For decades, you’ve been diligently saving and building your nest egg to ensure you’ll have a shot at maintaining an acceptable lifestyle in retirement. Once your working years are over, the focus becomes how to generate retirement income from the wealth you’ve built over your career. Or, in other words;

“How To Build A Retirement Paycheck”

This is Part I of The Bucket Strategy Series, the entire series is outlined below:

The Bucket Strategy Series:

- How To Build A Retirement Paycheck (this post)

- How To Manage The Bucket Strategy (How I maintain the bucket system in retirement)

- Your Bucket Strategy Questions, Answered! (Q&A regarding management of the buckets in retirement)

- The Bucket Strategy In A Bear Market (How it’s held up, the steps we’ve taken, and the lessons learned)

Moving from an “Accumulation Phase” to a “Withdrawal Phase” is one of the most significant financial changes that comes with retirement. Unfortunately, there’s much less written about how to generate an income in retirement than there is about your Accumulation Phase. Today, we’ll address the Withdrawal Phase, outlining a strategy I’ll be using in my retirement.

Turning your investments into a retirement paycheck takes a different approach than building wealth. Click To TweetHow To Build A Retirement Paycheck From Your Investments

The Bucket Strategy

A common approach to setting your investments up for the withdrawal phase is to establish a “Bucket Strategy”, originally conceived by financial planning guru Harold Evensky. Even though I’m still several years away from retirement, I’ve already been working on setting this up, and will share the specific approach I’m using.

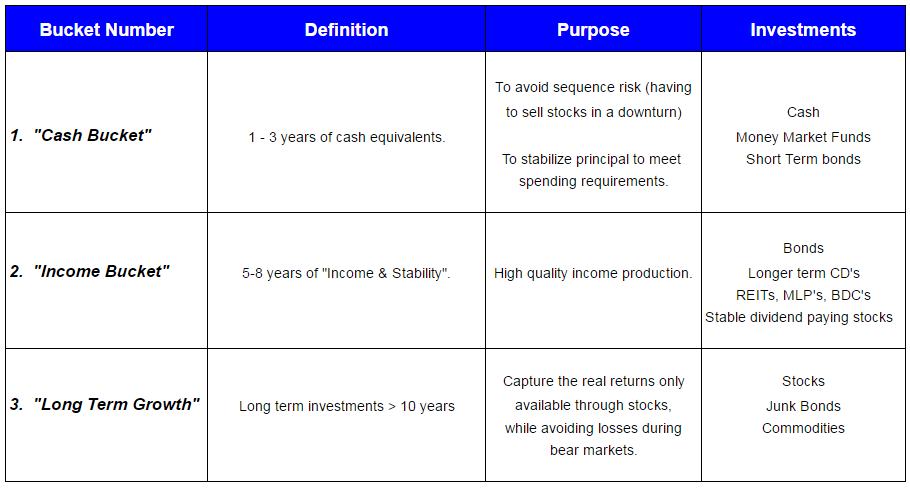

First, a description of each bucket.

Bucket One: “The Cash Bucket”

The cash bucket should be fully liquid, risk free and readily available. Depending on your risk tolerance, you should target to fill Bucket One with anywhere from 1-3 years of spending requirements not covered with other income (e.g., pension, social security, annuities). Your goal here is NOT to generate a high return, but rather to protect your spending requirements over the next few years.

To avoid sequence risk (having to sell stocks during a downturn), get your bucket filled PRIOR to your retirement date. I’m doing that now, and I’m ~2 years away from retirement. As a more conservative investor, I’m targeting 3 years of spending in Bucket One. Why? From 1966 to 2009, it’s taken the S&P 500 three years, on average, to return to it’s pre-crash high. You want sufficient cash in Bucket One to ride out a bear market.

Before retiring, insure you have sufficient assets to cover your annual spending requirement with a safe withdrawal rate of 4% or less (we’ll be targeting 3% in our retirement). For example, if you have $1 Million saved, 3 – 4% would give you a safe withdrawal rate of $30,000 – 40,000/year. A reasonable “Bucket One target level” for someone planning on spending $40k per year would be $80k – $120k.

To ensure you stay within your safe withdrawal rate, set up at least one year of your “cash bucket” in a separate account (I’m using CapitalOne), then establish an automatic monthly or bi-weekly transfer from that account into your checking account. Once it’s in place, you’ve established a “retirement paycheck”.

Bucket Two: “The Income Bucket”

The Income Bucket has a goal of generating income with controlled risk. Since you’ll be using the funds in this bucket to periodically “refill” Bucket One, you want to keep a focus on stability. However, to insure your investments are producing results and keeping up with inflation, you have to take some risk. While Bucket One is “No Risk, No Return”, you can think of Bucket Two as “Some Risk, Some Return”.

Investments in Bucket Two should focus on high quality fixed income assets (bonds, REIT‘s), with a smaller compliment of stable dividend paying stocks (e.g., JNJ) and other higher yield securities (MLP‘s, BDC‘s, etc). “Balanced” mutual funds with a blend of bonds and conservative stocks could also be considered for this bucket, as can mutual funds focused on dividends. In my portfolio, I consider my holdings in Vanguard’s Wellesley (VWINX) and Dividend Growth Fund (VDIGX) as elements of Bucket Two.

If you’re very conservative, consider this advice from Darrow Kirkpatrick and aim for 10 years of spending between cash and bonds. In that scenario, Bucket Two could represent 7-8 years of spending. For our $40k spender, that’d mean a reasonable target level for Bucket Two would be somewhere between $280k – $320k.

Several times per year (I’ll target quarter-ends) look for any asset class which has performed well, and sell portions of those investments to refill the cash in Bucket One. If (more accurately, when) we enter a major bear market, draw down the level of Bucket One for 1-2 years to allow time for your riskier assets to rebound. Alternatively, you can divert your dividend and interest earnings from Buckets Two and Three as a steady stream of cash into Bucket One. I think of the “dividend diversion” as a “Drip Refill” strategy, and plan on using that in my retirement.

Bucket Three: Long Term Growth

With the longest time frame, you shouldn’t have to tap the money in Bucket Three for ~10 years. Therefore, it’s focus is to generate the long term returns possible through stocks. Only stocks have demonstrated an ability to consistently outpace inflation. In fact, according to this article Meb Faber research, stocks have earned 5% over inflation in the past 10 years, compared to 2% for bonds and 1% for T-Bills/cash.

Bucket 1 is low risk, low return. Bucket 2 is some risk, some return. Bucket 3 is high risk, high return. Click To TweetThis bucket will have swings in value as the stock market does it’s normal thing. Since you don’t need to worry about accessing the money for 10 years, you can sleep at night through the next bear market, knowing that things will most likely recover before you need to tap into this stash. Don’t panic and sell in a bear, which will turn your paper loss into a real one. Likewise, look for strong market performance timeframes to siphon off some of the gains and diverting the funds to Buckets 1 & 2, locking the gains in for future use.

The Bucket Strategy – A Summary

How To Implement The Bucket Strategy

Follow these steps and you'll turn your investments into a retirement paycheck. Click To TweetI’ve added a tab in our personal net worth spreadsheet, and have linked all of the line items from our individual accounts into their appropriate buckets. Here’s a screen shot from my spreadsheet, which I’ve modified a bit (e.g., not my actual $ amounts, I’ve eliminated the name of investment holdings, and I’ve adjusted the target amounts to reflect the $40k of annual spending used as an earlier example).

I’m using this exact format for our personal retirement planning, and will plan on updating our actual bucket holdings once per year as I’m updating our Net Worth Statement. At the end of every Quarter, I’ll review holdings for potential reallocation to insure I’m within the target ranges for each bucket.

Note: I’ve also set up a link to the spreadsheet created for this post if you’d like to work with it as a template. To access the spreadsheet, click here.

Conclusion

Managing your money during the Withdrawal Phase is significantly different than during the Accumulation Phase. Take the time to understand the differences before you reach retirement, and work to align your investments to deliver a predictable retirement paycheck for the rest of your life!

If you’re already in retirement, consider setting up a bucket system, especially if you’ve been having difficulties keeping track of your spending. Start with Bucket One, and establish a monthly automatic transfer into your checking account.

I’d welcome any of my readers who are already in retirement to comment on this post, let us know any other suggestions you’d recommend based on your actual experience. If you use something other than the “Bucket Strategy”, I’d welcome your thoughts on why you chose to go a different route, and how it’s working out for you.

Together, we can Help People Achieve A Great Retirement!

Note: A subsequent post in this series has been published! To see how we’re managing The Bucket Strategy 18 months into our retirement, see “How To Manage The Bucket Strategy”.

My First Infographic!!

To support this article, I just produced my first infographic, using The Bucket Strategy as my topic. Enjoy!

Holy crap! This is awesome. The bulk of my strategy, as you know, is the glidepath strategy advocated by Pfau/Kitces. But unbeknownst to me, I was also including some elements of the bucket strategy as well. For instance, Mrs. Groovy and I have at least four years of expenses sitting in the bank already. This “cash bucket” is surely overkill, but we anticipate buying a new-to-us car in the next few years. Our brokerage accounts also produce between $13K and $15K in dividends each year. My goal was grab this money every January. But perhaps monthly or quarterly transfers to our checking account makes more sense.

I love the Bucket Strategy spreadsheet, Fritz. I never thought of that. I’ve downloaded your template and will begin working on it this week. I’m still going Pfau/Kitces/Collins, but that approach may be too conservative. Damn this retirement stuff is hard!

It never hurts to compare one’s plan to others. The bucket strategy is an excellent way to handle sequence of returns risk and manage one’s income in retirement. Thank you for explaining it so well. And don’t be surprised if I have a post in the next few weeks extolling the virtues of the Pfau/Kitces/Collins/Fritz approach to managing the withdrawal phase.

Talk to you soon, my friend. Cheers.

Holy Crap!? Wow, that’s quite a compliment! Funny, I was thinking about you this morning, thinking about how one could merge both the bucket strategy and Pfau/Kitces strategy. Amazing minds think alike, my friend! Glad the spreadsheet was of help!! Look forward to hearing how your retirement paycheck unfolds, given that you’re a few years ahead of me (hey, I’ll take any help I can get from those who walk the path ahead of me!!).

Hi Fritz,

This is my first visit to your blog. Fantastic post, I downloaded the spreadsheet and I am going to be playing with it – I am long ways away from retirement.

I would like to point to you Robert Schiller’s (Yale University) course where he talks about asset allocation between stocks and bonds. This chart was eye opening for me. The chart is Expected Annual Return vs. Standard Deviation of Return as you a sweep in 10% increments between stock and bond allocation.

What you will notice is that 50 stock / 50 bond has the same (risk profile) standard deviation of return as that of a portfolio with 100% bonds.

This chart provides insight based on historic risk / return data for you to optimize your asset allocation.

Course Lecture Link – http://oyc.yale.edu/economics/econ-252-11/lecture-4

Course Lecture PDF: http://oyc.yale.edu/sites/default/files/Lect04DiversifyS.pdf, slide number 5 has the chart.

–Michael

Michael, welcome to The Retirement Manifesto! I appreciate your comment on your first visit! Great links, thanks for making the site even better by sharing the information! Glad to have you on board, look forward to interacting with you in the future. Thanks again.

Great breakdown of how to be systematic. I also like your asset allocation suggestions.

Fritz,

Thanks for the great post! Your Retirement Cashflow spreadsheet has become my one of my favorites. I am retiring at the end of the year (at age 50!) and have been thinking about my spending strategy as I head into this new phase. I am going to spend some quality time with the Bucket Strategy spreadsheet this week. I always look forward to a new post from The Retirement Manifesto!

Warm Regards,

Alison Slade

“…has become one of my favorites.” WOW, that’s a real honor, thanks for the compliment!! Sounds like my Bucket Strategy article was published at EXACTLY when you need it! If you have any questions, feel free to contact me (IM on Twitter @retiremanifesto probably easiest way to reach me).

Fritz,

thx for detailing this. It clarifies a lot.

ATL

Enjoyed reading this Fritz. Great summary and very clearly laid out.

I will add that our strategy is mighty similar. Indeed we own some of the same funds in bucket two. We have a person that will pay out an annuity as soon as I pull the plug so our bucket one size factors that differential into what we need for safety net based on the pension “income floor”.

I wonder what you think of the nice work done by Darrow on the CAPE withdrawal strategy. I.e looking at CAPE on a yearly basis to decide when to sell bonds or equities. His work looks very solid and can lead to massive differences in ultimate size of the nest egg over the years.

Still wrestling with how much we need in US vs ex US equities. Such a great run for US stocks over the last decade you think it can’t last. I am however still in JLC camp of plenty international exposure can be gained from large US corporations that operate globally. Yet we own some emerging market, developed market ex US based funds and may increase that exposure a little more.

That would be…..” We have a pension” despite me being a person.

TGIF.?

Mr PIE – Yes, I’ve looked at Darrow’s CAPE, and I like it. I’m thinking along the same lines as you, and plan on using valuation metrics like CAPE to help determine when to “refill” buckets by selling various asset classes. I’ve also increased my ex-US Equity allocation slighly over the past 3-6 months. I don’t disagree with JLC, but I like to have clear “International Funds” so I can intentionally buy/sell international exposure to adjust my asset allocation. Thanks for your comments, nice add to the site!

I really like the bucket strategy. It was super easy to follow along and I love the infographic. I will definitely be downloading and playing around with the spreadsheet this weekend. Thanks for sharing!!!

Glad the infographic was helpful. I “self-taught” myself how to build one yesterday, kinda fun. Pleased it adds value to the content! Thx for your comments!

I agree. This is awesome! I love it!

Maggie, your FIRST post on my site! So excited to see your name, I LOVE your work!! Welcome aboard The Retirement Manifesto!

There once was a man from Nantucket

who put his money into a bucket

or three, and it was fantastic.

He made his first infographic

and the landing on Rockstar Finance? He stuck it.

CLASSIC!!!! Wow, Doc, you’re “On FIRE” Tonight! Great poem, means a lot to me that you took the time to write that. Nice getting to know you out here, looking forward to meeting you at #FinCon17!!

Likewise, Fritz!

Very well done Fritz. I too am a fan of the bucket strategy.

To me, the strategy’s real strength comes from its behavioral finance advantage over other strategies. As Michael Kitces has noted (https://www.kitces.com/blog/managing-sequence-of-return-risk-with-bucket-strategies-vs-a-total-return-rebalancing-approach/), the real behind-the-scenes work from the strategy actually comes from the total return/rebalancing that is implicitly built into the strategy.

But for folks living off of their portfolios, it is much easier to conceptualize one’s portfolio in terms of “buckets.” Importantly, then, because of the mode’s intuitive nature people actually avoid selling equities during down turns, which helps avoid the sequence of return problem. The strategy thus seems to fair much better with real people in the real world, which matters a lot.

So again, well done and thanks for your good work.

Best regards,

Mr. FIDough

https://fidoughhub.com/

P.S. Sorry you couldn’t make #FinCon16, but hope to see you at #FinCon17!

FiDo! Great to hear from you, and I’very already registered for #FinCon17 so will see you there! Good add to my article, and appreciate the Kitces link. That guy’s awesome. Thx for stopping by!

Hi Fritz,

Thanks for this. I am still far enough away from retirement that I haven’t got that detailed a plan, but information like this is very useful for all of us! I had not seen nor heard of such an approach before.

Cheers,

Paulie

I had a similar idea in mind but couldn’t quite explain it. This article lays it out very well. Well done!

I like this concept but cannot figure out how to split it all between regular investments, traditional IRAs and Roth IRAs.

Valid question, Tom. While I didn’t get into “tax treatment buckets”, I also have been intentional on diversifying my investments between each of the three tax treatments you mention. It’s important to have options when you enter retirement, as they will allow you to work some tax minimization strategies in the withdrawal phase. It’s outside the scope of this article, but you should seek to have some level of funding in After Tax, Before Tax (IRA) and Roth.

Fritz

Great article well explained. Have you considered a follow-up article on the details of re-balancing or already done one?

I assume you let Bucket 3 grow until you need funds for Bucket 2 based on your pre-set criteria. Once you determine that you need to fill Bucket 2, then you start looking at Bucket 3. Let’ say B3 is up 5% and you now want to take that 5% (or less I guess based on needs of B2) and send it to Bucket 2.

Next is that, while the portfolio is up by 5% it will be mixed, some assets will have grown far beyond 5% while others are down. Do you re-balance B3 before pulling the 5% or take the 5% from the high flier(s)?

This same scenario would happen in B2 to B1.

Cheers,

Frank

Frank, good suggestion for a follow-up article. I’ll be a bit less methodical when it comes to refilling the buckets. I really like the CAPE valuation strategy outlined by many online (e.g, Darrow Kirkpatrick), and think it’s a good metric to use to sell equities when they’re over-valued, but sell bonds when the equities are depressed. My plan is to occasionally (quarterly?) scan my portfolio and “pick off” a few shares of higher priced funds. Since I won’t have to worry about it until I’m at least a year into retirement, I haven’t defined a more scientific approach than that at this point.

This answered one of my questions thank you! I had looked into the bucket strategy several years ago and had even set up my grandparents trust using it. Somehow my mom had become responsible for it and had it all sitting in cash despite needing to cover some expenses decades out. Simple math showed it wasn’t going to last how it was.

The problem with this strategy and my whole investment philosophy at the time is that there is an assumption that CAPE will return to the mean. This is very dangerous because there is a very real difference in circumstances that make stocks the highest expected return even with a historically high CAPE right now. So where do you draw the line that says CAPE is too high and it is time to replenish bucket 2? Or even bucket 1 for that matter?

What kind of drag are all of these low possibly negative real returning assets creating on your portfolio? Have you seen a side by side back tested comparison? Also remember that you can’t set the cutoff points based on the data you use. This was one of my errors when I first looked at this.

Zack, thanks for your comment (sorry I couldn’t reply below it, would only let me reply here). I’m glad you’ve gotten involved in your Mom’s Bucket Strategy, clearly more than ~3 years of cash is excessive, regardless of investor sentiment or caution.

I agree with your concerns on current CAPE’s, and implications for timing to shuffle your buckets. Given that your Mom has so much cash, it’s a difficult time to reallocate. I’d suggest you target tranches over the next 12-18 months, and gradually rebalance her into stocks/bonds as appropriate for buckets 2-3. Not sure what your reference is when you state stocks have “high expectation of returns” in spite of today’s high CAPE. Work I’ve seen (e.g., Kitces) says future returns should be muted during the “mean reversion”, and I agree with the outlook that returns from stocks will be below average over the next ~5+ years. That’s the primary reason I’m sitting on 40% bond and 10% Alternative allocation at the moment.

In our case, we’ll be looking to refill buckets 1-2 during periods of high CAPE. When the CAPE is lower, we’ll tend to draw down the levels in the buckets, or rebalance with bonds. I do expect overall portfolio returns to be “below average”, and am planning a lower than recommended withdrawal rate as compensation.

Hope that helps answer your questions, thanks for stopping by!

Hi

I am also a fan of the bucket strategy, however, how often would you normally refill each of the first two buckets? Would it be any different to just take the “paycheck” directly from the equity bucket during the good years, and just use the two first buckets as a buffer zone in the case of market recessions, and then refill once the market bounces back? Why constantly fiddle around and moving money from one bucket to the other even during good years?

Good question, EW. Theoretically, you could do as you suggest. Net effect should be the same. I’m planning on keeping 1-3 years in Bucket 1. I’ll likely work to keep it “topped off” at the 3 year mark if the market’s doing well (sell equities as I’m pulling my paycheck from Bucket 1, hence the same net effect as your concept), and let it drop down to 1 year if we’re in a Bear. Similar approach for Bucket 2.

Thank you for the answer! Another question on my mind has been how often one should do the withdrawals, that is equity sales. Once a year? Once every 6 months? Once a quarter? Every month? Or some other indicator that says it’s time to sell? (Of course, the sales should only occur during a positive market return, otherwise the cash bucket would be used.)

EW, good question. In our case, we’re leaning more toward your last option (“indicator says it’s time to sell”). We’ll be watching the CAPE ratio closely, and timing our sales based on feeling rather than a strict schedule. There’s both art and science, let’s hope we get it right!

Great article!

I also use a similar bucket strategy, but mine is a bit different as I am self employed and location independent.

I have bucket 1 already set up with 2 years of expenses saved in a liquid account.

My bucket #2 is a rental income that covers 75% of our expenses.

The bucket #3 is income I get from my job that I still enjoy and only put in 4 hours a day. I like having something to do every day, especially with the fact I can do it from anywhere in the World.

My bucket #4 is my Vanguard portfolio that generates 50% of my expenses.

I guess my fear is putting all my eggs in 1 bucket, so I try to diversify so I’m able to get income from different buckets at any given time.

Do you think that’s overkill?

FS, thanks for laying out your strategy. My “buckets” are more “Time Phase” (earlier buckets fit for earlier years), whereas it sounds like yours are more “asset allocation” based. Either approach would work, as long as the approach works for you! That’s why we call it “Personal” Finance, right!

Amen to that!

out of curiosity, where do you put, or do you account for the social security income that you will probably receive in your 60’s or at 70?

i am really enjoying reading your blog..

Thanks for the kind words, Frugal! When we get to the point where Social Security will start flowing in ~15 years (Age 70, max that deferral!), we’ll simply include that in our calculation for how much of a “Paycheck” we have to establish from our Bucket 1 Capital One account. All things being equal, the amount of the “paycheck” we establish will be equal to our spending minus the incremental from SS. I’ve got a 40 year “Retirement Cash Flow model” where I flow it by year, with my most recent SS estimates. Hope that answers your question, thanks again for the encouragement.

Just curious. How much side income are you able to generate from your blog?

I’ve never made a penny. I do it because I love to write. That may change at some point, but for ~2 1/2 years now it’s just felt “right” to do it as a labor of love.

glad to see a mention of BDC’s. i just bought MAIN for some cash in mrs. smidlap’s after tax bucket and also a preferred etf which combine to throw off over a hundred bucks a month. they’re a little less risky as she may want to spend some of that and i could possibly have to liquidate some for her. we’re not in retirement but pretty close and pretty close in age to you. late to the fire party but that’s ok.

1st time i’ve seen your blog but i enjoy the style and that you like dogs!

fritz. i saw a quirky little thing here. i got a message on gmail of your follow up comment and a message for ME to moderate it which takes me to wordpress sign-in. not sure if something went haywire in cyberland but we’ll see how this comment works out.

Ok, that’s weird. Techno-idiot here, afraid that’s beyond my pay grade. For what it’s worth, I did get your comment….

Hey, new reader here. I am 32 and seriously looking at the retirement plan. My husband and are diligently working through Dave Ramsey’s baby steps to becoming debt free and building wealth. We are also keeping an eye on the Money Milestones we should be hitting, and we are tracking to have the 2x our annual income in retirement accounts by age 45.

I am wondering if implementing parts of the bucket strategy can be done early and somewhere within the Dave Ramsey baby steps? We will be debt free except for mortgage and student loans in March 2018. We plan to slow down on paying off the student loans and increase our emergency fund from $1000 to 6 months of expenses. Can Bucket #1 begin to be filled after we are debt free, before paying off our house? Do you recommend paying off the house before diverting money to Bucket 1?

Maybe simultaneously as we contribute 15% into retirement, some into Bucket 1 and the rest towards the mortgage?

Thanks so much!

Just read this from a link at early retirement forums and I like the bucket system. I was planning on doing something similar. Bucket one would be 3 years in cash equivalents, but subdivided into the 1 year and 2 year sub-buckets like you mentioned. 1 year of cash in a ‘high (er)’ interest savings like Capitalone or Ally Bank with auto deposits to the local credit union checking account like a paycheck.

Year 2 and 3 monies in higher interest CD’s, maybe a CD ladder that rolls over every 3 months.

But this is where I differ, I am planning on bucket 2 being the rest of my portfolio. I am building my bucket on the dividend growth investing path and I would have all of my remaining money in bucket 2, then monthly or quarterly use the dividends to replenish my 1st bucket. If my dividends are more than what I need for the replenish (i.e. more than the $40k/yr used in the example) then use the excess to reinvest in the best dividend stock value at the time.

I believe the benefit of this approach would be having 3 years of expenses in bucket 1 would allow us to ride out a bull market but still have money flowing in from the dividends from bucket 2 .

I plan on SS being the ‘bond’ part of my portfolio and will use that money to decrease what is needed out of bucket 1.

I reread this article again from the link on your retirement checklist article. It reminded me that my buckets 1 and 3 are fine. I need to work on bucket 2. Thanks Fritz!

I have been following your site for the past few months. I very much enjoy the articles. I too have been using options as a stream of income through out my life. I utilize your strategy in addition to several more short term trades. It is a shame that more people do not utilize options. It is a method for people to greatly enhance their retirement.

Being from the financial industry it is easy to see why the public has not been educated concerning these investments. ‘There was no money in it for the brokerage houses”. The time needed to educate and work with the public was just too costly. I was at one time a CFP etc, but quickly realized it was all about sales and not sound advice.

I also like the idea of a bucket strategy. My bucket one is a five-year CD ladder. With a 4% withdrawal rate, this equates to 20% of my total portfolio balance. If a down-turn occurs, I know there is five-years of CD income in place to help absorb the pain. One CD matures each year and can be counted on.

The remainder (80%) of my portfolio is 50% private real estate and 50% stock index ETF’s. My total portfolio throws off income of approximately 4.5%.

In a down-turn, I will spend the 5 year CD ladder first and divert all income and dividends from real estate and stock investments to bucket one. This extends my bucket one well beyond the 5 year CD ladder. My goal is to never have to sell any stock or real estate investments and have adequate liquidity if place if a market correction occurs and the income is cut.

Great approach, Marshall. CD’s are a very viable option for Bucket 1, and their annual (or 6 month) expiry’s make them well suited to implementation in the bucket strategy. I agree 100% with your goal of “never having to sell stock/real estate during a correction.”

I’m a bit confused by this discussion of regularly refilling buckets. Shouldn’t I transfer from bucket 3 to my checking account as long as stocks are doing well? Why would I ever draw from bucket 1 unless the market is doing badly?

Confusion = Bad. Philosophically, you’re correct. The difficult part is in the execution. In our case, I’ve automated “paychecks” from Bucket 1 into our checking account. I then refill from Bucket 3 periodically, keeping Bucket 1 full as long as stocks remain strong, and pulling it down when stocks turn down. If I “automated” exchanges from Bucket 3, I’d have to stop those automatic transfers whenever the market turns down, which would mean more frequent monitoring of my investments while I’d rather be out having fun. Ease of execution was one of my goals, hence the automated “paychecks” from Bucket 1. Hope that clears up the confusion!

Cash in an anchor and is not required IMHO, either than emergency fund. Neither is all of the income stuff, that can increase risks as well. My research has led me to a very simple approach of stocks/modest and growing dividends with some international allocation and bonds to manage the sequence of returns risk. The Vanguard managed portfolios allowed retirees to make it through that last 2 market corrections with ease. And with 4% plus inflation adjusted spending. The better news is we can spend more early along with our spending patterns. Retiree spending starts to decline at a decent pace near 70 and accelerates in decline. Retirement Income For Life: Getting More Without Saving More, by Frederick Vettese is a must read. It uses real spending patterns and bands for spending based on market conditions.

Apologies for the blogger bombing but here’s my article on those Vanguard Funds on Seeking Alpha.

https://seekingalpha.com/article/2560655-how-retirees-made-it-through-the-last-2-recessions

Dale

Dale, thanks for your input. There’s certainly a camp with your opinion, and I’m fine with that. No doubt that increasing cash doesn’t come for free. The decrease in anxiety also comes with a decrease in long term returns. I’ll have to check out Frederick’s book, thanks for the lead, and thanks for the link to your Seeking Alpha post (impressive post).

I am also planning to use a “Time phase” approach to our three buckets in two years starting at age 55.

No plans to refill buckets two and three. Each bucket serves a different timeline. When bucket two is empty at 70, move on to the third bucket until I die.

Bucket one= 2 years cash, only used if both equities and bonds are down at same time.

Bucket two= Age 55-70= 75% Equity and 25% bond index funds(taxable, low MER, globally diversified)

Bucket three=Age 70-Death = tax free ( 100% equities currently in TFSA= U.S. Roth)) + delayed government pensions

My question is asset allocation now and as I approach 70. Do I look at the portfolio in totality or individual buckets since they are serving different timelines?

I am comfortable at 75-25 currently overall but need the growth in bucket three until I get there at 70.

I would re-balance as I withdrawal but not sure how I get from here to there.

Do I increase Bond % in bucket three gradually as I age from 55-70?

What about bucket two allocation?

Any suggestions?

Carl,

Ironically, I just wrote a post on that very topic, titled “A Simple Guide To Targeted Asset Allocation”. I do look at our portfolio holistically when analyzing asset allocation, and I take into consideration the levels in each bucket as I establish my Asset Allocation targets for the new year (I do this every January). Hope you find the article helpful.

Fritz,

Great blog… I am a newbie here and I have couple of questions. How would you handle the taxes from the dividends? Also, my portfolio is with Vanguard… where would you put the money market fund for bucket 1… in the brokerage account or in the IRA? thanks in advance.

Newbie

J, thanks for reading my blog! I consider taxes as part of my annual expenses, keeping enough in Bucket 1 to cover living costs plus taxes. I keep my Bucket 1 MMF in an after-tax account for maximum liquidity/availability. Hope that helps!

Hi, thanks for the interesting article on the bucket strategy. One question when a long bear market hits say 8 years when you re balance you will need to buy stock. In such a long bear market how will you keep your asset allocation and still keep enough money in bucket one and two? I would think they would also draw down (at least bucket two would).

Just looking for your thoughts on this.

thanks

Bruce, if/when we face an extended bear market, it’s likely my asset allocation may get a bit skewed since I’ll be spending down my cash and bonds. I’m ok with that, since that’s the concept behind the buckets. Essentially, I would bring Buckets 1 & 2 down to the minimum target levels while waiting for the market to correct to the upside. I’d also be cutting back on spending. If things continue to be ugly, I also have some Bucket 3 items (e.g., alternatives such as commodities) which I could harvest if they’re holding up. Plenty of levers to draw, will be interesting to see how it goes when I actually have to draw them! Thanks for stopping by.

Do you guys have any comments about that article by Dale Roberts above where he reports that a cash position actually performed worse than the two reasonably conservative funds he mentions? https://seekingalpha.com/article/2560655-how-retirees-made-it-through-the-last-2-recessions

The two funds are essentially about 66s:33b and 33s:66b. The article was written in 2014 and in 2018 he still holds his point of view as valid.

It seems to me better than having so many years in cash, I’m all for at least one year in cash and I would definitely say two years would be more appropriate for me, but beyond that, if these two funds Dale mentions, can produce more than a portfolio that holds cash then why not make the entire bucket #2 one of these funds? Just pick one of the two funds according to your risk tolerance, the amount of your nest egg etc. Or maybe buy them both in certain quantities to achieve your desired 60:40 or 50:50 or whatever you’re comfortable with. Seems like that would be less moving parts than someone with the many positions I read about in people’s bucket #2 ? I’m probably missing something, so all comments appreciated.

Fred, I’m a fan of Dale’s and consider him a friend. He’s a smart writer, and makes some valid points. In our case, we don’t need to seek extra return, and I’m willing to trade a bit of return for additional security. It fits my risk profile at this stage in my life, and it’s an approach I’m comfortable with. That’s the beauty of “Personal” Finance, there’s no one right answer, and we each have to pick an approach that works for our situation and tolerance.

Really good article, Fritz. I am 30 years old and married with a couple young kids. We are saving half our income and in the accumulation phase and have a typical 90% stock and 10% bond portfolio. We have a cash emergency fund in MM with one year’s expenses.

My question is, should we keep on aggressive portfolio up until about 1-2 years before retirement? And then we can fill in the buckets? Anything you can tell me about the timing of that is great; we hope to retire in our mid 40s. Thanks for all you do.

In Christ,

Spencer

Spencer, Thanks for your kind words and very appropriate question. Ironically, I just completed the first draft of a chapter in my book which addresses exactly this issue. A direct question is “yes, you should keep your asset allocation target until you’re close to retirement”. In our case, we built up 3 years of cash in bucket 1, so in theory you would wait until about 3 years before retirement before starting to build up Bucket 1 (beyond your 6 month emergency cash reserve, which you should already have in place). Since the purpose of Bucket 1 is to avoid Sequence Of Return risk, is it important to have it fully funded before Day 1 of your retirement, but there’s no need to do it until you’re a few years out. Good luck on your journey.

Thank you!