This post is important, and I urge you to read it in its entirety. I’ll introduce a simple step-by-step process you can conduct once a year to ensure that you achieve your targeted asset allocation. Follow these steps, and you’ll be well ahead of your peers in your retirement planning process. Even better, the steps are easy. All you need to do is follow the free spreadsheet I present later in this post. Free!? Yep, can’t beat free.

Follow the steps in this “Annual Asset Allocation Review” and you’ll accomplish the rare feat of killing three birds with one stone:

- Achieve Your Targeted Asset Allocation

- Optimize Your Tax Location

- Manage Your Bucket System

Targeted Asset Allocation – An Overview

Asset Allocation is a critical element in retirement planning. According to Vanguard, “88% of your experience (the volatility you encounter and the returns you earn) can be traced back to your asset allocation.”

Asset Allocation Matters.

However, some folks don’t give sufficient attention to developing a Targeted Asset Allocation appropriate to their stage in life. Fewer have an ongoing process to ensure they maintain their targeted asset allocation over time. And even fewer understand the importance of “Asset Location”, and why it matters.

Today, a simple step-by-step approach to ensure you achieve your Targeted Asset Allocation. Click To TweetToday, I will provide an overview of these topics and a simple technique to keep yourself on track. As a case study, I’ll be sharing the results of my annual Targeted Asset Allocation checkup and will share elements of the action plan I’m implementing as a result.

Most Importantly, I’m sharing step-by-step instructions, as well as a free spreadsheet, to allow you to implement the same simple technique that I use once a year to keep our targeted asset allocation in check.

First…An Overview on Asset Allocation:

Why Does Asset Allocation Matter?

Asset Allocation is simply a name for allocating your investments into various asset classes. Since different asset classes tend to perform differently (think “Stocks” vs. “Bonds”), dividing your money into different investment classes is a technique to mitigate your risk, and is an essential element in effective retirement planning. For example, if stocks perform poorly for 3 straight years in a bear market, having some money in bonds can act as a buffer. This becomes increasingly important as you approach, and enter, retirement. For more detail, see my article “Why Is Asset Allocation Important”.

A good visual example of targeted asset allocation over time is presented in The Importance Of Asset Allocation by Snider Advisors:

Determining Your Targeted Asset Allocation

Your ideal Targeted Asset Allocation is a function of numerous factors, summarized below:

- Your Risk Tolerance

- Your Risk Capacity

- Your Time Horizon

- Level Of Return Required

While the old “rule of thumb” was to use “100 Minus Your Age” as your stock allocation, this approach is too simplistic to address the issues summarized above. As my friend Roger Whitney says in his book Rock Retirement, the goal should be to accept the “minimum effective dose of volatility” required to achieve your goals. Given that today’s focus is on the technique I use to maintain my targeted asset allocation rather than the background theory, I’d encourage you to read my article “Why Is Asset Allocation Important” for a more detailed review on determining your targeted asset allocation.

What About Asset Location?

In addition to ensuring the targeted asset allocation between stocks, bonds, cash, and alternative investments, the location of these assets is important. To optimize the tax implications of your asset allocation, it’s important to ensure you put the “right” kind of investments into the “right” kind of tax structure. For example, since Muni bond earnings are typically tax-free, it’s best to target these investments in your “after-tax” accounts.

Below is a summary of which types of assets fit “best” in which type of tax-structured account:

In “Our Retirement Drawdown Strategy”, I dedicated a section to the topic of Asset Location and would encourage you to read that post for more detail on the topic of Asset Location.

Now…The Good Stuff!

A Step-By-Step Guide To Asset Allocation

Ok, so now that you have the background, we’re going to walk you through the detailed step by step instructions for how to Achieve Your Targeted Asset Allocation.

The following process should be run once per year (I do mine every January, after updating our Net Worth at year-end). This process is easy, and I’ve made it as simple as possible with a free spreadsheet. Take a few minutes and input your numbers, and you’ll be on your way to achieving your targeted asset allocation!

Here are the detailed instructions for a simple annual process to ensure you achieve your targeted Asset Allocation. Click To Tweet I’ve created a dedicated spreadsheet, free to readers of this blog, to implement the following steps. The spreadsheet is titled “The Retirement Manifesto Guide To Asset Allocation”, and can be accessed by clicking on this link.

I’ve created a dedicated spreadsheet, free to readers of this blog, to implement the following steps. The spreadsheet is titled “The Retirement Manifesto Guide To Asset Allocation”, and can be accessed by clicking on this link.

IMPORTANT – make sure you click “File”, then “Make A Copy”, as shown to the right. You WON’T be able to make any changes to my “master” spreadsheet and will have to save a copy for your own personal use. If you’d prefer, you can click “File / Download As” then click Excel. This will allow you to work in the spreadsheet in Excel if you prefer it to Google Workbooks.”

Step 1: Determine Your Target Asset Allocation

When you open The Guide To Asset Allocation, your first step is to fill in the yellow boxes with your Targeted Asset Allocation, based on the factors outlined in my article “Why Is Asset Allocation Important”. Here is what Step 1 looks like in the free spreadsheet:

For this exercise, I’m using my actual targeted allocations. Feel free to modify to reflect your targeted asset allocation in your own version of the spreadsheet (simply click “File / Make A Copy”).

Step 2: Input Your Actual Asset Allocation

Every year, I capture the year-end detail from my Personal Capital account, including my Asset Allocation. I prefer using Personal Capital since it can calculate Asset Allocations from my holdings (e.g., if you have a Target Date fund, it “knows” how much is stock vs. equity and allocates it accordingly). Check your detail closely, some accounts will not necessarily be allocated automatically, and you may need to manually tag a few in the appropriate asset class (for some reason, it calls my CapitalOne fund “other”, but it’s straightforward to manually classify it as Cash).

Here is my actual Personal Capital data from Dec 31, 2018 ($ figures omitted for privacy):

Once you have this data, simply enter it into Step 2 in “The Retirement Manifesto Guide To Asset Allocation” spreadsheet (again, just fill in the yellow tabs, everything else calculates automatically). Note that all of the percentages in the table below match my Personal Capital data above. I’m using a fictitious portfolio balance of $1 Million, but everything else is based on my actual year-end data:

Step 3: Compare Your Actual vs. Targeted Asset Allocation

The beauty of the spreadsheet is that it will now, automatically, show you the difference between your actual allocation and your target asset allocation, both in percentage and dollar terms:

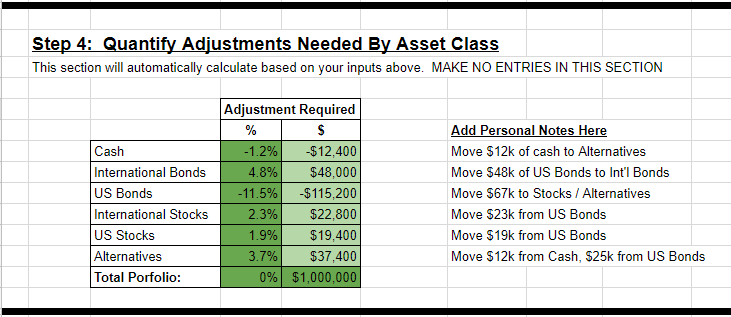

Step 4. Quantify Adjustments Need to Achieve Your Targeted Asset Allocation

What’s nice about using the free spreadsheet it that it automatically shows you the adjustments required by asset class in order to achieve your targeted asset allocation. A negative value means you have “too much” money in this asset class, a positive value shows additional funds needed.

Step 5. Implement Adjustments

You’ll note in Step 4 that I identified how much needed to be moved between asset classes in order to achieve my targeted asset allocation (see “Add Personal Notes Here”). For example, I have $12,400 too much in “Cash” and $115,200 too much in US Bonds. in order to rebalance, I’ll move these funds into the other four asset classes, which are below their targeted asset allocation.

To keep it simple, just remember I need to “Sell Bonds, Buy Stocks” for the sake of this example.

Remember Asset Location?

In the overview section at the start of this post, I explained how taxes can be optimized if certain asset classes are held in certain types of tax accounts (Before Tax/IRA vs. Roth vs. After Tax). Implementing adjustments is where Asset Location becomes a consideration.

Let’s look at our Roth Tax bucket as our Case Study Example:

Since Stocks are better than Bonds in a Roth account and recognizing that I need to move some bond money into stocks to achieve my targeted Asset Allocation, I would start with looking at my Roth account for any bond money invested there. As it turns out, I have $15k in some VFSTX (a Short Term Bond Fund) in that account.

To achieve BOTH my targeted Asset Allocation AND make an improvement in my Asset Location for tax optimization, I would execute an order to sell the $15k in the bond fund and buy $15k in VTIAX (an International Stock Fund).

Continue following that logic, and keep track of your cumulative changes until you’ve moved the $115k from bonds into the appropriate reallocated asset classes. Note that you won’t ALWAYS be able to optimize the tax location, but where possible make moves that accomplish both objectives (asset reallocation AND location optimization).

In my case, I usually set up automatic transfers which execute 1-2 times per month throughout the year. This avoids making too drastic of a move on any given date. It works for me, but there’s nothing wrong with executing all of the changes in a single day if that’s your preference. Make sure you take tax considerations into account when selling funds, and talk to an accounting professional if you’re uncertain about any of the moves.

If You’re Still Working: While I was working, I would typically make my adjustments via new money contributions rather than an outright buy/sell. In the example above, I would discontinue contributions into bond funds, and direct all new money into stocks. It accomplishes the same objective, without having to rebalance existing accounts. In the event you’re severely off track with your targeted asset allocation, you can do a combination of both buy/sell and redirection of new contributions.

A Word About The Bucket Strategy

As I wrote in How To Build A Retirement Paycheck From Your Investments, I’m using a 3 Bucket Strategy to fund our retirement. As a refresher: Bucket 1 holds all of our spending requirement for the next ~3 years in cash/liquid asset. Bucket 2 is aimed at stable income (Bonds) to cover years ~3-7, and Bucket 3 is aimed for growth (Stocks) for years 7+.

As you establish your targeted asset allocation, keep in mind your 3 bucket system, and ensure the allocations you’ve assigned to each category (cash, bonds, stocks) are sufficient to “keep your buckets full”. In my case, I link each line of my detailed Net Worth to its corresponding bucket and look at the totals by bucket compared to my 3, 5 and 7-year spending totals. Since I complete my Net Worth analysis before doing this annual Targeted Asset Allocation exercise, the bucket analysis is part and parcel of my asset allocation adjustment process.

If I need more cash to refill Bucket 1, for example, I would adjust my cash in the targeted asset allocation section (Step 1) before running through Steps 3-5.

Accomplishing the Holy Grail of killing three birds with one stone is not only possible, but it’s a natural outcome of this annual Targeted Asset Allocation Review:

- Achieve Your Targeted Asset Allocation

- Optimize Your Tax Location

- Manage Your Bucket System

Conclusion

Asset Allocation contributes 88% of your investment experience. Do you give it the appropriate focus? By following the easy step-by-step instructions in this Annual Targeted Asset Allocation Review, you can not only:

- Ensure your asset allocation matches your risk tolerance, but you can also…

- Optimize the location of your assets from a tax perspective and…

- Manage your Bucket System for retirement.

Three Birds, One Stone.

I told you this was an important post to read. Wink. Now, go do the exercise. It’s even more important than simply reading these words, and your retirement will benefit as a result.

Your Turn:

Let me know how your Annual Targeted Asset Allocation Review went. But PLEASE, remember to do that pesky little “File/Make A Copy” step when you open the spreadsheet. Just to remind you, I’m copying below a copy of the email I’ll send if you ask me for permission to edit. So, don’t ask (you’ll just get that same email again). Just do me a favor and do the “File/Make A Copy” Step. Please? Have I made my point? Smiles.

Dear XXX,

Thanks for checking out my site and for your interest in The Retirement Manifesto XXX Spreadsheet. To make changes, you have to save a copy to your own drive. This avoids anyone else seeing your numbers, and keeps the original intact for other readers. Just go to “File” and make a copy to get started. You can also do a “Save As / Excel” to accomplish the same thing, this choice will transfer the google worksheet into an excel spreadsheet. Trust that makes sense.

Thanks again for your interest!

Fritz Gilbert

The Retirement Manifesto

Thanks Fritz, as we discussed in emails over the weekend, this article is very timely for me. Rebalancing and getting my buckets in order has been my focus this month as the countdown has begun. Thanks, Bob

Glad it’s helpful, Bob. Ironic timing for your emails, happy to be of some help as you set up your Bucket System!

Fritz, thanks for taking time to share your process. I do something similar though have the opportunity to focus more on addressing asset location.

When I was working my 401k provider had a process to rebalance every 90 days so I always took advantage of that which was a painless way to stay between the guard rails.

Another advantage of this exercise is to look for places where you may be able to simplify your holdings, assess fees, etc.

So for 2019 it’s time to simplify my holdings in my traditional and Roth IRA as well as looking at Roth conversion opportunities.

Dave, I think the “asset location” piece of my process is a bit unique, glad to hear it’s an area of opportunity for you to fine tune what seems to be a solid process for you. You’re fortunate to have automatic rebalancing in a 401(k), I’ve not heard of that before. I’ll also be doing a Roth Conversion in 2019, I’ll write more about it here later in the year.

What makes up the “Alternatives” category?

Venise, in a broad sense, as per this definition from Investopedia, it’s anything that doesn’t fall into the other categories (see the link for some examples).

In our portfolio, it’s primarily comprised of precious metals (gold/silver), commodities (primarily through commodity focused ETF’s) and my option trading account (my “fun money”, where I do some really stupid trades on things like VIX, Interest Rate Futures, etc. Not recommended, by the way!)

This is great, and quite timely as I’m in the process of rolling over my megacorp 401(k) to Vanguard. The Mr. rolled his over a couple of years ago, and now everything will be in the same place. Do you recommend implementing your overall AA separately in each IRA, or having one with perhaps the more aggressive funds and the other more with bonds and cash?

Lou, I really don’t look at AA separately in my various funds, other than when I’m working on optimizing the Tax Location piece of the puzzle. As an example, for the “more aggressive funds”, I look at Bucket 3 / Roth per the table in my article. For all AA analysis, I look at our entire portfolio holistically. Good move for you to simplify and roll everything into the same place.

We do it a little simpler, with all of our changes in the “Before Tax” IRA accounts. Both our Roths and our After-tax are invested in VTSAX only. You are correct that for tax purposes, having the VTSAX for in the After Tax account does mean that we pay tax on our dividends and capital gains. However, we set that up years ago, so moving it around could cause us to have a one-time event that would result in losing our Obamacare subsidies.

We do make some withdrawals carefully from After Tax and pay capital gains. That is the most favorable to keep under the ACA subsidy line. It allows us to not touch the Roths and to avoid the higher taxes on the IRAs for now. That is our strategy because of the healthcare tax rules.

VTSAX isn’t a bad fit for After-Tax, since you’ll be paying capital gains rate instead of marginal personal tax rate (which is what you’d end up paying if gains were in Before-Tax). Also, good point about managing your numbers to maintain your ACA subsidy. You’re fortunate to qualify, and it’s a major consideration on how you manage your investments. Good addition to the discussion.

good advice and analysis fritz. i just started doing this last year and i only did it to write a blog post of my own after having a general idea and flying by the seat of my pants for a long time. the thing i realized is that i kept writing about raising my cash position from its paltry 3% to 15% as we got closer to calling it quits. seeing it written out helped me finally make the move and it felt good to hold 4-5 years cash with the goofy markets all winter. our bond equivalent is in preferred stocks around 15% for the higher yield but with higher risk. to each his own and you don’t get the yield without the risk, like most things in life. all the best- f.s.

Freddy, funny how writing a blog post helps you solidify a more formal approach to managing your money. I’ve experienced the same phenomenon, and it’s an unexpected benefit of blogging. Good move to be increasing your cash, it’s critical as you approach the Starting Line.

Good one. Agree with nearly all of it. Regarding Asset Location, I wish I had known earlier that there was too much of a good thing. We dutifully stuffed our tax deferred accounts so that >70% of our portfolio is there and we could use a higher percentage of after tax-for cash and taxes. Like you, I just retired last year and fortunately I can make up a bit because I am consulting part time. BTW, here is a link to interesting piece on bucket strategies. https://www.marketwatch.com/story/do-bucket-strategies-stand-the-test-of-time-2019-01-25?mod=retirement-weekly

If that doesn’t work because you need a subscription, here is the very dry study that was referenced:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3274499

Always good to keep up on the challenges..

I’m with you, Rob. We’ve got far too much in our tax deferred, though we didn’t really have much choice given that the Roth wasn’t an option through the first half of my career. Thanks for sharing the bucket links, heading over to have a look now. Congrats on your retirement, and good luck with the consulting!

I wanted to give a big shout out of thanks to Rob for sharing that intel on bucket study! I had to search for “Estrada Bucket approach” to get the full pdf as those links were only for an abstract. But it was well worth the hunt. I’ve heard and been convinced of a 2 or 3 bucket approach for years but then never understood how I would know when was a good time to refill the the non stock buckets (easy in the abstract but more difficult when you try and actually figure it out). I gave up trying to model buckets in my withdrawal strategies. But I found a simple strategy to pull funds yearly or monthly from a mixed portfolio regardless of market performance (e.g. pull my needs from a 50/50 stocks/bonds target even if the current mix has changed to 65/35 due to a stock market drop) and then rebalance back to the 50/50 target afterwards was easy to model and showed me good results. Turns out from that study that this also is better performance than the bucket strategy as it continues to buy stocks during those downturns even when I’m in the withdrawal phase! Do yourself a favor and check it out. Even if you disagree, the study will give you some insight on rules regarding when to refill your buckets and data on failure rates. Thanks Rob!!!!!

Very logical and clear process Fritz. Nicely explained

Bit too much cash for my liking but that’s why they call it Personal Finance

I am missing your Bitcoin allocation…..🤣

Cheers!

Mr PIE!!! Great to see you here, old friend. Hope all is well with you, think of you often. Too much cash, and pushing me into Bitcoin!? You’re clearly a much riskier investor than I am. I like my cash, and I hate bitcoin. Personal, indeed. Wink.

Fritz, I love your articles and this one is very timely and much appreciated. I use Personal Capital as well but my holdings only reflect my “Investment” accounts, not my savings, CD’s and other cash. Nothing listed in “Cash” on the left hand bar shows up in the “Holdings” graph. From your article, it seems that your cash accounts do show up. I’m wondering what I need to do to see and overall holdings graph instead of just an investment graph.

Thank you again for such great information!

Thanks for your kind words, Kyris. As I mentioned, I had to manually enter some of my cash accounts (e.g., CapitalOne), but they automatically appear in my Asset Allocation once I do that. See if you can manually adjust, seems that it was fairly straightforward when I did it (it was over a year ago, so sorry I can’t provide specific step-by-step instruction, my memory’s not that good!).

Fritz,

This post and the two referenced – about asset allocation and the bucket strategy – were helpful. Thanks.

Many retirees my age – late 60s – and older have private pensions and social security which partially fully meet retirement non-discretionary spending. It is particularly challenging for us to determine the appropriate asset allocation mix for several reasons:

1. Social security benefits for those of us with healthy investment portfolios and/or incomes may be means-tested in just a few years. While we are not likely to lose all our SS benefits, it is not at all certain how much of those future benefits to count on.

2. Most private pensions provide a fixed benefit, with no adjustment for inflation. Part of our challenge is to estimate the future rate of inflation.

3. Large future pension streams could allow for much more exposure to equities and other volatile categories in our investment portfolio. But such a strategy is hard for some to stomach, given all the more conventional advice we hear.

4. It is very difficult to know how much flexing down would be comfortable for retirees whose investment portfolio will only be funding discretionary expenses. I think my wife and I will be satisfied with two weeks vacation instead of six, but I guess we won’t know until it hits us.

Granted, having a large amount of “guaranteed” income and a significant portfolio is a nice problem to have. But it is still a challenge to navigate, even for a finance MBA like me.

John, valid point about consideration of “other” income sources. I, like you, am fortunate to have a pension (fixed, not inflation adjusted), and I also wonder about how much SS will ultimately pay. I tend to look only at our “unfunded” living expenses, which must be covered from our investment portfolio. Our withdrawal rate is <3% for 2019. I use that "unfunded living expense" as the basis for developing how much we should have in each Bucket, which then feeds into our targeted asset allocation by investment class. Good addition to the discussion, thanks for stopping by!

Me like a lot!! Freakin’ awesome. Knowing you have to rebalance is one thing. Knowing what specific amounts of what assets have to be rebalanced is another. Genius. And thank you.

Did you just call me a genius? Me Like A Lot!

Aah, thanks!! I just scheduled my first ever annual review with myself for June 2019. At this time, I’ll be rebalancing and I’m definitely going to use your spreadsheet. I saved as a copy so if I email you, it will be to mess with you…kidding 😉

Fritz

So what happens when the real world kicks in. Say stocks take a dive. Bucket 1 is ok, bucket 2 drops a bit. But B3 is now way below your target allocation, which is fine. The idea being to take from B1 & B2 so one does not have to touch B3 and make the losses real. But the allocation will be way off. Before retirement one would have sold bonds (B2) to buy more stocks (3) [which in theory are now on sale]. But now we are in withdraw mode. Can’t take from B2 unless it is above the target band, which very likely will be on the lower end of the band. So the whole balancing scheme goes out the window until the market recovers???

Frank, my objective is to keep Bucket 1 full the majority of the time (for example, I just sold some stocks this week which have done well, and moved the cash to Bucket 1). If the “real world” kicks in, I should be able to leave Bucket 3 alone for up to 8 years, though I agree with you that I may have to sell some bonds at a slight loss (at that point, I’d be selective and sell whatever has the “least loss”). After 8 years, I’d still have some assets in “alternatives” (e.g., commodities) which I’d hope I could harvest for survival. Obviously, I’d also be reducing spending to “needs” to extend the life of Buckets 1-2 in a major downturn. Between all of the options, I’m confident that my retirement would stay on track, though perhaps without all of the “wants”.

My only point was that you have your buckets and asset allocation. The buckets have their max/min. Which means that one may not be able to maintain their desired asset allocation, say if stocks take a dive. Bucket 1 will be full, Bucket 2 ok, but Bucket 3 will be down (on paper). At that point your desired asset allocation will be off until the market comes back.

I’m sure you are working on it, but would love to hear about some of your adventures in the 5-wheel. Maybe there will be some TRM meet-ups in the future….

Cheers

Fair point, Frank. In a situation like that, it’s fair to point out that I would likely stray from my targeted Asset Allocation.

Ironic you brought up the 5th wheel, writing a post now titled “The Great American Adventure” about our summer plans (cross-country via RV, with our 4 dogs). It’ll be out in two weeks, watch for it! Would be fun to meet up on the road!

Fritz,

Thank you very much for this and your other posts regarding withdrawal and allocation strategies. I’m 53 years old, and I’m planning to retire in a few months. My portfolio is divided among savings, after-tax, Roth and before-tax accounts, and I would like to make withdrawals from the after-tax account as long as possibe (even after 59 1/2) to maximize the tax benefits of IRA/401k accounts, making also Roth conversions over time. My portofolio is stock heavy, and I need to increase my bond exposure for the retirement phase. If you don’t mind, I would like to ask you a couple of questions to better undestand how the bucket strategy would work in practice:

1) As per the tax structure, it’s recommended to keep bonds in the before-tax account. However, since I won’t be able to use that account to refill bucket 1 with the sale of bonds (in case of a bear market), it probably won’t make sense to increase the bond allocation there. In that case, would it make sense to have them in the after-tax account, but then increase my income tax bill with interests taxed at the marginal tax rate? Or, would it be better to have a little bigger cash cushion to ride a bear market and continue to have a higher stock allocation – which in the long term would probably give me greater portfolio appreciation?

2) Since the tax advantaged accounts are off-limits, would the bucket strategy increase taxes in the long term, since I’d have to sell stocks from bucket 3 to buy bonds to refill bucket 2, and later sell these bonds to refill bucket 1 with cash, triggering 2 taxable events for the same dollar? In the scenario of having bigger cash cushion and stocks, each dollar would be sold and taxed just once. Or, since bonds would probably grow less than stocks while in bucket 2, the overall tax bill (and gain) would be lower than if the money was moved from stock to cash directly?

Thank you very much!

CSS, a very insightful question, you’re thinking about the right things. As you know, I retired at Age 55 and have some of the same issues with “tax location optimization” given the reality that we’ll need access to some of the asset classes that best fit inside before-tax accounts. In regards to Q1, I’m using a tax-free muni-bond mutual fund from VG in my after-tax account as my first line of defense in Bucket 2. Also, since I’m doing annual “topping off” rollovers of Before-Tax money, I could use this trade to access some of the bonds in my before-tax accounts. As for Q2, it’s certainly viable to pursue your “more cash/more equity” strategy, though you’d have to think about what you’re going to sell to raise your cash. If you’re selling equities to raise cash, you could easily invest that sale into muni-bonds instead of cash, and (hopefully) get a bit higher return with your Bucket 2 exposure of muni’s instead of “just” cash. Hope that helps, you’re clearly thinking through your options and I’m sure you’ll find a solution that works for you.

Thanks, Fritz! That’s a good suggestion – I haven’t thought of using tax-free muni-bonds.

I also would like to share an idea that I read somewhere in my research: keep all bond positions in the before tax account, and when the market is down, we would sell stocks from the after tax account, and immediately sell bonds and buy the same amount of stocks in the before tax account. That way, we would have access to the “bond money”, the overall stock/bond mix would be the same, and when it’s time to rebalance, we would sell stocks and restore the bonds position in the before tax account.

Do you think that would be a viable strategy?

Thanks again!

That’s definitely a viable option, CSS. I’ve read similar ideas on someone’s blog, but can’t remember the source.