Managing a personal portfolio is always a challenge. It’s something we typically do alone (or with an advisor) and we seldom get insight into how others manage their money in retirement.

Are we doing it right? What are other people doing? What can I learn from them?

While reading various blogs is helpful (and appreciated by this writer), what if we could gain real insight into how other “real” people manage their money in retirement?

Today, we’re in luck. I recently found a fascinating study that provides some rare insight.

Real people. Real money. Real answers.

Today, a look into how people manage their money in retirement.

Today, a fascinating look at how real people manage their money in retirement. Click To Tweet

How Real People Manage Their Money In Retirement

Managing our money in retirement is something that we typically keep to ourselves. Seldom do we get an opportunity to see what others are doing. Fortunately, JP Morgan studied 31,000 people as they prepared for and entered retirement. They compiled their findings for us in their report, “Mystery no more: Portfolio allocation, income, and spending in retirement.”

It’s a rare opportunity to compare ourselves to others, and I hope you’ll find it as interesting as I did. Below is a summary of the report, organized by major topic.

Voyeurs rejoice, it’s time to see how others are managing their money in retirement.

Asset Allocation: Dialing Down The Risk

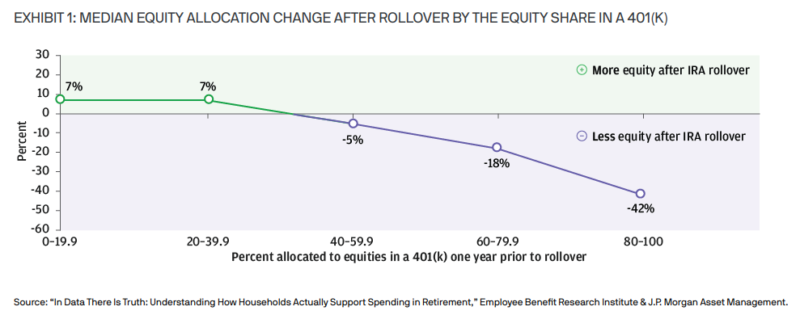

When retirees roll over their 401(k) balances, an astounding 75% reduce their exposure to equities. The median reduction is 17%, and those with a higher equity exposure tend to reduce it the most. Note in the chart below that those with an 80-100% equity exposure reduced it by 42%!

Are You Doing It Right? Reducing your risk as you approach/enter retirement is an important strategy to reduce your Sequence of Return Risk. If you have too large an exposure to stocks, you’ve likely suffered some anxiety in this year’s bear market. Moving some of that equity into lower-risk asset classes allows you to fund your retirement spending without having to sell equities after a downturn. As I’ve outlined in my posts on The Bucket Strategy, we keep 3 years of cash, and I’m sleeping just fine these days.

Using RMD’s As Withdrawal Guidance

Required Minimum Withdrawals (RMD’s) are established guidelines from the IRS for mandatory withdrawals from pre-tax retirement accounts starting at age 72 (Uncle Sam wants his tax revenue, after all!).

I was surprised to find that 80% of those surveyed who are younger than RMD age took no withdrawals from their retirement accounts. Meanwhile, a full 84% of those subject to RMD’s took only the minimum required withdrawal.

A better approach is to do annual withdrawals or Roth conversions prior to reaching your RMD age, using your marginal tax bracket and your safe spending rate as guidelines for how much to withdraw. It’s also important to recognize your spending will likely be higher in your earlier vs. later retirement years. You’ve saved that money to enjoy retirement, so don’t let an IRS guideline dictate how much you can safely withdraw or spend. Quoting from the study:

“The RMD approach is inefficient. It does not generate income that supports retirees’ & declining spending behavior and may leave a sizable account balance at age 100.”

Are You Doing It Right? If you’re not strategically withdrawing from your retirement accounts before age 72, chances are you’re doing it wrong. The tax savings over your lifespan can be significant, and I encourage everyone who retires before the age of 72 to develop a plan for Roth conversions in your “pre-RMD” years. I’ve outlined the strategy I use in How To Execute A Before-Tax Rollover Into A Roth. I’ve done a Roth conversion every year since I retired at age 55.

Given this year’s bear market and the potential 2026 expiration of current advantageous tax rates (see The New Tax Law Loophole That Benefits Retirees), it’s critical to determine if a Roth conversion is right for you NOW. Also, if you’re spending less than your Safe Withdrawal Rate (read my SWR opinion in Rethinking The Safe Withdrawal Rate) I encourage you to consider retirement account withdrawals to support your safe spending limits.

Spending Increases As Social Security & RMD’s Begin

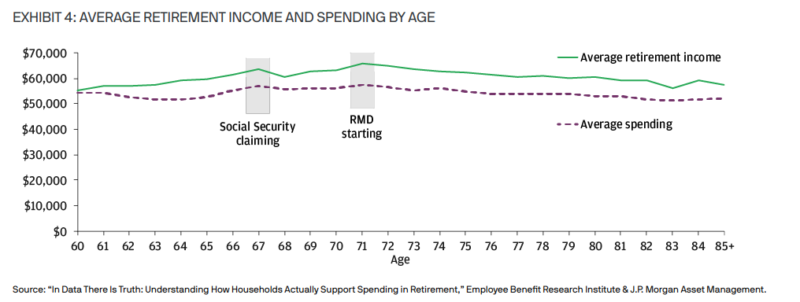

An interesting pattern appeared in the survey data. As income increases with the commencement of Social Security payments, spending also tends to increase. The same pattern occurs when RMD’s begin, as outlined in the following chart:

In reality, part of the increased spending when RMD’s start could be driven by the increased taxes associated with those RMD’s. On the Social Security front, however, it appears that the increase in income directly impacts the amount retirees spend.

Are You Doing It Right? The concern I have with the above data is that it appears people are holding back their spending in their “active years” (60 – 67), then increasing it as they near their 70’s. Clearly, there are many people who simply need their SS to cover basic living expenses. I wonder, however, if some folks are potentially suffering some opportunity cost of living a bit too conservatively in their pre-SS years when they could most enjoy the spending. I would encourage people to seriously consider running the New Retirement calculator (affiliate link) which effectively models both the Social Security and RMD tax impact by year. For more details, read my complete review on the New Retirement calculator here. Perhaps you can maintain a higher spending level in your pre-SS years by increasing your investment withdrawals, knowing they’ll be reduced once SS starts (assuming level spending). The New Retirement calculator can answer that question for your situation.

Households With Annuity or Pension Income Spend More

Managing your money in retirement is all about converting your assets into an income stream to support your retirement lifestyle. If that process is automated through either an annuity or pension, folks tend to spend more than if they fund their lifestyles exclusively through investment withdrawals. As I outlined in 5 Steps To Learn To Spend In Retirement, many folks under-spend in retirement (a phenomenon that actually has a name, “Chrometophobia”). I suspect this tendency is more frequent among those who don’t have the “safety net” provided by either an annuity or a pension. The study concludes with the recommendation that more 401k providers develop means of offering an “in-plan spending offering”. A full 85% of survey respondents stated they would be more likely to keep their balances in their 401k post-retirement if such an option were available. I predict this will be a likely development in the coming years.

Are You Doing It Right? If you’re under-spending your safe withdrawal rate, consider reading the “Learn To Spend” post cited above. In addition, if you have no guaranteed income, there’s nothing wrong with evaluating the potential of converting some of your assets into a guaranteed annuity. It’s a controversial subject, but my opinion is that they have merit in a situation where a retiree has no guaranteed income for life, especially if they’re spending less than they safely can as a result.

To read more, you can start with my post titled What Role Should An Annuities Play In Retirement. Another one worth your time is FIPhysician’s How To Use an Annuity in Retirement.

Conclusion

The study was a rare look into how 31,000 people manage their money in retirement. Not surprisingly, a lot of people seem to be making some mistakes (no Roth conversions come to mind). It’s understandable, given the complexity of the topic and the reality that learning to manage your money in the “decumulation phase” is an entirely different skill set than those used in the “accumulation phase.”

Hopefully, by reading how others are managing their money, you’re able to better evaluate your situation to help identify any “blind spots” you may be unaware of. If you’re concerned, this is one area where “DIY” is not always the best approach. Spend some time with a professional if necessary to develop your strategy and bring some peace of mind into your life.

Then, get on with enjoying your life in retirement. You worked too hard to get here.

Make the most of it.

Your Turn: Any surprises as you read how real people manage their money in retirement? Are you doing Roth conversions? What are your thoughts on annuities? Let’s chat in the comments…

Hi Fritz!

An interesting article, but one that does not surprise me. I think most of us will agree that the majority of Americans are not motivated to learn about personal finance; therefore the study shows what I expected. Most don’t adequately plan for retirement and spend what they make throughout the “accumulation” phase. Many are afraid to spend any of their savings in retirement because they may run out before death occurs. Again, this is easily prevented by planning out your decumulation phase. Many people spend way more time planning vacations than learning about money and the nuances of personal finance.

Carol and I just started our Roth conversions the past 2 years. We will do more in the next 3 and then be set. I fear we will also underspend as we age. Our children and grandbabies will be the benefactors. 🙂

Once I draw my SS at 70, we will have 2 pensions and 2 annuities in addition to our SS checks. More than enough to pay the bills and travel. We will give even more as we age to wonderful charities throughout MO and our country.

I urge all Americans to read finance blogs and books and ask retirees questions to learn how they can “live retirement” well and with purpose.

I just spoke to a wonderful lady, age 92, yesterday. It was my first visit with her and learning about her family was a joy! She is in hospice. I admire her wonderfully positive attitude although she is virtually blind and very hard of hearing. People like her inspire me to “be better” every day I age.

Peace and love to you and Jackie, Steve

“I urge all Americans to read finance blogs and books and ask retirees questions to learn how they can “live retirement” well and with purpose.”

Great advice, Steve. Had to smile when I thought of you talking with that 92-year-old woman, I’ve found my discussions with older folks to be some of the most enlightening I’ve ever had. Memories of my mid-Atlantic discussions with a WWII pilot came to mind…

Thank you for the update. We always feel that we have to hang on to that money. I have a full pension that covers all my expenses and that income is guaranteed until God takes me home. I have not touched any of the savings I have created. Fallowing the bucket method and running the numbers and I should be spending some cash each month that is in the spending bucket. I just retired 16 months ago and am still transitioning from a saver to a spender. It is a very hard transition. I opened my first IRA at 18 and worked for 38 years and retired at 57. Hopefully I can start to let go. Thank you for all that you do.

“I just retired 16 months ago and am still transitioning from a saver to a spender. It is a very hard transition.”

Indeed, a much harder transition than most folks realize. Congrats on crossing The Starting Line! If you missed it, you may be interested in my post 5 Steps To Learn To Spend In Retirement. It’s an ongoing challenge, and one we’re blessed to face.

Thanks Fritz, great post and very helpful with your links to prior posts and tools. I read a few blogs and watch youtube on personal finance so i feel like Im pretty up on most of this but i see a big gap. Many folks are either paying a CFA fee AUM etc or they are DIY. I hear many bloggers talk about paying a professional fee for service for those few things the DIY crowd need help with. like setting up and executing Roth rollovers and tax-loss harvesting etc. too bad theres not a list of “vetted” pros by zip code that folks could check out and use as I have no idea who these pros are as they all seem to want to manage all our $

Pete, I’ve got a link to Paladin on my “Resources” page, they do vet financial advisors by area and recommend several that meet their criteria. I agree that finding an appropriate advisor can be a challenge for many, but I can assure you that there are many qualified (and fair) experts in the field.

Also, thanks for your kind words about the post and links, much appreciated.

I thought it would be painful to start withdrawing a six figure income stream from investments, but it wasn’t. I just automated it so the money would direct deposit into our checking account monthly just like my pay used to. No pain at all. The amount we’ll withdraw will drop precipitously when we hit 70 and I start to take Social Security but until then we are living large off of our portfolio. We do spend only a fraction of what we could afford but we have and do everything we want so spending more just because we could isn’t appealing to us. We have gradually added some extra spending but we just don’t have an expensive lifestyle or tastes. Spending around $100K feels rich to us. With no debt, grown independent kids and a paid for house and cars our bills are not very big in our LCOL area.

Steveark, I couldn’t agree more on the fact that “automating” a retirement paycheck is a great way to live in retirement. 4 years in, and I wouldn’t change a thing. Works even better than I imagined. Congrats on living retirement well, we’re blessed beyond measure.

Hey Fritz , thanks for the info as always. My wife & I just retired at 61 & 58. We both have some pension money coming, 403bs and 401ks and social security of course. We know to do Roth conversions and we know more guaranteed income will be there in 6 or 7 years when we tap into my pension and social security. Currently, we are figuring out how to best reallocate our 403b and 401k money to cover the first 6 or 7 years ( and convert some of it in a Roth as we go). Really appreciate the info on the bucket plan 🪣 🪣 🪣!

Thanks

Congrats on crossing The Starting Line, SB! Glad to hear my Bucket Strategy Series is helpful for you (that’s proven to be my most popular series of posts ever written!).

Hi Fritz, we follow the bucket theory and were lucky enough to top up our cash on Jan 4th, the highest market day in history. Now, we’re just cruising along waiting for the bear to go back to its cave someday. We’ve already done the majority of our Roth conversions, using Pralana Gold to help me determine the most efficient way. Pralana is such an amazing tool. I will say though, that will all my planning, we’re still uneasy every time we take money out of the cash bucket. Just bear market nerves. 2.5 years into retirement.

JC, Ironically, I was only one day behind you (Jan 5) on my most recent “Bucket Fill-Up”, reiterates the importance of keeping Bucket 1 full while the markets are kind. I’ve been doing “fill-ups” on a quarterly basis since retirement, have taken a break during the 2022 bear, but resting easy with 2.5 years still in the bucket. I’m with you on encouraging that bear to get back in his cave… Finally, I’m not familiar with Pralana, will have to check it out.

One of the issues we’ve run into with Roth conversions is the AHCA. There is an AGI income limit and if you exceed it you will end up paying full price for health insurance. If you want to start spending assets before Medicare you will likely end up spending the money on health insurance (in some cases with very, very high deductibles) if you exceed the income limit. If you have other income streams it will reduce the amount you can roll over without hitting the ceiling. Any thoughts on this issue are welcome.

Vicki, great points, and the need to understand the impact on eligibility for ACA subsidies was one of the issues I cited in the linked post on doing Roth conversions. It’s definitely a factor that will make Roth conversions unattractive for folks who are receiving those subsidies. There are also considerations for the IRMAA impact on Medicare premiums if you’re aged 63 or older (IRMAA “looks back” two years). Both are factors that people need to consider when evaluating whether or not doing Roth conversions make sense for your individual situation.

Vicki, we used Pralana Gold to help us determine the best way to do our Roth Conversions, and it does take into consideration ACA subsidies. In our specific situation, we went big two years in a row and paid full ACA costs. We absolutely wanted to get this done before 63. The tax bills were quite large, but Pralana showed us how in the long run, it would be beneficial. This year, my fed tax bill will be $0 and a high ACA subsidy. Part of the decision too is to personal preference. We decided that knowing all Roth conversions were behind us, and low taxes ahead, lead to peace of mind. We now have a more predictable future.

I have not used Pralana Gold but will check it out since it looks at ACA subsidies.

I have used New Retirement Planner to work out the numbers to see the short term impact of loss of some ACA subsidies and large term impact down the road of doing Roth Conversions. This year I am planning on doing Roth conversion since there is no ACA 400% FPL subsidy cliff; capped at 8.5% of MAGI through 2022 because of the 2021 ARP. If the Inflation Reduction Act of 2022 goes through, it looks like it would expend this subsidy to 2025.

Even using a planner, there are so many assumptions we have to make. I read a good article recently from Andy Panko that looks at some of the considerations and assumptions. For me, this line stands out from that article that echoes what you said Jimcalf – “The way I frame the value of Roth conversions to clients is less about a tangible dollar amount of savings they will experience and more about a hedge and peace of mind.”

The ACA insurance premiums are why I have been living off of cash and only taking enough from pretax accounts to show income high enough to qualify for ACA.

I will go onto Medicare later in 2023 and then I can really get to work on Roth conversions.

Another gold brick here Fritz! You are so helpful and helping us become more insightful. Thanks a Million!

Images of a brick made of gold fill my mind….

IRA rollovers are pretty complex and professional tax help will be a requirement if I execute any. I am not sure if I am yet in the majority of retirees that don’t have a pension and tied up a large portion of investments into IRA’s and 401k’s. We have almost 3 yrs cash (1 year in after tax and two in 401k) and 14% in Roth. Although we will likely be able to roll over some, the taxes will add more burden on our withdrawal rate and we won’t be able to make much of a dent in our overall Roth position.

I sometimes wonder if using Roth IRA’s and after tax cash early to keep income near zero and rolling $100k per year until until 72 makes sense? Bad for any heirs, but perhaps better for us!

Perhaps worthy of noting in these posts is that for those who DO have a pension and possible subsidized healthcare, that 3 years cash is likely A- LOT less than than those of us that do not. I can tell you that it would be a lot easier ti sleep at night knowing that, say 2/3 – 3/4 of monthly expenses are covered with pension and subsidized care than for those of us who do not. The argument for annuities is a good one for peace of mind, especially if payout rates increase to 6%-7% in the next year. (That’s what I dream of these days😉)

Thanks for keeping us thinking, Fritz!

Dave, I suspect you are now in the majority (no pension, majority tied up in retirement accounts), exactly why having a strategy for accessing those retirement funds is so critical. Actually, your heirs will benefit if you can move that pre-tax to a Roth. As I just learned with my Dad’s passing, pre-tax accounts are forced with 10-year RMD’s when transferred to the heirs, so it’s even more punitive than when you held them (whereas Roth’s are tax-free even when your heirs inherit them). Also, note the comments elsewhere about others who have used professionals (one paid only $75) to help them determine Roth strategy. Finally, I’m with you on watching those annuity payouts increase as the interest rates rise, they’re finally starting to get interesting…

It would be nice to get clarity on that 10 year RMD rule for inherited IRAs.

My FIL passed last year. We have two interpretations on that law – (1), withdrawals every year for 10 years, and completely liquidating it by the 10th year, or (2) A withdrawal in year of death if not already taken by the deceased, then the second withdrawal in year 10 to liquidate, so no withdrawals in years 2 through 9.

Is there a definitive explanation on this rule?

Based on my reading and experience with my mother’s estate, if the original owner of a traditional IRA didn’t take their RMD in the year of their death, you have to take that RMD out in that tax year. I believe that gets taxed on the decedent’s SSN and should be shown on their final tax return, but I am not positive – my mother took her RMD prior to her death so I didn’t need to deal with it.

After that, once you have the funds rolled over to your inherited IRA, you can take as much or as little per year until year 10 from decedent’s death, at which time you need to have withdrawn the account down to zero. I took $10K from my inherited IRA in year 2 with the blessing of the IRA custodian, who explained the rules to me as they are currently understood.

What you can NOT do is convert your inherited pretax IRA to a Roth. I specifically looked into this.

The rules are different for a person inheriting IRA money from their spouse.

You may want to check with your advisor regarding RMDs for inherited IRA (not from a spouse) where the original owner had reached their required beginning date (RBD) before passing. The IRS recently “reinterpreted” the 10-year rule (via revised regulations) that now includes RMDs in years 1-9 where the original IRA owner had reached their RBD. If you fail to take your RMD, you could lose 50% of that RMD amount. There is still a lot of web content that still holds to the previous interpretation (no withdrawal required) so it can be very confusing.

We paid an accountant $75 to run all numbers with ACA premiums and our minimal income to determine optimum Roth conversions for 2022. Reassuring for us.

I hope Dave reads your comment. Wink.

Any suggestions on how to find a good/trustworthy/experienced CPA who knows how to incorporate ACA subsidies, passive income, etc. to determine optimal Roth conversion amounts each year? I could try to do it myself but if I could find a legitimate CPA for $75 or so I’d love to get their adivce!

We’re definitely doing the RMDs wrong. We have yet to do any Roth conversions. Part of that is because it would negatively affect our Obamacare subsidy. But mainly it’s due to inertia. We just got to run the numbers and do a cost-benefit analysis. I’m sure we could move 20K a year before we are Medicare eligible and not cut too deeply into our subsidy. Thanks for the kick in the ass, my friend. Great post.

Mr. G, my perception of you as an infallible example of how to do retirement right has now been shattered. At least I was able to enjoy kicking you, almost made it worth it…

Great article and your analysis of it was insightful, Fritz. I’ve only recently discovered your blog (thanks to Jason and Eric from Two Sides of FI) and am reading through some of your older posts as we prepare to pull the early retirement trigger in 18 months. As a Canadian, our pre-tax retirement accounts and medical care options are quite different from those in the US, but many of your strategies are still valid for retirees anywhere, even if their application is slightly different. I have the benefit of an accounting and finance background, so it’s not hard for me to translate 401K’s, IRA’s into Canadian equivalents and I even learned something about Roth’s today after digging into some of your links in the article above. Thank you!

Welcome from Two Sides, those guys are great! There are quite a few Canadians who read this blog, and I do think the “translations” work well, even though you’re talking RRSP’s vs. IRA’s. Many of the overarching principles apply to both, especially for folks like you who have finance backgrounds. Welcome to The Retirement Manifesto team, happy to have you aboard!

Thanks for the post Fritz, it was indeed an interesting study and a fun read. All during my working years I was 90% in equity, when I retired at 55 I dropped than down to 60%, so I pretty much fit right into the study. I guess I just became more of a chicken when I realized mortality was staring me in the face. Now, at 10 years into my retirement and I can more clearly evaluate how our retirement is unfolding, I feel very comfortable with the risk level for the future. You have always given sage advice on maintaining a multi-year cash cushion and doing a Roth conversion every year to fill up your marginal bracket. The advice you have given, and that I have followed, is one of the many reasons I have been reading your work for years. Keep up the good work, and thank you.

31, as an elite member of the small group who’ve read every single one of my posts, I especially appreciate your continued engagement with my blog. Happy to hear you’re still finding value after all these years. Thank you for your loyalty, it’s the greatest gift a reader could give to this writer.

I read and re-read this a bunch of times and then finally clicked the link to the study. I couldn’t understand how 80% of 31,000 people didn’t touch their retirement funds until they hit RMD. The study also showed that the “most common” retirement age was 65-70. That makes a bit more sense.

I often read and re-read your posts and this one will be no different! 🙂

Fritz,

Another timely post, thank you! I’m 3 months into retirement, and just finishing up some asset allocation details with my financial advisor – this provides a good check to make sure we haven’t missed anything. As always, looking forward to your next post!

Regards,

Tom

Fritz, you are not considering the severe impact of taxes on Roth conversions. You mention the negative aspects on IRMA and ACA subsidies. However Roth conversions can bump one into higher brackets with more costly consequences. If I expect to be in a lower bracket in retirement why would I want to pay taxes at a higher rate. If one had done conversions pre-2016 the tax rate would have been much higher. Tax rates are in the hands of our esteemed politicians. No one is prescient to be able to predict tax rates. Unless one has twenty to thirty years to breakeven on the transaction costs of a conversion, its better not to convert.

Ditto: “ If I expect to be in a lower bracket in retirement why would I want to pay taxes at a higher rate.”?

It wasn’t until about 2 years ago that I became aware of just how high my RMDs will be if I don’t do some Roth conversions prior to age 72. A lot depends on how much you currently have in pretax retirement accounts and what our tax brackets will look like after the current ones expire in 2025.

Given that I don’t plan on filing for SS until age 70 and have basically no income now (living off cash savings), I have a sweet spot for doing Roth conversions over the next few years that will be minimally taxed.

Kris, I think it depends on a few factors. First, if you delay taking SS until say 70, you might have a few years when your marginal tax rate (prior to Roth conversions) will be much lower than once you start taking SS. That is a great window in which to do Roth IRAs if you can do them at the 12% marginal tax rate. If it is 22%, that might still be a deal, depending on some other factors. Second, current tax rates are scheduled to sunset and revert to higher levels with lower standard & personal deductions in 2026. We’ll see if that happens, but almost everyone says tax rates have to go up or the US will go bankrupt. Third, there are the issues with IRMAA and NIIT and the SS tax rate bump that can dramatically increase your marginal tax rates for certain income ranges. Fourth, there is the issue for married couples when one spouse dies and the other is left with relatively high income and much lower tax bracket thresholds. If the husband in a couple dies first, the wife can outlive the husband by a number of years, and the taxes can be quite punitive when filing single. There are probably other reasons to do Roth conversions, but all of those factors should be considered in analyzing whether to do Roth conversions.

It does not take much to get bumped into the higher brackets. The 12% ceiling for MFJ is $83,550. Converting even $50K puts one into the 22% bracket. Convert $100K and we are at 24%, $1million it is 37%. My point is that there is a break even point well into the future, say 15 to 20 years when the Roth conversion becomes cost effective. The upfront tax payment reduces the net capital available to grow.

Roth IRAs and conversions are most advantageous at lower tax rates and the effect of the transaction costs dissipate.

I agree with the third and fourth points. There is no one size fits all solution with regards to Roth conversions.

Yes, I agree with your points. It is painful to think about paying 22-24% + state & local taxes on a reasonably large IRA conversion. But, at least in theory, conversions in the 22-24% tax brackets should still be advantageous compared to potentially paying 37%+ down the road. To reduce the pain of conversions, there are a couple of strategies that you might want to consider if you are charitably inclined. FIrst, you could make a reasonably large donation to a Donor Advised Fund which you can then deduct on your taxes as an itemized deduction in that year (up to 60% of your AGI I think). Then you can use that deduction to offset most of the tax effect of the IRA conversion. You would then make your charitable contributions from the DAF rather than from cash. [So, as an example, if you normally make $10K in annual charitable contributions, you could donate $100K to a DAF, get an immediate $100K itemized deduction (if your AGI is high enough), and use that DAF to make 10 annual $10K contributions to charity rather than from your checking account. Then you make $100K in IRA conversions in that same year and pay almost no taxes on the conversion.] Second, after you turn 70 you can make charitable contributions directly from your IRA to the charity (rather than from cash) and move money out of the IRA without any tax effect (and not using your taxable cash). That money does not need to be converted to Roth, and the Qualified Charitable Donations count towards your RMDs. Quite a win. Good luck!

I really enjoy reading your Retirement Manifesto articles. We decided early on to adopt the safety-first approach to managing our money in retirement. When I retired at age 63, we decided to partially annuitize our retirement assets to fund an income floor (using single premium immediate annuities or SPIAs) since we didn’t have a pension (other than SS benefits). However, by waiting until age 70 to claim SS benefits, our lifetime income (66% which is inflation-protected) covered all expenses except major travel. We get eight checks deposited monthly into three checking accounts that pay all our bills. Since we no longer have near-term needs to sell equities (outside of rebalancing), I felt comfortable investing the remainder of our portfolio fairly aggressively and have maintained an asset allocation averaging 70/30 since retiring. We’ve also managed to convert about 35% of our portfolio to Roth and will continue to do until the end of 2025 (staying in the 22% tax bracket).

Since all IRA withdrawals are fundamentally for discretionary use, we can (if necessary) support a variable withdrawal rate to avoid sequence of return risk (SoRR). However, since we do not want to miss out during our “go-go” years, we established a 5-year rolling CD/MYGA/bond ladder to create a reliable income stream to support our lifestyle regardless of market volatility. That ladder has been replenished for the past eight years but will probably be allowed to expire in five years (in that it has served its purpose). The remaining bond allocation can support a minimum of five more years of discretionary spending before needing to sell equities. So far, this strategy has been working well for us.

Glen,

We have spoken before about your strategy and how it has played out in real life.

Given that RMD’s are mandatory from a certain age, I think the trick is to try to have ‘enough’ floor income rather than to maximise floor income. In the latter case you could end up having too much floor and then have to consider either re-investing or gifting some of your RMD’s (the part that is excess to needs). Judging ‘enough’ however is tricky; especially before you are actually retired.

Is this how it played out for you?

With the benefit of hindsight would you now floor the earlier part of your retirement (age 63 to 70) with time bounded and/or reversible products such as you use for your 5-year rolling CD/MYGA/bond ladder rather than SPIAs?

Then, once SS came on stream, you would have been able to consider the need, if any, for further lifetime income from e.g. SPIA’s.

It was never our goal to “maximize” our income floor. In fact, my goal was to minimize SPIA income such that it covered our essential expenses in combination with my SS benefit at FRA. However, when I reached FRA, I was able to get spousal benefits, which was a “free” $12K per year while waiting to age 70. In hindsight, maybe I should have planned to start SS at age 70 but there was so much uncertainty at age 63 that I didn’t know if I could commit to that. That decision would have led to a smaller SPIA income (and the option to add more later was still viable). The other option I could have exercised was to include my wife’s SS benefit as part of that income (to cover essential expenses). That would have also lowered our SPIA income. My rationale for not using her SS benefit was to ensure that if something happened to one of us, the surviving spouse (with the “larger” SS benefit and SPIA income) would minimally satisfy essential expenses (knowing full well that inflation will have eaten into this “budget” in the future).

When I retired, Fidelity’s Retirement Analysis Tool forecasted that we would start withdrawals at 5% (based on expenses) and would gradually increase to 8% by age 92 (the end of my planning period). This initial analysis (at a 90% confidence level) also showed a decreasing legacy balance. This was before we annuitized any assets and had planned for starting my SS at my FRA. These withdrawal rates came very close to “RMD rates” (from a percentage standpoint). Instead we partially annuitized, waited to age 70 to start SS and currently our savings withdrawal rate is now 2%. Since we have converted 35% of our portfolio to Roth, the RMDs on the remaining T-IRA still covers more than what we need for discretionary expenses. This gives us an opportunity to grow our taxable brokerage account and also serves to address inflation (a key concern when establishing an income floor). Also, with that low a withdrawal rate, the legacy balance increases over the long term.

I did consider using a bond ladder to cover essential expenses up to my FRA in lieu of SPIA income. However, as interest rates had fallen and were still falling, there was a lot of uncertainty with any future SPIA payout rates. As it turns out, if I had waited to age 70 to start our SPIA, even with being seven years older, the payout rate would barely be any different from what we got at my age 63 (for the same “single” premium). This means we would have lost out on seven years of such SPIA income (for the same initial premium). However, if you dig deeper, the bond ladder would have “cost” 1/3rd of the amount initially allocated for the SPIA purchases. If the remaining 2/3rd were invested (similar to our portfolio) over the next seven years, a 7.1% average rate of return would make that arrangement equivalent. As it turns out, that may be very close to a wash.

The reality now is that we have enough income to cover all expenses (essential and discretionary) and have some inflationary “buffer” built into that income. The portion of that income that is currently being used for discretionary can be reallocated to address inflation of essential expenses. Depending on how bad inflation erodes our SPIA income, we may have another few years before our income will cover just essential expenses. Any “excess” RMD we have today can also be a good inflation hedge in the future (which was one of my concerns when purchasing non-COLA SPIAs). Even with hindsight, I’m not sure if we could have done “any better” or if I would do something different with what I have learned. Part of our outcome was definitely “good luck” (low inflation in the early years, market performance, favorable SPIA payout rate, etc.). The bottom line for us is that since retiring, having that peace-of-mind has been a major comfort as we enjoy our “go-go” years even during these volatile times.

Thanks very much for the additional details. They are very illuminating and clearly demonstrate just how many factors, including luck, are at play.

Out of interest, how did you fund the gap between your expenses and the spia payouts until your SS came on stream?

When I retired in 2013 (at 63), my wife had already retired three years earlier and started her SS benefits (also at age 63). So we had that income to start. We also had our SPIA income as well, which was started one month after I retired. The combination of those two income sources (her SS benefits plus our SPIA) covered about 80% of our essential expenses. Our original plan was to start spending our T-IRA for the remaining expenses since that is all the assets we had. While not part of my plan, I was offered a part-time consulting job which more than covered our expenses. The initial agreement was for six months but that arrangement lasted five years instead. When I turned 66 (my FRA), I was further able to claim spousal benefits (via the now-expired restricted application process). This, in turn, allowed me to annually receive 50% of my wife’s SS benefits at her FRA while I waited to age 70 (to claim my SS benefits). Those circumstances definitely made it easier for me to wait until age 70 to claim SS benefits and more than satisfied any income gap.

Glen,

Thanks for the detailed explanation.

I guess a key lesson is that plans change. I have been retired for over 5 years and our plan has changed in that time too.

Thanks again.

Interesting look at real cases. Michael Kitces has published extensively on the phenomenon of retirees underspending, by quite a lot. But it’s a hard mental shift to get people to risk spending more. Dying with millions is a much better outcome than going broke with years to live, especially if you have kids and charities to give those millions to.

A timely post for me! I just crossed the starting line yesterday at 61.

Time to start thinking about RMDs and conversions. I’ll start modeling conversions to Roth over the next few years for my two 401Ks and an IRA. The analysis I’ve done in the past years were for setting up for this phase of life, and now it’s here for me. My wife will continue to work for a few more years, so the switch from saver to spender will be softened by having that income stream for a little longer. Add to that deciding at what point I start pulling SS and pension. Much to think about here!

Thanks for your great articles.

Hi Bryan, You’re absolutely right that just because you have a planner filled out, it can only make calculated predictions. I swear it took me a year to really dial in all the input to Pralana Gold, and run zillions of “what if” scenarios based on inflation, market performance, expenses, taxation changes, etc. Then the Monte Carlo and other types of calculations vary every time they run (as they should). It’s like trying to see the forest through the trees. After a while though, I saw patterns developing based on changing inputs and recommendations of the system (Pralana has a Roth Conversion planning tool). To be honest, what it really showed me was that converting now, or converting later had a similar outcome, if the stock market performed at or below 8% year over year, but over that, I was way ahead doing the conversion early. It takes years though of lower performance due to loss of equity to taxes early on. So yeah, it’s educated guessing at best.

It does not take much to get bumped into the higher brackets. The 12% ceiling for MFJ is $83,550. Converting even $50K puts one into the 22% bracket. Convert $100K and we are at 24%, $1million it is 37%. My point is that there is a break even point well into the future, say 15 to 20 years when the Roth conversion becomes cost effective. The upfront tax payment reduces the net capital available to grow.

Roth IRAs and conversions are most advantageous at lower tax rates and the effect of the transaction costs dissipate.

I agree with the third and fourth points. There is no one size fits all solution with regards to Roth conversions.

Once you have accumulated an asset that allowed you to live comfortably at 3% to 4% …

It is time for you to have a deep self-reflection, and invest in the person you see inside.

Financially, if the investment requires the withdrawal rate greater than 4%, that investment…

must generate a profit in some future time, preferably, before the depletion of your assets.

Otherwise, have fun and don’t focus on the number for the rest of your life.

An accumulated pile of assets has no meaning, unless the owner(s) transform it into the potential of…

the assets creators within one life time.