Do you want to avoid future regrets?

I’m no prophet, but I suspect I know a regret that many Baby Boomers will have in the coming decades.

That regret?

Their failure to be more aggressive with Roth conversions when they had the opportunity. In hindsight, we may well recognize the 2020s as having been an incredible opportunity for Roth conversions.

Today, I’m making that argument.

My position: We are, quite possibly, living in The Golden Age of Roth Conversions.

It’s an era that could expire as early as 2026. In today’s post, I’ll present five facts supporting my argument and let you decide for yourself. Are we, indeed, living in The Golden Age of Roth Conversions?

More importantly, are you taking advantage of it while you still can?

We're living in The Golden Age of Roth Conversions. Are you taking advantage of it, or will you have future regrets that you missed the opportunity? Click To Tweet

The Golden Age of Roth Conversions

As a Baby Boomer, I remember early in my career when my boss told me I should contribute to my 401(k). Not only would I get the benefit of the employer match, but I could also reduce my taxes. That sounded too good to be true, so I (thankfully) followed his advice and made my first 401k contribution at the age of 22. I made contributions for the next 33 years.

If you’re in my generation, you likely contributed to a Before-Tax 401(k), as well.

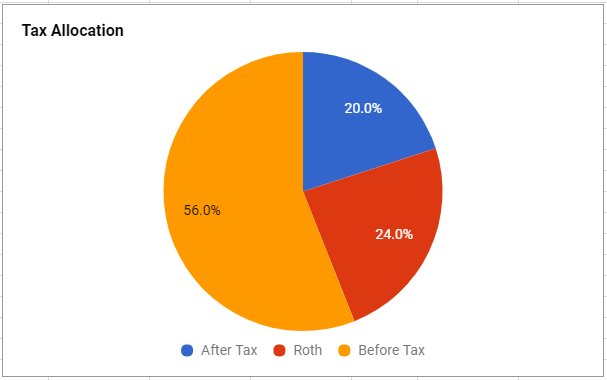

Back in the 80’s when we started contributing, there was no such thing as a Roth. Rather, all of our contributions went in on a “Before-Tax” basis and reduced our annual income by the amount of our contribution. As a result, many of us now have a large % of our retirement accounts in these before-tax accounts. Below was my situation when I wrote my “Retirement Drawdown Strategy” shortly before I retired:

My employer lied to me. I wasn’t reducing my taxes, I was simply delaying them until the date when those funds were withdrawn, at which point they would be taxed as income.

The time has come to pay the piper.

At this point, you have 3 options with how you’re going to manage your before-tax 401k or IRA:

- Do nothing, and wait until Required Minimum Distributions force you to withdraw at age 73.

- Withdraw money from the IRA as you need it for spending, paying taxes as you go.

- Do strategic Roth Conversions, paying tax as you convert the funds from pre-tax to Roth.

I’m a big fan of Option #3 for the five reasons presented below. In a Roth conversion, you transfer money from the pre-tax 401k/IRA to a Roth, which creates a taxable event in the year of the conversion (we pay the tax from separate funds kept in our taxable account via our Estimated Quarterly Tax Payments each year). The amount transferred will count as incremental income in the current tax year and be taxed at your marginal tax rate. The good news, however, is from that point forward those investments in the Roth will grow tax-free for the rest of your life.

Worth noting, doing Roth conversions doesn’t limit your flexibility from also doing withdrawals to meet spending needs (Option 2). You can make withdrawals from the pre-tax IRA in addition to the Roth conversions, as well as make tax-free withdrawals from the Roth five years after you’ve done the conversion.

Options are always good.

Argument 1: A Golden Tax Rate Window

In our portfolio, we’ve decided to go with Option #3 (Strategic Annual Roth Conversions). One of the primary reasons is today’s historically low tax rates.

Fortunately for us, the tax laws changed in 2018. As I wrote at the time in The New Tax Law Loophole That Benefits Retirees, the new tax laws give us a golden opportunity to access some of that Before-Tax 401k money at historically low rates. Below is a chart I created for that article that showed the significance of the tax change:

If you focus on “The Loophole” section in the chart above, you’ll notice that the new tax rates (Blue Line) stay much lower through a much higher income level ($315k) than the prior law. One note, while I called that blue blob a “loophole,” in reality it’s more of a window of opportunity presented by the new tax structure.

That window represents an opportunity.

It’s an opportunity I’ve taken full advantage of every year since I retired in 2018. As I wrote in How To Execute A Before-Tax Rollover Into A Roth, I did my first Roth conversion at the age of 56 and have done them for each of the past 4 years.

I hope you’ve been doing the same.

Argument 1: A historically low tax rate environment makes this the Golden Age of Roth Conversions.

That window is scheduled to close on 12/31/25 when the tax structure implemented through the Tax Cuts and Jobs Act (TCJA) will expire. Sure, Congress may do something to extend the tax cuts, but do you want your fate to rest in the hands of Congress?

The goal in retirement financial planning is to reduce lifetime taxes to the extent possible. Knowing we’re in a historically low tax rate argues for taking some action now (unless you believe future tax rates will be lower, which is a stretch in my opinion).

It’s time to take action, while you still can.

If you’re not yet doing Roth conversions, I strongly encourage you to consider doing one in 2023, 2024 and 2025. Two exceptions that could justify forgoing the Roth conversions:

- If you qualify for ACA healthcare subsidies and don’t want to lose your low-cost health insurance.

- If you expect future income to be significantly lower than your income today (e.g. you’re still working).

The chart above was based on tax rates for 2018. I’ve updated the figures below to reflect the 2023 tax rates. I encourage you to study the current marginal tax limits. If you’ve not yet done a Roth in 2023, use this as your guideline as you finalize your plans for your 2023 Roth conversion (see my Roth Conversion post for specifics on how to plan your Roth conversion in light of current tax brackets). The yellow highlighted row corresponds to the “blue blob” in the chart above.

Note also the opportunity to pay only 12% on your Roth conversions up to $89,450 of income. This represents a $13k increase at a 3% lower tax rate than the 2017 tax law. No one knows what the future tax rates will be, but there’s little argument that the current rates are on the low end of the scale. At a minimum, I’d encourage you to check your projected income (less the $24k standard deduction) for 2023 and see if you have room to “top off” your 12% tax rate with a Roth conversion.

Argument 2: RMD Pain – The Headline of The Future

Roth conversions are an easy topic to ignore, and I suspect many people will.

At some point in the mid-2030’s, however, I predict you’ll start seeing a lot of headlines about the pain that Required Minimum Distributions are inflicting on those who went with Option 1 (do nothing and wait until RMD’s force you to make withdrawals).

To help illustrate the point, let’s look at a hypothetical example.

- Married Couple, both 60 years old

- $500,000 in pre-tax IRA

- No Roth conversions planned.

If you decide to ignore Roth conversions and just “deal with the problem” when Required Minimum Distributions kick in at age 73, here’s what your future looks like inside your pre-tax IRA, assuming an 8% annual return and no withdrawals for spending (RMD factors available here):

This couple will be forced to withdraw (and pay taxes on) $100,000+ every year past their 81st birthday. Their heirs will be stuck with an accelerated RMD schedule (currently 10 years) on the $2M of pre-tax inheritance they receive.

Yeah, that inheritance will be nice, but your kids may not like having ~$180k / year of income forced on them, possibly during their peak earning years.

The Penalty of Widowhood

If one of the partners dies before the other, the cost of those RMD’s will become increasingly painful for the widow.

Let’s say he dies at 90, and she’s suddenly facing an RMD of $172k. That’s bad enough, but it gets worse. Using the 2023 tax tables, you’ll notice someone filing as a single adult instead of “Married/Filing Jointly” only gets half of the income for each tax bracket. For example, if you’re married the 12% marginal tax rate carries you to $89,450. If you’re single, you’ll be jumping to the 22% bracket at only $44,725.

Argument 2: If you’re married, your lower tax rates filing jointly (vs. your widow filing as a single) makes this the Golden Age of Roth Conversions. Any pre-tax money left to your widowed spouse will be taxed at the higher rate of a single taxpayer.

Argument 3: The Impact of Social Security

A further consideration is the reality that your future will include Social Security income. If, like me, you’ve decided to delay claiming Social Security, you have a window of opportunity to do Roth conversions before your income increases with the Social Security benefits.

Argument 3: If you’re delaying Social Security, you have a window of opportunity to do Roth conversions before your income increases with the Social Security Benefit.

Argument 4: Ugly Old Aunt IRMAA

The fourth argument in favor of doing Roth conversions in your early 60’s is the avoid the IRMAA penalty that could be triggered by doing large Roth conversions after the age of 63. I don’t see this as a major issue, and trust the White Coat Investor when he says to “Quit Worrying About IRMAA” (an article worth a read if you want to get into the details of the IRMAA penalty). At this point, I’m doing as large a Roth conversion as possible through age 62, at which point I plan on doing a bit more research into the IRMAA issue as I plan my conversions for age 63 and beyond.

Argument 4: Doing Roth conversions prior to age 63 reduces your chances of getting hit with the IRMAA penalty.

The Benefits of Doing A Roth Conversion

Let’s go back to the earlier example, and make one minor revision in the assumptions:

- Married Couple, both 60 years old

- $500,000 in pre-tax IRA

- $100,000 Roth conversions planned for ’23, ’24 and ’25 (none after that).

Here’s what the next 3 years look like for our couple since they’ll now be doing $100k Roth conversions:

If you compare the difference, the couple now has a balance of $305k at the start of their 63rd year, compared to $630k in our first example. When you extrapolate the IRA balance over the years and factor in the power of compounding, the impact is shocking:

The Blue Line represents the IRA balance without Roth conversions. Contrast that to the much lower Red Line, which results from doing just 3 years of Roth conversions (@ $100,000/year) between the ages of 60-62. (Obviously, the overall portfolio would reflect Roth balances growing to a much higher value with the Roth conversions, but I’m only focusing on the pre-tax IRA balance for the sake of this discussion).

By doing just three years of Roth conversions, the couple have reduced the burden on their children of inheriting a large, taxable, IRA. In the example above, the ending value at age 90 between the two scenarios is as follows:

- No Roth Conversions: $2.1 Million IRA legacy

- 3 Years of Roth Conversions: $1.0 Million IRA legacy (with a larger, tax-free Roth)

Minimizing the Dreaded Required Minimum Distribution

Today is an opportunity to avoid future regret.

Thanks to the lower IRA balance shown in the previous slide, the RMD formula will now result in a lower RMD for life. The following chart compares the RMD for our hypothetical couple, with the red line showing the significantly lower RMD resulting from just 3 years of large Roth conversions in their early 60’s.

By doing only 3 years of Roth conversions, the couple has created a much more manageable future obligation of Required Minimum Distributions. When one of the couple is left as a widow, the “single tax rate” penalty will be much less burdensome than in the prior example.

If you prefer tables to charts, the following compares both scenarios in tabular form:

Argument 5: RMD’s Cannot Go Into a Roth

One little-known fact is that you cannot do a Roth conversion with your RMD. The RMD must be transferred into a taxable account. You can still do Roth conversions, but only after the RMD obligation has been met. By definition, this increases the taxable income even further if you wait until your RMD’s start before doing Roth conversions.

Argument 5: RMD’s must flow into taxable accounts, so your ability to do Roth conversions is limited and will more severely impact your taxable income than if you’d done them prior to the start of your RMD’s.

Conclusion

I believe we’re living in the Golden Age of Roth Conversions for the following 5 reasons:

1. Our current historically low tax rate environment is scheduled to expire on 12/31/25.

2. It’s best to do Roth conversions with current Married Filing Jointly tax rates vs. risking having your widow pay the higher singles tax rate in the future. In addition, you’ll leave less of a tax burden to your heirs.

3. Delaying Social Security offers a window of opportunity to do Roth conversions before your income increases with your future Social Security income.

4. Doing Roth conversions prior to age 63 reduces your odds of getting impacted by the IRMAA penalty.

5. You cannot convert an RMD into a Roth, so your ability to do Roth conversions is seriously reduced once your RMD’s begin.

No one can tell the future.

Perhaps I’m wrong and future tax rates will be lower than they are today. For me, I prefer to think of it as the “bird in hand.” I’m hedging my bets, and doing some Roth conversions now. After all, it’s the Golden Age of Roth Conversions, right? Sure, you could argue that my examples are overly simplified. I did that to make a point, and we can argue the details all you’d like (see you in the comments – wink).

I suspect many folks will have regrets when they start experiencing the impact of high RMD’s. Unfortunately, by then it will be too late to do anything about it. All they’ll be able to do is read those “RMD Pain” headlines and shake their heads.

Will you be among them?

Or, will you take advantage of today’s opportunity and do some Roth conversions while you still can?

I’ll take the Bird in Hand, every time.

Your Turn: Are you taking advantage of The Golden Age of Roth Conversions, or not? Why? Do you agree we’re in the Golden Age of Roth Conversions, or do you think you’ll have a better opportunity to reduce your taxes in the future? Let’s discuss in the comments…

What about single filers?

Rick, I would say “The Golden Age” applies more to married filers than single ones for the following reasons:

1) No “widow penalty” to consider (tho, if you have children, the legacy impact is still a factor).

2) 2018 tax law didn’t change as favorably for single vs. married, so there’s less risk if it reverts to something resembling 2018 levels.

3) If there’s a chance you’ll get married in the future, you could incur a “reverse widow” penalty by paying single rates now, when there’s a chance you could pay married rates in the future.

That said, I still think it warrants considering Roth conversions to the top of your current marginal tax bracket, even as a single adult.

The 0% tax bracket (standard deduction) and the lower marginal tax brackets will also be adjusted for the growth on your portfolio. This adjustments will relieve the impact of the RMD allowing to draw more from your portfolio while staying in the lower marginal tax brackets.

Many that are rushing to do roth conversions today run the risk of paying the tax in a 22/24% marginal rate in order to avoid a 12/15% effective.

What would you suggest for someone who is almost 56, plans to work until 62 and has about $2 million in 401k? Thanks

Too little info to make a personal recommendation (which I avoid, anyway), but if you’re still doing before-tax contributions to your 401k you should evaluate your situation and consider changing those to a Roth (particularly if the before-tax deduction doesn’t drop you down to a lower tax bracket).

In our case, I converted to Roth in my 401k in my final 2 years of work, even though I was in my highest earning years. The pre-tax deduction didn’t knock me down a tax level, and I had too much in pre-tax and wanted to start diversifying while the tax burden wasn’t as noticeable since I was still earning an income.

I would be contributing to Roth 401(k)s as much as you can, Roth convert to the top edge 24% tax bracket and continue to do this before RMDs hit. Hopefully you can out-convert the growth so when you get to RMD age, you will be 100% Roth and pay $0 in taxes.

I retired early at the age of 55 and have been Roth converting as much as I can while avoiding the jump between the 24% and 32% tax bracket. It will take me years to get there, but I have an almost 2 decades to convert. Plus converting during a down year like 2022 and 2023 means more shares are converted for the same dollars. (Is it wrong to wish that the market tumbled some more for a few years until I have everything converted, then let it climb, baby, climb?)

The problem with IRMAA are twofold. First the Medicare premium surcharge isn’t scaled in. It’s a cliff. You make $1 over the income limit and you pay the penalty. If you don’t mind paying the penalty then you probably should consider continuing Roth conversions until you’re close to the next penalty. That however may put you in a higher tax bracket plus the IRMAA penalty. The extra taxes/premiums may start to bite more than you’d like. You have to think about it.

The other issue is that Social Security uses your income from two years prior to calculate your Medicare premiums. Mostly makes planning confusing. Your Medicare premiums for next year are already in the can based on last years income. I guess that also means that if you’ve been doing Roth conversions prior to being on Medicare, your first years premiums may surprise you if you haven’t thought about IRMAA a couple years in advance. What you’re taking for income this year won’t affect your Medicare premiums until 2025.

Frank, thanks for the reminder that IRMAA is a cliff. I haven’t researched it much yet (beyond the WCI link included in the article), but will definitely dig into the details prior to deciding on my Roth conversion at age 63. As for Medicare premiums, I was under the impression that’s what the IRMAA was used for (to determine your Medicare upcharge if you earn “too much”), but as I mentioned I still have more research to do in this area.

Fritz, the IRMAA’s are certainly a HUGE problem for those of us in retirement who are a few years older than you and did not have the ability (or the information/understanding) to do a Roth conversion before retiring and signing up for Medicare Plan B. The income limitations for IRMAAs are draconian at very middle-class income levels, whether filing married or single. These funds are not “income”, per se, but rather a transfer of income earned in prior years. Of course, additional income taxes must be paid since income taxes would have been due when the income was originally earned. However, large tax increases for SS or Medicare would not have been required when the income was earned and any increase in FICA taxes while still working would have been paid as if no plan contributions happened. So, yes, some income limitations might be justified because of the FICA tax that were not paid when the income was earned (and I’m not even sure that is accurate), but not at the severe level of IRMAAs when retirees are at their most vulnerable. Also, I do not believe that the income limitations are adjusted for cost of living/annual inflation. I have three years before my RMDs kick in. I have already done a limited conversion to a Roth in the last couple of years. If I continue a “limited” conversion before my RMDs, my Plan B costs will at least triple, and that will last for years because of the ludicrous way that Medicare calculates income based on the two-year delay. Roth transfers are shown separately on form 1040, and should not be included in Medicare calculations for Plan B IRMAAs.

The 401k contributions do not reduce Medicare/Social Security taxes. The main reason for IRMAA is to try to extend the life of Medicare. I wouldn’t be surprised if Roth withdrawals get included in IRMAA in some future tax bill, and/or on charitable contributions reducing the RMD as a way to extend Medicare further. I also wouldn’t be surprised to have Roth withdrawals count towards Social Security taxability to help extend Social Security. Someone has to pay the piper to keep those programs viable, and it’s not going to be poor people with little money, as there is no money to be had from them.

John, I agree there are likely “penalty taxes” ahead for those of us who have been most responsible. It’s a frustrating reality, and the odds are it will get worse instead of better with time. I also expect there may be RMD’s on Roth’s in the future (which argues all the more to do Roth conversions now to get as much tax free compounding as possible before the rules change)…

I understand the reasoning for IRMAAs, but the stringent criteria for setting the income limitations are regressive toward middle class retirees, who have to pay the same rates as taxpayers with vastly more incomes. Those much higher income levels should “pay the piper” for virtually all aspects of the Social Security and Medicare financing debacles. Harsh IRMAAs on middle class retirees are not going to resolve the root causes of the programs’ financial problems. Funding the programs properly, up front, in line with our Country’s progressive tax system, is the only sustainable way to properly address the much broader financial mismanagement of these programs, not by gouging middle class retirees with unchecked and seemingly arbitrary IRMAA income limitation levels.

I have been making Roth conversions since I retired at age 66. I am now 74. My spouse is also 74. We plan to continue Roth conversions until December 2025. We convert up to the high end of the 24% bracket which is 364,200 this year of taxable income. We file married and file jointly.

The IRMAA penalty this year is 7546 combined as long as MAGI is no higher than 366,000.

We also have to pay a 3.8% additional tax on our rental, dividend and interest income as our total income with conversions is above 250,000.

We will convert 254,000 and pay 68,582 (61036 income tax +7546 IRMAA) or 27% in total tax on the converted money. Fortunately we live in a no income tax state, which of course makes a big difference.

We plan to continue to convert to Roth all the funds in our Traditional IRA except those funds we plan to give to Charity.

Our Roth IRA’s will be inherited by our children, both families have relatively high incomes. Our State Estate taxes will be reduced because of the conversion. The Widow tax will be reduced.

We decided to pay the taxes so our children benefit and we benefit when one of us becomes a widow.

I am having a lot of trouble justifying a Roth Conversion. You are not, considering the lost opportunity of the money used to pay taxes. When I run the numbers it appears that once I reach the RMD age of 75 (currently late 50’s), if I do the conversion the taxes will be about $12K less with a conversion. That is assuming a $40K conversion annually from now until age 74. The lost opportunity on the taxes paid on the conversions would require 12 years to recoup (7 years if one of us passes away). This includes Social Security income in the tax calculation and assumes $50K interest and capital gains income during the conversion years.

Hamilton, that’s why it’s called “Personal” Finance, right?! I agree there’s a lost opportunity of the money used to pay taxes, but that also assumes tax rates stay at their current levels (which, for the record, I think is an optimistic forecast, especially given the higher interest rates and the resulting increased burden on the government to pay their higher interest rates on the ever-growing government debt). Regardless, I like the concept of diversification, and view the Roth conversions as a diversification of tax location. I won’t convert all of my pre-tax IRA prior to RMD’s, but I feel taking some now and some later is a reasonable approach for me, “personally.” Thanks for challenging the details, I’ve been waiting for someone to comment on the “opportunity cost” angle. Perceptive comment, thanks for adding to the discussion.

Ed Slott and many others have said that there is no “lost opportunity of money used to pay Roth conversions taxes.” Let’s say you have $100K in T-IRA and have a rate of return such that those funds double in 10 years. The T-IRA would have $200K in 10 years. Let’s also assume that the effective tax rate is 20% on withdrawal or conversion. As such, in 10 years, you would have $160K after taxes (given $40K is the tax). On the Roth side, you wind up depositing $80K in year one (having withheld $20K in taxes). In 10 years, that amount doubles, leaving you $160K tax-free. You wind up with the same amount as long as the tax rate is the same. The “cost of money” is not a factor. The Roth side locks in the rate at 20%. The T-IRA side, however, may vary depending on how much you need to withdraw at one time.

Thanks for the great comment, Glen. You laid it out beautifully, I should have included something along those lines in the article. Thanks for adding value.

Hamilton you are exactly right……..Roth conversions are important but are not a catch all.

Example………..at RMD age you need to have in your IRA around $800k so that your standard deduction makes your RMD tax free.

Example……….at age 73 that RMD factor is 3.8%……….just do the math……assuming your are married the SD is $30700 for a married couple over 65. 30700 divided by 3.8%=807789.

But yet none of the guru’s tell you that……why? Because they get you all worked up over conversions to Roth. Yes you need Money in a Roth. But you can have up to 800k in an IRA and pay no tax.

Ray, not a bad example, but doesn’t that assume $0 additional income in the calculation? What about Social Security, pensions, side hustles, dividends, etc?

I’m in the Ray camp. Don’t we want to plan for what is most likely? Living to 90 is not very likely and that is when RMDs are problematic. Also aren’t tax table indexed to inflation? That would call for using a real rate of return in your analysis I think. 8% annual real growth is not likely for me.

Hi Fritz,

Thanks for another thought provoking article! I had a question about asset allocation among retirement accounts. I know you advocate for stocks to be placed in the Roth IRA to take advantage of tax free growth for the expected highest performing assets. But one dollar in Roth does not equal a dollar in a tax deferred (td) account.

The government is essentially a part owner part of your td account. If you have $100,000 in a 401k, and are in the 24% bracket, you really only have $76,000 after taxes are paid on a withdrawal.

Lets say you have a $200,000 portfolio, and want to maintain a 50/50 allocation to stocks and bonds. If $100,000 in bonds are in your 401k and $100,000 in stocks are in the Roth, your portfolio appears to be balanced at 50/50. The problem is $100,000 in the 401k is worth significantly less(perhaps $76,000) than the $100,00 in the

Roth because of the embedded tax liability.

My question is do you take into account the relative value, pretax v post tax, when allocating assets among various accounts? If so, how do go about this calculation?

Thanks again for your outstanding work!

Brian

Valid point, Brian, and I agree with the concept of the government being a part owner of your Tax Deferred accounts. I don’t factor that in when I do my asset allocation since the td account will continue to grow based on the chosen asset allocation until the time of withdrawal or Roth conversion. Good food for thought.

I am 69 yes old, will retire next year and then take S.S. I have only $ 200,000. In a traditional Roth, which I will need to draw from for daily living expenses. I also just read in the article we can’t withdraw from a conversion for 5 yrs. That being said I think I’m not a candidate for a conversion, unfortunately. And yes I probably shouldn’t be retiring with so little. ( I do have CDs, bonds and cash). Your thoughts on a conversion ? Thx, Becky

After 59.5 you can withdraw the converted amount without waiting 5 yrs. That wait is if you are younger than 59.5.

I would say it most likely wouldn’t make sense in your scenario. Just take the minimum out you need after S.S. and when you get to RMD it likely won’t be an issue.

You mentioned having $200K in a “traditional Roth” which would not be subject to RMD nor taxation. If you meant to say “traditional IRA” of $200K, then I don’t think you need to worry about high RMD amounts. Your tax bill should be low unless you have something else kicking out a decent chunk of taxable income. Your biggest concern should be making sure you conserve enough nest egg so you don’t run out of savings.

Schwab has a handy online RMD calculator you can use and you don’t need to have an account with them.

Bz, as others have mentioned, I’m assuming you mean “traditional pre-tax” instead of “traditional Roth”. Assuming that’s the case, I agree with others that a Roth conversion likely doesn’t make sense in your case, just withdrawal the money as you need it for spending and deal with the RMD’s as required.

I’m now 63, retired at 61. I’m doing Roth conversions to the top of 24% each year, approx $200k per year. I’m doing it primarily to protect my heirs from paying the taxes during their peak earning years. Paying the taxes now out of my taxable brokerage account (approx $40k/yr) is PAINFUL, though.

Right on the heels of Hamilton’s argument against doing Roth’s, here’s John hitting them hard. For the record, I’m in your camp, John, and have been doing 6-figure conversions for the past 3 years. And I agree, that Quarterly Estimated Tax is a painful bill to pay each quarter, but I just keep thinking of how much I’m helping my wife and my daughter as I make those payments…

I’m in your exact same situation. Same ages and all. I’m doing the exact same thing as you. Have to find a way to ease the tax pain on my kids. Taxes would be so high it wouldn’t make sense for them to work.

I agree. We received an inherited IRA from a parent and the RMD moved us into higher tax brackets. So, we have been converting our IRA’s to Roth IRA’s while trying to stay below higher IRMAA thresholds and avoid the Investment tax of 3.8%. This seemed to work for the last several years. Now that beneficiaries have to take an inherited IRA in 10 years, we felt we should do it now over about a 7 year period. Congress should clean up all this stuff so that brackets line up better, there are no cliffs, and we can finally decide on one income number rather than AGI, MAGI, and Provisional Income. This will also benefit the surviving spouse which I had not considered.

Hi Fritz!

We have been converting about $40K annually for the past 3 years. Will continue until 2025, my age will be only 67. Plan on drawing SS at age 68 or 69 at this time. Also plan on reducing her old 401K by withdrawal method prior to RMD’s kicking in. Her Roth will be the last touched account. With SS added in, we will not have to withdraw much in our latter life. God is good, indeed. Anyone reading this for tax planning purposes is blessed already, and ahead of the general population!

Our children/grandchildren will be read into our personal finance strategy soon. Will research what is the best way to convey our wishes with their inheritance, but realize they can spend it however they want to. I’ll be in a better home when I am 6 ft under and it won’t matter to me. Generational wealth is important but most important is that the kids are happy with how they invest/spend unexpected funds AND live their lives with purpose. You know?

May God continue to bless you and Jackie….and your readers, Steve

Thanks for the reminder of how blessed we are to even be having this discussion, Steve. You’re spot on.

I am on the side of less Roth is usually better. In the first place “most” boomers will never have $1m in their IRA, especially if they do a little planning ahead.

As a boomer in his 70’s I have already enjoyed over a decade of spending TIRA money in the 12% bracket and less, for which taxes were deferred in the 25% – 33% brackets in the 80’s and beyond.

In a state with no income tax it is highly unlikely for me to be able to spend money in the 25% bracket even as a single person (which I am not, even in my 70’s.)

I don’t mind the “fear mongering” as it just means there will be more taxes sent in now, by others. Many spent lots of “ink” suggesting the Bush tax cuts would be repealed, which didn’t happen. I think this time will be no different, but even if it isn’t the top of the lower tax brackets keep marching higher right along with inflation. RMDs have already moved out to 73, which helps, and before you know it will be 75.

Did you just call me a fear monger? That’s probably going a bit far, but there’s always the possibility that I’m entirely wrong about future tax rates. I’d argue I’m not “mongering fear,” however, if I’m practicing what I’m preaching. Perhaps, in addition to being a fear monger, I’m just hopelessly naive….

Obama let the Bush income tax cuts expire. I was the guy that was giving everybody the “I told you so” the first paycheck when everybody was complaining.

John, I suspect this article may be attached to some “I told you so” emails in the next decade or so. Tax rates change, and you simply have to weigh the odds. Will future rates be higher or lower? Each person has to make that call for themselves, but I prefer the bird in hand and expect we will see higher taxes at some point in our future.

Thanks, Fritz! We’ve been converting Trad to Roth since 1999 as part of our investment strategy. Next year we will be 100% Roth (a 25 year process) & believe it will position us best for the future.

Congratulations on achieving the “100% Roth” milestone. That’s a HUGE achievement that very few ever achieve. The fact that it took you 25 years demonstrates what a difficult thask that is to accomplish.

I wonder if “I’M 100% ROTH” will become a “thing” in the future, kind of like “I’M DEBT FREE” has been with Dave Ramsey??

Do you realize that if your combined SS benefit is $60K (and you are both 65 or older) and drawing 4% from your T-IRA (making a gross income of $78K), you could have $450K in your T-IRA and but owe $0 in federal taxes (due to the current standard deduction)? In this scenario, you would be withdrawing $18K each year tax-free from your T-IRA. If the TCJA expires in 2025, you could still have a sizeable amount in the T-IRA and still not pay any taxes. Additionally, if you need funds to cover long-term care, there is a good chance that much of that cost may be tax-deductible. I have purposely left some funds in our T-IRA to address this possible need.

Glen, thanks for including the SS in your example. Ray left it out in his example above, where he argued you could have $800k and owe $0. I challenged him on the assumption of “no other income,” then came down and saw you doing the same math but including SS. The $800k drops to $450k as a result. Well done.

A financial planner showed us that given certain assumptions we would pay significantly less total taxes over our lifetimes with Roth conversions. I don’t think I have seen that number discussed. Could you show that number for your hypothetical couple? I believe in math.

I believe in math, too. That math, however, is beyond my current appetite (I’m heading out mountain biking this afternoon, after all!). I would expect you could model both scenarios (doing Roth conversions vs. not doing Roth conversions) in the New Retirement Roth calculator to get an answer. Perhaps you could share what your financial planner put together as an example?

What is the minimum wage h you suggest converting? We are 52 and 55. From what I read it we do it prior to 59.5 we get hit with penalties as well.

Diane, as long as you do the Roth conversion inside your 401k, it’s my understanding that you don’t have to wait until age 59.5 (not providing advice, and I could be wrong, so would strongly recommend you check with your 401k provider and/or CPA before doing a conversion).

As for “the minimum wage” I suggest converting, it really depends on your current situation, where you fall in your marginal tax bracket, how much pre-tax % you currently have, whether or not you get an ACA subsidy, etc. Afraid that’s not a recommendation I can provide without a lot more details, but you can get a sense of how I recommend “topping off” your marginal tax bracket in the “Roth Conversion” article I linked to above.

I have a question about this strategy. Is it true that you can convert a 401(k) to a Roth prior to age 59 1/2 without any additional penalties? In other words, do I need to be 59 1/2 before I can execute the strategy?

You can do Roth conversions before age 59 1/2. You need to check with the plan manager of the 401k under what conditions you can do a full or partial conversion (not all allow it). However, you should not pay the taxes on that conversion from any tax-deferred accounts (such as a withholding). You need to use savings or funds from a taxable brokerage account or possibly an inherited IRA (that allows distribution). If you withhold the taxes using the T-IRA (source of conversion), the IRS will view that tax withholding as an early withdrawal, which would be subject to early withdrawal penalty (10%) as well as treat it as income that is subject to ordinary taxation. If you act within 60 days (of that “withholding”), you can “return” any withholding to the T-IRA so long as you did not do any prior (IRA to IRA) rollover subject to the once-every-12-month limitation.

Jim, I did Roth conversions at age 56, 57 and 58. I had to call our 401k administrator (Vanguard) directly and execute the conversion via snail mail due to our plan guidelines, but I was able to get it done. As mentioned by Glen, I paid the taxes due from a separate taxable account to avoid penalties.

Thanks for the confirmation to continue my conversion plan for 2023. We’ll do one more in November.

I’m putting the conversion plan on pause for 2024 & 2025 to keep our taxable income down to qualify for the Affordable Care Act subsidy until Medicare kicks. Bittersweet, but happy to leave the Cobra payments behind.

You’re welcomed. 😉

Thanks Fritz,

I have read nearly all the your past articles and have purchased your book, and look forwarded to these notes. I really appreciate your insight and this article.

I was wondering if you could address the other end of this spectrum. We have been converting for a couple years now, targeting staying below 32% marginal tax rate. Other internet bloggers suggest that there may be a group of retires or soon to be retiree’s where converting 100% of traditional IRAs, over a couple years might make sense.

What do you think?

Especially for those items in your argument #1 and 2. Plus Estate taxes which are assessed on Gross values. IRA and Roth are tax equally $ for $. We are 65 and 66 professionals who contributed to IRA/401K plans their entire careers now with balances in excess of 5 million, have pensions, have income from other sources (family farm), and have dividend and interest income. Having a 401K/IRA with force RMD income is more than a good problem to have. We are looking into qualified charitable distributions and perhaps prefunding qualified endowments, and other gifts. But, why not convert all our IRA/401K to Roth over time? Say 7 or 8 years before RMD. We believe taxes will go up, now is a sweet spot. Also, we have the current benefit of living in a State that does not tax retirement or pension income. We plan to move so that factors into it too. We not worried about cross over curves, or IRMA, or really SS since RMD will kick us in or above current 37%. We like to manage were our saving go and not just turn it over in tax

So, if you have saved well, and really don’t need the RMD, what about converting 100%, and mostly for argument 2 and managing Estate taxes? Is this a topic for a follow up article? Thanks.

You didn’t ask me but with that kind of financial portfolio and the various moving parts, I would suggest hiring a fee only advisor whose expertise is drawdown strategy and tax planning to run some numbers for you, so you can come up with an optimal strategy.

“Other internet bloggers suggest that there may be a group of retires or soon to be retiree’s where converting 100% of traditional IRAs, over a couple years might make sense.”

Dennis, thanks for being an avid reader of my work, much appreciated. The biggest problem I have with accelerating Roth conversions is the reality that it would force you into much higher tax brackets. If you’re less worried about potentially paying more taxes than you would otherwise, it’s a consideration for the legacy impact. It’s a potentially very expensive way to proceed, tho. As for a potential future article, I’ll add it to the list, though the target audience would be a pretty small niche.

I agree with Lynne that it’s an appropriate topic for a CFP or CPA, given your sizeable estate. I’d hire somebody on a fee only basis to do a complete review of your situation and give you some counsel.

Good point on Qualified Charitable Donations, we’re doing the same with our pre-tax IRA (in addition to Roth conversions).

Nice write-up, Fritz. I would submit that for a lot of early retirees, capital gains harvesting should come first through the 0% bracket if they have significant after-tax assets.

Whether or not Roth conversions make sense will depend a lot on the individual situation. As you point out many will get healthcare through the ACA, which is essentially a tax at about 9% at the margin for every dollar of additional income. Add state taxes to that as applicable. You may end up at a marginal tax rate that can be cost prohibitive. As far as future tax rates – it is true that they are historically low but whether or not there will be changes is pretty speculative, I prefer to deal with current reality and what the most effective option is under present circumstances.

“…if they have significant after-tax assets.”

Fair point on capital gains harvesting, Dr Z, though I suspect most retirees have more in retirement accounts than they do in after-tax assets. Also, thanks for putting some numbers behind the fact that those with ACA subsidies need to be very careful about doing Roth conversions. As for future tax rates, only time will tell…

Fritz,

This should be classic investment analysis and time value of money. The investment is prepaying taxes now (from the IRA to Roth IRA conversion) to generate cash flow in the future (lower or no taxes from an RMD). How about applying an ROI or IRR approach to show the return on the investment and demonstrate that is is the best use of the money?

pc (great nic, btw), see Glen’s comment above from 10/12 1:22 pm, he addresses exactly this point better than I ever could…

Well done Fritz, one consideration I’m not sure is covered is use of qualified charitable deductions that serve as a credit against the RMD and do not count as MAGI for IRMAAs. Mike Piper has a good treatment of this in his most recent book More Than Enough.

Steve, thanks for bringing up the QCD’s (also mentioned by Dennis Boyd above). No doubt, QCD’s are a viable option to help deal with the RMD issue, and I’m doing them myself in addition to the Roth conversions. Thanks for the recommendation on Mike’s book. I’m a fan of his work and will add it to my “To Read” list…

Fritz,

As always thanks for the great, well laid out information.

Question: I am 59 yoa, retired, and have a 50/50 split of after-tax retirement investments ($500K) and IRA investments ($500K). What would be the difference if I took retirement funds out of my IRA over the next 3 years (~$300K) to pay off our mortgage, as opposed to doing roth conversions for the same amount ($300K) as opposed to using the after-tax retirement investments to pay off the mortgage.

Is it essentially the same, six of this, half-dozen of the other, or is there a significant benefit to the the Roth conversion?

Hmmm….this one will require some thought. My initial reaction is you’d be best to use the after-tax money to pay off the mortgage (assuming you have a high interest mortgage. If it’s <5%, I'd argue you're probably better off keeping the money invested and earning a higher net return over time?).

If you pay it off with after-tax money, you'd have $300k growing tax free inside your Roth forever. If you pay it off with the IRA, you'd have $300k growing in the after-tax, which would be subject to tax on the dividends and capital gains. I suspect the impact over your remaining ~30 years of life would be significant, hence my suggestion that you'd use the after-tax and let the Roth continue to grow (again, only if you have a high mortgage interest rate).

For insights as to projected IRMAA brackets, the Finance Buff does a great analysis each year

https://thefinancebuff.com/medicare-irmaa-income-brackets.html

His projections have been spot on and I am using these this year since I am on Medicare and I am converting in excess of $100k this from tIRA to Roth.

Paul, thanks for the addition of a great resource. I wasn’t aware of it prior to seeing your comment.

The tax problem of RMD’s is referred to as a Tax Bomb.

“My employer lied to me. I wasn’t reducing my taxes, I was simply delaying them until the date when those funds were withdrawn, at which point they would be taxed as income.” Shame on you for not doing your own research! There really was no other option then and they did you a huge favor getting you to invest money you would have likely otherwise spent. If you HAD done your research back then you would have known the main benefit was deferral of taxes, not nonpayment of them. And that benefit is substantial, especially if you don’t know how to chose the companies that will peak out exactly when you need the $. So this whole complaint is lame.

For me, the Golden age of conversions was a number of years ago, when they allowed you to defer the taxes another year or two. At that time I swapped out about half my 401k for a Roth. I looked at continuing the conversion process past that, but to me paying taxes now seems like an error. We really don’t know future tax rates. People keep thinking they will go up, but reality is your analysis mostly ignores inflation, and that is essentially the tax you cannot avoid.

No worries, aP. I was 22 at the time that comment was made, I’d done my homework by the time I was 23 and continued to aggressively save in my 401k pre-tax, knowing the reality that those taxes would be due someday WAAAAYYY out in the future when I got old.

Since then, I got old….

I love reading articles that validate all the decisions I’ve made and implemented. I’ve done Roth conversions to top off the 12% bracket since 2018, paid an extra roughly $4500 or so in taxes each year. It got me used to using the estimated tax payment system, a good lifetime habit to have.

In the past few months, I made an Excel-based model that handles taxes, SS taxability, account value projections, Roth conversions, etc. I initially modeled continuing my Roth conversions until our IRAs were all converted into the Roth accounts, and it took about 15 years (I’m 67, wife 64). All of this done within the 12% (moving to 15% in 2026) bracket. Seemed good, and I ended up with lifetime taxes going forward of about $420,000.

For some reason, I decided to see what would happen if I topped off at the next level, the (currently) 22% bracket. For 2023, that top is $190,750. It’s a model, can’t hurt to look, right?

Imagine my surprise when my lifetime taxes dropped to by $96,000, down about 25% from the slower approach. Yes, I incur some IRMAA, but the additional amount totals about $1600 over six years. That’s under 2% of my savings, and not material. And yes, my annual taxes go to $40,000ish per year, but then they stop forever. Entirely manageable.

Another great side-effect, as you indicated: my conversions will be done about the time I hit 74. My RMDs will be taken on tiny IRAs, and total about $6000 over two years. Then the traditional IRAs are zeroed out. All of our future distributions will come from the Roth accounts.

I don’t pay taxes after the next 6 years or so. The surviving spouse has no worries due to taxes, since there are none. The beneficiaries of my estate have nothing to worry about. I wouldn’t even have tried this except for my Excel model, the online sites didn’t point me this way.

So your advice is rock solid, and I’ve been living it for over 5 years. Thanks for the article!

I can’t quite comprehend how the lifetime taxes goes down if you are going to the 22% bracket instead of 12%. Would really appreciate if you would be willing to share your excel spreadsheet. What if they extend the tax cuts does that change things ? Will you reget going this route ?

Chris, thanks for the feedback. I will be willing to share the spreadsheet, or a version of it, as I’d love to have someone else validate it. I’m fairly meticulous and good modeler, but not infallible.

I want to redo my taxable Social Security logic so as to remove the macro (code module) I use now. That will make the workbook more transparent and not require coding for someone to audit it. And I have a couple other small improvements planned to allow me easier planning as I go through retirement.

I have modeled using ‘revert to pre-TCJA’ rules in 2026, so it can only get better if lower rates continue. I believe that addresses your regrets question.

I know, it’s non-intuitive to think a higher tax bracket yields lower taxes overall. But if you think about it, it’s just math. To greatly simplify, I have a 30 year planning horizon. If I front-load the taxes, and pay 10% higher tax on a) only a portion of my income and b) only for 6-7 more years, that should easily get dwarfed by future portfolio growth over 20+ years.

I haven’t yet modeled this next idea, but if I die early, say age 74, our income is still all in Roth. Taxes play no part downstream. Seems like the advantage outlasts me. And it would only be greater comparing to single rates.

So far, I’m happy. And since this was year 1 (I bumped my 2nd Roth conversion up last week), I can change my mind if I’m in error. We’re taking a year off next year for my wife to be on ACA and qualify for the subsidies for 7 months, which will mean a tax-free year in 2024, with no Roth conversions.

I hope that helps you see what I’m doing, or think I am! If you want me to contact you to review it via Zoom or something, reply with your email, obfuscating as necessary to evade spam scrapers.

PS – I mean, I can change my mind for the next year of Roth conversions, which for me is 2025. I know I can’t undo my 2023 Roth conversion. Sorry for the confusion.

Interesting results, Mark. As cited by chris, it seems counter-intuitive and hard to wrap my head around. Make sure you model is something you’re comfortable with (I love it when DIY’ers build spreadsheet models to make decisions, btw), but I agree with the other benefits you’ve cited from doing more aggressive Roth conversions. Just check your math…

Thanks for the thoughts, Fritz. I’m eager to get some input from some sharp minds as I develop this. I feel good about it so far, and Dinkytown and my own logic tells me I’m fine for 2022 and 2023, the only calculators available. But caution is always worth considering before big money moves. I’m committed for this year. Tripling my taxes was kind of a gulp moment, but it’s just a number.

Just curious why you didn’t consider using a tool like New Retirement or Pralana Gold to model your projections in lieu of creating your own Excel workbook from scratch? These software packages are not free but would appear to cover the kind of projections you want to do but with much less effort.

So as I’m 70 1/2, we just started taking SS this year. I started QCD this month as our contribution to church…then taking the same amount for a Roth conversion…as far as I can see I will continue that into at least the first 5 years of Rmds to help reduce the amount of Rmds and help tax bill if only one of us is left.

Julie, you’re the third to point out the value of QCD’s in dealing with RMD’s. I’m doing QCD’s myself in addition to the Roth conversions. I should have included the QCD option when I cited the three options of what you can do with the pre-tax IRA money, thanks for adding value to the discussion.

I started doing large conversations but backed off when it occurred to me that the limit on the SALT deduction was killing me. I couldn’t deduct the amount I was paying in state income taxes off of my federal return due to the $10,000 dollar limit. Just one more thing to consider for those of us in high tax states ( I live in California). Any thoughts on this factor?

Brent, good point in bringing up the SALT impact. Fortunately, I don’t live in a SALT state, so it wasn’t something I considered. Definitely a factor for those in SALT states, especially if you believe the SALT “penalty” will go away at some point in the future (or, if, like many others, you’re considering moving out of a high tax state in the future). Essentially, that would be an argument that future tax rates could be lower in SALT states, which would be a valid reason to reconsider doing Roth conversions.

The SALT limit sunsets at the end of 2025 with the rest of the TCAJA so bottom line is that this golden age of Roth conversions is less golden for those of us in states with high income tax. I’m still doing the conversions but at a slower pace than I initially planned.

Another benefit of doing Roth conversions is to beef up non-MAGI income (e.g., Roth IRAs) for early retirees who will be on ACA. My spouse and I are 53 and 57, respectively, and will both be retired beginning in January 2024. We will simultaneously be adding to and withdrawing from our Roth accounts prior to getting on Medicare at 65 since our after-tax accounts can’t support us in full and we aren’t yet eligible for our Traditional IRAs. Once we are eligible for tIRAs, the addition of Roth account will help to keep our income within the ACA limits and bridge this period.

TL, no doubt, having investments in diversified tax buckets can definitely be helpful in managing your taxable income going forward. You’re fortunate to have enough in the Roth to allow you to play that game during your ACA years…

I’m an early retiree (53) with a mix of pension, rentals, and investment income. So far my portfolio is about 42% trad, 41% Roth, and 17% taxable. I’m converting enough to stay within the lower tax bracket and also have a 72T distribution until I turn 59 1/2. Your article is spot on regarding why conversions are a good idea and I share your belief the tax brackets will go up in the future. My RMDs don’t kick in until I turn 75 so my goal is to have all pretax conversion completed by then. I have several neighbors and friends who are approaching retirement and I always suggest to them to check out your website and blog. Thanks so much for taking the time to share your thoughts on retirement planning and your life.

“I have several neighbors and friends who are approaching retirement and I always suggest to them to check out your website and blog.”

A sincere “Thank You,” Tom. As a writer, I could ask for no greater compliment.

Fritz, great post and to get us thinking with that all that wisdom we have developed over all the years 🙂 A site I cannot live without now, is NewRetirement. It not only has a ROTH conversion explorer, but so many other things in the tool box. So much fun to input a number or click a button and see what implications it can have on your lifetime scenario. I hope you are enjoying the fall…. its neve going to be here again, so get out there and go for it!

“A site I cannot live without now, is NewRetirement.”

Good to hear. You’re going to love an upcoming post I have titled “Food Stamps to FI – A Case Study in Retirement Planning.” I’m working with the folks at New Retirement on a case study. Don’t tell anyone yet, we’ll consider it our secret. Wink.

Fritz, You may lose out on some government credits/subsidies if you convert too much from IRA to Roth in a year. For example, if a married couple’s MAGI goes above $300K after conversion, they would no longer qualify for a $7,500 credit for buying a new Tesla or other qualified electric vehicle. I believe several other credits/rebates will be offered under the Inflation Reduction Act for energy improvements in the home and that these may have income limits as well. These income-limited credits along with IRMAA make it difficult to calculate the right amount of Roth conversions to perform.

Thanks for the additional insight, Bob. Good thing I’m not planning on buying a Tesla anytime soon…

Nothing beats taking a deep look at your own personal situation. For me, I use a combination of the Flexible Retirement Planner program, IRS calculators.com for tax calculation and the RMD calculator from AARP to dive into the painful world of future taxes.

The takeaways for me after a recent trip down this rabbit hole is:

1) In all cases for me (I’m 65 and currently retired and living in the 12 % bracket with a sizeable reconning when it comes to RMDs), I will be further ahead both with regards to tax payments and total accounts balance if I keep doing limited conversions to my Roth. However, it’s NOT as much as one might think concerning all the hype. You have to add up the extra taxes you’re paying for the conversion and compare it to the future. You might even find, as I did, that you might not break even until you hit 85…food for thought.

2)The tax money you spend now has to come from somewhere. If you pull it out of an acct that’s maybe making 6%, an 80k total tax investment over 8 years could be worth 100k left in the acct it came out of, so add that into the calculations above and maybe your break even point just got moved further out.

3)Many articles like this one get hung up over federal tax brackets. I’d argue that doesn’t really matter. What does really matter is your total tax percentage when you include federal, state, and capital gains. The above calculator I mentioned does that for you. For example, it matters where in the federal bracket you are…there isn’t much difference in total tax percentage between the high end of one federal bracket and the low end of the next one up, so why worry about filling up brackets with conversions? That’s not what matters.

The biggest reason I can see for doing Roth conversations is to give your heirs more options when passing wealth down. If the goal is just to lower your tax deferred reserves, pay less taxes, and have a retirement income stream that won’t run out, then maybe…gulp…an annuity is a better avenue to get there.

FWIW, I enjoyed reading your article and it has a lot worth considering.

“The biggest reason I can see for doing Roth conversations is to give your heirs more options when passing wealth down.”

I’m with you on that one, Scott. Interesting that it’s not a more common topic of discussion.

If I convert to a Roth and the investment goes down, I have paid unnecessary taxes on a diminished asset. If a distribution is placed in a taxable account and the investment goes down, I can tax loss harvest and save taxes. The loss of recharacterization made Roth conversions less valuable.

Going from the 12% to 22% tax bracket is an 83% increase in your marginal tax rate.

The Standard Deduction and tax brackets are adjusted for inflation every year especially at age 65. Many Federal and State retirement credits exist.

If a retiree is subject to IRMMA then you are in a high bracket. I am not going to worry about your income. You have enough to be comfortable.

I’m hoping, given the 20+ year time horizon I’m considering, that none of the investments in the Roth go down over that time frame. From a short-term perspective, I agree with you that tax harvesting in a taxable account is a sound strategy, but it doesn’t eliminate the value in also doing Roth conversions, IMHO.

My wife and I are 63 years old and plan to retire in 4 years. We have 90% of our money in 401k’s and about 10% in after tax brokerage. We are now in a very high tax bracket so doing ROTH conversions now would bite us hard. If we wait until retirement when our tax bracket is lower and we do the ROTH conversion, we will then have to live out of our ROTH along with SS. Does it make sense to convert or just pay as we go and do the RMD’s at 73 when taxes would be lower? Our time line on ROTH is short with no longevity for tax-free growth as it will be depleting.

Great article — I agree with all your arguments and response comments! I especially want to echo your discussion of the widow/widower tax penalty. This point doesn’t get mentioned enough in articles on Roth conversion strategies.

I have modeled retirement drawdowns in sequence across our 3 account-types: 1) taxable; 2) IRA; and finally 3) Roth. I was mainly considering that we needed to get our IRA balances low enough such that, when we are in phase 2 and hit RMD ages, we would not be forced to withdraw any more than we had planned to spend anyway during that phase. It seemed like we could get there without being too aggressive on Roth conversions.

However, I only recently realized (as your article properly highlights in #2) that tax-bracket income limits are CUT IN HALF if one spouse dies. We are lucky to be in good health but, holy cow, the widow/widower penalty would be a huge, unhappy game changer!

So, for all the reasons you have argued above, we are increasing our annual conversion amounts.

-What are the key strategies and considerations individuals should keep in mind when navigating ‘The Golden Age of Roth Conversions’? How can one make the most of this opportunity to optimize their retirement savings?

Howdy Fritz,

Thanks for the great info!

I believe there is an incorrect tax rate in the Argument 1 2017 MFJ table: the $75,900 – $153,100 bracket rate should be 25% and not 22%. Would be nice *IF* it was 22%. 😊

Keep up the great work!