 66 and 4 months for people born in 1956 and is gradually increasing to 67). You can get that maximum if you first claim benefits at your own full retirement age; the amount is reduced if you file earlier.

That includes if you file early for your retirement benefit — say, at 62, as in this scenario — and switch to spousal benefits later. Even if you are at full retirement age when you file for spousal benefits, your total monthly payment will be less than half of your spouse’s primary insurance amount, reflecting the fact that your initial Social Security claim came early.”

Does the calculator take this into consideration?

Thanks, a devoted reader, MJ

Yes, the calculator accounts for the fact that a person’s own retirement benefit will still be reduced due to early filing, even after their benefit as a spouse kicks in.

Went through the calculator and it said the same thing for us. Me 70, my wife 62. But the other problem is longevity. I’m not too sure I’m going to make it to 70. I’m 52 now and already have had a triple bypass. My family history doesn’t’ give me a lot of hope for having a long life. Wonder if waiting to 70 is a good idea in that situation. We have planned around SS anyways though but it’d be a nice thing to use on vacations.

The calculator does allow you to experiment with different mortality assumptions if you check the box at the top of the page for additional options.

Most likely, if you are the higher earner by a significant margin, it still makes sense for you to wait, because doing so also has the result of increasing your wife’s benefit as your survivor.

But if you have similar earnings histories, it may make sense for you to file early and for her to wait.

If you do decide to file early, I hope it turns out to be a terrible decision. (By which I just mean that I hope you’re surprised with a much longer-than-anticipated life.)

I used maximizemysocialsecurity years ago to discover a hidden benefit that I wouldn’t have known about without the software (it more than paid for the 1 year annual subscription). If my wife took SS early, there would be a 3 year overlap where our adopted daughter could receive a child benefit. I think this is usually used by folks who are disabled with children or grandparents who gain custody of a grandchild if the child’s parents die. Nonetheless we did it. My wife’s health issues weight heavily on our decision to claim at 62. I plan to do the same purely because I don’t know what Congress will do to change the rules, and I really don’t need the money, but would like to have it earlier rather than later. So it’s more emotion than math that is making this decision. If we knew the exact date we were going to die, the decision would be easy – go with the math. Since we cannot predict our death dates, we just have to make a guess as to what is best for our individual situations. It’s really rolling the dice on whether you live a long or short life.

I don’t have specific numbers right now but I’ve always wondered about the downside of more SS income. Particularly when someone becomes widowed and falls into a different tax bracket? For ex: we (MFJ) FIRE’d and now live tax light and use a portion of ACA tax credits. However if we wait until 70 (or more precisely take SS at any age), obviously our income goes up and taxes will, as well. So by waiting until we max out SS, and then someone passes, the widow will be hit pretty hard as a single filer with a larger tax bill on more income. I know, it’s a tough, first world, problem, but running optimized tax scenarios is a never ending quest. This isn’t even a huge portfolio, just one that’s (hopefully) enough. Part of me wants to structure a portfolio with higher dividends and low growth, now, and then change to a growth portfolio with low income once SS kicks in but there are tax consequences for shuffling the deck, there, too. Mike is probably the guy I need to tap for an hour or two to kick things around with.

Retirement tax planning can indeed be super tricky.

You’re right to be considering the survivor scenarios in the tax plan. Often, they’re a point in favor of Roth conversions in the post-ACA, pre-SS years. (And that may itself be a point in favor of delaying SS, to create that window of time.)

Im impressed this tool takes into account WEP. my wife has a teachers pension so she doesn’t get access to SS unless she goes back to work in another job that pays into SS.

What is the best way to factor in a pre-existing disease that is likely to shorten life? Should I just use the specific age mortality table and pick an earlier age?

I would do a run using the “smoker residual standard” life insurance table (even if you aren’t a smoker, it can roughly reflect the overall concept of somebody with a shorter than average life expectancy). And I would also experiment with various “assumed age at death” options.

For the other person, I would continue to use the default mortality table or whichever table best reflects his/her health.

With the market currently tanking, (down 10%), I was giving consideration to taking SS at my FRA of 66.5. I am now 65, retired and single (never married) and with my 401k down 10%, I was thinking of not taking any money out next year so fund has time to recover somewhat. I do have a generous pension but need 401k money as supplement and for travel. Travel may be out next year. Any thoughts on revising my strategy?

I’ve written about this topic before, if Fritz doesn’t mind my posting a link:

https://obliviousinvestor.com/social-security-in-a-down-market-does-it-make-more-sense-to-file-early/

For a single person in average health, delaying is somewhat advantageous, actuarially. (That is, it’s a good deal, but not a you’re-absolutely-insane-to-pass-this-up sort of deal.) That’s still true, even with the market having gone down recently. (And for anybody concerned about the possibility of running out of money during retirement, delaying has a risk reduction benefit.)

Mike, with all of the help you’ve been on this post, you’re free to post as many of your articles as you possibly can. You’re a true wealth of information, I’m honored to have you engaging with the readers! Thanks again! (And, apologies for being a bit slow approving a few of your comments with links today, I’ve been outside and offline all day….yes, I am retired. Wink).

Thanks, Fritz!

Thank you for bringing attention to this calculator. I love the color graph showing the array of alternative options that are close to the optimal times for starting social security. Mike, Thank you so much for making this calculator so accessible and free of charge.

Really enjoyed your article in that it came close to what we did. We “completed” our SS claiming strategy in 2020 (when I turned 70). My wife claimed at 63 (plus two months) when she retired in 2010. However, we also had the (restricted application) advantage of my claiming spousal benefits against her FRA benefits when I reached my FRA of 66 (a benefit that is no longer available). Another difference was that my wife’s SS benefit (even when taken early) was over 50% of my FRA benefit so it didn’t make sense for her to take the spousal benefit. One thing that was not mentioned in your analysis was the potential to reduce your taxable income by maximizing your SS benefits (while reducing your T-IRA withdrawals).

Let’s take the first scenario where the couple makes $52K in SS benefits plus $48K in T-IRA/RMD withdrawals for a total income of $100K. This scenario results in 60.6% of the SS income to be taxable with the resulting federal income tax being $5,685 (using 2022 tax tables with senior discounts).

Alternatively, let’s say the couple delays claiming and now have $68K in SS benefits with a smaller $32K in T-IRA/RMD withdrawals for the same total income of $100K. In that scenario, the taxable portion of SS benefits becomes 36.3% with the resulting federal tax being $2,949 – a decrease in $2,736 in taxes per year (compared to scenario one).

In the first scenario, using the 4% rule as part of their retirement income plan, the annual T-IRA withdrawal implies a balance of $1.2M while the second scenario implies a balance of $800K. However, notice that the second scenario results in better tax savings due to less SS income being taxable while having the same gross income. The second scenario also has 68% of that gross income as an inflation-protected (CPI-W) guaranteed lifetime income compared to 52% for the first scenario. Additionally, the second scenario will also allow an annual long term capital gains (LTCG) withdrawal of $26K, tax-free, and pay roughly the same federal taxes as the first scenario (with no LTCG income). The increase in taxes is due to more of the SS income becoming taxable and not due to LTCG taxation (which is still at 0%). The additional heavier “weighting” of lifetime income in the second scenario also makes it easier to be more aggressive in investing remaining funds (accepting slightly more risk while improving one’s rate of return over the long term).

I don’t know how much of these considerations factor into any “break even” analysis but I like being able to mitigate market volatility, having more inflation-protected income, and paying less taxes, when possible. It has taken 10 years to carry out our claiming strategy but I can say, with some confidence, that it has panned out better than expected. Even if something happens to the both of us tomorrow, we have had the peace-of-mind of having this “longevity insurance” while knowing our beneficiaries will still be well taken care of.

I tried the calculator. My wife and I are only a few months apart in age but she stayed home with our children so her PIA is much lower than mine. The calculator recommended that she file at 62 years and 6 months. But that will decrease her spousal benefit when I retire. I have always assumed that she would file at full retirement age, get a little from her earnings and then get quite a bit more from the spousal benefits when I file at age 70. Does the calculator take into account the reduction in spousal benefits that occur when the spouse files before full retirement age?

The calculator accounts for the reduction in her retirement benefit that will result from her filing early for it. (And this reduction will continue to be relevant after her benefit as a spouse kicks in.) If she files for her benefit as a spouse prior to full retirement age, that benefit will also be appropriately reduced by the calculator.

In short, it accounts for all reductions from early filing, when they are applicable.

Either there is something wrong with the calculator or I’m missing something. Assume my wife and I are the same age, both born in July 1959. Assume we both die at age 93. She has very little of an earnings record with PIA of $600 and I have max’ed out earnings such that I qualify for the maximum PIA of $3455 at FRA (66yrs, 10 mths) and $4330 at age 70. The calc says she should file now. This would give her a reduced benefit of $425 from age 62yrs, 10 mths till when we both turn 70 and I file. That’s 86 mths x $425 = $36550. From age 70 til 93 she’ll get 35% of my FRA PIA ($3455 * 0.35) = $1209.25. that would be for 23 yrs ($333753) for a total benefit of $370303. If she filed at FRA that would be 3 yrs, 2 mths (38 mths * $600 = $22800) plus 23 yrs (276 mths * $3455/2 = $476790) for a total benefit of $499,590. Filing now as the calc suggests would cost us $129287.

Your benefit calculations are off.

If she files now, 48 months prior to FRA, her retirement benefit would be $450 (75% of $600 PIA) rather than $425.

When your retirement benefit kicks in at 70, and her spousal benefit kicks in at that time, her spousal benefit would be $1,127.50 (half of your PIA, minus her PIA — no need for reduction for early entitlement because she has reached her FRA by this time). And to that, we would add her $450 retirement benefit (still reduced for early entitlement) to get a total monthly benefit of $1,577.

As a separate point, if you input that you’ll both die at age 93, the calculator does not actually indicate that she should file immediately.

My understanding is my spouse’s benefits are reduced if the she files prior to FRA even if the she is at FRA when I file. Here is something from the AARP web site.

“The top spousal benefit is 50 percent of your husband’s or wife’s primary insurance amount (the retirement benefit he or she is entitled to at full retirement age, which is 66 and 4 months for people born in 1956 and is gradually increasing to 67). You can get that maximum if you first claim benefits at your own full retirement age; the amount is reduced if you file earlier.

https://www.aarp.org/retirement/social-security/questions-answers/switch-social-security-spousal.html

That includes if you file early for your retirement benefit — say, at 62, as in this scenario — and switch to spousal benefits later. Even if you are at full retirement age when you file for spousal benefits, your total monthly payment will be less than half of your spouse’s primary insurance amount, reflecting the fact that your initial Social Security claim came early.”

IMO if you want to be truly confident, you have to go to the actual authoritative sources (the law or the regulations).

Regarding reduction for early entitlement, it only applies if entitlement is actually prior to FRA. See here:

https://www.ssa.gov/OP_Home/cfr20/404/404-0410.htm

In the case in question, entitlement to spousal benefits doesn’t begin until after FRA. Note that her retirement benefit is still reduced for early entitlement.

Also note that she doesn’t ever switch to a spousal benefit per se. She continues to receive that reduced retirement benefit. And then her spousal benefit is added on. This article discusses that concept in case it’s helpful:

https://obliviousinvestor.com/3-biggest-social-security-misconceptions/

Chris, I posted a reply but I think it got caught in comment moderation jail because of links I included.

Generally when you want to be really sure, it’s best to go right to the source. In this case that means the law or regulations. With regard to spousal benefits being reduced, see CFR 404.410. (I included a link previously, but if you google it you’ll find it.)

The key point is that any particular benefit is only reduced if entitlement to that benefit begins before FRA.

Note though that her own retirement benefit would still be reduced for early filing. And that continues to apply even after her benefit as a spouse kicks in. (Note that you never “switch” to a spousal benefit per se. You continue to receive your own retirement benefit, then receive a spousal benefit in addition, if applicable.)

Thanks for your comprehensive responses to these technical questions, Mike. Apologies for being slow in “releasing” your initial comment with the links, just got online for the first time today and saw it pending. Ah, the joy of retirement….trust you understand. Thanks again, you’ve been truly amazing with your engagement on this post!

Great stuff. My wife is a school teacher in CA so she will not get a survivor benefit from me do to the penalties. In order to calculate our amounts, should we just run separate calculations as if we are single?

You can fill out the calculator as married, check the box at the top of the page for additional options, then check the box for government pension and provide the amount, and let the calculator apply the GPO as necessary.

Wow, this is the most helpful information I’ve found on the topic of when to claim social security. Thanks!

Hi – could you also discuss where and how the calculator reduces spousal benefit maximums due to early filing? is it possible to clearly delineate that in the numerical results? MaximizeMySocialSecurity is returning different results than the example – thank you!

You can see it with any application for spousal benefits prior to full retirement age.

An easy example: run the calculator with two spouses with default DoBs. SpouseA has PIA of $2,000. SpouseB has PIA of $500. Don’t change any other inputs.

In the recommended solution, SpouseA files for retirement benefits at age 70 and SpouseB’s spousal benefit begins at that time. The spousal benefit in that case is $6,000 per year ($500 per month, calculated as half of SpouseA’s PIA, minus SpouseB’s own PIA) shown in the table.

In contrast if SpouseA and SpouseB both file for retirement benefits today (May 2022) and SpouseB’s spousal benefit therefore begins immediately due to deemed filing, you’ll see that SpouseB’s spousal benefit is reduced ($3,925 per year).

Thanks for all of the great information and pointing me to the SS Calculator. The calculator states I should file 6 months from now at 64 1/2 and my husband should file at 70. I’m still working though – is the calculator only for people who are no longer working? Can you clarify how I would use this information if I’m still planning to work for a few more years. Thanks!

If you check the box at the top of the page for additional options and check the box for “still working,” it will apply the earnings test as applicable.

Again though, all the calculator is doing is calculating the filing age (or combination of filing ages) that results in the highest expected total sum of benefits over your lifetimes (after accounting for foregone returns that result from spending down the portfolio faster).

It’s not accounting for taxes. And there may be tax reasons to file earlier or later.

And it’s not accounting for the risk reduction that results from filing later.

I’ve used Mike Piper’s tool a number of times (selecting different alternatives strategies) and have studied my results. I am single (with no dependents) and can afford to wait to age 70 to use Social Security for what I think is important — for me — which is longevity insurance (somewhat frugal spender).

Also, I realized if there is 25% cut, 25% cut of a bigger number will still give me more compared to a 25% cut of a smaller number.

I also figured that if I die earlier than my break-even date, I won’t miss what I didn’t get since I will be dead (heirs don’t need my estate since they’re better off than me). But I am starting my backdoor Roth conversions as a result of that decision.

Fritz, excellent article! I’m glad that the Retirement Planning Guidebook was able to bring Mike’s Open Social Security calculator to your attention. It’s a wonderful tool!

Wade, thanks for taking the time to leave a comment on my blog. I’m honored that you follow my work. Your book was excellent, and it’s only because I read it that this post was written. Like many retirees, the concept of spousal benefits confuses many of us, great to have you and Mike so willing to share your expertise on the subject. I’m honored to share great work, and you both are real assets to all of us trying to figure it out.

Sorry if this has been addressed already, but my understanding is that the spousal benefit cannot exceed half of the worker’s PIA, which is the worker’s benefit at full retirement age. Per the Social Security website: “The spousal benefit can be as much as half of the worker’s “primary insurance amount,” depending on the spouse’s age at retirement.” In that case, I don’t understand the strategy of having your wife wait until age 69 11 months to claim a spousal benefit. Her spousal benefit maxes out when she hits her own full retirement age, which depending on her birth year is 67 or earlier. Unless I am missing something, waiting until age 69 11 months would not increase her spousal benefit.

“Sorry if this has been addressed already, but my understanding is that the spousal benefit cannot exceed half of the worker’s PIA, which is the worker’s benefit at full retirement age.”

That’s precisely correct.

“In that case, I don’t understand the strategy of having your wife wait until age 69 11 months to claim a spousal benefit. Her spousal benefit maxes out when she hits her own full retirement age, which depending on her birth year is 67 or earlier. Unless I am missing something, waiting until age 69 11 months would not increase her spousal benefit.”

It’s a bit hard to follow, because Fritz has redacted the dates in question for privacy reasons (understandably). But the reason she’s waiting here is simply because she isn’t eligible for a spousal benefit until that time (i.e., the time at which Fritz files for his own retirement benefit). That is, she’s not waiting just for the sake of waiting. Rather, Fritz would be delaying in order to increase his own retirement benefit (and her benefit as his survivor if that becomes applicable), and a (negative) result of doing so is that she has to wait for her benefit as his spouse until he has filed.

To clarify, in this scenario, Fritz’s wife files for her benefit at her FRA and then switches to spousal benefit when Fritz files at age 70. She doesn’t wait to file until Fritz turns 70. She doesn’t qualify for the spousal benefit until Fritz files, but she can claim her own benefit from her FRA until he files.

In the scenario discussed above in the article, Fritz’s wife is filing for her retirement benefit prior to her FRA, at age 62 and 8 months.

And then when Fritz later files for his own retirement benefit, deemed filing kicks in and she automatically files for her benefit as his spouse.

Fritz, Great article on helping people work out their SS strategy! Too many commercials and articles written to scare people into decision paralysis. The result for myself using Mike’s tool is… I am on track with the plan I have.

It is very important to determine of the both big influencers as you and Mike have pointed out: differnce between spouses in the PIA at full retirement age and the difference in age between the two spouses. I am lucky that my spouse is nearly 3 years younger than myself and I have a high PIA. That actually gives me flexibility on when to claim after FRA bsed on if I am willing to take less than the 100% payout; say 97%, even 95%.

FYI: I just retired two weeks ago at age 55 into a declining market that cannot figure out it it is at a bottom. Do I care? No, because I have followed your Bucket Strategy and I have 5 years of cash and cash equivalents saved. Let the spending begin!

Steve, congrats on crossing The Starting Line. I’m honored to hear that my work on the bucket strategy is giving you peace during these interesting times. I feel the same, no worries!

Fritz–I LOVED this article today. LOVED IT! I hopped on the website and ran our numbers but I wanted to be ultra conservative. I am 54 and my husband is 55. I don’t know exactly when we will retire but I know we are not working into our 60’s. When I got our #’s from the SSA website, I put $0 for future income as if we were retiring immediately (so it lowered our PIA). However, both my husband and I have worked since college so our PIA’s at full retirement age are only $353 apart. Not a big difference. What fascinated me was the calculator told me to pull my PIA at 62 and my husband pull his PIA at 70 to maximize our benefits. I was surprised by that. I always thought (no analysis, just my own thoughts) that I would pull at full retirement age and he would pull at 70. But I never expected it to make me pull early and take the reduction for filing at 62. My guess is the reason for this is that my husband’s increased benefit at 70 plus my lesser one for pulling early but for a longer time frame maximizes our result. Does that make sense to you? I will do a scenario where I pull at FRA and he pulls at 70 but I expect the site should tell me that would be less.

It’s a result of the fact that, for the spouse with the lower PIA, delaying benefits results in an increase in the household benefit amount for as long as both people are still alive, which is not as good of a deal. (Though that doesn’t necessarily make it a bad deal.)

This article discusses that concept:

https://obliviousinvestor.com/long-will-collect-social-security-survivor-benefits/

I read the article and I get it. I never thought of it that way before. Thanks Mike!

LOVED, twice, in all caps! Wow, you just made my day…wink. Thankful to have Mike jumping in answering the technical questions, I know when I’m out of my league!

My husband is 4 years older than me. I filed for Social Security at age 62. My husband was born in 1953 and at his full retirement age he filed a restricted application and applied for spousal benefits from me delaying filing for his own benefits until age 70. He will turn 70 next year. Once he starts receiving his own benefits will I be able to switch to drawling spousal benefits from him in order to increase my Social Security earnings? If so, would that be 1/2 of the amount he will have at age 70?

You will be able to file for a spousal benefit if your PIA is < 50% of his PIA. (Note that you don't technically "switch to" a spousal benefit. You continue receiving your own retirement benefit, plus a spousal benefit.)

Your spousal benefit would initially be calculated as half of his PIA, minus your PIA (note: half of his PIA, not half of his monthly benefit). But because your spousal benefit will begin prior to your FRA, it will have to be reduced for early entitlement. The reduction is 25/36 of 1% for each month early, up to 36 months.

So for example if you're 6 months younger than FRA when he reaches age 70 and your spousal benefit begins, your spousal benefit would be half of his PIA, minus your PIA, multiplied by 0.95833.

And that spousal benefit would get added to the same retirement benefit that you've been receiving since age 62.

At age 67 (both spouses), still working and in the highest tax bracket (including NYC), is there any scenario where it makes sense to take benefits before we stop working for good?

Tax planning is very case by case, so without doing a full blown analysis I wouldn’t want to say definitively. But it’s very unlikely. When still working, especially at a high earnings level, it usually makes sense to defer as much other income as possible, with the idea that you’ll likely have a lower tax rate after you stop working.

I just read your 2020 post “A Strategy For Buying Into A Bear Market” and was wondering if you are following the same strategy this time.

I am, indeed. I don’t have as much “excess cash” as I had before the COVID-correction, so I’ve revised my tranches accordingly. Tranche I has been executed (15% correction, 0.5% of net worth), waiting for tranche II (20% correction, 1% of net worth).

Well, I am single and was not married to my former spouse for ten yrs. I am 62 and figure I will wake up one morning and decide, today is the day I fully retire and take ss. It could be tomorrow, it could be in 8 yrs. I suspect it will probably be around 65 bc of Medicare.

This SS calculator does not account the Government Pension Offset (GPO). Having worked for an employer that did not pay into SS I am not eligible to receive 1/2 of my spouses SS.

If you’re talking about calculators on the SSA website, it’s true that some do not account for GPO.

If you’re talking about the Open Social Security calculator discussed in this article, it does account for GPO. Check the box at the top of the page for “additional options” then check the box for “government pension” and provide the necessary information, and the calculator will do the math accordingly.

I checked the box under additional options that says “are you receiving a pension not coveted by SS” but the recommendation is to suspend my account and apply for my spouse’s SS at age 70. The GPO does not allow me to claim a spousal benefit as I understand it.

The GPO won’t stop you from applying for a spousal benefit. Rather, it reduces the amount of the spousal benefit (potentially all the way to zero). Without knowing the inputs used I cannot say for sure, but the calculator will indicate a filing date if a deemed filing occurs, even if the amount in question is zero. It will appropriately calculate the benefit amount as zero when applicable.

Very well researched, well written piece and extremely helpful. I’ve book marked the calculators after working with them and came up with a workable plan.

Modeling is very helpful. I’m still working through some models deciding the value of time and early access to monthly payments. Decided how much money to leave on the table over 30+ years is an interesting project for me to model.

Does leaving $50,000 on the table really matter over that period of time if the total Social Security benefit is around $1,1M (not including taxes)?

The calculator apparently has a bug. When we entered our PIA amounts, the annual benefit amounts do not match the entered amounts. For example, my actual PIA of $3,318 ($39,816 annually) shows in the calculator as $52,557 annually. How can the calculator reach such an erroneous discrepancy?

Your monthly benefit would only be equal your PIA if you file for your retirement benefit to begin exactly at your full retirement age. If you’re filing, for example, 48 months after your full retirement age, your monthly benefit would be 132% of your PIA.

I filed at 70 and my current actual monthly benefit is $3,318 ($39,816 annually). Why does the calculator come up with $52,557 annually?

Your PIA is defined as the monthly benefit you would have received if you had filed at full retirement age.

If you filed at age 70, your monthly retirement benefit is more than your PIA. The increase in monthly benefit for each month of delay is 2/3 of 1%, which works out to an increase of 8% (not compounded) per year. In other words, if you filed at age 70 and your FRA was 66, your monthly benefit is 132% of your PIA.

So if you enter your currently monthly benefit as your PIA, you’re overstating your PIA. And the calculator is just taking your word for whatever you enter as your PIA and doing the math accordingly.

Oops. This was intended to be a reply to George Bacon’s 5/20/22 5:20pm comment.