Call me a nerd, but I love studying retirement statistics (for the record, I prefer to consider myself curious). When something as dramatic as COVID comes along, it really makes the numbers interesting.

If you’re curious like me, you’ll enjoy today’s post. A compilation of some fascinating retirement statistics I recently came across, including some graphs for those of you who prefer to view the charts.

If you’re interested in how you compare to “average”, you’ll also find today’s post of interest. Wondering what impact COVID has had on retirement confidence? We’ve got that covered, as well.

Curiosity-seekers, unite. This one is for you…

What's retirement really like? What impact has COVID had? Today, a look at some fascinating retirement statistics. Click To TweetFascinating Retirement Statistics

A while back, as I was doing some research for my post titled The Mad Retirement Rush of 2020, I came across an article with some interesting retirement statistics and saved the link into a draft post (I do that a lot, with over 100 draft posts currently holding ideas for future posts). I wanted to do further research on retirement statistics to see how many I could compile for a dedicated post on the topic.

Today, I’m pleased to publish the resulting work and share what I’ve found during my research. A variety of fascinating retirement statistics, dedicated to all of the fellow retirement nerds in the house.

With that, let’s dig into some numbers:

Retirement Readiness Statistics

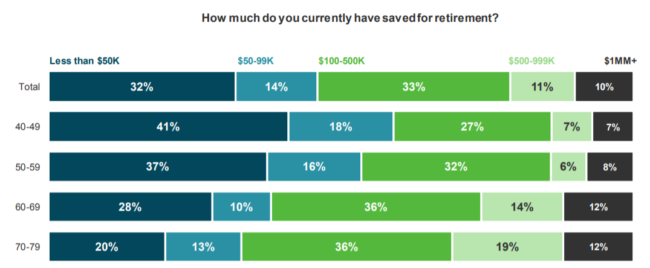

- Nearly 2/3 of 40-year-olds have <$100k saved for retirement (Source: TDAmeritrade Retirement Survey)

- 51% of Baby Boomers are still paying on their mortgage in retirement, and 40% struggle to pay off their credit card debt. (Source: Legaljobs.com)

- 1 out of 12 Americans believes they’ll never retire at all. (Source: Legaljobs.com)

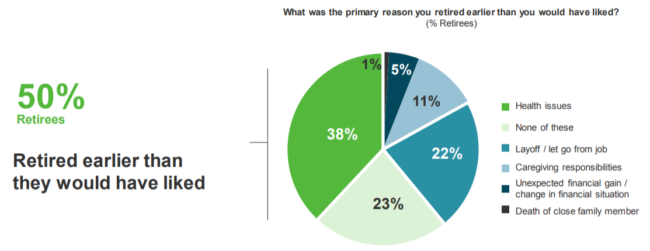

- 50% of retirees retired earlier than they would have liked. (Source: TDAmeritrade Retirement Survey)

- 73% of retirees say their retirement was a “full-time stop”, with only 19% experiencing a gradual transition (e.g., fewer hours). Among those still working, half expect a gradual transition. Related, only 30% of retirees work for money in retirement, whereas 72% of workers expect to work for some pay in retirement. (Source: 2021 EBRI Retirement Confidence Survey)

- The average US household had $255,000 in their retirement accounts in 2019, a 5% increase from 2016 (Source: MagnifyMoney)

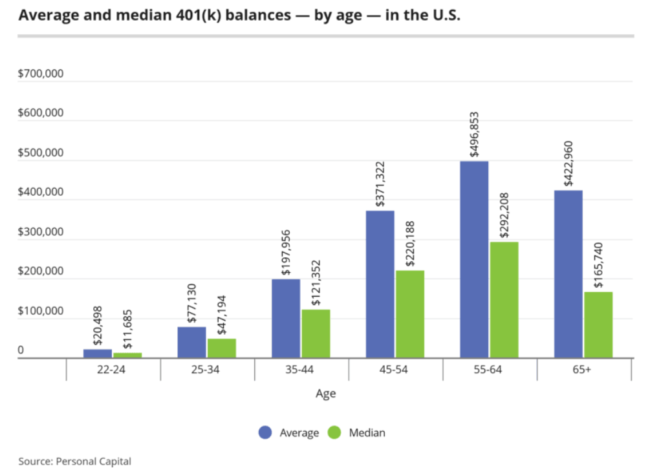

- Among those with 401(k), the average balance by age is shown below: (source, Personal Capital as cited in MagnifyMoney)

COVID’s Impact on Retirement Confidence

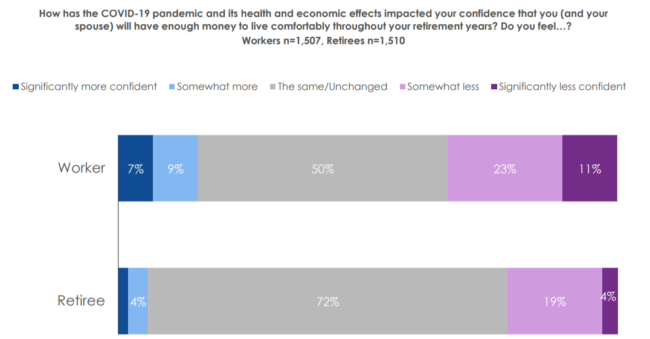

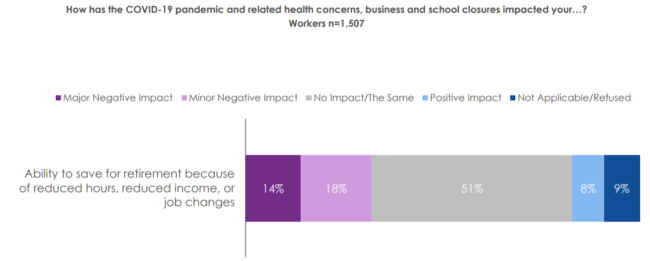

- While the majority of workers are still confident of their ability to retire, 34% of workers are less confident in their ability to live comfortably in retirement than they were pre-COVID.

- COVID has caused 1 in 4 workers to adjust their expected retirement date, with 17% now planning to retire later and 6% who plan to retire earlier.

- 32% of workers say COVID has negatively impacted their ability to save for retirement.

All statistics in the above section compliments of 2021 EBRI Retirement Confidence Survey

- 30% of Americans with retirement accounts reported making withdrawals from them in the first two months of the COVID pandemic. The average withdrawal was $6,757 (Source: Investment News)

Baby Boomer Statistics

- Every day, 10,000 Baby Boomers turn 65 years old. (Source: Legaljobs.com)

- 8 in 10 retirees report that their overall lifestyle is as expected or better. Only 26% of retirees report spending is higher than expected. (Source: 2021 EBRI Retirement Confidence Survey)

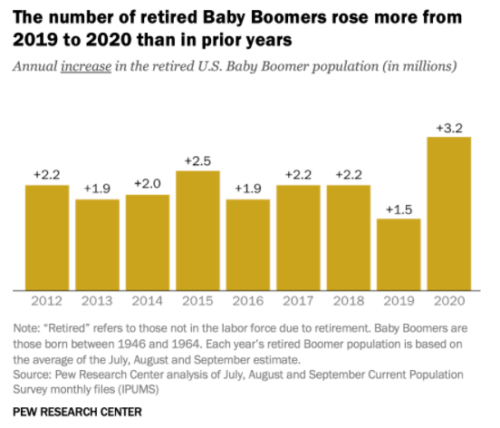

- Baby Boomer retirements increased significantly in 2020 vs. prior years. By September 2020, 40% of Baby Boomers were retired. (Source: Pew Research)

- At least 1.7 million older workers retired early due to COVID (Source: Bloomberg)

- Average annual spending by retirees in 2018 was $49,441, compared to $65,834 spent by workers. (Source: Annuity.org)

Social Security Statistics

- Between 2009 and 2019, the beneficiaries of Social Security have increased from 33.5 million to 45.1 million.

- An individual retiring at full retirement age in 2020 receives a maximum of $3,011 Social Security benefits. (All 3 of the above bullets per Legaljobs.com).

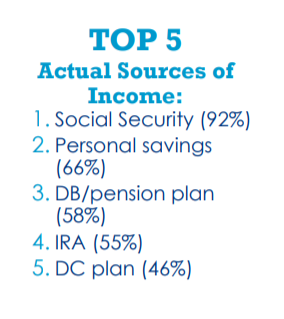

- 92% of retirees cite Social Security as their most common source of retirement income, with a surprising 58% citing pensions (Source: 2021 EBRI Retirement Confidence Survey):

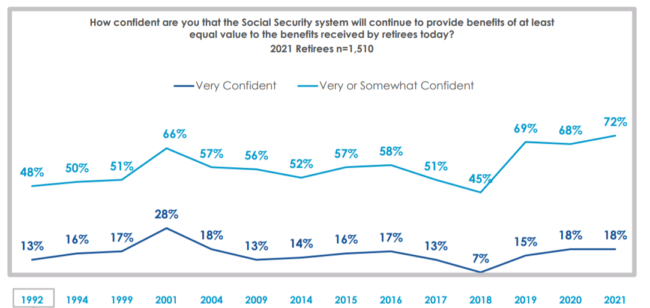

- 72% of retirees and 53% of workers have confidence that Social Security will continue “to provide benefits of at least equal value to those received today”. (Source: 2021 EBRI Retirement Confidence Survey)

Pension Statistics

- 23% of boomers are subscribed to a private pension plan. (Source: Legaljobs.com)

- 79% of Union workers receive a pension, compared to just 17% of non-union workers. (Source: Legaljobs.com)

- In 2019, only 21% of workers have a pension plan, and 43% have a retirement savings plan (Source: Annuity.org)

Health Care & Life Expectancy

- Health care costs continue to be a top concern for retirees, with 1 in 3 saying their health and dental costs were higher than expected. (Source: 2021 EBRI Retirement Confidence Survey)

- The average retired couple leaving the workforce in 2020 will need an estimated $295,000, post-taxes, to pay for health care expenses (excluding long-term care). Source: MagnifyMoney

- A man turning 65 in 2020 has an average life expectancy of age 84, while 87 for a woman. (Source: Legaljobs.com)

Average Retirement Age Around The World

- The United Arab Emirates has the lowest average retirement age in the world at 49, which is both the official retirement age and the average actual retirement age for both men and women.

- Norway has the highest average retirement age in the world at 67 for both men and women.

Source: Annuity.org

Other Interesting Stats

- Gray Divorce is a real thing, with 1 of 4 spouses over the age of 50 divorcing (up from 1 in 10 just two decades ago). (Source: Legaljobs.com)

Conclusion

After 6+ years of writing, today marks my first “statistical compilation” post, filled with a variety of retirement statistics. I find it interesting to read various studies and comparing our situation to “normal”. I hope you feel the same, and enjoyed this compilation.

Your Turn: Are you a curious nerd? What retirement statistic most surprised you? Let’s chat in the comments…

Oh you know how I love me some numbers… thanks for the great stuff to chew on early this morn!

These are terrific stats for people who are developing their financial plan. I will be speaking to a group of recent college grads next week. I look forward to sharing some of these statistics with them and asking them how those statistics are likely to change over their working years. These numbers and the cost of living in 1966 when I was their age should lead to some interesting conversations about how much they should be saving. BTW, in 1962 my first car cost $3000 new!

Paul, I’m 3X honored by your comment:

1) that you’d take the time to read my content.

2) that you’d make the effort to leave a comment.

3) that you’d find it worthy to use in your tremendous work with the younger generation.

Thanks for making my day! And yes, the impact of compounding is staggering, on both investment returns and inflation…

In 1985, my brand new Nissan Sentra (with the AC – which used to be an option) was $9,000.

Fritz, these stats are very telling. Thank you for compiling/sharing.

im shocked that people have savings when they retire, i guess without mistakes during life,,,it can happen,, i worked 40 years, ,made decent money at end,, [around 80 grand a year,, and have nothing in bank ,mistakes, like picking wrong woman,, gambling,,drugs at a young age, killed me to point where im paying for it now,,the only smart thing i did was put myself on budget whemn i retired,,, and im making my debt first priority in my view, because i lived it,, mistakes when young are your burden when you retire,,,,,learn from this post,,,its a post i write with a heavy heart, i lost a family,,,i lost hundreds of thousands of dollars,and i lost my dignity,,and no matter what i do now to correct it,, the scars will always be there

Wishing you the very best from here on forward. Remember today is the first day of the rest of your life…use it well

Thank you for sharing this article as well as others. I expect to retire later in 2022 and your messages are helpful. I appreciate your professional work and service to others.

Thanks, Fritz.

I enjoy looking at statistics as well. It’s absolutely scary to start thinking about pulling from our investments and seeing how much an impact inflation can have on your retirement financial security and lifestyle. My accumulation mantra has been “it’s not how much you make, it’s how much you save”. I get the feeling that retirement will be “it’s not how much you have saved but how much you spend”. It will be a tough transition, I’m afraid…. 2-1/2 years to the starting line! Time to get my head shaped and ready to go!

The very fact that you’re thinking about the transition 2 1/2 years before the fact is a great sign, Dave. Yes, it’s a big adjustment, but as I’ve written many times, there’s a direct correlation between the amount of time you put in preparing for it and how smoothly the transition goes. It went exceedingly well for me, I hope my articles on what I did to prepare are helpful on your journey.

Thanks for the stats, which I love by the way. I am within a month of retiring and read every article you send, thank you!

The actual sourced of income is one of the most interesting facts for me.

Joe, congrats on your final sprint to The Starting Line, thanks for taking me along on your ride!

I wonder how meaningful the 401k numbers are? During my career, I have changed jobs a number of times and rolled the previous employer 401k amounts into IRAs.

Charlotte, I agree the 401(k) numbers could be misleading, but the overall retirement savings would catch it. Shocking, and concerning, how little the “average” person has saved for retirement.

I agree! As a single mother of three who was a public school teacher (i.e., not a high wage-earner), I know that saving much more is very “doable.” My retirement will be comfortable – similar to my working lifestyle – not extravagant, and it truly was not that difficult to achieve.

I can’t help wondering how many folks are going to survive financially on what they have saved. Personally, I would find it very frightening.

Hi Fritz,

Love your work, thanks for providing great content. I’m a bit surprised about how low the median savings amounts are for people at or near retirement age. A bit concerned that SS is the top income source for 92% of us also. Although maybe that just means it’s the most common source of income, not necessarily the largest source of retirement income. Thanks for all the data….looking forward to your next book.

WOW – those are some shocking statistics. The financial ones to some degree but the “Graying Divorce” really shot up, just crazy. Recommended your blog to a young guy last evening, so good to have a resource to suggest. Hitting a few more miles today then Glacier will be in the history books. I’m such a fan of your writing and how you and Jackie are living your dream retirement life. See ya this fall!

You’re talking about blogs during your CDT hike!? Congrats on finishing off Glacier, that Triple Crown in looming large. Thx for your kind words, friend, looking forward to seeing you soon.

Great post. Interesting read for sure.

Great article. Despite the gains reflected in some statistics in recent years, there is still a lot to be concerned about since about 70% of the 78 million baby boomers in the U.S. have fewer savings than they need for a secure retirement. Some will make it through retirement with help from their families and America’s social programs. Others will live minimal and frugal lifestyles to make their assets last as long a possible. This is why I wrote Redeeming Retirement: A Practical Guide to Catch Up. In this book, I lay out a long list of strategies that those behind in preparing for retirement can choose from to improve their chances of being able to “retire with dignity.”

“In 2019, only 21% of workers have a pension plan, and 43% have a retirement savings plan (Source: Annuity.org)”

The above line states 43% of workers have a retirement savings plan. I have two questions.

* What is the percentage of workers that have ACCESS to a retirement savings plan, including those who choose to not participate?

* Does the 43% include those who have IRA’s? Many IRA’s are roll overs from employer sponsored plans created when the employee left the company.

From one number nerd to another – Great stuff!

Great questions, Jeff, and one of the frustrating parts of compiling data from reports without being able to dig into more context or ask the follow-up questions.

I’m a big fan of auto-enrollment in savings plans, and like the fact that it’s catching on. Historically, too many haven’t participated without realize the significance of their decision.

Not to mention the fact that by not participating in a 401K they are leaving free money on the table if there is an employer match

Hi Fritz–this is some great information. My husband and I loved looking at the different retirement ages around the world! I sent this article to a group of moms I serve with on a school committee with. I try to put financial articles in front of them and talk about finances/their financial future. (I had my son when I was 36 so I am the older mom and now in my early 50’s). While I have always had thoughts about retirement, your blog (and book) have given me much more to think about (and introduced me to Roger’s podcast and the RRC)!

Anyway, when I see an article that won’t scare off my younger counterparts, I share it with them. Hopefully I can motivate them to pay more attention to this right now in their late 30’s and early 40’s. Keep the great content coming!!

Thanks for making an impact, those mom’s would be wise to listen to your advice. I’m honored that you’d consider my work worthy of sharing. Much appreciated.

I think the stats are under-counting total balances due to individuals that have multiple accounts from multiple employers. I’d love to see the savings stats per person, not by account.

What’s a DC plan? Thanks!

Defined Contribution (think 401(k), where the amount of contribution is known). It’s the norm these days vs the historical DB, or Defined Benefit, which is when a retiree receives a known benefit at retirement (think traditional pensions).

Great post. It was very interesting and I hope there will be similar posts in the future.

I’m not financial genius by any stretch of the imigination but, we were going to roll my wife’s 401k into an IRA. After talking to a finance guy we found the biggest difference for us is that q 401k is protected from judgements, I.e.. Catastrophic medical etc. An IRA is not.

Hi Fritz

I am one of your followers and thanks for the information and the example you lead to retirement.

We are looking to retire by the end of 2021 (happily and prepared).

The data not surprising to me is sad. To me that means to retire with sufficient funds and living the life is a rarity to the general public.

Regards,

Darrell

I see someone above asked about the DC definition. Thanks for the answer. The shocking stat for me was the amount we need to think about preparing for healthcare costs…YIKES! Thanks, Fritz. Appreciate your hard work and insight. My best to you and Jackie.

Sharon

Sharon!! Great to see you in the house, old friend! And yes, the healthcare costs are shocking – we’re paying $1,900/month for private coverage (with a high deductible, to boot!) until we qualify for Medicare, and it’s still 7 years away. Fortunately, we planned for it, so we’re fine. Jackie says “hi”!

Hi Fritz, great post to help people realize that you need to have a plan and to be motivated to execute it through out your working years. Failing to plan really is planning to fail. And be assured that your blog is always worth sharing, it’s top notch financial planning information that people always benefit from. Thank you for your efforts and dedication.

Blushing….thanks for your kind words, from one of my most loyal readers! Much appreciated.

That’s for the Stats. What I found amazing, while working, was that some employees thought the company was screwing them by offering a 401k plan. It was dollar for dollar up to 9% of your annual salary and that was started in the late 90s. Before that it was up to 6%. Oh, we also had a DB plan, so it was not all just 401k, which was icing on the cake IMO. I tried to explain to some folks and it was like talking to the wall. I retired in 2016, and received my DB lump sum. The company stopped the DB plan in 2014, except for those of us grandfathered in. They now just fund a % of retirement money annually to a DC plan for newer employees. It’s the new mantra (position) from the AON/Hewitt type consultants nowadays, which reduces long-term liabilities for corporations, thereby justifying their consultant fees. Just the way the World works today. GLTA.

Randy, the move from DB to DC is certainly solidy in place, you’re fortunate to have had the DB (as was I, which I took as an annuity). Thankful to have the certainty of income from that pension for the majority of our needs!

The statistics are very interesting, Fritz. I’d be interested in the savings needed per household/couple. If shown by each individual those statistics can be very different for a household with both a high earning and a low earning spouse. Only 1 of the 2 could be meeting the goals, but when combined as a household, the couple may be 100% on track.

Thanks Fritz for the great information, I have been trying to convince my wife that we are pretty secure in our retirement plans and it is a hard sell for a once 15 year single mom who struggled for so long. This information is SUPER informative and sets a benchmark for where one is in their plan. I could not wait to pass this along to her. We are 22 months out from retirement and appear to be in the top 12% with a new paid off house. I think this will go a long way to ease her nervousness of the upcoming dates. Great work!

Glad to hear my work is helpful, John. You should also review my When Can I Retire series, it’ll walk you through everything you need to ensure you’re ready to cross The Starting Line.

Fritz, thank you for doing the nerd work for us. I have been a follower of yours for awhile and I enjoy how you present the work. I am 59 and have been working for myself since age 30, and when people ask how I have managed to prepare for retirement, I always let them know, I did it based on “lifestyle”. As my income increased I didn’t really change my lifestyle that much. All disposable income items whatever they are get paid in full. As they say in the south, “I don’t live high on the hog.” In January I bought a place outside Murphy, NC, so we are practically neighbors. I would enjoy buying you lunch and say thank you in person. I have friends in BR and Elijay, so I am down your way often.

Howdy, Neighbor! Murphy is, indeed, just up the road. Give me a shout when you’re in town, I’ll take you up on that lunch! Look forward to meeting you.

This quote makes me realize the value of all of your work with RetirementManifesto, you aggregate and help with retirement BLINDSPOTS:

“When I ask people “where mistakes come from?” they often say a lack of intelligence or experience. But we know this isn’t true.

Most mistakes don’t come from low intelligence. We all know people with extreme raw intelligence that make mistakes all the time.

Most mistakes don’t come from a ‘lack of experience.’ We all know people with tons of experience that make mistakes all the time.

Mistakes come from what we can’t see. Mistakes come from blind spots.

In life and business, the person with the fewest blind spots wins.

It’s hard to make good decisions when you don’t have the facts. It’s hard to make good decisions when you’re solving the wrong problem. It’s hard to make good decisions when you’re missing key pieces of information. It’s hard to make good decisions without perspective.

You can’t make a good decision when you’re blind.”

— Shane Parrish from Farnam Street blog

Another great post. Thanks Fritz from one data nerd to another.

I found it interesting that (3) countries still practice sex discrimination for official retirement ages – Italy, Israel and China. All three have lower ages for women than men, and yet women liver longer (4-5 years).

Haha! I was thinking the same thing. The patriarchy is definitely off its game in Italy, Israel, and China.

Fritz — Nice summary of stats!

For me the uncertainty of Health Care costs is the top of this list, I followed the link you provided to see if there were more details for the $295,000 will be needed, but I didn’t see any more details. Maybe one of your saved drafts is already strategies regarding health care in retirement… Both Pre and Post medicare eligible — COBA is only an options for limited time and VERY expensive.

Thanks for all you do, this is a great resource.

Brent, great seeing a friend from my childhood “in the house”! I did write a post about health care (I went with COBRA, and the post was written when I didn’t know what I would do once COBRA expired). My COBRA is now expired and I went with a private plan from Aetna, paying $1,900/month until age 65. Yep, it’s expensive, but retirement is really just a math problem and I included $2,500/month in my estimates when figuring out when I could retire, so all is good. I’ll need to write an update to that original post to let everyone know what we did, I get the question a lot…

I just started subscribing to your blogs. I was surprised that high of number receive income from pensions.

I am a statistics nerd too. My son came home upset in the 6th grade because someone called him a nerd. I told him “Nerds rule the world” and then gave him examples such as Warren Buffet, etc.

Great work!

Welcome to the team, Barb! Glad to have a fellow nerd in the house, wink. I suspect the highish number of folks with pensions is due to the demographics, the folks in their 50’s who are starting to think of retirement have a much lower % of pension coverage, unfortunately.

Thank you Fritz for the data. I was surprised by the average social security monthly payment.

It was great fun reading these statistics. All the while I thought I was special. Now? I’m just mediocre. Now that I know these facts, what’s next? Suicide? What are the statistics on suicides after retirees read these facts? Just curious. Perhaps you can write your next article on how many retirees commit suicide?

Now that’s a morbid thought…I prefer to keep it light. Wink.

For the record, I Googled it and found a relevant article here. Scary numbers, actually – retirees have the highest rate of suicide, and it’s increasing. Sad, that…

Glad you are addressing the mental health aspect of retiring Fritz. There is a lot of help out there for retirees and ACA has provided more funding for mental health counseling etc.

Great Stats Fritz. I have been researching the stats and various information sources for over 3 years now and appreciate the details. My wife and I will be retiring in 2-3 years and it can be a challenging sorting through all the stats. What I believe would be interesting to consider is possibly presenting a view with numbers that speaks to the typical retirement scenarios. Knowing what the typical successful retirement couple have put into place x year out based on their existing income streams would be beneficial. Furthermore, wondering if it is possible to also describe it by a typical lifestyle. Regardless, love the details and videos.

Phillip, I have done a few case studies, you may be interested in this one:

Can They Retire? A Real Case Study

I hope you find it helpful!

Fritz,

As a Surveyor, I also love to crunch the numbers. Maybe its the fear of being normal , that has motivated me to save, plan and invest. I enjoy reading these stats and giving myself a pat on the back for exceeding my age bracket rather substantially. However, at 53 yo, I know the market can make some radical moves on the short term. My wife and I are getting close to pulling the trigger on retirement, but feel we have a unique, but also possibly more common then is mentioned situation. My wife and I started a family later in life so, with a 7 year old, it becomes a more complicated math equation for us at this time. I am curious if you have any stats or comparable of other couples in our situation.

I rarely find information on my situation, either, but I can’t think it is that unique: I am newly retired as an individual, not part of a couple.

Almost all information seems to refer to couples, but of course there are many singles-divorced, widowed, never-married, those who, in fact, sadly become widowed relatively early after retiring.

Should the amounts needed (such as insurance, travel, or health care) be halved? What additional expenses might the retiree who is an individual need to anticipate? How do my savings/retirement funds compare to others who are single? And beyond finances, what special challenges should the single retiree prepare for? It seems difficult to find this information.

I’m very impressed that I know someone who gets a comment from Paul Merriman! Fritz, you are a super star.

Too many stats and we have no idea if they statistically valid. Some maybe be plain wrong.

For example, 401K balances by Personal Capital. Our (spouse and me)401K balances are at ZERO, but have plenty of investments in Roth IRA, Rollover IRA, Simple IRA and in non-qualified mutual funds. I am likely not the only one. I moved 401K, SEP, Simple investment into the Rollover over the years.

As an Engineer, I love science in general. I enjoy statistics due to its usefulness as evolved social scientific facts which can be used to design a life.

As for examples…

Statistical fact – “Average annual spending by retirees in 2018 was $49,441, compared to $65,834 spent by workers.” –

Financial Plan based on statistical fact – taking inflation into consideration, plan for $49,441 as minimum for retirement income.

Statistical fact – Gray is a real thing, with 1 of 4 spouses over the age of 50 divorcing (up from 1 in 10 just two decades ago).

Relationship Plan base on statistical fact – invest compassion and understanding into the marriage as the relationship matures. The “Me, me and me” mindset as we get older is a force of destruction of marriages.

As always, a great article. These stats are very interesting. As you know I fell into the 2020 retirement rush, having been asked by my employer to retire 6 months earlier than I had planned. Fortunately I was financially and mentally prepared and my first year of retirement has literally flown by without a glitch. Keep up your writing. It is inspiring to so many folks.

Great set of statistics.