I just discovered a New Tax Law Loophole, of sorts! It’s an element in the New Tax Law that I’m excited about, especially as an Early Retiree. I’ve found an area where the new tax law favors retirees and solves a problem that many Baby Boomers face in their retirement finances. I’ve not seen much written on this topic yet, so I decided to weigh in by presenting today’s post.

I’m planning on taking advantage of this discovery to reduce “my problem”, and I suspect you may be able to do the same. Today, I’ll share the idea with you, and why I think it offers an opportunity for many of you, my (much appreciated) readers.

You Know That Loophole in the new Tax Bill which benefits Retirees? I'm taking advantage of it, are you? Click To TweetAs a person who plans to retire this year, I’m laser-focused on the new tax law and what it means for my retirement planning. I’m paying attention. Fortunately, it seems to be good news. I’ll lay out what I’m thinking, and I welcome your thoughts.

Shoot holes in my logic, I could well be wrong. But I think there’s something here worth looking into.

Please appreciate that this is a high-level overview of the new tax law. We can talk about specific situations, and how they impact the overall “net” benefit of the loophole, all day long. They do matter, but that’s not the point of today’s post. A few examples: To my SALT Friends: I feel for you. Not everyone is going to benefit from the new tax law. In many of your situations, I’d think “geo-arbitrage” like Stacy is, and consider moving to Nevada. Thx for your spreadsheet, Stacy – fascinating stuff. The same goes to my SINGLE Friends. Unfortunately, you don’t get the same benefits as married folks do. However, SALT and SINGLE are out of the scope of this post, tho I appreciate you all.

But we’re going down a rabbit hole.

The Point Is This…

….I think there’s a unique opportunity for retirees in their 50’s and 60’s, especially those with IRA’s or 401(k)’s.

Give me a minute of your attention, and see if you agree.

The Tax Loophole For Retirees

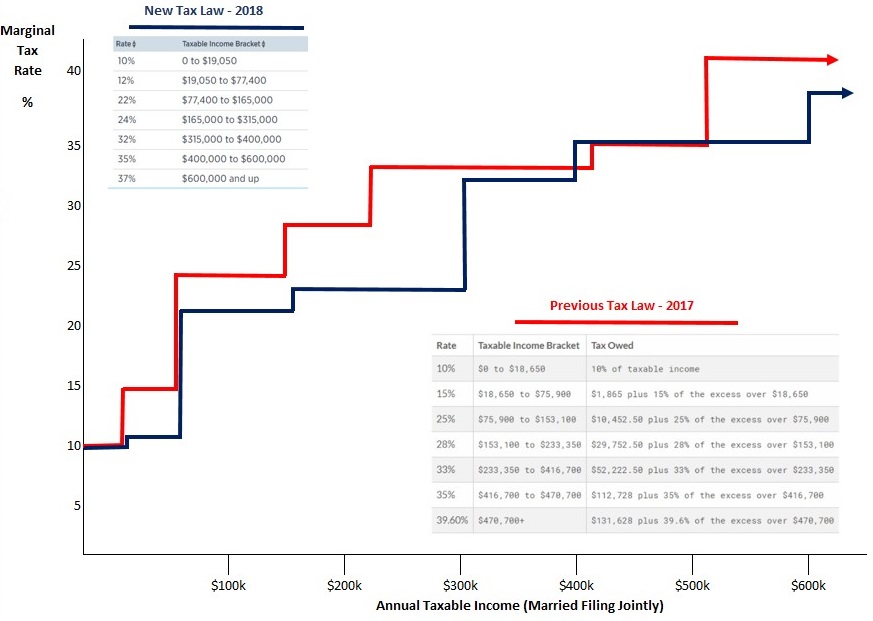

The Chart above shows the new tax law, effective Jan 1 2018. It’s an important chart, and I’m going to get into it shortly. First, there’s a quick backstory that I trust you’ll appreciate, a bit of color commentary if you will…..

I came up with the chart last week. In about 30 seconds. Unplanned. On a whiteboard in my office, with an inquiring co-worker. Unscripted. Long story made short, that brainstorming session on the whiteboard led to this post. I thought you’d find that interesting. Here’s what started it all (please don’t critique the numbers, I drew the darn thing from memory!)…

So….What’s The Chart Mean?

Ok, you want to know the Bottom Line. I understand that, and I promise that we’ll get to the “So What” in a minute.

Baby Boomer retirees may benefit in a big way from the New Tax Law. Click To TweetHowever, and as you know, things aren’t always that easy. Before we get to the solution, and what the chart means, you need to understand the problem. A problem that many baby boomers face, whether they realize it or not. I’d like to explain this problem first, as a prelude to discussing how this tax law provides a bit of a solution.

So bear with me a minute, as I explain the problem.

The Problem? Required Minimum Distributions

Do you have money in an IRA? A Before Tax 401(k)?

If so, are you familiar with Required Minimum Distributions (or “RMD”, for short?). To keep it simple, IRA’s have long been touted as a great way to build your retirement investment portfolio in a tax-efficient manner. In essence, you are able to invest “Before Tax” money in an IRA, meaning it’s tax deductible in the year you make the contribution. The investments continue to grow tax-deferred until you withdraw the funds in retirement.

Nirvana, right?

Um, yeah, until you hit the Requirement Minimum Distribution in retirement.

The problem is that you are required to begin taking taxable withdrawals from your IRA’s at the age of 70 1/2. The government was ok with letting you avoid taxes during your working years, but it’s time to pay the piper. The government wants their tax revenue, after all. Darn Government.

What's The Problem Many Baby Boomers Face? Required Minimum Distributions. The New Tax Law may help. Click To TweetThe RMD is mandatory, and the amount that you’re forced to withdrawal counts as taxable income. If you have $500k in your IRA and you’re 71 years old, you must withdraw $19,531 in 2018. (using this calculator).

The Big Issue: That withdrawal is unavoidable, and is taxed at your marginal tax rate. For folks with significant IRA investments (hello, Baby Boomers, who had no “Roth” option for the first 2 decades of their working career!), these RMD’s can easily bump you into a higher tax bracket, and there’s nothing you can do about it.

An Example: Joe has a decent pension from his long corporate career, and pulls in a decent social security check each month. Joe’s taxable income in retirement is $65k, and he and his wife are comfortable living on that. Unfortunately, Joe just turned 70 1/2, and he got hit with his $19,531 RMD. His taxable income jumped to $84,531.

Looking at the “Old” tax brackets, you can see that Joe just got bumped from the 15% to the 25% tax bracket:

How The New Tax Law Offers A Loophole

Fortunately, Joe doesn’t have to deal with the 2017 tax law anymore. It’s 2018, and there’s a new law in the land! Now, he’s subject to the new tax law, which has lower tax rates, and higher thresholds between each bracket.

THAT’S what the chart up above is all about, and what we’re going to talk about below.

Early Conversions Of Before-Tax IRA’s

While the REQUIRED Minimum Distribution kicks in at age 70 1/2, there’s no law against taking distributions from your IRA BEFORE AGE 70 1/2.

In fact, doing so can prove to be quite beneficial.

Even more so under the new tax law.

- I’m planning to take early distributions from my 401(k) / IRA starting at Age 55. I talked about it in my Retirement Drawdown Strategy last summer. My goal was to take whatever amount of withdrawal I could take each year to push me right up against, but not over, the next marginal tax rate income hurdle.

Looking at the numbers from the “Joe Example” above, I was planning on taking just enough to get my income to, but not above, the $153,100 threshold. This would ensure I paid no higher than the marginal 25% tax (details in the Drawdown Strategy post).

I was discussing this strategy with Physician on Fire in a comment on his excellent post on RMD’s, and his response (pasted below) led to today’s post:

I was quick to realize the Doc was on to something, began researching this post, and promptly tweeted out this well-deserved attaboy:

The Loophole That Doc Discovered

Thinking through what Physician On Fire said in that comment, I realized there was, indeed, a potentially large loophole in the new tax law for certain individuals. Those individuals are most likely married, long-term corporate or government employed Baby Boomers with high before-tax 401(k) and IRA’s. I realize it’s not everybody, but I think it’s worth highlighting for those folks who may stand to benefit.

Are you a Baby Boomer with significant $ in an IRA or 401(k)? The new tax law may offer you a loophole to avoid your RMD problem... Click To TweetHere’s the loophole – we’d discuss it below:

How To Take Advantage Of The Loophole

If you’re ~55-69 Years Old and have a sizeable investment in a pre-tax 401(k) or IRA, you may want to study the chart above in some detail. Below, I’ll lay out how playing the “Early Conversion Tax Bracket” game compares in 2017 vs. 2018:

- In 2017, Joe can only convert IRA’s up to $153k of income before triggering the 28% rate (red line).

- In 2018, Joe can convert IRA’s up to $315k before triggering a tax greater than 24% (blue line).

The Window Of Opportunity:

The New Tax Law Allows You A Window Of Opportunity To Convert Up to $315k / yr From An IRA! Click To TweetThis window may not work for you, and the new tax law could actually worsen your situation vs. 2017. The results depend very much on your specific situation.

However, if you’re in your 50’s or 60’s and have a lot of money in an IRA, you’d be wise to check into it.

(As a prudent disclaimer, please recognize my analysis is intentionally a “simplified and generic situation” to communicate the overall issue, and the findings are not necessarily applicable to your personal situation, especially if you’re single or live in an area with high State & Local Taxes (SALT). Sorry, you don’t get much of a break from this new law.)

How To Execute The Plan

Starting later this year, I’m planning on meeting with my CPA to discuss how much of my Before-Tax IRA I should consider converting in 2018. The decision will be based on how much income we’re projecting I’ll earn, and how much room is left between that number and the $315k income threshold for the start of the 32% marginal tax bracket. Say, for an example, that I have income of $100k. The conclusion would be that I could consider converting up to $215k ($315k Threshold – $100k Income = $215k window for IRA Conversion).

I haven’t gotten into the specific details of how to execute the conversion, but I’ll figure that out with Vanguard when the time comes to make the conversion later this year.

A Limited Time Opportunity!!

This Window Will Likely Close, and higher tax rates will most likely become the norm again in the USA. You can argue against that conclusion if you’d like, and that’s fine. Decide for yourself if you think this is a short-term opportunity to convert some before-tax money at the potentially lowest tax rate you’ll have available to you.

Physician On Fire and I are in agreement that this is likely a limited opportunity, perhaps until 2025. While his email below is small, his key sentence is “You might have 7 or 8 years in which to take advantage of the new low rates”.

Conclusion

The new tax law may offer an opportunity for Baby Boomers with significant investments in before-tax 401(k)’s or IRA’s to consider converting those funds into Roth or After-Tax status before the Required Minimum Distributions kick in at Age 70 1/2. Converting these funds now may avoid the unpleasant experience of having your RMD’s force you into a higher tax bracket in your 70’s and beyond.

The extension of the historically low 24% tax hurdle to a surprisingly high level of $315k allows a window of opportunity for Baby Boomers to convert more money, at a lower tax rate, than was possible under the prior tax plan. If you don’t have as much money to convert, a similar strategy could be used targeting the $77,400 cutoff @ a 12% tax rate, or the $165k cutoff @ a 22% rate.

This opportunity will be lost if/when future tax law re-introduces higher tax rates, which this writer thinks is a likely scenario in the next 8 years.

If you think this concept has merit in your situation, seek the advice of a licensed professional. Heck, I wrote this article, but I’m still relying on my CPA to help me work through the numbers and make sure this is a prudent tax planning move for my retirement years.

If you’re interested in the new tax law and the impact it has on various retirement income planning schemes, I’d encourage you to read this article from the Mad Fientist, a real expert on these types of strategies. His article is worth your time if you’d like to study further on the concept.

Finally, I put the chart from this post up on various social media channels a week ago, and it’s generated a ton of discussion. Nick Nelson, a reader on the Radical Personal Finance Facebook Group, recreated my chart to show the “Effective Tax Rate” (total tax / taxable income) comparison between the 2017 and 2018 Tax Laws. It’s an interesting chart, but it didn’t really fit in the commentary above. I’ll include it here as an interesting additional item (thanks for the permission to share, Nick!). A shout out of thanks to all of my friends on Social Media for jumping in on the discussion, I appreciate the exchanges!

PS: Finally, in really small print here at the end…where no one is still reading. Disclaimer!! This analysis is based on very broad assumptions, and no reader should draw conclusions for their specific personal situation. Many personal situations will affect how this law applies (SALT, and Single vs. Married are two huge ones that come to mind). The purpose of this article is merely to communicate the broad stroke changes in the tax law, illustrate the potential loophole for married-filing-jointly filers, and raise awareness for those who may benefit from the theory raised.

I look forward to some likely chatter in the Comments. What do you think, is there a loophole?

Let’s start a discussion!

Fascinating! While this specific loophole will likely not apply when I hit retirement, I really enjoy learning about how folks are viewing the different strategies 🙂 Thank you for sharing this one!

Hi Fritz,

There is a loophole but the hole becomes a bottomless pit, rather quickly.

ACA.

Pushing conversion numbers too high takes you off the chart with healthcare subsidies and drives healthcare costs into the stratosphere. For the aging demographic (i.e. those who will spend more on healthcare ) you describe, this can be catastrophic for long term financial plans.

The trick is to find the right balance of income versus subsidy cliffs. Doable as others have described – Justin at Root of Good in particular.

Of course if one has a Heath care plan provided by a former employer at a reasonable cost, this is not an issue but those plans are few and far between.

Fair point in the “income” from pre-tax conversions impacting ACA subsidies, Mr. PIE. Unfortunately, my healthcare costs will already be in the stratosphere, since my pension will kill any chance of subsidies. For those dependent on the subsidies, it is a major consideration on how much you should convert. Great addition to the discussion.

Yep, we’ve got the ACA to consider here. If the health insurance landscape changes for 2019, we can find a sweet spot for those conversions.

Wouldn’t the loophole still apply once we reach age 65 and are no longer getting insurance and subsidies via ACA?

It would, if it’s still available. I’m only 55, so I suspect this loophole will be long gone by the time I reach 65. Depends how close you are to Age 65, and how much risk you want to take.

Very interesting Fritz, good analysis. My big chunk of tax-free money is in a government TSP, but the rules are very similar to an IRA. However I don’t think I’m old enough yet to take advantage of the loophole.

I’ll have to sit down and chug some more numbers for my situation but thanks for posting this, this is good stuff.

And you’re correct, this will not last. The political wave will no-doubt swing (starting this year) and the new tax rates are only good for 8 years per the bill anyway. But the bill won’t survive nearly that long, if I was a betting man.

Excellent article. But I’m going to agree with this poster. The tax cuts will not last, too many people upset about them. I predict the next president that gets into office will raise the rates. Nobody knows the future and I hope we get the 8 years at these brackets…but doubtful.

Worth seeing if your TSP plan let’s you make Roth Rollovers, shouldn’t be age restricted, more of a question of whether your plan allows them or not. Good luck!

“If you’re ~55-69 Years Old and have a sizeable investment in a pre-tax 401(k) or IRA”

Why specify the above age range, unless I am missing something these conversions can be done at any age under 70? I retired last year @ 48 and I am weighing my options for Roth conversions. It appears that the new tax laws are going to lower the cost of converting and speed up my conversion timeline even at my younger age.

Troy, not sure why your comment got posted twice … see my friend PoF’s response below, nothing further to add. Congrats on your early retirement, and you’re smart for considering Roth conversions. I picked “55-69” based on penalty free access, but PoF is correct (as usual). Thanks for stopping by!

Why specify the above age range, unless I am missing something these conversions can be done at any age under 70? I retired last year @ 48 and I am weighing my options for Roth conversions. It appears that the new tax laws are going to lower the cost of converting and speed up my conversion timeline even at my younger age.

When you leave your employer in the year in which you turn 55, there is no penalty for IRA withdrawals.

However, you are correct in your assertion that you can do Roth conversions at any age without penalty. Starting early enough, you may have room to do a decent amount of conversions in the 12% tax bracket, even.

Cheers!

-PoF

The separation from service exception to the 10% early distribution penalty only applies to qualified plans, such as 401ks. The exception does not apply to IRAs.

Andy, thanks for the clarification.

Being allowed to take money out of an IRA without penalty at age 55 sounded too good to be true. And indeed it is.

Here’s a link which explains the separation from service exemption. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

Great add to the discussion, thanks guys. For the record, I’ll be doing the rollovers from my 401(k), so the IRA exclusion doesn’t apply. Sorry for those looking to rollover an IRA….

Thanks Fritz, I have noticed the same thing about the lower brkts. I am retired on the ACA and can’t do much until 2019. At that time I intend to fill the lower brkt with my Roth conversion and pay no more than 12%. I am currently converting small amounts at the “0” tax rate and staying in the sweet spot for premium and cost sharing subsidies.

Thanks again for the timely article.

Sounds like a good strategy to protect your ACA subsidy, while still doing what you can to minimize your future tax burden.

Hey Fritz

Thank you very much for this.

Here’s what discourages me: the new tax law also cancels Roth Conversion “take-backs”, where we could pull the money back if we under estimated our income or, much worse, if the market undergoes a major “correction” and we find ourselves paying full taxes on assets the have depreciated by 50%? That frightens me.

You are correct, Cyn. Folks will have to be more careful when they initiate a conversion, as you’re stuck with it once you make it due to the elimination of the recharacterization option. A definite downside to the new tax law. Thanks for the good addition to the discussion!

Looks like a winner and a great opportunity for guys like you, Fritz! Great find!

I’ll be curious to see how this plays out and what your CPA has to say.

— Jim

This seems like an important find. I must admit this isn’t on my radar much right now, but it’s an important reminder about the fluidity of things. It looks like we will be close to FI in under a decade, but who knows what laws and regulations will look like then!

One thing you can count on, they’ll look different than today! A good example of why you have to constantly monitor these things, especially something as big as a major tax law change!

Loopholes are great, but I prefer worm holes….

Actually this is quite useful. I, at some point, will be doing some rollovers from traditional 401k to roth 401k, but for now am enjoying the tax break. Look forward to seeing how your plans work out!

I’ll keep you posted as the conversions are made, starting Q4 of 2018!

Smart discovery! I hope somebody finds loopholes like this when I retire in 20 years 😉

I have been converting for the last couple of years up to the 25% bracket. Retired at 54 and want to get all pretax qualified accounts to Roth IRAs before social security kicks in. I wouldn’t call this a loop hole, just a benefit of lower tax rates until 2025. I think the government is fine with converting earlier as it puts more money in their coffers, which reduces the deficit thus shoring up the argument that tax reform will pay for itself.

Good for you playing the “tax bracket conversion game”, Monte. I’d agree it’s not really a “loophole”, but it does add a major opportunity to play the existing game at a much higher level for a few years. Good point about this driving some additional taxes earlier than would have otherwise happened.

We have a sizeable amount in IRAs and also are getting the Obamacare subsidy. It is tempting to switch to a healthcare ministry and go all the way up to $315,000. Using Nick’s chart, it looks like we would pay about 21% tax on the $315,000, which is 66K for 2018, but it would have been around 25% or 79K. That is a difference of $13,000 in tax. But our subsidy is currently around 20K. Yep, still does not work for us.

Then there is also the fact that we live in California, and the state tax would get to 13.3%.

Great way to look at the tradeoff of the ACA subsidy vs. your various options, Susan, and I agree with your conclusion until something else changes (e.g., reduction of ACA subsidies). Healthcare ministries are a good option, and something we’re considering for our retirement. Also, as much as I love visiting CA, I do feel sorry for all of you folks in “High SALT” states. I suspect you’ll see some migration out of high SALT states under the new tax law.

Please be aware of the Net Investment Income Tax (3.8%) which kicks in at $250K for Married Filing Jointly. So you probably would want to keep your Roth IRA conversions under $250K , not $315K.

Great add, Herbert! I wasn’t aware of that, will check it out. Thanks for the great contribution to the discussion.

But that’s just a tax on investment income, not on your 401(k) withdrawals or Roth conversions. If you’ve got a large taxable account spinning off tens of thousands in dividends, it could make sense to keep MAGI close to $250,000. If not, I wouldn’t be too concerned about the NIIT.

Best,

-PoF

I’m not a tax expert but I see this example on IRS website. Seems the Net Investment Income is added on top of all your other wages and other income (ie capital gains, dividends). So if you convert more than $250K, all these possible investment income might be added on top and taxes an additional 3.8%.

https://www.irs.gov/newsroom/net-investment-income-tax-faqs

20. Single taxpayer with income greater than the statutory threshold.

Taxpayer, a single filer, has $180,000 of wages. Taxpayer also received $90,000 from a passive partnership interest, which is considered Net Investment Income. Taxpayer’s modified adjusted gross income is $270,000.

Taxpayer’s modified adjusted gross income exceeds the threshold of $200,000 for single taxpayers by $70,000. Taxpayer’s Net Investment Income is $90,000.

The Net Investment Income Tax is based on the lesser of $70,000 (the amount that Taxpayer’s modified adjusted gross income exceeds the $200,000 threshold) or $90,000 (Taxpayer’s Net Investment Income). Taxpayer owes NIIT of $2,660 ($70,000 x 3.8%).

Thanks for doing the research, Herbert. Nice addition to the discussion, and definitely something to keep in mind as you quantify how much to target for rollover!

Fritz- Great work as always! You may even want to consider an eighteen month lease on a Florida condo and claim residency for two tax years to avoid the state income tax.

I agree with the comment there’s a nice second block in the “up to $77,400” category. That plus the $24,000 standard deduction is a huge window to convert under the new law! ACA subsidies are the wildcard in that window, but if those get blown via side hustle income or something else, the higher IRA conversion window is nice

I’ll leave that to those High SALT folks. I suspect a migration will begin…..

I agree that the $24k Standard Deduction is a “win” for many (including me).

Great Chart! What a great way to visualize the new tax brackets. These are the kinds of posts that really get me thinking about my plan. Finding the sweet spot to take advantage of all the opportunities from lower taxes to ACA subsidies is the goal. Thank you for laying this out!

Glad you liked it! I was pleased when I brainstormed the chart on that whiteboard. I’d been struggling with how to explain the tax changes, and happy to hear that my chart delivers on that goal!

Seems like this might affect you as well, it’s a story from a couple of years ago, and you’d need to update the numbers, but for those taking social security your plan might have an issue.

http://www.oregonlive.com/finance/index.ssf/2014/09/when_an_rmd_knocks_you_in_rang.html

The crazy thing in there, is when you actually end up paying 150% tax rate for some of your dollars.

EXCELLENT ARTICLE!! Perfect example of why the Required Minimum Distributions are “Land Mines” to many Baby Boomers. Now’s our chance to clear the minefield before we get our legs blown off.

Oh my God, I got a CMLT reading this post. Awesome analysis, my friend. And awesome input from PoF and The Mad Fientist. As Mrs. Groovy pointed out, the fly in the ointment for us is Obamacare subsidies. Any IRA conversions we make now would decrease our Obamacare subsides and thus increase the effective tax rate on those conversions. But for any baby-boomer who has a sizable 401(k)/IRA and isn’t relying on Obamacare subsidies, the “Fritz Loophole” is a wonderful, if ultimately short-lived, opportunity. Bravo, my friend.

Um….what’s CMLT? Wow, I now have a Loophole named after me! I’m Honored! Too bad the ACA subsidies take you out of contention for the loophole. Good luck with the move, loving your posts on The Groovy Ranch!

Great post Fritz. This seems like a great opportunity for us younger folks to take a mini-retirement and drive some conversions.

Nice chart. But it leaves me with one question.

Won’t the AMT catch me if I try to withdraw or convert to Roth to take advantage of that otherwise beautiful 24% rate?

Now, more than ever, we need an online tax forecaster like TurboTax offers for the 2017 filing year, but I haven’t seen updated for 2018.

I don’t know the details, but I’ve read that the AMT has been essentially eliminated as a concern for all but those in the really high income brackets (I heard $1M cited on a podcast). Worth checking out with a CPA, but I think the AMT risk is greatly reduced with the new tax law.

Reading this makes me glad most of my money is tied up in real estate. LOL!!!

Thanks for confusing the absolute sh** out of me, Fritz! I think I need to get more educated on “conversions” so I can maybe take advantage of this when I retire early in the next 1.5 years. I wonder what you consider to be a “large amount” in a retirement account. Does anything less than 1M qualify?

Sincerely,

Early Retirement Dunce 😉

Hey Cubert (certainly NOT a dunce, I love your stuff!) Happy to confuse you! Certainly “lesser amounts” could still benefit. The main question is whether there’s a risk that RMD’s will push you into a higher tax bracket. The calculation for RMD’s is easy to find via Google. Just multiply the factor by your Before Tax money, and determine if you’d like to reduce that amount while this loophole is available.

I plan to do Roth conversions starting at 62 when I start this year up to the new 12% threshold. In our situation, I don’t feel compelled to donate an additional 10-12% to Uncle for the next few years. I also do not want to exceed the 170 AGI Medicare threshold and pay more and since they do a 2-year look back, that starts next year for me. My wife just retired from the same company I work for and we have the “new” (and not improved) cash balance pensions which grow at 3-4% a year so we plan to defer those along with SS to 70, opening the Roth conversion window. I also plan to get some longevity insurance from a QLAC out my IRA (new amount this year is 130K), which has the added small benefit of reducing the RMDs. My goal at 70 is to keep our income below 165K (with 2 SS checks, 3 small pensions, and later a QLAC) and some taxes on the remainder not converted to Roth will just have been deferred to 22% (or if it reverts 25%), which is still a lower rate than we are paying now.

As you say, there are host of individual factors to consider when taking these decisions and I agree with your plan to consult with a professional. This an interesting discussion and thanks for including us dinosaurs in the conversation!

It sounds like a solid plan, Rob. You’ve clearly thought about the best approach for your situation. Congrats on a well thought out strategy. (No dinosaurs here…)

This is very interesting. You have to be in a specific situation to take advantage of it.

24% is still pretty high. You’d need to have a huge amount in the Traditional IRA to make it worth it.

Most people can probably draw down a good amount before they hit RMD. How many people really have 2 million dollars in their 401k? Very very few.

It is a very nice loophole if you can take advantage of it.

I agree, Joe, that it’s a benefit to a specific situation. Regardless, I thought it best to share and make folks aware. I suspect anyone with ~$500k or more in before-tax could get some benefit, depending on their specific situation. Thanks for stopping by!

Fritz – finally getting to read your full post that you teased us with by sharing your excellent comparison graph on RSF. I’m glad a waited so I could see the additional input in the comments. I have to disagree with Joe above. We will very likely have over $2M in our 401k/IRAs and face enormous RMDs if we don’t convert pre to post during our early retirement years. I don’t think this is that uncommon at all in this community. We had already planned to do these conversions in our 50’s and 60’s by using up all the space in the lower 2 brackets, but may need to rethink the amounts to convert annually in light of the new brackets.

Like others have mentioned, we may have ACA subsidies to concern ourselves with if they survive so have to watch that carefully. Thanks for the write up.

Hey Sean! Going heavy with Roth makes sense without question early in your career. As your income rises, there are sometimes benefits to contributing to a before-tax account, especially if you expect your income/tax rate will be lower in retirement. Most important is to save as much as you can, which it sounds like you’re crushing. Thanks for stopping by!

Interesting. I will have to look into this. One thing that would hurt us is it would put us over the limit for making Roth contributions. Plus I take it this would only be from 401K from previous employers but not rollover IRAs? EG not sure if you can convert from a current employers 401.

As a 72 year old retiree taking RMDs, I am very happy I started my Regular IRA to ROTH conversions at age 62 when we retired. The temporary new tax rates would have been even more advantageous for me. But if you really want to see why you should do this, check your tax obligation after RMDs start and your spouse dies. Now you have to file as single. Run the numbers and see why reducing your pretax dollars now will save you money in the future. Another thing to think about is Social Security. We started conversions and SS at 62. This caused 85% of our SS benefits to also be taxed. Perhaps bigger transfers before SS started may have been a better option for us.

I am taking RMD’s now and your are right; it is a landmine. But no one has mentioned that at age 70 you can give money away tax free and it counts as an RMD; it’s called a QCD. So don’t convert all of your IRA / 401K; save some for your church.

Also, you don’t have to go to just a no income tax state like Florida to escape the state tax. Some states like PA don’t tax IRA distributions although there may an age restriction. Georgia does not tax the first $65,000 (per spouse)

Hi Fritz

Happy New Year sir !

What did you end up doing in 2018 ?

Your plan for 2019 ?

Best Wishes – Love the blog

you be the man !

James

Hi James! I had more income than expected in 2018, due to cashing in of some of my options, etc. at retirement. Therefore, I’ve decided to wait until 2019 to do my first Roth conversion. I’ll be moving ~$125k from my Before-Tax 401(k) into a Roth later this year.

I realize I am reading this article about a year later than when it was published.

I came to the same conclusion as you but I wanted to share a different slant on it.

Depending on other factors of how the tax law effects you it may change your short term behavior for contributions. My case we took the standard deduction for 2018 (always itemized previously) and we had a large QBI deduction as well. We made the decision to use more of the 24% bracket and simply pay down our no longer tax deductible mortgage. The market looks a tad overheated and while I’m not trying to time the market, I am willing to pay some more taxes now in the large MFJ 24% bracket loophole you highlighted. Without getting political I wonder if they anticipated this demographic of wage earners to spending money instead of saving more pre-tax. While I’m just paying down my mortgage I’m sure some other people are perhaps just sort of pre-paying their tax bill now knowing rates will go back in the next few years. My guess is about 3 years.

Good thing I get notified of comments on “old” posts, smile. You raise some good points/questions. We also took the standard deduction in 2018 (first time), as well as funding significant charity $$ into a Donor Advised Fund in Dec 2017 to take the tax break under the old/higher tax rates. I also think many folks will think about paying down mortgages since it’s harder to deduct (we chose to pay off our retirement home). Good point about potential political motives to incent people to avoid pre-tax savings, hadn’t thought of that before, certainly possible. Thanks for weighing in with your well thought out comment.

For those over 65 and on Medicare, there is the Income Related Monthly Adjustment Amount (IRMAA) which charges higher taxable income folks significantly higher Medicare premiums. It should be considered an additional income tax. It kicks in at $170,000 and goes up more at higher increments. I am using the strategy of this article, but only up to the $170,000. The incremental “tax” of higher premiums is pretty steep.

Great addition to the discussion, David. I wasn’t aware of that particular detail for those on Medicare, thanks for pointing out a very important detail.

Fritz,

Medicare premiums are determined by looking back 2 years, so 62 is the last age when you can max out your Roth conversions. After that, you want to keep your AGI under the Medicare Income Related Monthly Adjustment Amount levels for your filing status to avoid doubling or tripling your Part B and Part D premiums.

Also you need to stop HSA contribution at least 6 months before enrolling in Medicare.

Although the lookback period is two years, you can petition the SSA with form SSA-44 for a reduced Medicare premium based on current year’s expected earnings. For example, you could make a very high salary, then retire and suddenly have a lower salary. Giving that information to SSA, declaring a “life changing event” resulting in lower salary, that current year lower salary is used for determining medicare premiums. I successfully and easily accomplished this for my first two years after retirement. Note: I did have to pay the higher premium for a couple of months each year until the form was processed, but then I was credited for the higher payments and made no payments until the accounting caught up.

Great info, David! I wasn’t aware of the option to petition the SSA, and you even included the form required! Even better, you actually executed the strategy with success, well done. Great comment, thanks for adding value to the discussion!

Great discussion Fritz. As a baby boomer starting retirement at 66 the challenges mentioned above are formidable. Our generation is facing an explosive tax situation – at 70 our tax obligations rise exponentially with pension income, social security and RMDs. Any conversions will impact medicare premiums substantially. Also, I have heard that it makes sense to convert only if you can pay the “conversion” tax with after tax funds. Your thoughts?

P.S. Are there any CPAs you could recommend whose expertise is in analyzing Roth conversions?

AS, you’re spot on with the tax explosion at Age 70. Throw in the risk of increased future tax rates, and the exposure is potentially huge. I’m converting as much prior to Age 70 as I possibly can (up to the marginal tax rate threshold, as explained in the post), and I am planning on paying the taxes with after-tax funds. Best to drain your after-tax paying the taxes due while converting as much of your before-tax money into ROTH as possible. I would expect most CPA’s could work with you on the conversion, I know Dana Anspach’s firm focuses in this area (check out her book, Control Your Retirement Destiny). Roger Whitney could also likely help you out, or point you to some recommended resources. Hopes that helps.

Very timely as I was just looking at this RMD issue on my nestegg calculator and thinking of conversions for me and my wife (53 and 58 respectively). This alone is also making me reconsider when to start social security….. In other words, delay SS for both of us and take advantage of keeping our income levels low to maximize conversions until she’s 70 (not to mention the 8% per year boost in SS benefit). But I hadn’t really thought about monster conversions into the $300k tax level until reading about the concern that the codes may close both the smaller conversion holes for me in maybe 5 years. One thing that stumped me this year is reaching the American Opportunity tax credit limit of about $180k. That only applies to parents funding their kids in college and using non 529 funds to pay for about $5k a year of college expenses and allows taxes cut of about $2500, but it looks to phase out totally (or significantly reduced) when over $180k according to my 2018 tax forms. So this may limit us this year to about $20k of conversions (I just gotta take advantage of that credit). Thanks for the post Fritz and the wonderful comments by your readers!

Jeff, you’re spot on with the concept of delaying SS to maximize Roth conversions. You get the benefit of increased SS payments by waiting (as I explained in this post), plus you can reduce your eventual RMD’s. That’s a win-win in my book!

Great addition to bring up the American Opportunity tax credit limit, a definite factor for folks still funding college. Thanks for your kind words about my blog, glad my “monster conversion” concept made you think, it’s always good to be aware of your options.