The 4% safe withdrawal rule is a well-known “rule of thumb” for those planning for retirement.

One thing it has going for it is that it’s simple to apply.

If you have $1 Million, the 4% safe withdrawal rule says you can spend $40,000 (4% of $1M) in year one of retirement, increase your spending by the rate of inflation each year, and you’ll never run out of money.

Simple, indeed.

But, I’d argue that simplicity comes at a potentially very serious cost. Like, potentially running out of money in retirement.

Today, I’ll present my argument against the 4% safe withdrawal rule given our current economic situation, and propose 3 modifications I’d recommend as you determine how much you can safely spend in retirement.

The 4% Safe Withdrawal Rate rule is easy to follow, but that simplicity comes at a cost. Like, potentially running out of money in retirement. Click To TweetRethinking the 4% Safe Withdrawal Rule

I read a lot of information on retirement planning, and lately, I’ve been seeing more content challenging the 4% safe withdrawal rule. I agree with those concerns and felt a post outlining my position was warranted.

As a brief background, the 4% Safe Withdrawal Rule is based on the “Trinity Study,” which appeared in this original article by William Bergen in the February 1998 issue of the Journal of the American Association of Individual Investors. For further background, here’s an article that Wade Pfau published on the study. I’ll save you the details, you can study them for yourself at the links provided.

The conclusion, based on the study, is summarized below:

“Assuming a minimum requirement of 30 years of

portfolio longevity, a first-year withdrawal of 4 percent,

followed by inflation-adjusted withdrawals in

subsequent years, should be safe.”

My Concerns With The 4% Safe Withdrawal Rule

In short, some key factors about the study are relevant, especially as we “Rethink The 4% Safe Withdrawal Rule”

- It’s based on historical market performance from 1926 – 1992.

My Concern: Relying on past performance to predict future returns can mislead the investor, especially given the unique valuations in today’s markets (more on that below). This point is driven home by this recent Vanguard article that projects future returns based on current market valuations:

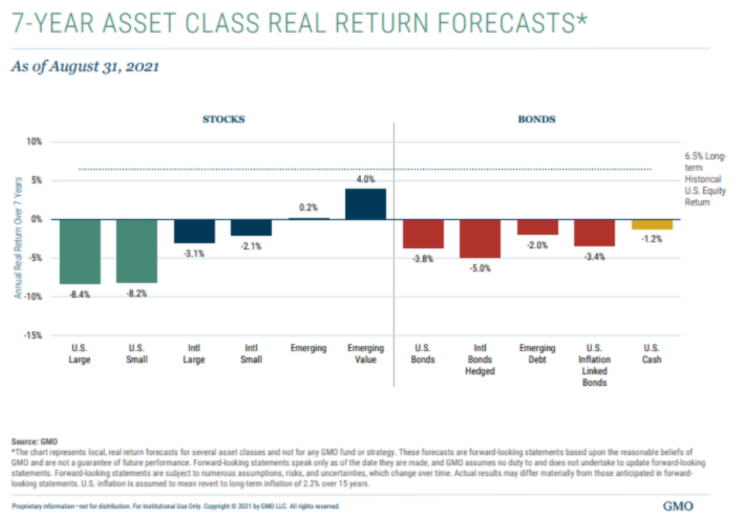

If you think the Vanguard outlook is depressing, check out this forecast from GMO as presented in this Wealth of Common Sense article titled “The Worst Stock and Bond Returns Ever”:

- Note the VG forecast is nominal (before inflation) whereas the GMO is real (after inflation).

Why Are Future Returns Expected to Be Below Average?

The biggest driver for the projected below-average returns is the high valuation in today’s equity market (particularly in the USA), and the fact that interest rate increases would negatively impact bond yield. In my view the CAPE Ratio is one of the best indicators of market valuations. Below is the current CAPE ratio as I write this post on November 16, 2021:

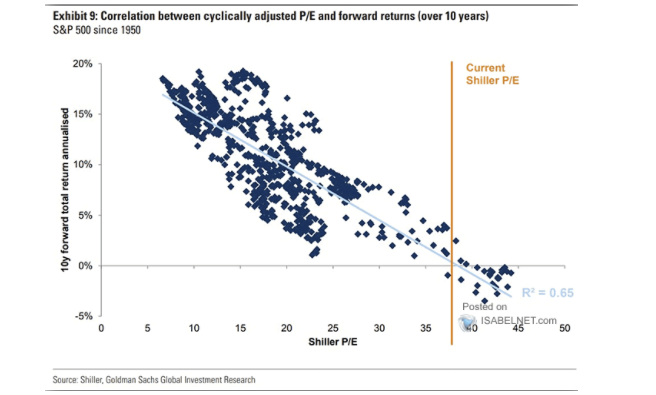

The reason current valuations matter is the fact that they’re highly correlated to future returns, as indicated from this concerning chart that I saw last weekend on cupthecrapinvesting:

Based on today’s CAPE ratio, the historical correlation suggests the forward total returns over the next 10 years could be close to 0%. Scary stuff for someone who’s planning on equity growth to pay for their retirement expenses. Scary stuff for someone who’s committed to the 4% safe withdrawal rule.

In addition to the bearish outlook for US equities, bonds could be negatively impacted if when interest rates increase. To get a sense of how low the US 10-year Treasury yields are now compared to long-term averages, below is the current chart of 10-year yields from CNBC:

Bond prices are inversely related to interest rates, so as rates go up, bond prices go down. So, if you’re holding 60% stocks and 40% bonds, it’s possible that you could see decreases in both asset classes.

As cited in this Marketwatch article, The Fed has begun signaling that interest rates are “on the table” for 2022, especially if the current bout of inflation proves to be less than a transitory event (for the record, I suspect it will be more than transitory, but what do I know?).

This brings us to the next concern…

My Other Big Concern With The 4% Safe Withdrawal Rule:

In addition to my concern above (the risk of an extended period of below-average market returns), I don’t like the part of the rule which states you should “increase your spending the following year based on the rate of inflation.” As most of you know, inflation has been on a bit of a tear lately, as demonstrated in this chart from usinflationcalculator.com:

Based on the 4% Safe Withdrawal Rule, you would be increasing spending next year based on the higher inflation rate, which could well be the same time you’re seeing lower than expected returns.

I don’t know about you, but that doesn’t sit well with me.

My Suggested Modifications to The 4% Safe Withdrawal Rule

It wouldn’t be fair to cite my concerns with the 4% Safe Withdrawal Rule without suggesting an alternative. Following are the 3 modifications I’d suggest for your consideration. I’m applying all 3 of these modifications in our personal retirement strategy.

Given my concerns with the 4% Safe Withdrawal Rule, I'd suggest the following three modifications: Click To Tweet1) Reduce Withdrawal Rate to 3.3%

Ironically, we’ve been targeting a 3.25% Withdrawal Rate since I retired 3.5 years ago. I based our target on the excellent Safe Withdrawal Rate Series from Early Retirement Now. The series comprises 48 posts dedicated to the topic, with more mathematics and graphics than you could imagine. I’m not ashamed to say that Karsten (“Big ERN”) is smarter than I am, and I respect his work. In a gross over-simplification of his amazing work, his conclusion is folks should target something in the 3.25% SWR range, and I took his advice.

Big ERN may have been the first to come up with that number, but more serious heavyweights in the industry have recently come on board. Most notably, Christine Benz and her team at Morningstar came out with a must-read post earlier this month titled What’s A Safe Retirement Spending Rate In The Years Ahead.

A quote from that article:

Using forward-looking estimates for investment performance and inflation, we estimate that the standard rule of thumb should be lowered to 3.3% from 4.0%, assuming a balanced portfolio, fixed real withdrawals over a 30-year time horizon, and a 90% probability of success. – Morningstar Nov 11, 2021

In fairness, I should point out that there are others who suggest an even more conservative approach. My friend Casey Weade, CEO at Howard Bailey summarized David Blanchett’s article Retirement Planning in the Post-4% World as follows:

2) Adjust Your Spending Based on Market Returns

Rather than automatically adjusting your spending based on inflation, as suggested by the 4% safe withdrawal rule, we’re planning on adjusting our spending for the following year based on how the market performs in the current year. Each year during our Annual Financial Update, after we’ve updated our Net Worth, we multiply our retirement account balances by 3%, 3.5% and 4% to determine a range of potential spending for the following year. Thus far, the process has worked well and I plan on continuing it for the foreseeable future (especially given the fact that we retired “early”, and would prefer avoiding a 4% withdrawal rate until our mid-60’s at the earliest).

There are a wide variety of “Dynamic Spending Rules” available. One I found of particular interest was included in this excellent Vanguard White Paper, which suggests a “ceiling” of 5% and a “floor” of -1.5%. I’ve included another dynamic spending strategy in the “Related Posts” section below titled “How Much Can You Safely Spend in Retirement.” Being willing and able to adjust your spending based on actual market returns has been proven to increase your statistical chances of not outliving your money, and I’d strongly encourage everyone to build some flexibility into your retirement spending plans.

3) Include International Equity Exposure

I’ve long been a fan of maintaining a broadly diversified portfolio, and currently have 20% of our portfolio invested in international stocks (along with 40% in US equities, 30% in bonds/cash, and 10% in Alternatives). The CAPE warnings given earlier in today’s post are specifically related to the S&P 500, which is a USA-based index. Many folks argue that investing in a broad index like the S&P 500 brings sufficient global exposure based on the global sales of the companies included, but I prefer to have a “clearer line of sight” on our international holdings. In full disclosure and as a Vanguard fan, our holdings include their Total International Stock Index Fund (VTIAX) and All-World ex-US Small Cap Index Fund (VFSAX). We also hold some international bonds through Vanguards Total International Bond Index (VTABX).

As you determine your appropriate asset allocation for retirement, I’d encourage you to consider adding some international exposure in light of the current valuation differential between USA equities and those in other parts f the world. I’d also encourage you to study, and understand, Home Country Bias.

Related Posts:

- 10 Steps to Make Sure You Have Enough Money to Retire

- How Much Can You Safely Spend In Retirement?

- Seven Strategies to Make Your Money Last Through Retirement

Conclusion

Running out of money is one of the biggest concerns people have as they plan for, and live in, retirement. Given today’s unusual market environment, I urge caution. If you’ve been a fan of the 4% safe withdrawal rule, I hope today’s post has given you some things to think about.

The good news is this: With the above-average return of the market over the past few years, you may be surprised with how much you can afford to spend, even if you reduce your withdrawal rate. Morningstar did a nice job of summarizing the phenomenon. In summary, the higher returns have likely increased your net worth significantly, and a lower withdrawal rate may not impact your planned spending as much as you’d initially expect.

Do yourself a favor.

Run the numbers.

Be safe out there.

Your Turn: What are your thoughts on the risk, if any, of using the 4% safe withdrawal rule given today’s market environment? If you’re retired, what withdrawal rate are you currently using? Any plans to reduce it? If you’re close to retirement, what withdrawal rate are you using in your plans? Let’s chat in the comments…

Obsessing over the “safe withdrawal rate” seems to be the number one pastime of retirement bloggers. Since no one can predict the future, no matter how many fancy graphs they present, being flexible in spending is the safest plan. If you need every penny, buy an annuity.

Haha, I agree it seems to be a bit of an obsession of late to many in the field, I believe it’s due to that age old concern of ourliving your money. I agree with you – flexibility is the key. And, thanks for adding the point about annuities, I was going to add that, but the post was long enough and annuities require an entire post to explore the details.

“The sky is falling the sky is falling”. That refrain has been repeated since stock markets began. And yet we are near records highs, again. We’ve been hitting record highs for over a century. The Trinity study has been updated several times by the authors with withdraw rates increased to 5%. The study was again updated by the authors in their 2011 update which conclude, “The sample data suggest that clients who plan to make annual inflation adjustments to withdrawals should also plan lower initial withdrawal rates in the 4 percent to 5 percent range, again, from portfolios of 50 percent or more large-company common stocks, in order to accommodate future increases in withdrawals.” Predicting what rates of return (ROR) or inflation will be in 30 years is pointless. Back in 2009 Jack Bogle wrote don’t count on ROR being as good as the past. If you followed his advice back then you would have missed out on big stock asset growth today. Using historical data is the only way realistically to define retirement asset risk, whose data includes the great depression, stagflation of the 60’s/70’s, dot.com bubble, great recession, etc. If things get worst then these experiences then it won’t matter what you thought the ROR of inflation would be or even where your money is, we will all be in big do-doo.

Fully Agree

The sky is falling and other warnings are as good as the predictions of my astrologer! The authors are taking no chances and cannot be wrong and are always right because one has to live for another 30 years to validate their theory. All they are saying live below your means. A good advise in any market conditions.

Amen Matt. I’ve heard it time and again. If you wake up every day and say the stock market is going to crash, maybe once in a decade you will be correct. I remember when we all thought Alan Greenspan knew all there was to know about the global economic system. As he was leaving the Fed, he predicted decades of very low equity returns. He too was wrong. I believe if you asked him today why he missed it (BTW he gives himself a “C” grade for irrational exuberance)…he would say…..well I didn’t know that X, and Y and Z were going to happen. Everyone agrees that the market value is high at the moment, and it will correct, but folks were predicting that several years ago. The best input I’ve read on this subject is Pfau’s book on “How Much can I spend…”. It’s not an easy read if you don’t like numbers, but you really get a strong foundation behind what is behind the 4% and Wade does many, many iterations to test sensitivities. I think the best advice is to be flexible in your spending and stay aware of what is happening in the economy if you are a DIY’er.

My wife and I are 71 and 72 and have been retired for 4 years. We are gifting to our 3 children and their spouses and our 5 grand children so before the year begins we need 200,000 plus taxes on the money we take out to support our giving. In our case thank God we are able to handle it and this (2021) will be the first year of rmd’s that we have to take. This is a very personal issue and of course we could live on 2% if we stopped gifting to the kids and stopped giving to charities. I sleep better at night and we have enough that in a severe downtown in the market (coming when ???, but coming) we can reduce our commitments.

JJ – your generosity is a bright light in a darkening world. Thank you for sharing.

Fritz, my frustration with the 4% Rule for retirement withdrawals is that it does not seem to take into account the “income” that your portfolio will payout each year. In our situation, my wife and I can basically cover most of our living expenses with dividends and interest, and when we start taking Social Security, we will have more than enough to meet our needs. Basically I don’t anticipate having to make withdrawals from investment principle until we have to start RMD’s.

So my question to you is why do none of the retirement planning gurus ever take dividends and interest into account when they figure withdrawal rates and income needs?

Thanks again for a great article.

Hi Dale, don’t worry, the safe withdrawal rate calculations include dividend payments and capital growth, with your withdrawals calculated as a % of the total value of your portfolio. Many growth stocks these days don’t pay dividends but still contribute significantly to the growing value of your portfolio. Apple, Amazon etc.

Tony, I agree that capital grows in good years(and drops in down market years), but all the articles I’ve read just say, “ if you have $1 million and take 3% a year your money will last 30 years, or 25 years if you take 4%. Hopefully you have it invested in ways that are paying dividends, interest and CG, along with market gains overtime that will continue to grow your portfolio even as you take income from it. As I said above, I don’t think we will have to touch our principle until RMD’s kick in. And hopefully I will have a big chunk of our IRAs and 401-ks rolled in Roth accounts by then(8 years).

Im coming close to retirement and was thinking about Div and Cap gains sort of the same way you are until I came across some arguments that taking Dividends and is no different than drawing down on principal. just a different way of accessing the capital. I’m still getting educated on this but maybe worth a look at the research on this https://www.youtube.com/watch?v=f5j9v9dfinQ Ben is someone I follow as he does a good job of summarizing information and also backing it up with referenceable research I can go review and draw my own conclusions.

Wade, I retired in July 2020. After my final paychecks stopped I had all the dividends and CG from our joint taxable accounts paid into the money market funds and then transfer them into our checking acct as needed to replace my paycheck instead of reinvesting them as we had in our accumulation years. We have to pay taxes on them anyway so it doesn’t add to our tax burden. Not doing this, but selling shares to raise income causes additional capital gains taxes over and above the taxable dividends. So to me there is a difference. I appreciate your comments and others who have responded to this article. It’s good to see what everyone else is thinking and doing.

My shield against capital gains taxes is to do a bunch of investing in a Roth IRA brokerage account. All the gains are tax free (unless Congress finds a way to change the laws). Alas, the Roth money is not accessible until 59.5, but traditional 401(k) is available at 55 using the little known IRS rule of 55 with your last employer. The loophole I used was to rollover all my past 401(k)s into my last employers before I turned 55 making it all accessible when I turned 55 (minus what I’ve converted to Roth)

Dave – I agree with your capital gains and dividends comment. One example, Vanguard Wellington Fund is paying 6% in Capital Gains next month. This money goes into my Money Market Bucket for 2022 spending. I don’t intend to touch principal for many years, if at all. I will spend what I get in Capital Gains and Dividends.

Excellent post as always Fritz. Many thanks for your insights. Much appreciated!!!!

*Dale

Thanks to both Mike and TonyB for responding to Dale. Yep, I’ve suggested dividends can be used to “drip fill” Bucket 1 in my Bucket Strategy, and agree they comprise part of the SWR calculation.

I’ve got a completely different approach to my retirement. When I retired in august, I drew a line in the sand started with the end of 2020. My plan is to only withdraw the growth, but capped at the tax bracket I want to stay below (24%). So the most I could withdraw (or Roth convert) is something like $329k. Initially, I will withdraw more cash than do Roth conversions in order to build a $250k cash buffer. Eventually, I will do bigger Roth conversions and withdraw just what I need to survive. But if we hit some bad years, instead of pulling from the 401(k) I will pull from cash and ride out the storm until the 401(k) grows positive again.

With this, spending is really curtailed to the growth and hopefully I hover around this line in the sand my entire life. In bad years, we live a modest life. In great years I could buy a Lambourghini.

You deserve the name Ninja. Wink. As long as you have the willpower to ride the resulting swings in income, it’s an interesting approach. I would caution you to think about long-term inflation, and the need for some of that growth to compound to held offset increasing expenses in your later years.

Enjoy that Lambourghini, and congrats on your recent retirement.

Agreed. In years where 401k growth exceeds my self imposed cap I will let it ride. I got 7 figure growth over the past 3 years and although we can’t always expect that, I’m happy when it happens. I’m almost more afraid of getting shellacked by RMDs at 72 that’s running out of money or inflation. This the aggressive roth conversions between 55 and 72

My nest egg is apparently nowhere near yours, but I also had big concerns about RMDs. So I’ve made a plan to Roth convert up through my desired tax bracket in order to lower my overall amount of pretax money. Pretax is currently a good 80% of my savings, so this is not an insubstantial percentage.

Lynne & Ninja, I’m a strong proponent of doing Roth conversions well before your RMD’s kick in. I started age age 56, and plan on doing one every year to the top of my marginal tax bracket. “Too much” pre-tax is a common problem, and doing consistent Roth conversions prior to RMD’s is the best approach to handling it that I’m aware of.

My plan is to do about $80k in Roth conversions next year, then crank it up to $180k+ as the money and limits allows. I started at 55 years of age doing a Roth conversions, and my hope is to be able to catch up to the growth. I guess it’s not the end of the world if the growth overwhelms the conversions.

Is it wrong to wish for a couple really bad down years in order to convert more shares at a cheaper price? Ideally, hold on for dear life as a $3m nestegg drops to $500k, convert everything, then pray it goes back to $3m+?

Fritz, do you have a blog about the whens and whys of Roth conversion? I have read it’s not a good idea as you get closer to retirement age so I want to understand your statemen – ” I’m a strong proponent of doing Roth conversions well before your RMD’s kick in. I started age age 56, and plan on doing one every year to the top of my marginal tax bracket. “

Re. Roth conversions, the good news is that the 24% federal income tax bracket is currently huge – from $178,150 to $340,000 of taxable income (not AGI) for married couples https://taxfoundation.org/2022-tax-brackets/ – so unless you‘re very wealthy you can convert quite a bit each year and still stay within that bracket. However, any action that increases your AGI can affect your income taxes in other ways, such as limiting deductions and credits (both state and federal) so best to work with a tax professional. Student financial aid and Medicare premiums may also be affected. Spreading conversions over several years is usually the best plan for a number of reasons, though you may decide to take advantage of a market downturn (e.g., March 2020) to convert assets that are temporarily depressed in value. Assets can usually be transferred in kind from a traditional IRA to a Roth IRA; converting from a 401(k) or other deferred compensation plan may be more complicated.

Chamilton, I do indeed. Here you go…

How (And Why) To Execute A Roth Rollover

LMK if any questions after you’ve read it.

Give up trying to get financial aid if you make any money at all. We’ve filled out the forms when each child was a Freshman, they look into your 401(k) balance and all of your savings accounts, then come back with nothing other than unsubsidized student loans if you have any money at all. You have to be making nothing, have no assets, and no savings to actually get some financial aid. I fall back on the goal of making/saving/having enough money so you don’t have to worry about financial aid or discounted medicare.

I did a BIG Roth conversion in March 2020 to take advantage of the stock drop and only realized after that I forgot about the Net Investment Income Tax (NIIT) which is a 3.8% tax on investment income which applies to single filers who make (or withdraw from IRA to convert to ROTH) over $200,000 and married couples who make over $250,000.

Thanks for the tidbit on NIIT. I’ve never heard of if, but will learn very quickly as this might affect me. Upon first glance, it sounds like if you only pull from retirement funds and do Roths to exceed $250k, there is no tax. the NIIT tax appears to only be from capital gains and other investment income. Although I do have an after tax brokerage account, nearly all of my stock trades are made in a Roth brokerage account so there are no taxes. I’m hoping I’m protected from NIIT with traditional and Roth 401(k)s and IRAs. Someone scream if this is not the case

Taking money out of a regular IRA and converting it into a Roth IRA is a taxable event and applies to your MAGI. If you are married and convert $300,000 from you IRA into a Roth, you pay 3.8% tax on $50,000 ($300,000 – $250,000). Since your MAGI is now $300,000 (not counting any above the line deductions) your capital gains tax (based on taxable income) is now likely 15%, something else to consider. If you are on Medicare those costs go up too. https://www.kiplinger.com/retirement/retirement-plans/roth-iras/601141/hidden-costs-of-roth-ira-conversions

https://www.irs.gov/pub/irs-pdf/i8960.pdf

I don’t think Matt’s interpretation is correct – hopefully Fritz will chime in – the NIIT would only apply to any capital gains (for example, gains from securities sold in a taxable account) incurred in the same year as the large Roth conversion was made. The Roth conversion itself would be taxed as ordinary income, not investment income. As always, please check with a tax professional prior to taking any financial action that may have significant tax implications.

I did not mean to imply that a ROTH conversion is a capital gains, it isn’t. I was just trying to show that a big Roth conversion will/may have other tax consequences such as any capital gains you would have (taxable account) may be to a different tax bracket as a result. Thanks for keeping an eye me.

To clarify, if I pull $250k from my pretax 401(k) and convert $90100 from traditional to Roth, does NIIT apply? Similarly what if I pull $300k from traditional and convert $40100 to Roth? My goal is to stay in the 24% tax bracket in 2022 ($340100 limit)

First I want to make clear I am not a tax professional, the 3.8% surtax is a very complicated topic. I was not entirely correct, sorry. Two of the best explanations are at these links: https://www.irahelp.com/slottreport/3-rules-you-must-know-about-38-surtax

and https://www.investmentnews.com/roth-conversions-can-ease-new-tax-28643

The rollover amount from a regular IRA to a ROTH is technically not itself taxed the 3.8%, but that amount does apply to your MAGI which can then put you into the $250,000 surtax bracket which could then make investment income (such as capital gains) subject to the 3.8% tax in addition to the normal capital gains tax.

Thanks Matt.

This makes sense to me. Since all of my brokerage investments where I buy and sell frequently are in a Roth, I think I’m completely covered. I’m just hoping I don’t stumble onto some other gotcha. Years ago I bought a Chevy Volt and there were some wealthy people who got hammered with Alternative Minimum Tax because of the EV tax credit. I snuck through without any issues. I’m hoping to do it again in a year or two assuming the tax bill changes make it through. it appears the $7500 tax credit can now be as high as $12.5k with the new changes. The next trick is for the car companies to start shipping in volume as supply chain shortages are hammering availability.

Hey Fritz and thank you for thinking ahead on our behalf yet again! You are providing a valued perspective and service to all who have joined your blog.

I am about 2 years from the starting line. Explaining this all inside of 3-5 minutes to my lovely wife (that’s about all she can stand from me in one conversation) I have been stating and restating 4%, knowing that it may be closer to 3% and emphasizing flexible spending and even adding some work into the conversation. Like one other reader, once we hit mid 60’s, Social Security will be an option and should put us at a high comfort level.

The downer in all of this is the expected duration of the downturn and if true, I think we are all in trouble, bucket approach or otherwise, it will strain principle.

Thanks again for a thought provoking post. We all owe you our gratitude for your commitment to this community.

Please keep shepherding us!

Dave

Congrats on your final 2 years to The Starting Line, Dave. Pleased to see you spending a lot of time preparing, happy to hear my work is helping you on your journey. And, you’re not alone with having a spouse with a 5 minute max limit on talking about this stuff, I think that’s a reality for many folks, including me. I suspect she’ll give you a much longer window when you get to the really good stuff, like what you both want your lives to be in retirement!

100% agree. This is a large reason why I just bought a website to bring in some instant cash flow and allow us to now take closer to 3% withdrawal for the foreseeable future. Better safe, than go back to working for someone else!

And a great website it is, indeed. Nice to have you in the blogging community!

For those that believe inflation is only 6% have not been to the grocery store or the gas station or had a tradesman bid a job on their house or tried to buy clothes or cars or much of anything. I have never believed in the 4% rules and have tried to keep it under 3%. Thought buying a “fixer upper” does not lend itself to that. Thanks for the article

We could talk all day about the “real” inflation rate, couldn’t we? I agree that what’s most important is the true inflation you’re experiencing in the essential goods you consume during retirement. Thanks for the comment.

I suppose it’s worth continuing to think about this topic, but it seem overblown to me.

Think about it this way: At a 4% withdrawal rate, your money is guaranteed to last 25 years (100%/4% = 25). If you invest in ultra safe Treasury Inflation Protected Securities, you’d also have inflation protection. The average person retires at 65, so at a 4% withdrawal rate, you would be literally guaranteed to have your money last until 90. Obviously, if you invest even a portion in stocks, you’d make it even longer.

At 3% it would last 33 years, and at 2% it would be *guaranteed* to last 50 years!

Now, I’m not suggesting an investment portfolio entirely made up of TIPS. But looking at it this way helps demonstrate how silly this debate seems. At rates below 4% the most likely outcome is that people will die with way, way more than they had to begin with.

Who stands to gain the most if retirees drawn down very little of their asserts in retirement? The investment industry. Since their profits are a function of investable assets, they would like us to to spend as little of our money as possible. I suspect they are interested in pushing this idea, as are professional financial planners.

But, you might say, what’s the harm in being careful and erring on the side of caution? For people with tons of money, it’s probably not a problem. But for people planning to retire, it scares them into working far longer than they probably really need to. For most retirees, it means scrimping and saving rather than enjoying their money in retirement. And for early retirees, it has them spending the least money when they are relatively young and healthy, and most likely flush with cash when they are less likely to be able to enjoy it.

So, I think it’s wise to keep an eye on it, but don’t obsess about it, and don’t use a withdrawal rate that would be guaranteed to far beyond your life expectancy.

Great comment! I completely agree with:

„But, you might say, what’s the harm in being careful and erring on the side of caution? For people with tons of money, it’s probably not a problem. But for people planning to retire, it scares them into working far longer than they probably really need to. For most retirees, it means scrimping and saving rather than enjoying their money in retirement. And for early retirees, it has them spending the least money when they are relatively young and healthy, and most likely flush with cash when they are less likely to be able to enjoy it.“

So important to spend money early in retirement on those activities that you may not be able to enjoy later due to physical (and mental) decline.

A wise and thought-provoking comment, Jim. This would all be so much easier if we could see into the future, wouldn’t it? How long we’ll live, what our LTC situation will be, how our investments will perform, etc. Until then, maintaining a balanced approach and keeping it all in perspective is the best way to go, in my humble opinion. Thanks for making us all think today. (And, for your help in punctuation – wink!)

Of course the problem is we don’t know our exact life expectancy. My father was certain he’d die earlier so he spent all his money and was flat broke 4 years ago. Yet he is still alive at 90, and now on Medicaid in a nursing home. He has already lived longer than both of his parents.

I prefer to retain enough money to afford a better end of life living arrangement than the dingy place he’s living in now. So I am planning on some kind of buy-in type of place like where my aunt went. She gets far better care and better living conditions.

P.S. my father also fiddled around with investing, chasing potential large (risky) returns rather than sticking to a coherent plan. Some of those paid off but many others didn’t, and net result was to prematurely deplete what should have been a nest egg large enough to have sustained him for life. He sold several investments at a large loss, totally lost his investment on a few, and for reasons unbeknownst to me purchased a home above its actual value in a pleasant over-55 community, then proceeded to sink about $40K into it in solar panels, windows etc. Made no upgrades inside that would have substantially enhanced the home’s appearance and value. When I sold it last year in the middle of the Covid lockdowns, the selling price was $45K less than purchase price from 15 years prior. Solar added nothing to valuation. It still had the original 20 year old cabinetry, flooring and roof, and appliances were aged but functional.

I think his experience proves that having a coherent investment/spending plan yields far superior results.

Sad story, Lynne, and a great reminder on why this stuff matters.

Wow. Must…resist…the…urge…to…daytrader…penny…stocks….

Similar story, a close friend of ours moved away to Michigan, sold their house in IL during the housing crisis (taking a loss), renovated a trashed foreclosure in northern Michigan, took another loss selling it to move to Kentucky where it’s warmer.. Must…resist..the…urge…to…flip…houses.

A 2.80% withdrawal rate off a portfolio that is up over 400%(14.80% annual average )in the last decade is still more income then a 4% withdrawal rate on a portfolio that average 7% over the same the same time period and grew 100%..

Wade Pfua acknowledges that.if you are retiring right after a secular bull market your withdrawal rate should be reduced due to a pending correction. And on the flip side if you happen to retire right after a secular bear market you can have comfort in a higher withdrawal rate due to the positive returns that will succeed a bear market.

I contend we are nerding out way too much on the math here. I come back to withdrawing the minimum you need to survive during bad years and withdrawing more, up to the gains in decent years, and withdrawing even more, up to the marginal tax bracket you want to stay in during great years. If you never dip below the nestegg value when you started retirement, and follow this, you will not run out of money. This variable spending is really more in line with how we would operate anyway. All this effort trying to compute a fixed withdraw rate when the market is unpredictable and variable could cause you to retire later and overshoot your target, as people tend to worry and plan for the worst possible scenario which rarely happens. And even if you retired just before dot bomb or the financial crisis, today you’d be just fine if you didn’t panic and sell everything (which a lot of people dod. And now regret).

There‘s also a very simple strategy for those who have their retirement investment assets primarily in tax-deferred accounts: starting at age 72, withdraw only your RMD each year. That way, you‘re guaranteed not to run out of money, ever (or at least until age 115). I‘ve actually read some research papers that tested this strategy (of course they were written when RMDs started at age 70 1/2).

I actually wrote a post on that exact strategy. Prior to your RMD’s kicking in, they recommend 3.5% SWR. Here’s the post:

https://www.theretirementmanifesto.com/how-much-can-you-safely-spend-in-retirement/

I completely agree with your variable spending plan! However, nerding out is just way too much fun :>) I do spend a lot of time reading retirement blogs like this one (which by the way is the best), reading retirement planning books and articles and playing with my Pralana Retirement Planning software https://pralanaretirementcalculator.com/ Do I then day trade, reblanace on a weekly bases or change everything based on the latest trends, absolutely not! Most of my retirement funds are in Fidelity Zero fee total market index funds, set and forget.

Thanks for the article Fritz. On a more optimistic note, the Bengen study and subsequent updates all looked at worst case scenarios that determined under the worst historical data, by retiring at historically the worst possible time, you could sustained 4% withdrawals for 30 years. In the vast majority of retirement years, you could have retrospectively withdrawn more, in some cases much more. Indeed some recent papers suggest that by using guard rails to limit increases and decreases in annual withdrawals you can afford to take out more than 4% and still survive a 30 year retirement. In reality I suspect most people don’t stick rigidly to the 4% rule and vary their withdrawals to reflect the performance of their portfolio and income requirements for that year. The secret is not to sell if the market does go through a rough patch and enjoy your hard earned cash!

Bingo! Prior to taking Social Security (at FRA for both of us) we had been pulling ~6% WR per year for 10 years and *still* our portfolio grew beyond where we started. Now that we are collecting SS our WR has dropped to ~3.5%. 8^)

FYI, started our retirement with $1.51M, bottomed out at $864K during the Financial Crisis, hit $1.65M the year we started SS (2017) and now, after 14 years, have a $2.15M portfolio. And that’s after spending $1.4M in retirement ($100k per year). Flexibility baby! 8^)

Awesome job. Just hoping the market keeps going up like it has been over the past few decades. Depending on how long you have ahead,, you might even see your nest egg grow to 8 digits!!! I highly recommend people consider a variable spending model instead of pulling a fixed amount every year – pull the minimum needed to live during bad times (like the financial crisis or dot bomb) and pull more when times are good (but no so much that you ever go negative).

JC, thanks for sharing your numbers and illustrating a “real” case study. No doubt, most folks underspend in retirement. I agree with TonyB that a huge element is avoiding selling in a bear and vary your spending as much as possible based on actual market performance. Good discussion today, thanks for jumping in.

I put a link in my post to a PDF version of a spreadsheet that showed our portfolio’s progress over those 14 years. It did not show up. Did it get lost? Deleted?

Let me try that link again….

https://www.dropbox.com/s/2c5odifh4nerrns/PortfolioProgress%202021-10-31.jpg?dl=0

or

Hmmm….no idea, I never saw the link on my side. Makes me really want to see that PDF, though! Perhaps you can email it to me and I’ll see if I can add it in the comments from here?

Found it in my “Pending” comments, had to approve it to get it to show. Great spreadsheet!

Scary headlines get attention. Back in Jan 2012, Vanguard 10-year outlook for a 50:50 portfolio was 1.1-6.6% (25th to 75th percentile of the simulated outcomes), with a median of 3.8%. In the Dec 2020 report, the projected 10-year return for a 60:40 global portfolio was 3.2-6.0% (25-75th percentile), with a median of 4.6%. The example portfolios in the reports are not exactly the same, but it seems to me that their forecast is better now than it was back in 2012 (larger shadow of 2008-2009?). The uncertainties on the forecasts are huge, so I’m not as scared (yet).

Nothing like adding some historical perspective to the discussion, John. Thanks for that. I agree that it’s best to “listen,” but not to get too obsessed with those “scary headlines.” No one knows the future, so focus on building a plan that will let you ride the waves as comfortably as you can.

Jim Sloan had an interesting post on Seeking Alpha recently that had a somewhat different take on investing and withdrawals in retirement (warning: Jim is a huge Buffett fan, but also super smart and a great writer. Specifically regarding the 4% rule, he cites an article by Javier Estrada:

„Javier Estrada, a Professor at the prestigious IESE Business School at the University of Navarro, Spain (locations in Madrid and Barcelona), published a paper (“Buffett’s Asset Allocation Advice: Take It…With A Twist,” October 26, 2015) based on the series of 30-year periods from 1900 to 2014. It presumed a withdrawal rate of 4%.“

Well worth reading, especially for retirees who will be able to fund basic living expenses through Social Security and pensions and have the desire to leave a financial legacy to heirs.

Thanks for sharing, Sabine. Off to read it now…

Good article!! From article: What a bond allocation actually does is more or less assure lower returns. I wonder if the same thinking would apply to foreign market investing? Total US market index investments have almost always out performed total foreign index investments. So, is investing in foreign market index funds really reducing rick or just lowering returns??

Hey Fritz, great article on a topic that is always worth thoughtful consideration. I retired at 55, for me that was 9 years ago. I spent a considerable amount of time looking at a safe withdrawal rate based on what I would need in income to enjoy the retirement my wife and I had always imagined. I settled on 2.2%, after reading every paper I could find at the time from people far more knowledgeable on the topic than myself. I discussed that decision with my financial planners at length and they said that was extremely conservative and encouraged a more liberal withdrawal strategy.

To me it was just a fairly simple math problem, based more on what I felt I want to spend rather than the maximum I could be spending. I have adjusted the amount every year at my annual review at the end of December, dependant on portfolio performance, tax bracket drift, Roth conversion, etc. It has pretty much stayed right around the 2% range, which has been fine financially and not dramatically effected my cash flow situation.

Could I spend more and not outlive my money? Probably. Do I want to spend more now? Not really. My wife and I enjoy spending our time together doing activies we never had time for when we were both focused on our careers. I always managed our retirement money at Vanguard while we were working. Saved diligently and keep debt in check. When we pulled the plug and started my next phase of our life we decided the focus would be on enjoying our time together. That’s why I hired financial planners to manage the stuff I knew was important, but I didn’t want to spend the necessary time on it to do it right. If I could buy more time, that would be worth every penny, but I can’t. Life is too short, live within your means and truely enjoy it. Money is not nearly as important as you may think it is.

Fritz, as always a great article. Thanks for your time and thoughtfully done research, I very much appreciate your efforts.

“Do I want to spend more now? Not really.”

Therein lies the key. Thanks for sharing a real-life example of what contentment looks like, and thanks for being a regular reader. I appreciate your frequent comments.

Hi Fritz,

As I understand it the 4% rule was based on the idea if you retired at exactly the wrong time you’d still be able to take an inflation adjusted 4% from your portfolio for 30 years. Michael Kitces continually points that out and says you’re likely to leave a whole lot of money on the table by withdrawing less than 4%.

Wade Pfau and Big ERN came up with different safe withdrawal numbers, anywhere between 2.8 to 3.25%, based on current valuations. It makes intuitive sense that valuations should be taking into account, but weren’t they factored into Bengen’s work on safe withdrawals?

Which of these uber smart retirement experts is right? No clue. But since we only get one shot at retirement I agree it’s probably best to be conservative, flexible, and even better, to have a big fat bucket of safe assets to cover your essential expenses just in case the markets aren’t so kind going forward.

Thanks for the great blog!

Brian

Brian, solid questions, I assume the “abnormal” part of the market right now is the unprecendented low interest rates and the potential “double whammy” effect on both bonds and stocks. Regardless, you’re bigger point is the one that matters – we have no way of knowing who’s right, and we won’t know if we’ve done things correctly until we’re on our deathbed. Once again, it all comes down to balance. Living well today, but not forgetting tomorrow, and recognizing our need to be flexible. Thanks for the comment.

Interesting article but my struggle is more about figuring out longevity. I have grandmothers who both lived to 90 plus but the flip is my mother passed at 65 and father at 81. While I feel fine about leaving my family something, a withdrawal rate that makes my lifestyle diminished and the dice roll to a younger death, well that certainly is not ideal and a sad end to a long working career. We have a 5 year exit plan with retirement in our early 60s then we are going to “spend young” with decreasing spending as we age and trips, travel and adventures are less appealing. We plan to start at 3.5 then when social security kicks in move to 3% or less

depending on needs. I run my numbers via Fidelity frequently and fingers crossed it will be enough!

Carol, no doubt about it, the longevity question is one of the hardest to answer. Your approach is sound. Best of luck with that 5 year plan!

Fritz,

Really enjoy reading most of your posts, but this one was like most other news articles (depressing). I plan to stay active, spend, live and enjoy retirement while I am still physically and mentally able.

Why do we still need the same amount of savings at age 84 as we do at 62? We all have S.S. and most likely a lot less desire to do costly activities. Enjoy your working life savings while you can, you can’t predict what tomorrow will bring.

Sorry to depress you, LL. Wink. I, like you, am very active and have no “wants” that are going unmet in my early retirement. As for your comment about “age 84”, most “experts” cite a “U-Shape” to our spending curves as health care expenses cause our spending to increase in the latter years of life. So yes, enjoy your savings while you can, but recognize the need to balance lifelone risks.

Another excellent post, Fritz! Once again, you’ve summarized well something we find ourselves talking about often with our own viewers. Thanks for all the valuable content you produce. We’re excited to shortly be putting out our thoughts on your great “10 Steps to Make Sure You Have Enough Money to Retire” article. It was an excellent summary for the community!

Best regards,

Jason @ Two Sides of FI

Jason, I’m honored to be featured on your platform, please tag me when it comes out and I’ll share it. Looking forward to seeing what you come up with on that post.

Thank you, Fritz! That’s very generous of you. Will do.

Jason @ Two Sides of FI

Do you know if anyone has ever tried to do a similar study with a dividend growth portfolio vs using a mix of index funds & bonds? It seems that the FIRE community is very big on index fund investing no matter what the current valuation of the market is. But, what about a dividend growth investing strategy? What I am currently doing is investing in dividend growth stocks. My portfolio currently has an overall 4% dividend and, if the dividends increase at the rate of inflation, I could take out the 4% (plus inflation adjustment) forever without touching my next egg. I know that the main concern people have with picking individual stocks is that most people cannot beat the market so the default is to invest in the market (S&P 500, total index fund, or similar). But, if I have a $1,000,000 portfolio that has a dividend payout of 4% (and I only need that 4%), and if that dividend increases at the rate of inflation I do not see a need to beat the market or even keep up with the market. Your thoughts?

Larry, I’ve not seen such a study, but I suspect you could find something close with a bit of work on Google. I agree that dividend growth investing makes sense, and include some dividend growth funds in my diversified portfolio. The concern I would have with your scenario is that the entire $1M portfolio would be invested in a dividend-focused asset class, which is against my principle of maximizing diversification. You could make the same argument for REITS, as an example, but I would never recommend someone put 100% of their portfolio into REITS. I include REITS in my 10% “Alternative” asset class.

Ironic timing, this just out from Retirement Researcher, stating their concern with focusing on Dividend Investing is that it could lead to insufficient diversification. Amazing minds!

https://retirementresearcher.com/total-return-vs-income-investing-same-but-different/

I have a very different philosophy. Dividend producing stocks are often laggards in the market. As many financial advisors push you into safer and safer investments as you get older, I’m a firm believer in riding the horse that got me here. At 55 years of age I hope to have 40+ more years of growth ahead of me, so I’m all in on aggressive growth mutual funds. In other words, mathematically 10-12% growth always beats 4% growth plus 3% dividends. And 15-20% growth beats them all… alas it’s a crap shoot whether the particular mutual fund you choose actually achieves better than S&P 500. Finally, blue chip companies paying dividends are starting to falter. Take the classic big named companies like GE, IBM, Kodak, Montgomery Wards, Sears, KMart, Marshall Fields, Radio Shack, etc. Many are struggling or have already gone bankrupt a few times. The real interesting thing is figuring what is the next Chipotle, Apple, Google, Facebook, Paypal, etc. Some company that you’ve never heard of will emerge as a common name over the next few decades. That’s where I want my money, not dividend stocks.

I want my money in every feasible asset class. We never know what will be next year’s winner, so I like to have some exposure to them all. In your case, you’re heavily slanted to aggressive growth. That’s been a hot segment for years, so what if small and/or value funds outpace growth for 30 of the next 40 years? I’ll always have some winners, I’ll always have some losers. You do you. Wink.

Just wanted to remind everyone to please remember to factor in the effect of Roth conversions on your Medicare Part B and D premiums after you reach age 63, since Medicare has a two year look back for MAGI when calculating the IRMAA (income related monthly adjustment amount). The IRMAA ranges from 40% to 240% of the basic Part B premium. So, for example, the 2022 Part B premium will be $170.10, but for someone whose MAGI was between $170,001 and $500,000 in 2020 that premium would increase significantly to $544.30 ($170.10 plus a Part B IRMAA of $374.20).

I would much rather pay higher Medicare premiums and do my Roth conversions now than save on Medicare and pay up the butt on RMD taxes. The math is simple. According to Firecalc, a $3m nestegg today could grow to anywhere between $6-20m in 17 years (when I turn 72). Taxes on RMDs will easily overwhelm these higher Medicare premiums. Not doing a Roth is like losing a $100 bill to pick up a quarter.

Ninja, I agree on the importance of doing Roth conversions when they make sense, but Sabine has a good point about factoring in the impact when you turn 63. Until then, I’ve got a burning green light to do Roths, and I’m doing them as aggressively as I can. When I turn 63, I’ll look at the math before automatically executing a strong Roth conversion in that year. Cost/Benefit, every year.

In my case, since my wife is already on Medicare, I’m already paying a penalty. I’m pretty sure I won’t be able to convert everything at 63, but hopefully before I hit 72. I just hope that Congress doesn’t change the laws and somehow find a way to tax roths.

Excellent point, Sabine. I actually have reminders all over my calendar in the year I turn 63 to ensure I take the IRMAA impact into my Roth conversions. One more reason to be aggressive in my Roth conversions between ages 55-62, which is a major element of my current strategy.

And then, on the other hand, we see headlines and blog and podcasts like this: https://www.kiplinger.com/retirement/happy-retirement/602281/are-you-being-too-frugal-in-retirement

Yep, I’ve even written them myself:

It’s Time To Live Like No One Else

It’s all about balance…

You bring up some great points but it’s all speculation in the end. The future tends to surprise us. I have a burgeoning business that I love and I will get a pension so I will likely be able to get by on a 1% withdrawal rate or possibly none. As long as my business keeps growing and I keep enjoying it, then I’m golden!

“…but it’s all speculation in the end”.

True, that. All we can do is educate ourselves and make the best decisions possible. And, perhaps, start a killer graphics arts biz. Congrats on your success, you’re crushing it!

This points out the recommendation to minimize one’s floor expenses (or matching these expenses to reliable income sources), so that WHEN markets crumble and/or other disasters occur, one can cut back on flexible expenses to weather the storm. Having a paid off primary residence, flexible vs. fixed expenses, renting vs. owning toys that have ongoing expenses etc.

Thanks for another great blog post, Fritz! The charts you included are quite depressing, but are from respected industry experts, so they definitely have credibility. I do tend to be “glass half full” type of person, so maybe I just don’t want to think it will be that bad in our first 10 years of retirement. However, I recently watched a Fidelity webinar that discussed how the Millennials are the next big generation of our time next to Baby Boomers. Many Millennials are already old enough to invest in the stock market. Fidelity’s projection of stock market growth based on populations of Millennials was compared to when the Baby Boomers “came of age” and started families, buying houses, commodities, etc. The Millennial population is even higher than Baby Boomers were back in the day. The charts Fidelity showed us of how the stock market increased with Baby Boomers (because of shear volume of new investors) were astonishing. They predict that it may be a similar situation as Millennials continue to invest. Have you looked into these numbers (demographics) and projections when figuring safe withdrawals like 3.3%-4%? Maybe it won’t be the sad chart predictions after all? Curious about your thoughts on this.

As Dave said above, “it’s all speculation in the end.” Who knows what will happen tomorrow, all we can do is factor in as many of the variables as possible, and have a plan to mitigate the risks that most concern us. Kind of a tough dance at times, right? Thanks for pointing out the Millennial impact, certainly a factor. As for me, I believe in wide diversification and a solid bucket strategy to mitigate Sequence of Return risk. I’ll always have stock exposure, have to find a way to maintain long term growth, even with the risks of volatility along the way.

This piece feels like the most important part to me:

There are many factors that push towards having a wider margin of safety. The two key ones to me are time horizon and flexibility.

The longer your time horizon, the bigger the impact of a poor starting sequence. I really like BigERN’s work exploring withdraws rates that might be better for very long retirements, even for perpetually sustainable withdraw rates.

The more flexible you are, the more you can push up that withdrawal rate. Flexibility might mean reducing spending in response to a down market. It might mean bringing in some income.

If you want more confidence that you won’t have to make those kinds of adjustments then you’re smart to use a lower withdrawal rate.

You’re a perceptive reader, Tommy. Without a doubt, the fact that I moved from “Accumulation” to “Withdrawal” at age 55 has many consequences for my approach. You’re spot on with your comment, and flexibility is a huge advantage for those who have a longer time horizon to fund in retirement.

Hi Fritz,

So as a 28 year-old aggressively saving and working, this is basically a win-win for me? Or, at least there is no need for me to worry about equity returns for the next decade?

As a 28-year-old, you don’t have to worry about ANY of this stuff. The best thing for you would be a 10+ year massive BEAR market. Save as much as you comfortably can, and come back to reading retirement blogs in another 15 years or so. Until then, focus on saving what you can and, more importantly, find ways to enjoy your journey.

Fritz is spot on but I would add, that at 28, Mike’s best return on investment would be to invest in himself. Increase your income potential. The best long-term inflation hedge. And if not married with dependents, an excellent time to consider starting a business. No better time to fail, learn, then try again or at least have bragging rights to say you gave it a shot.

Some in the younger set may be better off using their funds to create/buy a business rather than saving for retirement (of course one would invest enough to capture matching funds, etc.). The ROI is potentially very much higher, but still plenty of time to save for the future. Take advantage of a system that is highly skewed toward business owners vs. the salary slaves.

53M , 55F (retired) I was planning to pull the cord end of Dec to join my wife in early retirement. The current planned SWR for us is less than 2% (we currently have 70x expenses saved, not including owned real estate). If things get bad we can cut back to go even lower (that 2% includes quite a bit of cushion). We have a pension payment (with 3% COLA) that essentially covers all our fixed expenses and the bulk of discretionary expenses. I’d say what is giving me heartburn right now is all this talk of extremely low expected returns over the next 10+ years and possible inflation spike(not just transitory but persistent). When I run models of inflation going to 4, 5, 6% it’s a trainwreck over long periods. Also, I do recall similar talk of low expected returns about a decade ago that never came to pass (wish I saved those articles so I could see what the thesis was back then). Being in tech I feel thedigital transformation and productivity improvements over the next 2 decades will be massive and cause deflationary pressure, but I’m by no means an economist, so this is just my gut combined with what I’ve seen directly in my line of work with large commercial business. The reality is nobody really knows what is going to happen in the future. I think we’re all taking a leap of faith that things will just work out. and if they don’t well I can always sell the house and downsize to a van and live in the woods. 😉

“…we currently have 70x expenses saved…”

‘Nuf said. Get the heck out of Dodge. See you on this side of the line!

Whoa, Fritz! I think you may have set a 2-day comment record! Good article for shaking the bees nest.

Aloha Fritz and all!

Well, personal finance plans are just that, personal. Everyone should have their own thought out plan. Ours is very simple, we will not have to withdraw any % of our portfolio until RMD’s begin in about 9 years. Until then, we plan on decreasing our pretax accounts, transfers into our growing Roth IRA’s. We also are targeting staying within approx. $106K income per year, until our RMD’s kick in and perhaps put us into the next tax bracket. We are grateful for our 2 pensions and 2 annuities that provide for a little more than essential expenses now, without withdrawals from our portfolio. Social Security for me in 5 years and my wife in about 3. Should be able to gift it away and fund our travel. No luck involved, worked long and hard and careful planning starting at age 30. I find it simple to plan, but all of us are unique as God planned it!

Hopefully some of your portfolio is invested in ways that are paying dividends, interest and CG, along with market gains that will continue to grow your portfolio even as you take income from it. As I said above, I don’t think we will have to touch our principle until RMD’s kick in. I believe that growing your Roth accounts reduce significantly any future tax increases, etc. before drawing SS just makes sense.

We are grateful for Fritz and many bloggers that post their opinions/thoughts/plans and encourage us to think for ourselves on what actions we choose for our PERSONAL finance plans. 😉

God speed to all, Steve

Luck is always involved 😊

Steve,

I would recommend being a bit more aggressive. For example, the 22% tax bracket for married filing jointly is between $81-172k. I assume you are boosting your Roth conversions to stay below $172k in total income. But the jump from 22% to 24% marginal tax rate goes all the way to $329,850 in income. That next jump to 32% ($329851 to 418850 in income) is the painful one, which is what I’m working hard to avoid as well as any of the higher tax brackets. So consider bumping to the upper edge of the 24% tax bracket in your Roth conversions. As money compounds, you might find yourself in nosebleed territory if the market growth outpaces your conversions. Finally, Congress is tossing around some $425k-450k number in new legislation which might make it really painful if you end up with that much taxable income. My goal is to stay way below that and potentially have $0 in taxable income with only Roths at play.

On the topic of Social Security, I’m doing the opposite of what most people do, I’m pulling as soon as I possibly can as I have no confidence in our Government’s ability to manage this money. If you die early, you’re leaving money on the table. If you die late, sure waiting until 72 maximizes your income, but I’d rather pull the money and give it away or invest it rather than leave it in the system.Lord knows I will have paid far more than I will ever get out. I try to stay away from bad “investments” through I guess this is more like a tax with a future benefit (sounds a bit like insurance) than an investment.

“…So consider bumping to the upper edge of the 24% tax bracket in your Roth conversions….”

Sound advice. In fact, that’s exactly what we’re doing in 2021, the 24% up to $329k is likely a limited time offer (thanks to the 2018 tax law revisions, which I suspect will be unwound at some point in the not-to-distant future.

Do you apply your 3.3% rule differently across taxable and tax deferred accounts? That is $1000 from one doesn’t equal $1000 from the other after taxes.

I do not. Rather, I include our tax burden in our spending estimate, then ensure that the 3.3% SWR covers all of our spending obligations, including the taxes required to access tax deferred accounts.

Whether you take out 3.3, 3.5, 4.0 or 5.0%, you are taking it out to cover your expenses and taxes are one of those expenses. It is wise to strategize to minimize those taxes, but they get paid out of your WR regardless. We don’t spread our withdrawals across all our accounts (brokerage, taxable, tax-free), we draw from where it makes sense for the coming year based upon our plan. Whatever we draw has to cover any taxes incurred. Math that ‘shit’ up! 8^)

Whether you take out 3.3, 3.5, 4.0 or 5.0%, you are taking it out to cover your expenses and taxes are one of those expenses. It is wise to strategize to minimize those taxes, but they get paid out of your WR regardless. We don’t spread our withdrawals across all our accounts (brokerage, taxable, tax-free), we draw from where it makes sense for the coming year based upon our plan. Whatever we draw has to cover any taxes incurred.

Math that ‘shit’ up! 8^)

Ooops. Duplicated post because I thought the Captcha blocked me. Sorry…

the best strategy is to apply the 0% rule! Just earn enough to always cover expenses and then let your assets ride =)

Thanks for the article, I agree that valuations and interest rates will make an interesting case study for the 4% rule. I just don’t feel like being one of the guinea pigs!

Except some of us don’t want to work when we retire. So the hope is that the earnings exceed the living expenses so even though I’m withdrawing from the nest egg, it never (or rarely) goes negative in any given year. That’s where I suggested the “line in the sand” (scroll up).

A 2.80% withdrawal rate off a portfolio that is up over 400%(14.80% annual average )in the last decade is still more income then a 4% withdrawal rate on a portfolio that average 7% over the same the same time period and grew 100%..

Wade Pfua acknowledges that.if you are retiring right after a secular bull market your withdrawal rate should be reduced due to a pending correction. And on the flip side if you happen to retire right after a secular bear market you can have comfort in a higher withdrawal rate due to the positive returns that will succeed a bear market.

Hi Fritz,

If I have a $2MM portfolio and a $500K home (no mortgage), then don’t I have a 25% safety margin if only the portfolio is included in the calculations? Maybe I’m missing something.

Thanks for another great post.

Jim

Well, I guess you hhave a 20% safety margin if you’re OK with living under a bridge :-).

(Sorry, couldn’t resist. After this thread ends I’ll go back to being my usual quiet self.)

Sabine,

Life is too short not to have some fun right? Thanks for the comment.

Seriously though, I live in a large home on 10 acres. There is no way I will need or want to live here forever. I will be seriously downsizing. On top of that, if some of the SWR is currently used for utilities, maintenance, taxes, etc. then those funds should still be available for similar but lower expenses later (don’t forget, the model is allowing for inflation already). Why wouldn’t at least some portion of this be a cushion? Maybe somebody else will comment?

Thanks

Jim the Troll

I also live in a large home in the country (24 acres), but we’re not planning on downsizing. Plus with the housing prices today if I sell my house in the middle of nowhere and move to a bigger city, I’d be reducing the square footage, but would probably have to pay more for housing.

Jim, I have to admit, my first thought was the same as Sabine’s. With the detail you provided in your second comment, I’d recommend you follow the same course we did in our retirement planning:

1) We don’t count home equity toward our retirement savings, the $ is not available to cover retirement expenses unless you want to “live under a bridge” (of course, there are HELOC-type alternatives, but I wouldn’t suggest those for primary retirement spending).

2) In a case where you’ll be downsizing (as we did), you can count the “extra” principle that will be freed up from the downsizing. Be conservative, you never know how much your house will sell for or how much you’ll ultimately pay for the replacement.

Hope that helps.

We love the 4% rule for its implied simplicity! But Bengen says you have to monitor this strategy and be willing to adjust in down turn periods (other factors withstanding). Depending on your age, you can potentially withdraw at a greater rate. Based on conditions in early 2020 Bengen felt the rate was more like 5% to achieve a 25 to 30 year savings life. But if you’re a FIRE player, maybe listen to Ric Eddleman about his longevity thoughts.

Really, is there a Ron Popeil “Set it & Forget it” retirement distribution strategy? I think not unless you turn down the rate of withdrawal (whatever that % rate is). For those with enough social, residual, pension, etc., income, your answer is, “withdraw savings at the least rate you have to, to enjoy life and protect savings long term”. If this gives you the comfort you’re seeking WRT “not outliving your savings”, you’re golden. If this doesn’t work in your case, work longer, make more, save more, etc. until you have reached the point you are golden or you risk a tarnished future. Is this Rocket Science? Maybe not, but it does require some monitoring and work.

Know your risk tolerance and be willing to live with the consequences of your actions. If you want to “out live your savings”, know the consequences of your savings & withdrawal strategy. And be honest with yourself; don’t down play because you’re burnt out and want out now.

From my perspective saving more has its rewards. We’ve worked longer, over funded, and now can take out more than 4% if we desire. I don’t regret still working at 66 as we have the satisfaction of knowing we have the ability to fund us beyond age 100. Knowing if the economy/market endured a 50% down turn we’d still survive is our reward.

Thanks for the Blog,

Best Regards to you all & your individual cases!

I guess I look at Bengen’s 4-5% rule a little differently. I used it before retiring. First determine how much you plan on spending each year in retirement (at least the first few years anyway). Then determine how much in retirement savings you need to achieve that goal using the 4-5% rule. For example, you plan on spending $80,00 a year. So 4% of what number gets you $80,000? Why $2,000,000 of course. That means if you start with $2,000,000 and spend $80,000 a year (adjusted for inflation) your money will last at least 30 years. It also assumes you do not want to leave money to family or charity. Whether or not you can spent more than $80,000 depends on the many issues brought up in this blog.

Kitces just came out with an article about risk based guardrails in retirement distributions: https://www.kitces.com/blog/risk-based-monte-carlo-probability-of-success-guardrails-retirement-distribution-hatchet/?utm_source=ActiveCampaign&utm_medium=email&utm_content=The+Retirement+Distribution+%22Hatchet%22%3A+Using+Risk-Based+Guardrails+To+Project+Sustainable+Cash+Flows++%5BNEV%5D&utm_campaign=NEV+Wednesday+Email

Great article Fritz! I really enjoyed reading all the different takes and opinions!

I would add the 4th option to the list for adventures and excitements…

invaluable nutrients for the aging brains!

Travel 6 to 9 months to the less wealthy countries…

and come back to the States for 3 months to reconnect with family and friends.

With just an investment of an airplane ticket and as soon as you step into a foreign country soil, the US dollar receives an instant gain in purchasing power.

Good luck!

Happy Thanksgiving all!

So in retirement we‘re using a kind of modified envelope system where we have one account (funded by a monthly pension annuity that includes a COLA) for all our recurring monthly bills, another for medical/dental expenses, individual checking accounts for discretionary expenses, and savings accounts for major stuff (international travel, major home repairs and improvements, major charitable donations).

Among our recurring automated monthly payments about 14% are monthly donations to various charities we‘ve supported for years. Though we hope that we will be able to make these donations indefinitely, we view this 14% as a buffer: funds that could be redirected to living expenses if absolutely necessary. This provides us with a bit of wiggle room and peace of mind.

(We may switch some of these monthly contributions to annual qualified charitable distributions once I turn 70 1/2 if I have any assets remaining in deferred accounts. My husband only has a Roth account as he‘s completed all his conversions.)

Our envelope system is a bit simpler, one for fixed expenses (property taxes, life insurance, medical insurance, auto insurance, auto registration stickers, homeowners insurance, safety deposit box), variable expenses (clothing, retail purchases, power bills, streaming services, cell phone, internet, restaurants, entertainment, groceries, gas) and college expenses for our youngest. My wife’s social security goes into a separate account that we use for gifting to children and hopefully travel someday.