A Retirement Investment Drawdown Strategy is a key element in retirement planning. The strategy used in the “Withdrawal” phase is fundamentally different than the “Accumulation” phase, and it’s important to define your withdrawal strategy prior to your retirement date. Today, we’ll outline our personal retirement investment drawdown strategy as an example for you to consider.

Note: I also wrote an update on how this strategy actually worked after we retired. Read this one first, then check out “Revisiting Our Drawdown Strategy After 3 Years of Retirement.”

A Retirement Drawdown Strategy is a key element in retirement planning. Click To TweetI think about the “Accumulation” vs. “Withdrawal” a bit like an escalator. On one side, you’re working your way up. On the other, you’re working your way down. They’re fundamentally different motions, but both entail the same escalator. In the same way, both Accumulation & Withdrawal entail the same assets, but the motions are markedly different. On the way up, energy is expended to lift you higher. On the way down, brakes are used to slow the descent. (Another analogy I thought of is an airplane taking off vs. landing, hence the Featured Image at the top of this post)

In full transparency, I stole the idea for this post.

I stole it from a Doctor. A really smart doctor. I told him I was stealing it. He didn’t seem to mind, and in fact encouraged me to write this piece based on his original post. I’m replicating his original format to allow easier comparison between his drawdown strategy and mine. Perhaps we’ll start a trend (See The P.S. at the end of this post…I’ve got an idea), it’d be interesting to compare strategies between bloggers.

Below is the comment exchange with “Doc” that started it all (check out Doc’s original post at Our Drawdown Plan For Early Retirement, by PhysicianOnFire.)

Our Retirement Investment Drawdown Strategy

Prior to today’s post, I did not have a written document outlining our Retirement Investment Drawdown Strategy. I had it clearly defined in my head and knew what we were planning to do, but had never committed it to paper. It’s a good thing to do, and the writing of this post has been a good exercise for this writer. Thanks again, Doc.

Today, We're Writing Our Retirement Investment Drawdown Strategy On Paper Click To Tweet(Not paper, actually, but rather mysterious electrons flying around some Cloud, whatever that means. Isn’t our technology amazing?).

What We’re Starting With

Starting at a high level before moving into the details of our plan, let’s have a look at our current Asset Allocation:

As we’ve moved closer to retirement, we’ve reduced our stock exposure from ~70% to ~50%, and increased our bond allocation accordingly. If When there’s a market correction, we’ll likely rebalance a bit back into equities, but as a conservative investor I’m comfortable with our overall Asset Allocation at this stage, especially given the current CAPE Ratio of 29.5 (then again, I suffer from The One More Year Syndrome). We’re intentionally positioned a bit defensively at this critical point leading up to retirement.

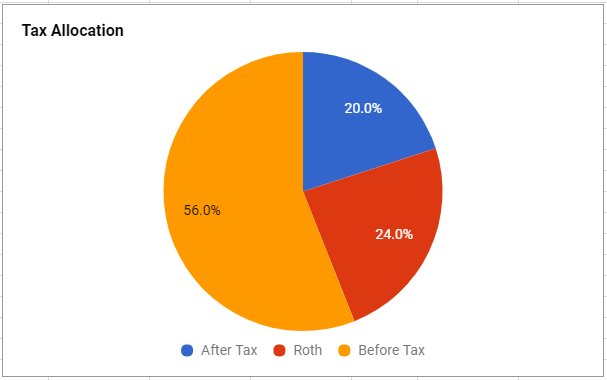

This pie chart shows the “big picture” of our retirement holdings by tax status. We have 56% of our retirement money in Before-Tax accounts, which will be a tax management challenge in retirement (you’ll see details on our strategy for minimizing taxes in the detailed strategy below).

Unfortunately, the Roth wasn’t available until well into my career, so the only option we had was to invest our 401(k) into the Before-Tax fund. Never give up that company match! When the Roth was added, we began contributing to it as well. We’ve also done some “Mega Back Door Roth” conversions, which are outside the scope of this article but have contributed to increasing the Roth piece of the pie to 24% (I wish it were larger, like Doc’s 50% in After-Tax. He’s in good shape from a tax perspective, whereas I have bigger challenges in that department).

While “Doc” presented his detailed holdings in his strategy post, I’m going to skip that in my document. I have all of the detail, but I don’t think it adds significant value to this post (ah, the freedom of being a blogger. You can decide what’s in, and what’s out. Poof, it’s done! Have I told you lately that I love to write?).

As an example of the level of detail I track, below are the holdings from our after-tax accounts, in the same format as Doc’s original post:

A word of caution: don’t draw any conclusions by looking simply at our After-Tax holdings. The various tax accounts must be looked at holistically to understand how we’re allocating our assets on a broader scale. Having said that, note the 16% in Muni-Bonds. These make sense for us in the after-tax block, given our high-income (& taxes) and the favorable tax-free treatment of muni-bond interest payments.

Asset Location Strategy – Tax Optimization

An important part of retirement income planning is to ensure you put the “right” kind of investments into the “right” kind of tax structure, such as my Muni bond example above (it’s best in after-tax since earnings are tax-free).

Some other examples: where should a REIT be held? (Real Estate Investment Trusts pay high dividend yields, which are taxed as income if held in an After-Tax account) What about bonds? What about equities? While Doc didn’t address this in his post, I think it’s important, so I’ve added it here (and, just like that, it’s in. I love this stuff….)

Below is a summary of the types of funds best suited to various tax accounts:

The First Moves We’ll Make When We Retire

Delay The Pension

One of the biggest decisions we have to make prior to our retirement date is when we’ll start our pension. I’m sincerely blessed to be the “Last Of The Dinosaurs” with a Corporate Pension, and I’m thankful. I’ve worked hard for that benefit over the past 32 years (yes, the entire duration with one company! Wow, I really am a dinosaur), and it’s an important part of our retirement plan. We have to insure that we optimize this piece of the retirement income puzzle. 3+ decades of effort and finally our payday is on the horizon.

Just like Social Security, a pension grows if you can delay the start date. In the case of our pension, it grows ~6% annually during the deferral period. Big number, especially in this low-interest-rate / high equity valuation environment. There are few investments where you can get a guaranteed 6% rate in an ultra-safe investment, so we’d like to defer the pension as long as feasible.

The chart above shows the impact of delaying our pension, with a deferral to 2020 increasing the % of our retirement spending that would be covered by our pension from 69% to 78%. That’s huge.

Unfortunately, delaying the pension means we’d be pulling 100% of our spending needs from our investment assets during the period of the deferral, and it’s critical to ensure we have the liquidity for that large of a pull in the first few years of retirement. We can’t defer forever, and we have to figure out how long we can push this thing. We’d be looking at a withdrawal rate close to 8% during the deferral, which would decline to 2% after the pension kicks in. Alternatively, we would start on Day 1 with a withdrawal rate closer to 3%. Interesting analysis, glad I have some time before I have to finalize our pension start date decision.

To support our pension deferral analysis, we’re taking a creative approach to debt. After being 100% Debt Free for the past 15 months, we’ve decided to get a loan in conjunction with our “Good To Great” relocation that’s currently underway (Quick Update On The Move: the old cabin hits the real estate market this week, fingers crossed for a strong selling price! And, we LOVE the new “Great” cabin, having moved in a few weeks ago. It’s perfect for our retirement, and we’re glad we made the second move just 13 months after our last downsizing move. Exciting times! I’ll break down the final financial impact in Good To Great #4, or #5, after we get the final numbers. Hoping to bank ~$30-40k net after the dust settles).

More on the debt decision in a future post, but the 3.5% mortgage allows us low-cost flexibility until we finalize our pension deferral decision. We’ll hold the equity from the old cabin sale in an isolated reserve account at CapitalOne360, and can pay off the mortgage at any time with a simple transfer of the reserve. Nice option, at a low price. I’m buying.

Tax Optimize IRA conversions into A Roth

If we defer our pension, it also means our income will be zero during the deferral period. This will provide an ideal opportunity to pull heavily from our Before-Tax funds and convert them into after-tax and/or Roth at the lowest possible tax rate. Since I’ll be 55 when I retire, I can pull 401(k) Before-Tax money without penalty, a small loophole in the IRA code that gets us around the traditional Age limit of 59.5 normally associated with withdrawing tax-favored retirement funds.

We’re planning on withdrawing before-tax money right up to the limit of the marginal tax brackets during the time of the pension deferral. Ultimately, it will also reduce our Required Minimum Withdrawals at Age 70.5, which may otherwise “force us up” into higher tax brackets due to the fact that the RMD is taxable.

It’s complex, but I think it’ll work. I’m planning on lining up a meeting with my CPA to talk through the specifics, but it affords a limited time opportunity to adjust that 56% Before-Tax slice of the pie in our Tax Allocation chart shown earlier.

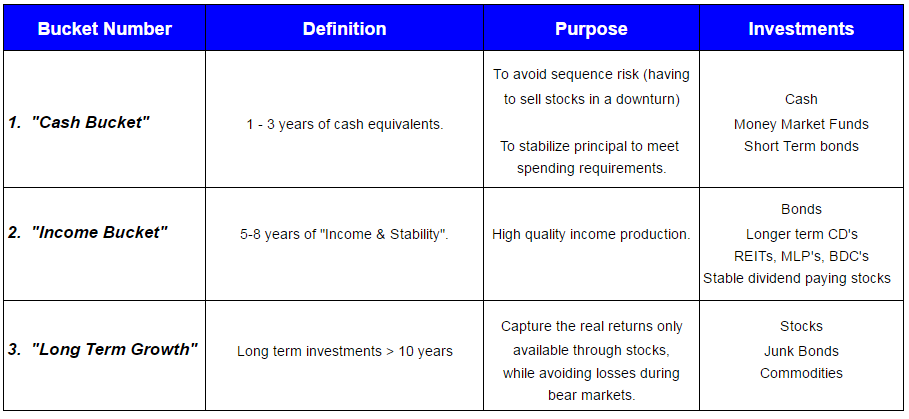

Implement The Bucket Strategy

I’ve written previously about The Bucket Strategy in How To Build A Retirement Paycheck From Your Investments, one of my most popular articles ever (and a Rockstar Award winner!) with over 16,000 views to date. I even built my first Infographic for the post. I won’t rehash the strategy here, but will say that it’s an integral part of our Retirement Investment Drawdown Strategy, and fits well with everything else I’ve written in today’s post.

In summary, we’ll be allocating assets across 3 buckets, based on when we’ll need to access the money. See the article for full details

Figure Out Health Care Insurance:

A BIG issue and one which I’m starting to study in detail is how we’re going to manage the mine-laded field of private health care insurance. I’ve built a worksheet with links to everything I can find on the options, and we’ll be making our “Private Pay Health Care” decision prior to retirement. Probably some posts on this one, it’s a biggie, and we don’t yet know what we’re going to do. We’ve budgeted $20k/year for health care/insurance, but I fear that’s insufficient. What a mess…..

Setting Up Our Paycheck

It’s been “fun” to figure out how to manage all of the financial stuff in a low-maintenance manner. We really want to “make it easy” in retirement, but it’s a complicated subject. We’ve come up with a simple 3-step solution that will work for us. We’ll manage the tactical “monthly paycheck” in the following manner.

1) Separate “Paycheck Account”: At the start of each year, we’ll transfer our total annual “paycheck” amount into a separate account with CapitalOne360 based on our targeted withdrawal rate for the year. We’ll set up monthly ACH transfers into our checking account (Annual/12 months), then simply live on the cash in our checking account without having to worry about strict budget tracking. If we have money in our checking account, we know we can spend it. If we run low, we know we need to cut back. Easy, and part of our financial plan to Move Our Retirement From Good To Great (wow, that series has been a hit! More to come…Teaser Alert: I have Episode 3 of the Series in a Draft form…stay tuned).

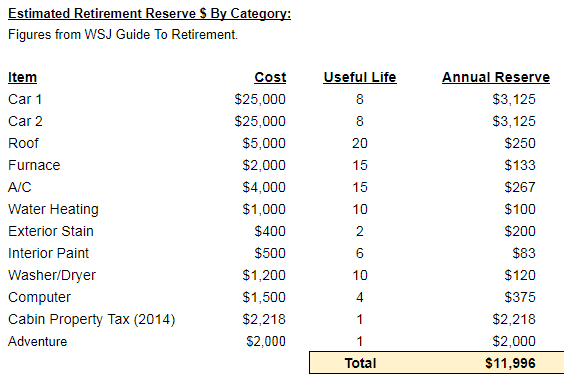

2) One-Off Expense Reserve: Based on the following analysis of longer-term maintenance items (e.g., Air Conditioner, maintenance, cars, etc.), we’ve established a $12k/year “Reserve”, which will be set up in a separate account in CapitalOne360 and not included in our monthly “paycheck”.

If we have a maintenance issue during the year, we’re free to pull from this account. If we have a good year, the $12k will roll over to the next year, an additional $12k will be added in January, and the Reserve will begin to grow. When it’s time to replace a car, we’re targeting to have enough in the reserve account to buy the car with cash.

3) Annual Monitoring: At the close of each year, we’ll compare our “Beginning vs. Ending” balances from the segregated accounts, and easily determine our actual spending for the year. Every year, as we update our Net Worth statement, we’ll figure out how much we spent in the prior year, determine next year’s targeted Withdrawal Rate, and adjust the ACH “paycheck” accordingly. Shouldn’t take more than an hour every January. A somewhat “elegant” solution, me thinks. We’ll see how it goes, and adjust where necessary.

All in all, I’m comfortable with the overall strategy and think it will offer a low-maintenance way to enjoy our retirement without worrying about daily spending decisions. I look forward to your feedback in the comments below.

Longer Term Strategy Items

As we move through retirement, there are a few items we’ll need to finalize in the coming years. I’ll summarize them in bullet format for simplicity:

- Delay Social Security: We’re planning on delaying Social Security to Age 70. Need to study the options on spousal benefits to maximize lifelong benefits.

- Protect The Roth: We’ll plan to dedicate the Roth only to long-term equity funds, remembering my outline above that shows equities are best suited for allocation into a Roth. Roth’s are also the most tax efficient engine once you’ve retired. They also don’t have a Required Minimum Distribution, so you can let ’em ride. That’s a good thing because the Roth will hopefully be the last money we ever touch. If there’s anything left at the end, we hope our daughter, and our charities of choice will inherit Roth money. Save it til last, and let it grow. That’s our strategy.

- Life Insurance: We’ve got a $200k term policy that expires when I reach Age 72. We purchased this 2 years ago as a “bridging strategy” for my wife in the event I die the day after I retire (dreadful thought, that!). Since the pension survivor benefit drops to 67% upon my death, we thought an “early death” buffer was worth the minimal expense (~$50/month).

- HSA: Doc touched on this, so I’ll include it here. We’re also in a high deductible/HSA plan, but we’ve not built up significant $$ in our HSA. We contribute the max every year but spend from the account as medical bills arise. For simplicity, we use it to “pay as we go” rather than intentionally pursuing a longer term tax strategy. A possible area that’s sub-optimized, but a minor factor (especially since we don’t plan to work post-retirement, so we’ll have no earned income and will be unable to invest additional funds in our HSA). Bottom line: not worth the effort given the small $ value.

- Part-Time Work: We are planning on never having to work for money again. However, we may pursue some short term seasonal employment opportunities, such as working for a summer at a National Park, at some point in our retirement. We’d do it more from a “socialization/experience” objective than for the $, but we’d benefit financially as well. We’ll weave into our tax planning if we end up pursuing some short-term assignments.

- Long Term Care: Several years ago I did a “deep dive” on long-term care insurance, and determined that we’re better off “self-insuring” against this risk. I should probably write a post about the analysis, given that it was a fairly detailed process. Bottom line: with the cost increases that insurers have applied to long-term care policies, the break-even point has moved up to the point where self-insurance is the best solution for us. The risk is concerning, but we’ll deal with it if it happens. We’ve run the numbers and should be able to absorb anything up to 5 years of long-term care without significant issue. Longer than that, we’ll figure it out (we may have to acquire a taste for cat food, but we’ll survive).

Conclusion

There you have it. Our Retirement Investment Drawdown Strategy. We’ve “built” the entire concept entirely on our own, and have never shared it with anybody until today. I’ve enjoyed writing this post. I hope you’ve learned something, and our strategy has given you some mental exercise. Perhaps it’s time to craft YOUR retirement investment drawdown strategy?

I’d sincerely appreciate your comments. What are we missing? Are there any holes in our plan? Are there pieces of it that you can apply in your strategy? Are there things in your strategy that we haven’t considered. A lot of smart people are reading these posts (“We’ve” been growing here at The Retirement Manifesto, and I thank each of you for coming along for the ride – special thanks to all of the new readers who have subscribed over the past month).

I welcome your input as we finalize our plans.

Comments are encouraged below. I read every one, and appreciate you taking the time to leave your thoughts on this important topic.

“The Chain”

As you’ll see in the P.S., we’re trying something new in the blogosphere. We’re “Building A Chain” of blog articles, where different bloggers are sharing their detailed Drawdown Strategy. To help keep track, I’ll edit this post as new “links” are added in the chain. Eventually, we’re planning on compiling these into an e-book, and donating all proceeds to charity. Thanks to the following bloggers who have joined “The Chain Gang”!!

Anchor: Physician On Fire: Our Drawdown Plan in Early Retirement

Link 1: The Retirement Manifesto: Our Retirement Investment Drawdown Strategy

Link 2: OthalaFehu: Retirement Master Plan

Link 3: Freedom Is Groovy: The Groovy Drawdown Strategy

Link 4: The Green Swan: The Nastiest, Hardest Problem In Finance: Decumulation

Link 5: My Curiosity Lab: Show Me The Money: My Retirement Drawdown Plan

Link 6: Cracking Retirement: Our Drawdown Strategy

Link 7: The Financial Journeyman: Early Retirement Portfolio & Plan

Link 8: Retire By 40: Our Unusual Early Retirement Withdrawal Strategy

Link 10: Early Retirement Now: The ERN Family Early Retirement Captial Preservation Plan

Link 11: 39 Months: Mr. 39 Months Drawdown Plan

Link 12: 7 Circles: Drawdown Strategy – Joining The Chain Gang

Link 13: Retirement Starts Today: What’s Your Retirement Withdrawal Strategy?

Link 14: Ms. Liz Money Matters: How I’ll Fund My Retirement

Link 15a: Dads Dollars Debts: DDD Drawdown Part 1: Living With A Pension

Link 15b: Dads Dollars Debts: DDD Drawdown Plan Part 2: Retire at 48?

Link 16: Penny & Rich: Rich’s Retirement Plan

Link 17: Atypical Life: Our Retirement Drawdown Strategy

Link 18: New Retirement: 5 Steps For Defining Your Retirement Drawdown Strategy

Link 19: Maximize Your Money: Practical Retirement Withdrawal Strategies Are Important

Link 20: ChooseFI: The Retirement Manifesto – Drawdown Strategy Podcast

Link 21: CoachCarson: My Rental Retirement Strategy

Link 22: Accidently Retired: How I Planned my Early Withdrawal Strategy

Link 23: Playtirement: Playtirement Preservation Stage

Note: Links that are not highlighted have become extinct since this post was published.

Important P.S. Announcement To My Blogging Friends

Something’s brewing between Doc, me, and a few other bloggers who have already said “Yes!” to a new concept we’re working on. The best part – each of you are invited to join. Consider this “P.S”. your personal invitation to join something unique, something new, something unorthodox. I hope you’ll accept….

Here it is….

Introducing the launch of “The Drawdown Strategy Chain”, a new concept we’re developing on the fly. The concept is this: The Chain will be built through the words and backlinks of blogs written by anyone in the network of Personal Finance bloggers who have decided to write a post on their personal drawdown strategy.

Open to all.

Just write a post, backlink to existing members’ articles on the topic (“Build The Chain”), and you’re in! I demonstrated the technique with my links to PoF’s strategy in my post. Have fun with it. Modify the approach as you see fit, but try to stick somewhat to the basic format first outlined in Doc’s post (and used in my post above), it’ll make it easier to compare our various strategies.

The Retirement Investment Drawdown Strategy is an important topic which is typically under-represented in the world of FIRE blogs. Let’s try something creative to spread the word on the importance of having a Drawdown Strategy, and leverage our social network in the process. Jointly built content.

Join The #DrawdownStrategy Chain! A new concept, let's see where it goes. You In? Click To TweetSo, let’s build something. A Chain. Doc’s the anchor, and I’m “Link #1” Join us by simply writing a post for “The Drawdown Chain Series”, a FIRE-community-built Series Of Articles On A Focused Topic, written by The Virtual Community Of Bloggers.

Who’s going to be “Link #2”? Link #3?

Here’s how to join the chain:

1) Write A Post on Your Drawdown Strategy.

2) Backlink to any article previously written in this chain-based Series (e.g., Pof’s article, the one you’re reading now, plus any other bloggers who have published after mine. All of the links in the chain, coming together, see how that works?).

3) Post your article on Twitter with “#DrawdownStrategy“, and tag any other blogger who’s already in the chain. (send multiple Tweets, if we get that big). We’re the only ones using #DrawdownStrategy, so it’ll be a clean hashtag chain.

Cool, right?

I decided to add this P.S. after completing the above article. 21 seconds ago I sent the following Tweet, which marks The Official Launch Of This Initiative:

We’re trying something new here and would appreciate your support.

IM me via Twitter if you’d like to discuss.

This will be fun.

Support It.

Join The Chain Gang.

(Please?)

7/27/17 Update: The Chain concept has exceeded expectations, today we’re at 18 Links and growing!! Readers now asking for updates as we execute our plans!! Something to consider a year from now!

Count me in! I’ll begin drafting a post soon. A very good and thought provoking exercise. I have thought through some of the steps myself including managing that tax liability in pre-tax accounts, but will need to fine tune some of the other pieces. Mine will be a little more simple given no pension considerations (I don’t really factor in social security either, just to be conservative).

Thanks Fritz!

Great to hear The Swans will be part of the chain!! Look forward to your thoughts on how you’ll handle your Drawdown Strategy! Thanks for joining the fun!

DEFINITELY bookmarking this one . . . you guys should seriously consider an e-book/book on the topic . . . lots of wisdom to come . . . I’m sure . . .

Interesting you mention an e-book. I had the same thought – we could collect all of the “strategies”, compile into an e-book, and donate all of the proceeds to a charity. Certainly a thought!

Bingo! Definitely fills a niche . . . often a hard to understand one . . .

Strange how this area is “under-reported” in the FI community. Hope to fix that with “The Chain”. We’ll keep the e-book idea open, depending on how many links we end up having in the chain.

Are u considering the 12k that u transfer to the one-off account, do u consider this as part of ur annual spend? If u do, do u consider this part of ur 4% withdrawal stratetgy?

Esther, I do consider any money spent from the “one off account” as part of our annual spend, but only when the money is actually spent. Each year, I add an additional $12k to the seperate fund, so we’ll have sufficient funds in the account for any of the “chunky” maintenance spending requirements.

That pension is a sweet deal. Not that you didn’t work for it, but man… will it continue to grow if you delay beyond July, 2020? Certainly, you’ve got assets to bridge a larger gap. How great would it be if it could cover 100% of your anticipated expenses?

Good luck in selling the first cabin and I look forward to seeing more drawdown strategies in the chain. When we have a handful of posts, I can link to them all in a future Sunday Best post.

Cheers!

-PoF

Excellent idea to “display the chain” in a Sunday Best, thanks for supporting the effort! My pension would grow for ~2 years, then flatline. Also, it’s not inflation adjusted, so once it’s set it’s fixed for life. Thankful to have it, for sure!! Thanks for the original idea, excited to see how much the “chain” grows.

BTW, see comment above re: potential e-book, with profits to charity. Since you’re the “anchor”, I’d like your thoughts on the concept?

Hey Fritz. Thanks for sharing your drawdown strategy. It looks beautiful and I can’t imagine it not being successful. Our strategy looks eerily similar to yours–at least in my head anyway. I haven’t committed ours to paper yet. Definitely time to join the chain. Look for my contribution this week.

Another joins the chain!! This is getting “Groovy”! Thanks for supporting the concept!

Looking forward to our “Trash Talk” this Saturday!! Honored to be your first vlog guest! We’ll have fun!

Nicely done! While I have no specific draw down plans, I love to read what others are doing. I still have plenty of time to figure things out. I know I will be taking time off at some point (before FI!) and will begin my conversions during that time. I would really love to talk to a tax person that could tell me how much I can convert to my Roth before being in a different tax bracket. I am sure the math is easy and spelled out somewhere but I tend to get bogged down by all the other shit when searching. I’m making that my 2017 FI goal – figure out tax implications for conversions. Wow – sounds exhilarating!! 😉

We’re a bunch of nerds, aren’t we!?

You’re smart to focus on the tax side, and maximizing Roth conversions under the tax bracket hurdle rate. Same concept as my “delay the pension” idea, and a good area for you to focus on over the next year or so since you’re a bit further away from needing to start your #DrawdownStrategy!

This is such a significant topic of discussion and yet I find so little articles on it. Kiplinger’s recently released their Retirement issue and there wasn’t one article on this. Wish more financial journalists would cover.

I couldn’t agree more, Melissa. That was the main consideration behind my idea for “The Chain”. Hoping we can create some great content on this under-reported aspect of retirement! Thanks for your support.

Feeling woefully underprepared as we haven’t begun to create a drawdown strategy even remotely close to this magnitude of detail. Do I have to? 🙂

On another note, have you looked into health sharing ministries/companies for your health care needs? I know a few people who have used them for years and love them.

Laurie, I suspect you’d be surprised if you started putting pen to paper on how many of the details you’ve actually thought about. Try it, it’s a great exercise.

Yes, we’ve considered Health Sharing ministries, probably our top option at this point. I’m keeping links to all of the great articles recently written on the topic, including The Green Swan, ESI and ThinkSaveRetire (click links to see each of their posts on the topic).

I will try it. I get so intimidated by some of this financial stuff sometimes.

Good reading Fritz!

Say hello to another dinosaur. Who said they were extinct….?

Liked your PIE charts…..:>)

As you know, I also have a pension which we will talk about in our post that will publish later today. My pension will form a small, but not insignificant, part of our overall expense needs (20%). I can also defer but will take it immediately, to provide an income floor to protect as much as we can around SoR risk.

Some of our strategies are very much aligned such as ROTH conversion, placement of assets and having a decent amount of cash at all times. On healthcare, I can jump onto a gold-plated plan to cover family from my former employer. If only the rates will be what they are now – alas, no! Healthcare sucks for majority of us in retirement – it is only a matter of “how much suck”.

Our cash plus post-tax investments will amount to ~50% of our portfolio, so a bit different there. We also stopped life insurance when we hit FI. We’ll also touch on SWR and the drawdown vs wealth preservation concept.

Again, love this chain idea, really enjoyed reading your strategy and look forward to reading more on this topic that is SO important to those close to retirement.

Link #2!! Thanks for joining the party, Mr. PIE! I look forward to seeing your #DrawdownStrategy, I’ve always respected your work and expect we’ll all learn some things from your plan!

I’m also planning on COBRA for the first 18 months through my employer. Sounds like we have a lot in common. Looking forward to reading your detailed plan!

I think I did it right!

What a great read! I’ve got some more thinking and writing to do now.

Nice to see the ‘good’ cabin on the market (hope it sells soon for a nice profit!) and I love hearing Jackie and you are enjoying the ‘great’ one.

Wonderful ideas here, I look forward to seeing other posts in the chain!

Thanks, Amy. Look forward to having you become a member of “The Chain Gang” when you finish your thinking! I’m excited about the topic, and think it’ll be fascinating to see how others are approaching the #DrawdownStrategy challenge!

I think your bond allocation is too conservative. Realistically, you can treat bond funds like cash for volatility purposes.

I think you should be around two years of living expenses in bonds, the rest should all be in equities. When stocks go up, sell those funds, when stocks decline, live off the bonds (now I am sharing my draw down strategy).

For healthcare, assuming you agree with the belief system, join a Christian health sharing ministry. We are going to pay about $200/month for a family of four, with a 10k “share” also known as a deductible. The rest we will pay out of pocket (minimal most years) with discounts of the health share network.

I don’t think delaying SS is a good idea under any circumstances. There is a big opportunity cost in investing, vs. the higher amounts you may get later on. Also, no guarantees you and your wife will live long enough to get the benefits of the higher payments. When you die, SS ends.

I use a long term return rate of 9.7% per year, compounded, for equities. If you don’t withdraw at 62, that’s the rate you should use to determine the money you are losing by having to draw down from your portfolio, instead of “drawing down” from social security. I will apply as soon as I am 62, in just 21 short years.

Oh, and congratulations on your retirement.

Patiot (love your name, btw), thanks for your comments on our plan. I’ll address each below:

I can understand your comments on bonds, but it works for us. We’ve saved quite aggressively, and feel we only need to take the risk required to make our plan work. Had we saved less and needed more growth, we may be tempted to try your plan. For now, we’ll stick with ours (ah, the beauty of “Personal” finance, right!)

As for healthcare, yes, were 90% convinced we’ll go the way of Christian health sharing (see other comments on this post, I shared some links).

It sounds like we’re aligned on SS. As for long term return assumptions, I’d argue you’re return of 9.7% is too aggressive, given the current CAPE of 26+ (see MoneyForTheRestOfUs for some great work on the topic). As you can see, I’m being conservative. Better to have a surprise to the upside, vs. the other way around! Thanks for your comments, comprehensive, sincere, and helpful. Good insight from a 41 year old (gees, I can even do math!), earlier than most folks think about a Drawdown Strategy.

Great post. I hear Mr. Groovy’s brains spinning….

What about instead of a mortgage, pay that off, and getting a large line of credit on your home before you retire? The 8% draw down in the first two years is way too risky for my blood. If the market tanks during that time you can ride it out and use the line of credit. Otherwise you might erode your nest egg.

Our long term care policy is to self insure, too. I’d rather stay flexible in keeping the option open to move to another country if it came down to that. But I’m sure not paying money every year to an insurance company, only to have them jack up the rates in 20 years, or lower the coverage, just when I might need it most.

Hey Mrs. G!! Perhaps Drawdown Strategy will be fodder for the “Trash Talk” with Mr. G this weekend!? As for line of credit, we considered that, but the simplicity of just getting the 15 year mortgage when we bought the “Great” house led us in that direction. We like simple. Essentially, it’s the same as your concept. We’ll have the money in reserve if we need it, and we’ll pay it off once the pension starts. We’re in agreement on the issues of LTC. Frustrating, but reality.

Look forward to chatting through it with you & Mr. G during your visit this weekend!

Very cool! Looks like you have a very solid plan. I might do a post, although ours is so odd. I’m not sure it could even fit a format. =) But part of that is how long our timeline is and how much change we anticipate. We have created more of a flexible outline instead of a specific plan. As in, there are 10 solid possibility and routes we can take then adjust as needed.

We use 3 buckets. 1. Minimum passive income for expenses (pension, rentals) Right now $2450 a month, although going to $2680 in a few months. 2. Large cash bucket to bridge the gap plus any other fun things Currently $55,000 because we just gave a friend $5,500. =) 3. Future income (stocks, rental increase, paying off rental mortgage) Right now stocks are at $620 a month. In 5-6 years, we could pull $1200 if we let it grow till then. Our rental mortgages, paid off, would add $700 a month.

Plus the anything we really want to do that might pay a bit of cash. THAT is a big unknown. It could be big, or really small. Right now the things I REALLY want to do (that I want to make time for on vacation because they are so awesome) bring in about $500 a month. But when our kids our older I could see us flipping 1 house a year as a family, maybe to help the kids learn skills, and pay for their college. Or I might take on more than 1 freelance writing client and stop saying no so often. =) Or I might build a small RV park. Or I might write a book. Or I might launch a full mentoring program. Or I might do more public speaking. Who knows. We are having such a good time on this trip, we might travel full time with the kids for a year. =) So I don’t factor income into the equation, because I have no blasting idea. We just work with the 3 buckets. =)

Ms. Montana, I love your “modern life”, a true demonstration on what’s possible if you dedicate yourself to developing side hustles. You’re a shining example of how a flexible life can be developed, and it’s fascinating to watch. I agree, a #DrawdownStrategy is a bit out of place with your approach, tho it is refreshing to hear that you’re using the Bucket Strategy to good affect.

Thanks for your comment, enjoy your time on the coast! I enjoyed your vlog on FB, looks like a great spot! And, if I get a vote, I’m voting for the “travel full time with the kids for a year” option. No regrets. Knowing you, you’ll find the means to keep the side hustle revenue flowing in!

Thanks for sharing your retirement withdrawal plan. My wife and I are more then ten years away from FIRE, but we have a similar plan. She has a pension. plus we have taxable, tax deferred, and tax free accounts too. We plan on following a withdrawal strategy similar to your plan.

Dave, I’m glad my plan was of value to you. Your benefit: you’ll be able to watch me progress 10 years into retirement before you get the chance to pull your plug, so you can learn from my mistakes! Thanks for taking the time to comment, much appreciated!

Great information!

A small point, but I was wondering why the property tax on your home is in the reserve bucket? It is a fixed amount that you are obligated to pay each year, rather than an item that you are saving for like a car. I would have included it in my monthly paycheck.

Thanks for paying attention to the detail, Kathy! We’ve intentionally put the property tax in reserve to keep our checking account “clean” each month. If we have money in checking, we know we can spend it. Easier, in my mind, that having to remember a small building “reserve” in checking each month for our annual property tax. You can do it either way, this way works best for us.

Thx for sharing Fritz! The plan looks solid. having for 2 years a withdrawl of 8 pct and then go to 2 pct for the rest of your life sounds great. I assume you actually might have that money in cash. It means, worst case, you only need to find 22pct savings in the budget.

Kinda surprides to see a second car (no judgement, we have 2 cars as well)

You work with an annual paycheck. DO you expect dividends to provide this, or will you be selling assets?

When selling assets, why not do it each month.

(sorry for all the questions, I try to understand fully)

Amber, I agree that the 2% withdrawal rate is appealing. Unfortunately, it’s expense to “bridge” (and yes, we will have the liquidity in “Bucket 1” to cover the bridge before we retire). You know us Americans, we all have two cars!! Smiles.

We’ll funnel the dividends into a liquid money market account, then sell stocks as required to keep Bucket 1 to our targeted level. We’re not going to make it automatic (e.g., sell each month) to avoid reverse dollar cost averaging. We’ll sell when we feel things are doing well, and hold when the market’s soft.

I totally understand your concerns with the CAPE ratio – however everyone seems perfectly fine in a bond market that is at historic highs with interest rates so low. I can imagine bond prices dropping significantly as interest rates rise.

Still a few years away from pulling the plug. The issue I run into is I will be have great cash flow at 71 without my 401k but not now at 51! Looking to diversify now with rental real estate and a side business to create more cash flow during an early retirement.

Thanks for sharing.

Rocky, nice to see you on my site. Good point on the bonds, they clearly are not without risk in this low/rising interest rate environment. Problem is: there aren’t really any “safe havens” right now, so we’re just diversifying across as many asset classes as possible. I expect a very slow, gradual interest rate rise, and most of our bonds are short/mid term, so impact should be (fingers crossed) minimal.

Real estate and side hustles are solid plans. We’ve considered both, but 1) don’t want the hassle of managing real estate after we’re retired and 2) don’t want to work in retirement, even if it’s a side hustle. Both could be revisited in time.

Awesome plan thanks for laying it out!!

I just try to continue to grow my taxable investment account. My aggressive account has grown at 35% per year for the past 6 years and my conservative side is at 15% per year growth. I plan to continue to put into this and then plan to just live off of the dividends. The account should spit out 200-400k per year and then the dividends will grow from 6-10%/year that will out pace inflation and I will never have to touch the principal. I started investing in the market 20 + years ago and am in my early 40s.

John, depending on your tax bracket (in your 40’s, you should be starting to make some real $$), you may want to consider some tax advantaged accounts. $200-400k income from investments is incredible, maybe I need to hire you as my financial advisor! Thanks for stopping by.

Ok John, I’ll bite.

Your aggressive account has grown at 35% per year for the past six years and your conservative “side” (?) is at 15% per year growth.

Please enlighten me (and perhaps other interested readers), what “market” are you investing in?

Thanks.

Great post Fritz on a topic that I agree is not talked about much. My plan aligns closely with yours except yours is much more planned out than mine. Your post will help spur me on to get ours on paper soon (and join the chain gang).

The one black hole for me is healthcare costs. One never knows what lies ahead and even with insurance (which is costly now and will in all likelihood outpace inflation in the coming years) costs will rise as we’ll all need more healthcare as we age. I currently have LTC insurance through my employer and am still deciding whether to pick up the cost once I retire. We can’t plan for every eventuality and agree that we may have to just deal with it if the need arises.

What I really liked about your plan is that you’ll pay yourself an annual salary and not track every single cost. The point of retirement is to spend more time doing the things that bring us happiness. I too want my financial plan to be more or less on auto pilot once I’m retired and then I can place more value on time rather than money. Could a future post on achieving that balance be in the cards?

Thanks, Paul

Paul, regarding that “future post”…..stay tuned for next Tueday’s post. Ironically, it’s about the topic of “balance”, from a slightly different perspective. Hint: Autumn is coming….stay tuned!

Great idea. I will work on a post. We haven’t put much effort into our draw down strategy because we still make good income. It needs to be done, though.

Joe, thanks for joining The Chain Gang, great job writing up your drawdown strategy! Nice to have you on board the train!

Hey Fritz! I love your blog.

I wrote an article about this for other websites (it got picked up by several outlets) and I thought your readers might find it of interest. If you don’t want it linked, I understand if you delete it. (I have no financial interest in doing so, just trying to be helpful.) http://www.bankrate.com/retirement/tax-savvy-retirement-plan-distributions/#slide=1

Kandice, thanks for sharing your post, definately applicable as a comment link in the drawdown series!

Wow! A lot to go through. Nice job being so thorough. I’ve admittedly not done any of this because I have a plan of never touching principal until I die! My goal is to just keep on trying to make more than I spend, and slowly increase my spending to coincide with inflation.

Didn’t realize with this plan, I don’t have to make a investment drawdown strategy plan. Will bookmark this page as well if plans change. Well done on the thoroughness of your plan.

Cheers,

Sam

Sam, thanks for stopping by my site (love your work, I guess I learned “long form” from you!?). You’re in a great position, and I hope you never have to change your plans to starting “drawing down”! Thanks for the kind words on “the thoroughness of the plan”, much appreciated!

I wish I could poke even a tiny hole in any of your assumptions to help you make your plan stronger, but this looks well-thought out.

Healthcare is the scariest fish in the room. I am in my early thirties and don’t know what will be around when I get to the early retirement phase.

It’s a tough time to be an early retiree, but I suspect things will get sorted well before you have to face your decision! I’ll keep you posted as things unfold with our retirement. Thanks for stopping by!

Very helpful column, and the chain gang will produce dividends.

Drawdown strategy and tactics are the hardest part of personal finance to get right because the “terminal date” in the analysis, and costs incurred on the eve of that date, are basically unpredictable and cannot be altered comfortably to align with resources available at the time.

I believe this accounts for the abundance of caution that so many of us employ in the accumulation stage. Put another way, I don’t know how long I and my wife will live, or how we will pass, but I don’t want either one of us to outlive our means, so I will work longer and invest more than “necessary” because I’d rather be safe than sorry.

You haven’t paid any attention to money flow.

For example, you have 5 years of income in the “income bucket”. After one year has gone by, you now have FOUR years of income in the “income bucket”. Now what? Do you now want only 4 years of income there? After one more year, it’ll be down to THREE years of income.

No, I think if you want to keep 5 years of income there, at the end of the year you have to replenish it to get back up to 5 years. Which means you have to sell stocks to refill the income bucket.

Extend this out to a few years, look at the money flow, and you will see that your spending (“income”) is sourced from the stock bucket, with a side-trip through the income bucket. You are just moving the money around and not reallu accomplishing anything,

Every year you spend your annual amount, and every year you sell stocks in that same amount (minus whatever dividends & interest you receive). Having that money flow through several buckets before it gets spent doesn’t accomplish anything. There is no difference between selling bonds to raise spending money then selling stocks to buy replacement bonds — and selling stocks to raise spending money.

And regarding the “One-Off Expense Reserve” … what if the expense happens before the reserve is built up? What if you have to buy a new car next year instead of in 8 years? What if the furnace AND the A/C AND the water heater all fail at once and you have to replace them all in year 5?

Sure, on average you only need $12k/yr, but that’s long term. Short term, you may need $30K all at once. Murphy’s Law.

Yeah, guess how I figured out the problems with that? I wound up having the Car#1 Fund borrow money from the Roof Fund, and then the A/C fund had to borrow money from the Car#2 Fund. It couldn’t borrow from the Car#1 fund because that fund had already lent its money to the Roof Fund. But then of course, the A/C fund had to repay its loan to Car#2 fund and Roof Fund had to repay its loan to Car#2 fund. Right about then the problems with all this came apparent. You wind up with all these funds borrowing and lending money to each other, but IT’S THE SAME D*MN MONEY. In reality, the way to handle it is to leave the actual money in your overall retirement/investment accounts and account for the reserve funds by including it as part of your expense budget, reducing your regular monthly cash “income” by that amount.

Fred, thanks for your comment. In our article with more details on The Bucket Strategy, you’ll see we have most certainly considered “money flow” in our planning. The purpose of having a 3-5 year “Bucket 1” is to AVOID selling stocks in a bear market. If the market’s in a Bear, we’ll draw down the cash bucket until the market recovers, or sell bonds if we’re running out of Bucket 1 money.

We’ll only sell stocks when the market’s doing well, so we won’t necessarily “sell every year in the same amount” as our cash withdrawals. That’s precisely the reason for the buckets, to allow a buffer between your annual spending needs and your stock sales.

Regarding the “reserve”, you’re correct in pointing out the risk of having $30k all at once. If that happens, we’ll simply pull the spending from Bucket 1, and refill the “Reserve” in future years (as you said, it’s a long term average, so if we get hit hard in Year 1, we should theoricially have some “lighter” years in the future, allowing us to refill the reserve account).

i recommend the blog “my money design” as a good example of withdrawal plan. It has inspired me to start building up mine. Right now I am leaning towards an asset alocation percentage to tell me from which bucket i can withdraw money. A work in progress. Congrats on the blog, i will happily browse it in the next days. cheers.

oh, i just saw you know the guy from “my money design”. you´re good to go !

I enjoyed my first reading of your blog, but some of your decisions would not be right for me and my wife.

I retired in 2013 and she retired last month. We are not at all afraid of running out of money. Rather, our biggest fear is reaching age 85 and discovering we could have withdrawn tens of thousands each year from our IRAs. So we plan a withdrawal rate of 5 or even 6 percent.

The biggest problems with research which promotes lower withdrawal rates seem to be:

1. Social security and private pensions were not considered or not given enough consideration;

2. Insufficient weight was given to retirees ability to flex spending in response to market downturns;

3. Assumption of flat spending requirements over a 30 or 35 year retirement is not supported by evidence: even though health care expenses rise, almost all other non-discretionary and discretionary spending drops sharply after age 75 or 80.

4. Including Great Depression sequential return risk – highly unlikely to be experienced again – in attempting to forecast future returns greatly biases results toward overly conservative withdrawal rates.

If a new retiree has a significant nest egg, and also Social Security or private pension income, I would advise him to consider spending much more in the first decade of retirement. The research which causes retirees to fear running out of money is flawed. The opportunity to enjoy accumulated wealth has much greater utility when retirees still have the health and energy to enjoy the expenditure.

John, thanks for your extensive comment. I appreciate your perspective, another example of why it’s called “Personal” Finance! I agree there is some risk of “regret” with the 4% rule, but it’s a tradeoff. There’s a risk of running short in later life, but there’s also the risk of regret that you could have spent more.

We’re targeting the point where we can live very comfortably on the 4% (or less) withdrawal to avoid having the scrimp in early retirement, thereby avoiding future regrets while also doing our best to insure we have $$ if we live to 100 (my Dad’s a very healthy 84, so longevity runs in the family).

John –

With regard to your 4th point about sequence of return risk informing how much and how soon one can generate income from a lump sum of money that is invested in stocks, I disagree. I think the risk is real and one doesn’t need to look to the Great Depression to see how it has played out.

After the roaring 1990s, especially the last half of the decade, here are the returns the S&P 500 provided:

2000 -9.03%

2001 -11.85%

2002 -21.97%

2003 28.36%

2004 10.74%

2005 4.83%

2006 15.61%

2007 5.48%

2008 -36.55%

Imagine telling someone who planned to retire on January 1, 2000, with a million dollar stock portfolio and thinking that a 4% “safe” sustainable withdrawal rate that sequence of return risk is unlikely to be experienced, the Great Depression was 70 years ago.

There are ways to mitigate the sequence of withdrawal risk, e.g. retiring with 1-2 years of living expenses in cash and laddering CDs for years 3 and 4 and buying a single premium immediate annuity to cover basic expense come to mind.

Being flexible in terms of how much income you need in retirement is perhaps the most important element in successful retirement income planning.

You state, “The research which causes retirees to fear running out of money is flawed.”

Please cite the research that is flawed and what the flaw(s) is/are.

If you are referring to Bengen and the Trinity Study, I agree that both are problematic (flawed) for application today but academics like Wade Pfau argue that these studies suggest higher sustainable withdrawal rates than are likely today, that is 4% isn’t safe it’s too high.

William Sharpe, a Nobel Prize winning economist, has thought quite a bit about retirement income planning and he too has some trouble with the 4% “rule”. See this very brief article from 2010:

http://www.fa-mag.com/news/william-sharpe-do-4-withdrawal-rate-make-sense-5331.html

Quoting from this article, Sharpe said: “…the big problem with the 4% rule is its insistence on fixed spending coupled with investing in a portfolio with variable returns. Maintaining the same withdrawal rate in down markets will cause the retiree to run out of money.”

Finally, marginal utility and happiness are excellent economic and philosophic terms respectively that should be seriously considered when writing one’s “Investment Policy Statement” for retirement. For many people, marginal happiness and utility peak at an income of $75,000 a year. See this from TIME MAGAZINE:

http://content.time.com/time/magazine/article/0,9171,2019628,00.html

If “my” happiness requires $100,000 of annual income that’s fine but I’m going to need a bigger nest egg (and will need to do a lot more income tax planning) than someone who is happy with an annual income of $50,000. It the root of marginal utility and happiness is the concept of hedonic adaptation — in this context, we “get used to” an ever increasing standard of living as our income increases. America is a society “built on” consumption. Home much consumption do you need to be happy?

As Fritz has blogged, it’s called “personal” finance for a reason.

I think it’s not a return your getting in your pension or SS. Instead take that money and reduce your withdrawal rate. I think you’ll find your net worth increases much higher as opposed to delaying either.

What if you die early? That money is gone forever that you didn’t collect.

One factor to consider, FP, is that my wife gets 67% of my pension if I were to die early. So..delaying would increase that rate for her, even if I do pass early. I’ve got a year to make the decision, working on it…. Thanks for your input.

“A possible area that’s sub-optimized, but a minor factor (especially since we don’t plan to work post-retirement, so we’ll have no earned income and will be unable to invest additional funds in our HSA). ” I know it’s a minor thing for you but maybe your readers might benefit from knowing that HSA contributions DO NOT require earned income, like IRAs do. Please see this Kiplinger Personal Finance article…

http://www.kiplinger.com/article/insurance/T027-C001-S003-you-don-t-need-earnings-to-contribute-to-an-hsa.html

Excellent post and thank you for sharing it with us.

Nice add, BO. I wasn’t aware of that, and suspect many of my readers weren’t either. Thanks for contributing to the discussion!

Fritz,

Nice post. A couple thoughts:

1. I like your comparing the accumulation – “decumulation” phases to going up and down an escalator and an airplane taking off and landing. Another analogy to consider is climbing up a mountain and climbing down a mountain in that they are very, very different skill sets. And i think the descent is more lethal than the ascent for mountain climbers.

2. Retiring at 55 could mean 10 years before you’re Medicare eligible. I wish you the best of luck staying healthy and being able to access health insurance. Luckily, the U.S. Congress is on the case.

3. A minor typo in this paragraph: Since I’ll be 55 when I retire, I can pull 401(k) Before-Tax money without penalty, a small loophole in the IRA code that gets us around the traditional Age limit of 59.5 normally associated with withdrawing tax-favored retirement funds. You are referring to the IRS (Internal Revenue Service Code) and not “the IRA code”. The Code sections are 72(t)(2)(A)(v) and 72(t)(10). See this chart from the IRS: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

It’s not so much a “loophole” as it is an exception to the rule (which generally is a 10% penalty tax on “premature distributions”). That’s largely how tax law is written…here’s the general rule and here are all the exceptions to it.

4. With regard to Health Savings Accounts, someone posted a reference to a Kiplinger article to document you don’t need “earned income” to contribute to one. Might be more helpful to go to the source – IRS Publication 969. Generally, my understanding is that to contribute to an HSA, you have to be covered by a “high deductible health plan”. And who knows what the rules in this area will be going forward.

5. Social Security is based on one’s highest 35 years of covered wages.

See here: https://www.ssa.gov/pubs/EN-05-10070.pdf

For those with less than 35 years of covered wages, $0 salary is used in the formula.

Everyone should set up their personal account at the Social Security web site here: https://www.ssa.gov/myaccount/

Claiming Social Security is still a big deal (for married couples, widows, never-married, etc, etc.) and here are two excellent websites to help:

a. http://maximizemysocialsecurity.com/ and

b. http://www.socialsecuritysolutions.com/

Well worth spending some money to get objective advice on this.

Lastly as your post and others are demonstrating, safely getting down the mountain is tough stuff and it’s way more that turning a nest egg into income.

Dave, thanks for the comprehensive, and helpful, addition to the topic. Nice links, appropriate for the discussion. Thanks for the obvious time you’ve invested to advance the discussion. Much appreciated.

Can you elaborate on how much is your expected annual expenses post retirement? Also was curious on the 20K/year allocated towards healthcare insurance. Is this based on the current ACA market premiums or are you anticipating some other event?

Happy to, John. We’re looking at ~$100k of annual expenses after-tax, ~$120k if you consider taxes owed. Included in the $100k is $20k for medical, based on estimates I’ve heard from ACA. I suspect it could be worse if potential modifications are implemented (e.g., 5X pricing ceiling for high income, vs. 3x pricing ceiling in current legislation). I suspect the $20k is too low. We’re funding the $120k bill via both a pension and a ~3.5% withdrawal of assets.

Hey Fritz — I’m not on Twitter but I took a stab at my own retirement plan. You’ll see the pingback. Thanks for the inspiration! I’m not sure it’s up to par with the other submissions, but I appreciate the series and good on you for getting it going.

Personally, I’d love to get to the point in retirement where I can live on interest / dividends / investment gains rather than actually drawing down or selling assets. We’ll see …

All the best — I’m new to your blog and look forward to reading more of your posts. –Rich

Thanks Fritz!!! I’ve learned a lot from your posts. This drawdown post and the great comments made me realize I also need to “put the plan in writing”. My wife and I did the FIRE event a few years ago and we have a spend down strategy that works fine but it is not formalized in “text”.

Trying to keep it simple is also a big thing for us, so we just put a fixed amount in a separate account each year and all expenses are paid from that account. It is then quite easy to review once a year to confirm if your spending is in control and less than your retirement budget (inflation adjusted each year). Similar to your plan, we handle one time expenses that occur occasionally (new A/C, car, etc.) from a separate account and withdrawals from this account are influenced by how well the investments are performing. This is working well for us so we are thankful to not need to bother anymore with detailed budgets each year.

You are absolutely right that this is “Personal Finance”, and everyone needs to understand that the best investment plan and the best drawdown plan is a function of each person’s financial situation and what makes them happy and keeps them FI.

One area were I really need some help is dealing with the possible cost of long term care. You indicated you plan to “self insure” if long term care is needed (a 70% probability for a family of 2). Would you (or other readers) elaborate or provide your thoughts regarding how much money should be available to deal with this issue? If I wanted to leave the kids a little inheritance, would buying a life insurance product with LTC distribution capability make sense to protect the estate?

Redfish, thanks for the kind words, glad they inspired you to put it in writing. Simple = Fine!

GREAT point on Long Term Care. In my case, I ran the numbers assuming: 1) Paying for LTC vs. 2) Investing the same amount and letting it grow. I have to go back to my numbers (it was a few years ago), but I think I started “pay vs. invest” analysis assuming Age 55. By ~Age 80, I had enough in my “investment” bucket to self-insure a 3 year stay, which I considered my breakeven point. Beyond that, the math favored “Invest” instead of “Buy”. I should write a post on it, and will add it to my “Draft” files (I’ve got a lot of those, so no promises when/if I’ll publish).

The life insurance angle is certainly viable, tho the cost of life insurance would likely get very high as you age. I’d look at a very long term policy (e..g, 30 year fixed), and run the math. Great comment.

Hi. Haven’t read all the comments, apologies if these questions have been addressed. Are these withdrawal strategies more appropriate for early retirees, vs someone age 63-64? And wondering what your thoughts are about Darrow’s post: http://www.caniretireyet.com/new-research-the-best-retirement-withdrawal-strategies/

Thanks.

East Coast, thanks for sharing Darrow Kirkpatrick’s post. I’m a huge fan on his, and his article is perfectly aligned with mine. His findings that the CAPE Ratio is the best indicator of when to sell stocks made an impact on my when it first came out, and it’s likely that I’ll use his logic as I refill my bucket’s on a quarterly basis.

Also, my strategy is certainly most appropriate for an early retiree. Each of us should have a very specific strategy, based on your age and objectives at the time of our individual retirements.

A bit late to responding here, but just have to say how much I enjoy your presence in the FI world, whether it’s these posts or hearing you on my favorite podcasts! You have even been instrumental in getting my husband eased into this crazy community. It’s baby steps for now, but I thank you for your part!

Our situations are similar, so I’m especially attentive to your posts. We’re in our 50s, most savings in pre-tax, retiring soon & holding our noses regarding healthcare costs, and delay our SS claims to let them grow (no pensions for us though!). I especially like following you as much of the early retire community is much younger and have “I’ll just go back to work” to rely on. Or they discuss 60 year time horizons that I can’t relate to (good for them though!). I just read Big Ern’s post on his opinion of the 4% rule, so now I’m scared how to proceed on spending.

I love seeing you enjoying your retirement scenery as well. My parents were living just north of there (Murphy, NC) until a few years ago and all their doctors were in Blue Ridge. We briefly thought about relocating there until they moved closer to family. Also, we were test subjects for Roger Whitney’s podcast about a year ago. He’s a great guy who helped us see a few areas in our plan needing attention. So thanks, and we’ll be staying tuned in!

Great article!

I plan to retire early (~age 54) and I am very interested doing some Roth conversions in the years where I have no income from my job and before I start pulling money from my 401K. Reading the section of your article “Tax Optimize IRA conversions into A Roth”, you make it sound like you have to retire at (or after) age 55 in order to do Roth Conversions.

While it is true you can access your 401K early if you leave your company the year you turn 55, I’m not aware of any age limitations for converting to a Roth. The way I understand Roth conversions you simply have to roll-over the 401K to an IRA then do some incremental conversions. Of course you can’t take money out of your Roth until you are 59 1/2 (although there are some provisions for taking the principle out after 5 years.)

Can you clarify this critical step in the Retirement Investment Drawdown Strategy?

Thanks!

Hey Fritz,

Would you mind adding my article to the chain of links at the end of your article? I feel like I’ve missed the train and I’m running to catch up! Lol. Here’s the link: https://www.coachcarson.com/rental-retirement-strategy/

I reread your article as well. Love your plan. How is the drawdown on the pre-tax accounts going? That seemed to be a key part of the this short-term interval before you start drawing a pension.

Hey Chad! Better late than never, right! You’re added! I’ll be retiring in June, plan on starting our pre-tax rollovers later this year. Great timing with the new tax law, as I noted in The New Tax Law Loophole That Benefits Retirees. Sometimes it’s better to be lucky than good!

Also plan to maximize pension and Social Security at 70 while draining pretax funds to keep RMDs from becoming too painful (and avoid SS tax torpedo). My modest pension also increases roughly 6% each year deferred. I view it as a market hedge. Pensions also have Minimum Required Distributions and a Required Beginning Date similar to RMD for tax qualified accounts. According to my research and pension admin, that is April 1 of the year following the year you turn 70.5 (to avoid tax penalties).

A big brain in retirement research named Wade Pfau has a book and articles about using a reverse mortgage as a substitute cash or bond bucket. Idea being to reduce drag on returns with higher equity allocation. Borrow in down markets, pay back in up markets. Sort of like a big fat credit card with lower interest. And the credit limit grows as you get older. Other research substitutes annuities for cash or bonds for higher overall withdrawals. Academia is finally starting to focus on optimizing decumulation.

I’ve found a very configurable free calculator called Optimal Retirement Planner for projecting draws from various income sources that includes taxation. Great for modeling pre/post tax withdrawals, Roth conversions, etc.

Great article and I like your current asset allocation. I believe you’re very prudent to be risk-averse in terms of equity allocations based on CAPE. Even after the 10% correction equity valuations are still extremely high. This will end badly for many folks, especially those passive, fully-invested, 100% long equity-only index investors. Good luck and Godspeed in your retirement. I’m soon behind you and I’m looking for a rural cabin to move into!

MrFIREby2023

Hi Fritz,

Great post, links and comments by all.

I am surprised I don’t hear more people implementing the strategy my wife and I are currently utilizing to lower their withdrawal rate. I am 54 and we have been retired since I was 39. We are currently living on about 75K a year (2.5% SWR-No mortgage, we just naturally spend this much – we aren’t budgeting). I’ll have a pension starting at age 65 and I am waiting until 70 to start SS and my wife will start hers around age 65. Here’s the thing. We currently have Silver 94 health coverage which is fabulous. Our monthly premium is…$2 (not a typo) and I don’t think we even have a deductible and we can see specialists without approval etc. I realize many have income from real estate etc. they can’t avoid as we used to so they won’t qualify. We just sell the amount of stock we can each year to stay in the sweet spot for allowed income. We have some additional cash from selling our previous home and when we need more money we can withdraw contributions we made to our Roth (check the 5-year rules before you plan on this) to cover any gaps. I know traditionally Roth money is withdrawn last but we don’t have kids and in all likelihood we are going to have too much money down the road so we will be donating much of the highly taxed RMDs etc. Health insurance premiums and the additional cost of actual healthcare received are so expensive it seems worth it in our situation to partially tap our Roth over the upcoming years. We basically have received freeish healthcare since the ACA passed. Do you think tapping our Roth in this way is a mistake? Based on the healthcare we’ve actually received and not paid for the past few years (We mountain bike so we break things), we are saving at least 20K a year. Thanks for EVERYTHING!!!

Some other folks are doing the same thing as you are, especially the very frugal young early retirees. I’ve not yet been able to enjoy a subsidized ACA premium and cringe each month when I pay that huge amount for a $6K deductible plan. Some folks like me, in their early 60s, don’t have insurance at all and are hoping to stay in one piece until Medicare age. I’m not quite that brave.

Next year I plan on minimizing my income so I too can get a decent medical plan and not pay $9K-12K annually for my current lousy plan. It’s become a real disincentive to continue working, even with my current part time gig. A good 20-25% of my after-tax, after-401K income goes towards premiums.

I haven’t been brave enough either to risk one of those Health Sharing Ministry plans. I am concerned that if something big happens I’d be left high and dry.

Given that after deferring your company pension >75% of your anticipated retirement spending is covered, is it not the case that once you draw SS (at age 70) all, or at least most, of your anticipated retirement spending will be covered. In which case is it not the “Gap” years immediately following your early retirement that are critical? Or have I misunderstood something?

Al, perceptive question, and our “gap” years were certainly a focus as we were decided when to retire. In reality, the impact of potential future inflation (and the fact that I have a fixed pension), does show a projected need to draw from our investments throughout our life, tho at different levels. I found the spreadsheet projecting spending and sources for that spending through Age 95 to be invaluable in developing our strategy. The early years were critical, but the later years cannot be ignored, especially since we have the risk of self-insuring for LTC.

Nice to have a link to this in your Top 10 articles. Totally missed this previously.

My wife and I retired a couple of years ago. She was 59 and I was 65. I ran all sorts of analyzers to decide how to maximize our Social Security benefits based on our projected longevity and benefit levels. Decided for her to draw at 62 and I would take the Spousal benefit until I turn 70 and them claim full benefits. Unfortunately this option is only available for those of us born in 1952 or earlier. This cut off will also prevent her from switching over to the Spousal benefit and draw on my benefits instead of her reduced benefit at 62. She draws a healthy pension so that her pension, my meager pension and our SS put us into a situation where we have to pay tax on our SS benefits. We have about 55% of our retirement money in Roth accounts, 35% in traditional IRA/401Ks and 10% in long term taxable investments. My goal is to keep our annual income below the 174K level that triggers the Medicare IRMAA adjustments for Parts B and D that will double (or worse) the cost of our premiums for my healthcare. Note that just because some income may not be “taxable” some of that may be added back in when calculating income limits for IRMAA limits.

Until my wife turns 65 she can continue to carry her former group health plan through her former employer. My problem will be managing my income when RMDs kick in 2 years from now. At some point I will be faced with biting the bullet and converting traditional 401Ks into Roth IRAs and facing not only a big tax bill but also dealing with IRMAA (see https://www.investmentnews.com/article/20191111/FREE/191119992/medicare-premium-increase-and-irmaa-surcharges-announced-for-2020 and scroll down to see the 2020 chart). The IRMAA surcharges range from about 40% to over 300% or even 400%. Once a threshold is breached my strategy becomes convert as much as I can before it triggers the next higher IRMAA income and /or tax threshold. Granted we are very fortunate to have this “problem” – but once I get most of our money into Roth vehicles I no longer have to worry about triggering higher tax levels and facing IRMAA. That is the really sneaky penalty that you don’t know about until you hit it. Should one of us pass on then the IRMAA limits are even lower and will be very difficult for one of us to avoid even if I manage to convert most of our traditional retirement accounts over to Roths. Unfortunately, I divested our rental property this year so I have no room for converting this year without exceeding income limits.

Here’s a link to download a good white paper discussing strategies to minimize IRMAA’s impact (https://aivante.com/wp-content/uploads/2019/10/Aivante-Medicare-Means-Testing-Whitepaper-10-28-2019.pdf). Ifg this link doesn’t work it can also be found a couple of paragraphs below the chart I previously referenced.

Tom, I’m pleased that you found this post from my Top 10 summary, and appreciate your excellent comment! A few comments on the points you raise:

– SS strategy: You’ve obviously done your homework, and I agree the elimination of the Spousal Benefit option limits a great optimization strategy.

– Roth Conversions: GREAT point on focusing on the $174k limit to maintain your Medicare IRMAA adjustments. This is one area I’ve not (yet) studied in detail, but your note does a nice job of highlighting the issue.

– RMD Management: You’re certainly not alone in facing significant challenges in being “forced” to withdraw your pre-tax monies, a major issue for retirees when they hit the (new) Age 72 limit from the new SECURE act. I’m pleased to see we get a few more years with the new legislation to work our pre-tax balances down, and hope the extra 18 months will help you mitigate the risk.

Thanks for the great comment, and very relevant links. I’m pleased to have you as a reader, and thank you for bringing additional value to this post with your excellent comment.

If Roth accounts are left to charities then money is wasted. Charities would not have to pay tax on non-Roth accounts and therefore the money paid for taxes is lost.

Roth conversions can make sense even if Roth accounts might be left to charity. It’s still valuable to reduce “cumulative” taxes (ordinary income, Medicare surcharge, etc.) by lowering RMDs. Roth conversions might not make sense if both spouses die before enough RMDs are taken to reap the tax savings.